Bitcoin: A June recovery while BRC-20 runs out of steam?

- Bitcoin ordinals hype cools off leading to a miner income slowdown.

- Assessing the potential for a BTC rally as miner reserves surge.

The Bitcoin neighborhood had combined emotions concerning the just lately launched BRC-20 token commonplace. Sadly, these against it couldn’t do a lot and Bitcoin miners are notably comfortable about it.

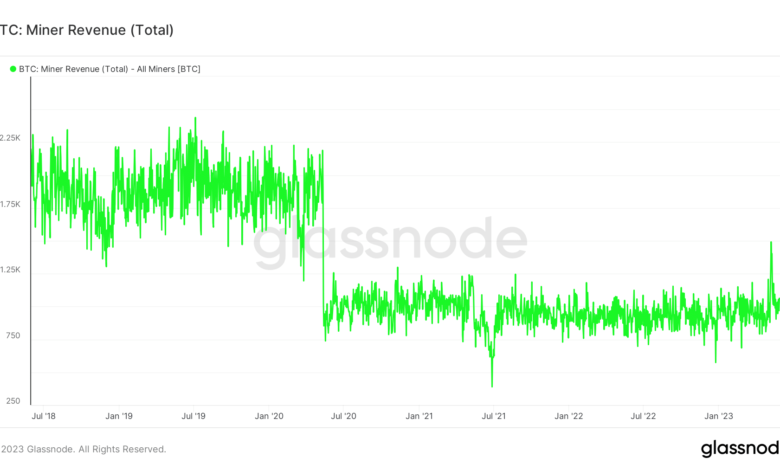

The BRC-20 tokens unlocked a number of community exercise which in flip led to a surge in Bitcoin miner income. The thrill that beforehand surrounded the BRC-20 token commonplace, particularly Bitcoin ordinal inscriptions has since died down.

Bitcoin miner income shrunk in the previous few days as a consequence. Miner income peaked at $17.8 million on the top of the BRC20 hype.

On the peak of the BRC-20 frenzy, #Bitcoin Miners had been incomes $17.8M in transaction charges, with solely 2 buying and selling days throughout the 2018 peak recording a bigger charge income.

At the moment, Miners are incomes $1.7M in charge income, a -$16.1M decline from the current peak. Nonetheless, this… pic.twitter.com/T5pJpeoxxk

— glassnode (@glassnode) May 29, 2023

The current surge in Bitcoin miner income represented the most important spike noticed within the final three years. The final time that miner income was that prime was in the course of the current peak in Could 2020.

Supply: Glassnode

Greater miner income tends to encourage extra miner participation since there’s extra income to be shared out. As such, the upper profitability tends to draw extra miners and this has been the case within the final 4 weeks.

Unsurprisingly, Bitcoin’s hash price has been on an total uptick to date this 12 months. It additionally soared to the very best historic degree at first of Could.

Supply: Glassnode

The general surge in Bitcoin’s hash price mirrored the slight market restoration noticed on a year-to-date foundation.

Are miners contributing to promoting stress?

Taking Bitcoin miner reserves into consideration is among the greatest metrics for assessing the general market sentiment. A drop in miner reserves indicated low confidence available in the market. Alternatively, a surge in miner reserves indicated that there was slight market confidence.

The miner reserve metric has been on an total downtrend for the final 5 months. Nonetheless, it simply registered its largest spike within the final 24 hours on the time of writing. Which means that miner confidence was recovering.

Supply: CryptoQuant

The brand new-found Bitcoin miner confidence comes at a essential time in Bitcoin’s worth efficiency. BTC has been tuck within the ranging marketplace for a bit over two weeks nevertheless it just lately launched into a bullish breakout. Curiously, this breakout got here proper after the conclusion of the BRC-20 and Bitcoin ordinals hype.

What number of are 1,10,100 BTCs price at this time

Will Bitcoin ship a bullish efficiency in June? Nicely, it’s nonetheless too early to name particularly since whale exercise doesn’t match Bitcoin miner reserves but. Nonetheless, a bullish miner reserves spike and unstable directional actions may very well be anticipated now that the value was shifting out of a low quantity vary.