At $86K, Bitcoin could face a bull trap – Watch for a potential sweep!

- Bitcoin is perhaps nearing a key liquidity zone round $86k, the place 77% of liquidation ranges are lengthy

- A traditional setup might be forming the place overcrowded positions are exploited earlier than a possible reversal

Let’s take a step again to look at Bitcoin’s weekly construction. The high-FUD sentiment that weighed on its latest worth motion is perhaps easing, with BTC constantly closing each day candles at a mean of $82.60k – An indication of underlying bid energy.

Notably, the Relative Energy Index (RSI) gave the impression to be under overheated ranges, suggesting that momentum nonetheless has room to increase with out triggering speedy profit-taking.

Supporting this bullish undercurrent, all exchanges recorded net outflows of 35,758 BTC on 11 April, at a worth of $83,403 per BTC – A textbook sign of strategic accumulation.

Collectively, these indicators allude to the emergence of a possible backside formation. One the place an more and more strong demand wall could take up sell-side stress and cap draw back danger. A minimum of theoretically.

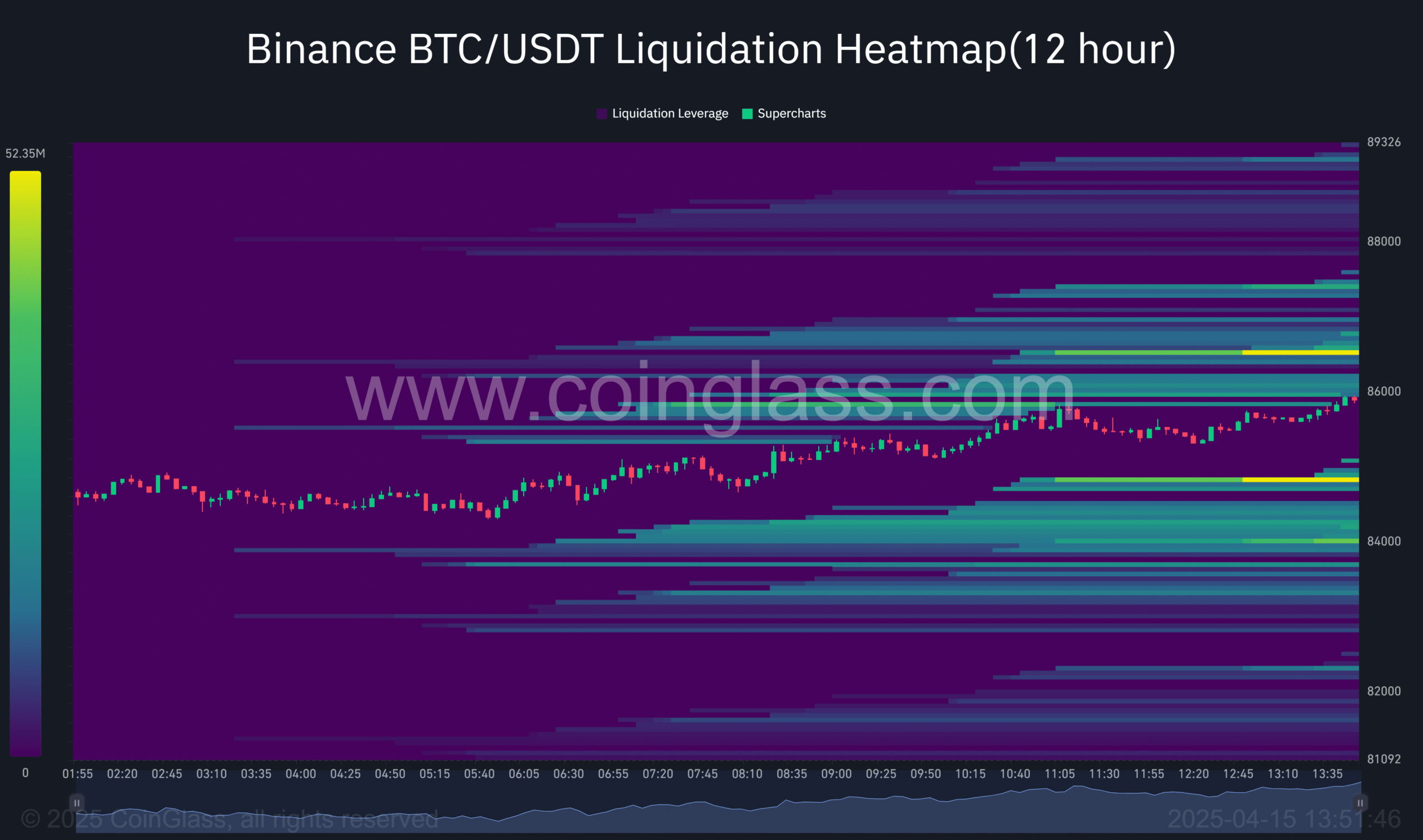

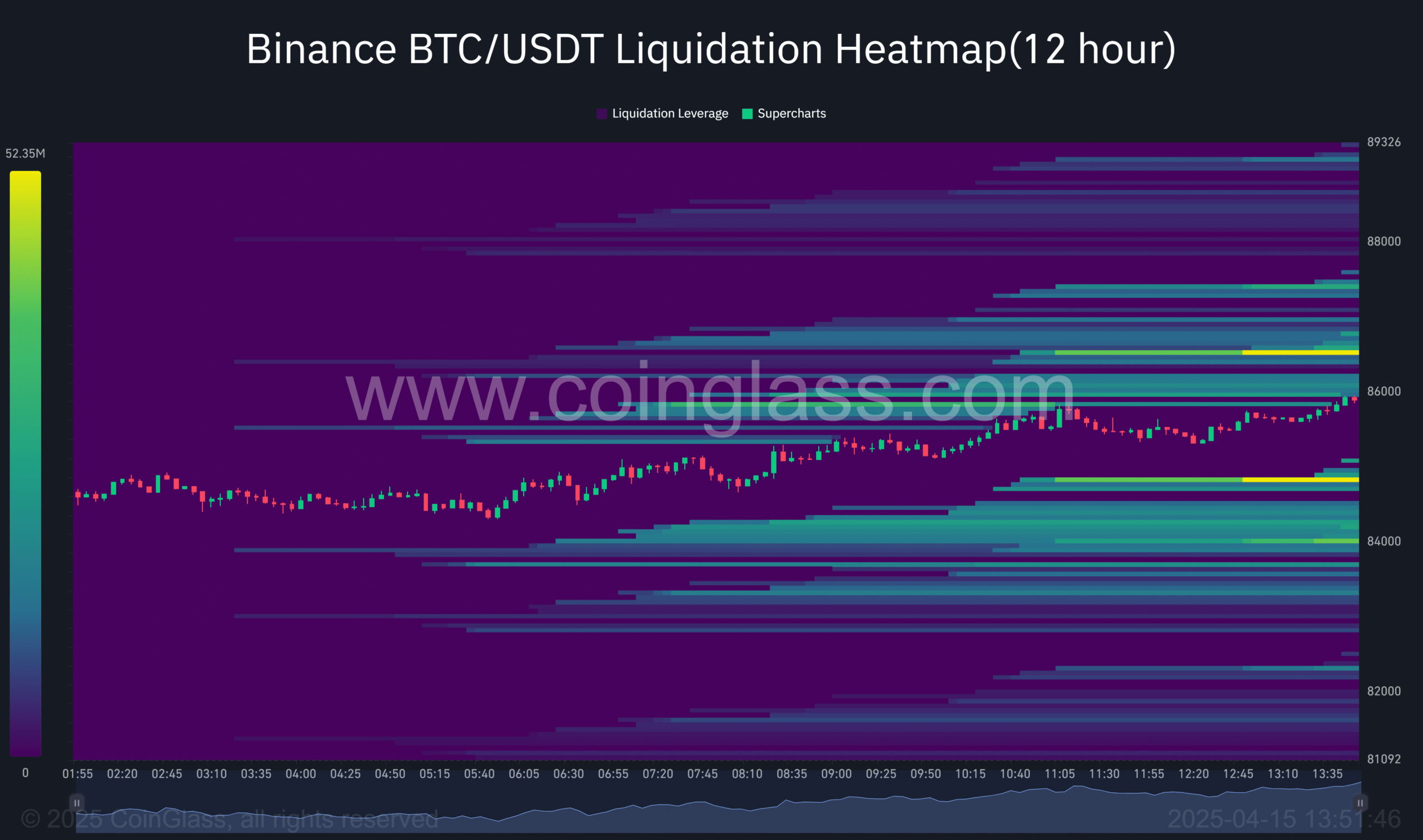

Nevertheless, from a liquidity standpoint, the image is perhaps much less reassuring. A major liquidity cluster has been forming above press time worth ranges. In response to AMBCrypto’s evaluation, this might create a high-risk setup for a draw back liquidity sweep.

