Bitcoin: ‘$60K ends up being the bottom’ this cycle, analysts predict

- Analysts see $60K because the 2024 cycle’s correction backside.

- Nevertheless, worth consolidation may prolong for longer.

Final week was arguably the worst for markets, particularly risk-on property like Bitcoin [BTC]. US equities closed the week in crimson.

Equally, BTC prolonged weekly losses in April, hitting a low of $59.6K amidst halving, US tax season, and Center East tensions.

BTC has since improved and was above $66K, able to reverse current losses. Moreover, the halving and US tax season are out of focus. Center East tensions additionally eased barely.

This begs the query: Is the Bitcoin halving sell-off over? Some market watchers assume so.

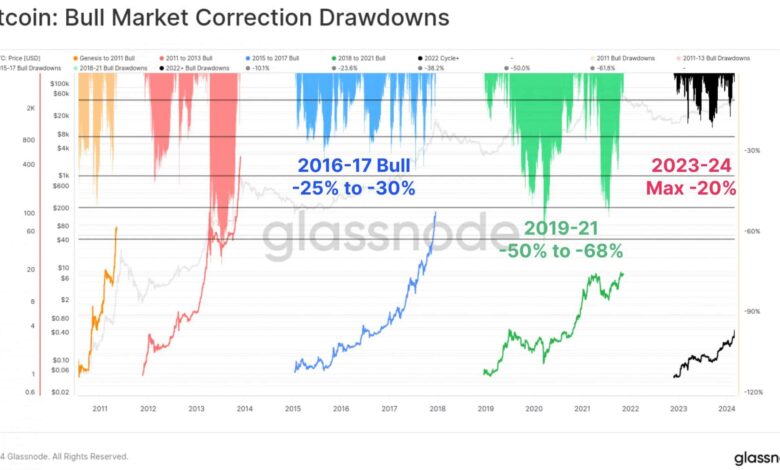

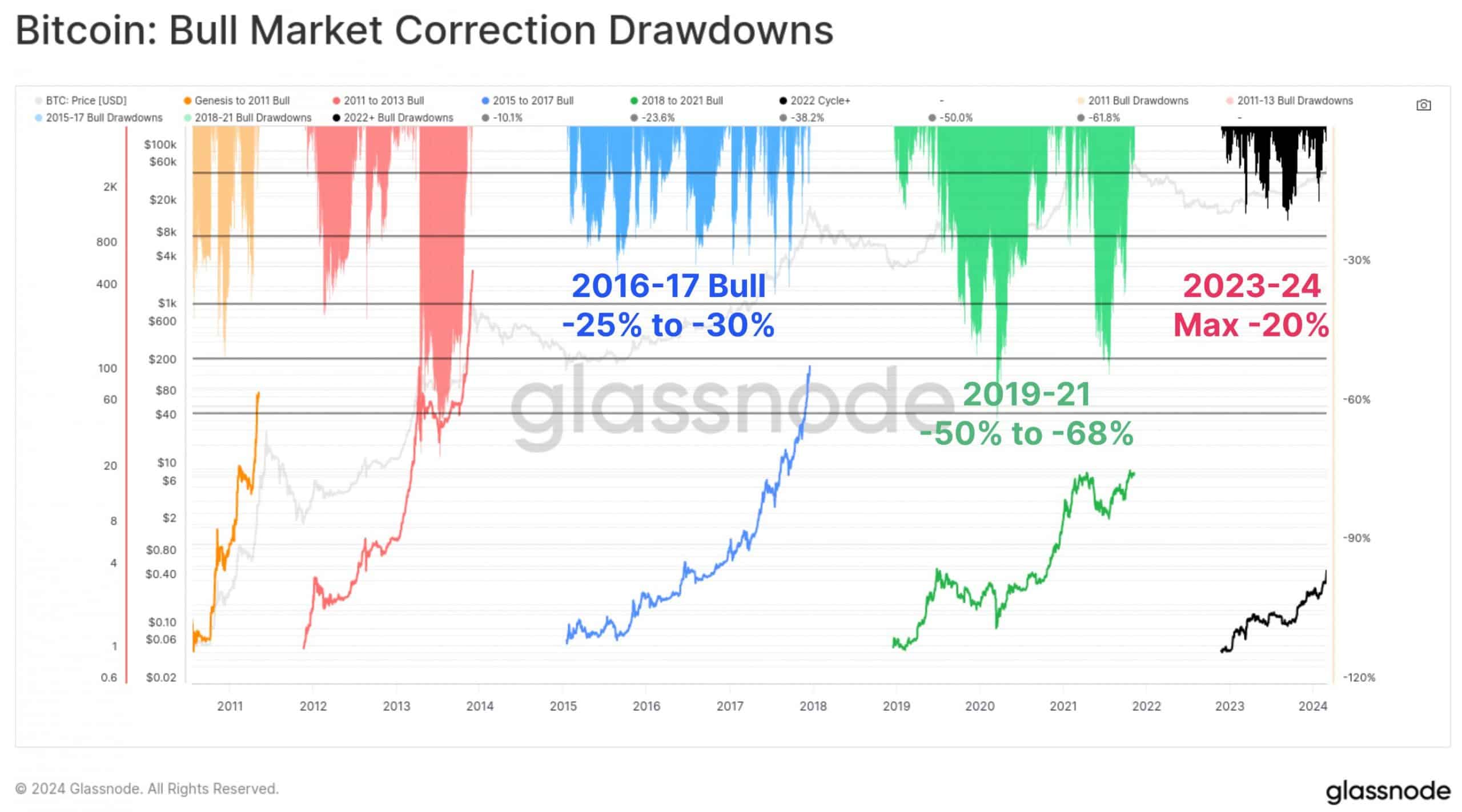

Famend crypto analyst Tuur Demeester not too long ago stated that $60K may very well be the underside of the present correction and matches Glassnode’s present bull sample.

