Binance Coin: Before you click on the ‘Buy’ button, read this

- Regardless of slight good points for buyers previously three months, BNB might face promoting strain.

- Merchants have resolved to overlooking the opening of BNB contracts.

Binance Coin [BNB], the native cryptocurrency of the Binance alternate, could have completed properly to stay above $300 regardless of the latest pink days of the market. Nevertheless, the resilience proven may not be affirmation that BNB is in a first-rate place for an uptick.

Learn Binance Coin’s [BNB] Value Prediction 2023-2024

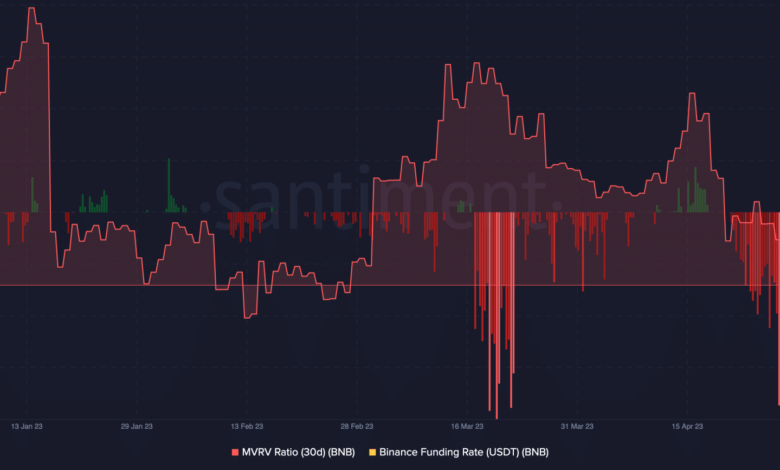

In accordance with Santiment, the coin’s Market Worth to Realized Worth (MVRV) ratio has been growing since 20 Might. At press time, the metric was 7.211%.

BNB missing consideration?

Typically considered as a macro-oscillator, the MVRV ratio reveals the ratio between the present worth of an asset and the typical worth acquired whereas mentioning how overvalued or undervalued the asset is.

When the ratio will increase, it signifies that buyers are displaying a willingness to promote, relying in the marketplace cycle. Since this was the case with BNB, the rise had the potential to propel an extra drop in worth.

![Binance Coin [BNB] funding rate and MVRV ratio](https://statics.ambcrypto.com/wp-content/uploads/2023/05/BNB-BNB-09.47.39-28-May-2023.png)

Supply: Santiment

In consequence, merchants appear to be detached concerning the BNB worth motion, the funding charge revealed. On the time of writing, the BNB funding charge was 0%. This impartial state explains how longs and shorts weren’t excited about paying one another to maintain their futures or choices contracts open.

An extra analysis of the derivatives market exercise confirmed that the Open Interest (OI) has been lowering across the identical interval because the MVRV ratio began growing. The OI measures the amount of cash invested in contracts associated to a coin.

Due to this fact, the OI lower implied that each patrons and sellers have been actively closing their positions. If it have been to be the opposite method round, then it could imply that merchants have been leaping on the BNB worth motion for potential good points.

![Binance Coin [BNB] Open Interest and price](https://statics.ambcrypto.com/wp-content/uploads/2023/05/Screenshot-2023-05-28-at-09.58.39.png)

Supply: Coinglass

No trigger for buzz

Whereas the typical sentiment towards the coin mildly elevated during the last two weeks, it did not exit the damaging zone.

As of this writing, on-chain data confirmed that BNB’s weighted sentiment was -1.05. The weighted sentiment considers the optimistic and damaging commentary on social networks.

Is your portfolio inexperienced? Verify the Binance Coin Revenue Calculator

So, when the metric is above the zero midpoints, it infers that the notion across the asset is generally optimistic. Nevertheless, the keep within the pink zone means that the broader market was not optimistic concerning the BNB short-term worth motion.

Supply: Santiment

At press time, the ratio was 6.583. Though the worth was the very best for all of Might, it was nonetheless thought-about low. Therefore, market individuals made extra earnings than losses within the month. However it was nowhere close to the height recorded in January.