Briefly, is that this setting the stage for a bull lure?

Market makers set to take advantage of overcrowded lengthy positions

At press time, Bitcoin was closing in on a key liquidity zone close to $86.50k. Nevertheless, there gave the impression to be signs of weakness beneath.

Supply: Coinglass

The retail lengthy positioning has been comparatively low, with bid-ask ratios within the unfavorable to sign fading demand. Moreover, the flat Open Curiosity (OI) indicated a scarcity of recent capital inflows to help the transfer.

Extra crucially, 77% of liquidation ranges clustered round this liquidity zone have been lengthy positions. Consequently, this liquidity cluster might act as a magnet, probably triggering a draw back sweep as market makers capitalize on pressured liquidations.

In actual fact, this stage additionally represents the Alpha Price zone, a key space that has traditionally acted as each help and resistance. There’s a danger Bitcoin would possibly briefly go above this stage, solely to fall again down – Organising a bull lure.

Bitcoin wants actual conviction-backed onerous information

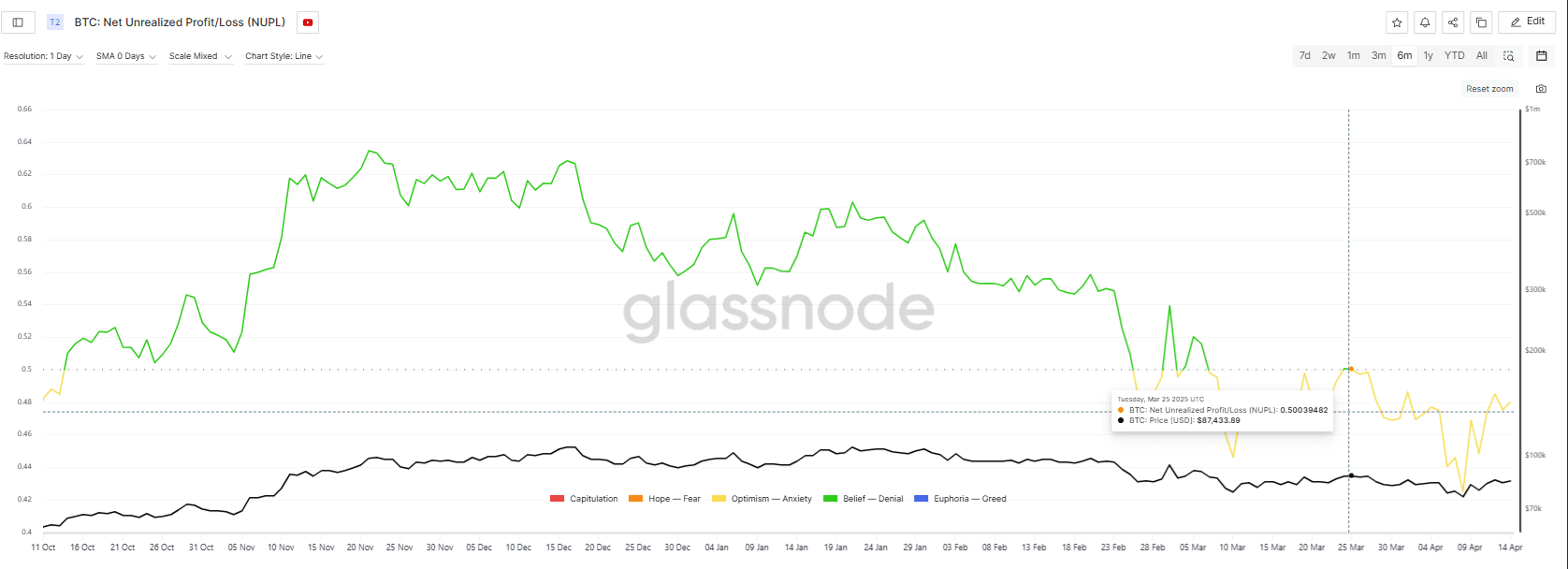

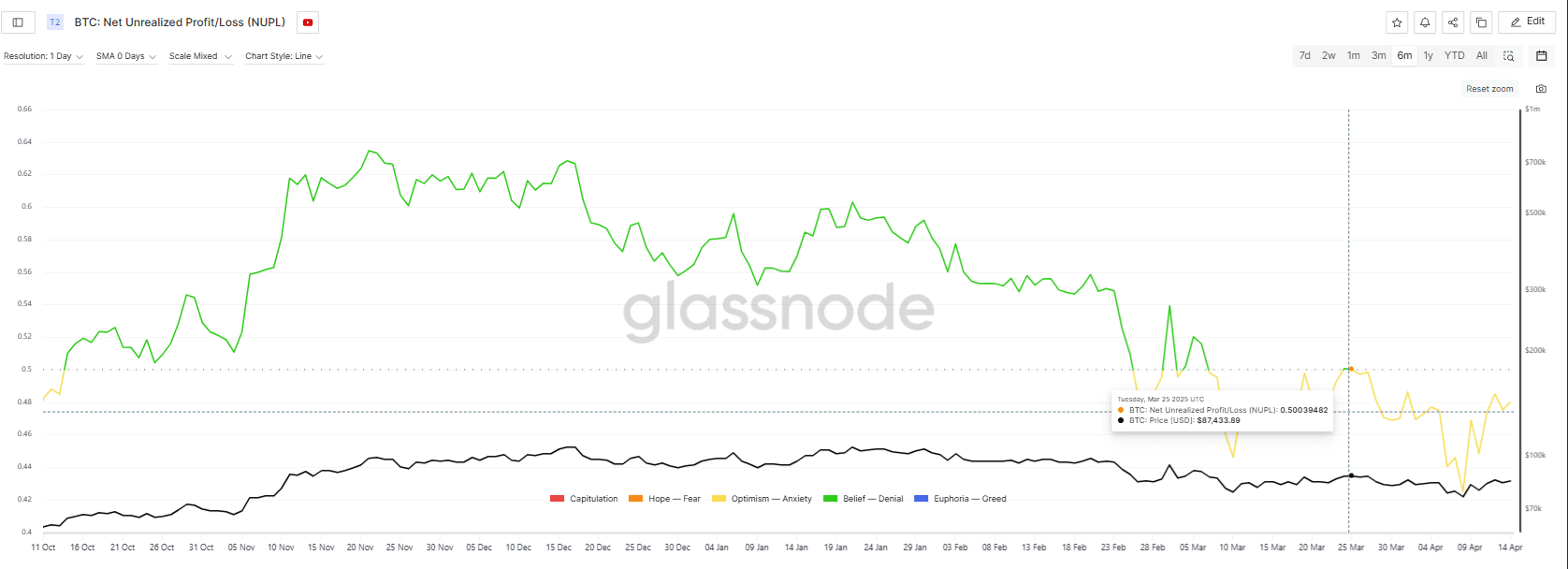

The NUPL (Web Unrealized Revenue/Loss) metric reveals the state of BTC’s present erratic worth motion.

Since 07 March, it has stayed inside the ‘Optimism’ section. This hinted that a good portion of the market is in unrealized revenue, with massive holders possible accumulating.

Nevertheless, each time BTC approaches the $86k–$87k zone, the NUPL shifts into ‘Anxiousness’, exhibiting {that a} rising variety of market contributors are beginning to really feel uneasy about their unrealized beneficial properties.

This shift means that income, although not but realized, are being pressured and will quickly be taken off the desk.

Supply: Glassnode

As an example, on 25 March, Bitcoin briefly reclaimed $87.5k. Nevertheless, earlier than the NUPL might enter the Perception section, it reversed into Anxiousness. This pointed to market contributors more and more realizing or hedging in opposition to unrealized income.

As Bitcoin revisits this zone, an identical sample might drive the NUPL decrease, signaling a shift in market sentiment.

Consequently, with 77% of liquidations concentrated in lengthy positions round this vital liquidity cluster, a draw back sweep might be triggered. This may result in pressured liquidations, probably driving BTC decrease.

Until Bitcoin decisively breaks out of this range-bound construction, the danger of additional volatility and liquidation cascades stays elevated. This may go away the market susceptible to a bearish leg.