“Bitcoin: I feel it’s seemingly that $60K finally ends up being the underside of this correction. 20% drawdown from the excessive.”

Supply: X/Santiment

What subsequent for BTC worth post-halving?

One other pseudonymous crypto analyst, McKenna, echoed Demeester’s correction backside at $60K. In keeping with McKenna, BTC halving sell-offs may very well be over, and an prolonged sideways motion was seemingly.

“I feel there’s a excessive chance that the underside for the halving selloff is in, however concurrently, I feel there’s an equal excessive chance that we’re forming a re-accumulation vary. That means anticipate sideways worth motion for longer than anticipated.”

McKenna claimed that BTC’s potential sideways motion may rally stronger altcoins. However an AMBCrypto report not too long ago discovered that the market wasn’t but ripe for an altcoin season.

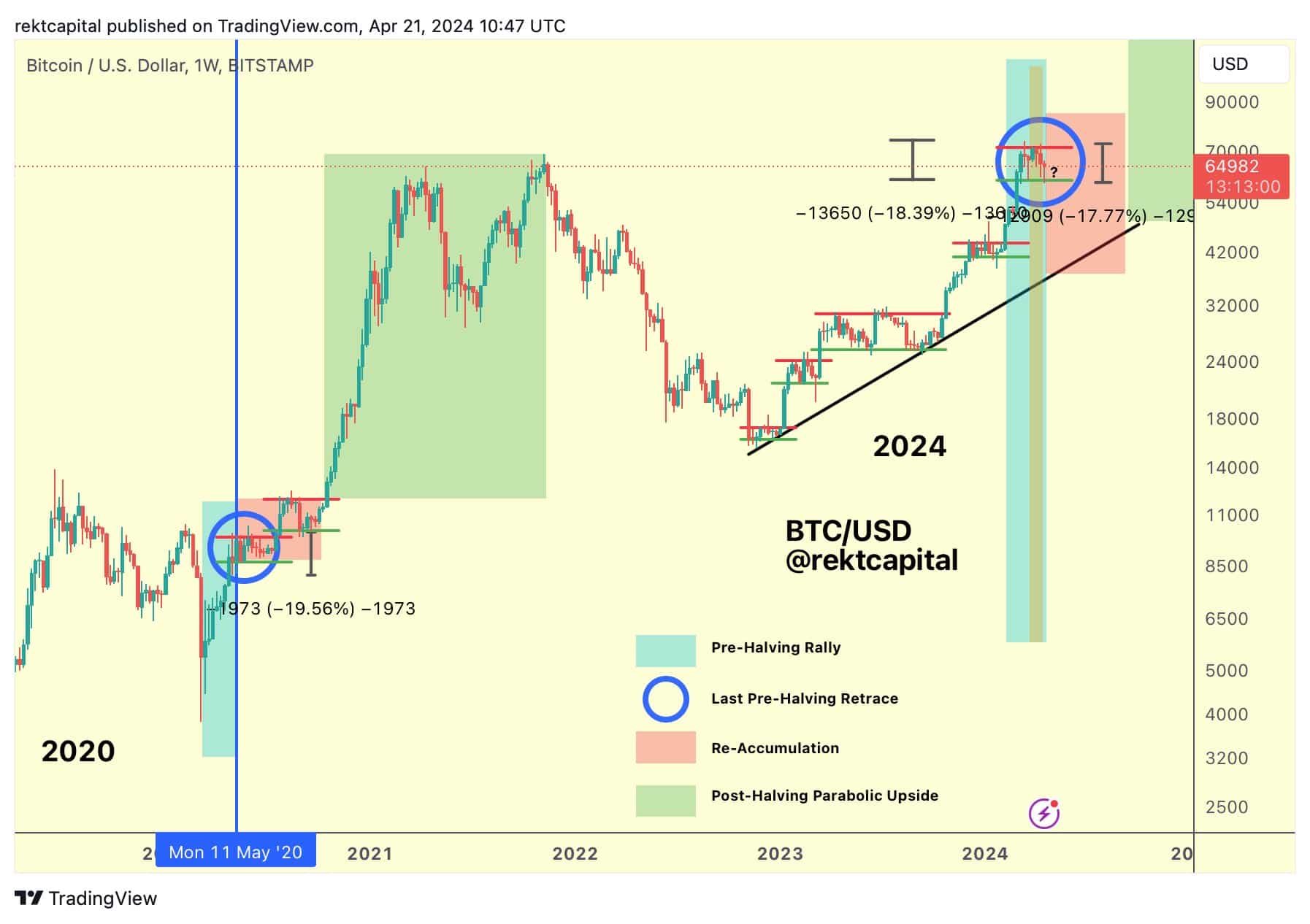

On his half, Rekt Capital, a famend dealer and market cycle analyst, opined that present costs may very well be the very best discount for BTC if we’re within the re-accumulation part.

“What if Bitcoin has already revealed the highest and backside of its Publish-Halving Re-Accumulation Vary? Then the costs inside this vary could be the very best we can get earlier than Bitcoin is lastly prepared Publish-Halving Parabolic Upside.”

Supply: X/Rekt Capital

Some market watchers anticipate higher situations beginning in Could.

In an early April assertion, BitMEX founder Arthur Hayes projected market situations may enhance in Could after US tax season and BTC halving. A part of his assertion read,

“The timing of the halving provides additional weight to my resolution to abstain from buying and selling till Could.”

If the sideway motion extends and market situations enhance in Could, the present vary of $60K and $71K may very well be essential watch ranges going ahead.