Bitcoin: Are the bulls back on track after BTC price crash

- Shopping for sentiment was dominant available in the market for Bitcoin.

- BTC was up by 3% final week, and some indicators have been bullish.

After a worth correction on the third of January 2024, Bitcoin [BTC] was fast to get better as its weekly chart turned inexperienced. Whereas that occurred, the king of cryptos witnessed an enormous surge in a key metric, reflecting traders’ curiosity in buying and selling the token.

Does this imply one other bull rally is within the works?

Bitcoin transitions are skyrocketing

The yr 2024 started on a great notice, however simply after a number of days, BTC witnessed a worth correction, pushing its worth all the way down to $42,200.

Nonetheless, the coin was fast sufficient to make a rebound. As per CoinMarketCap, BTC was up by greater than 3% within the final seven days.

When BTC was recovering, it witnessed its largest spike in transactions. Ali, a preferred crypto analyst, lately posted a tweet highlighting this incident.

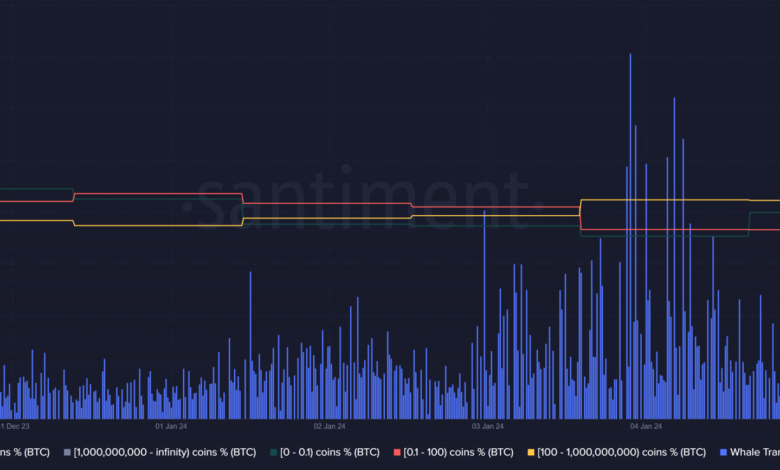

He talked about that BTC skilled its largest spike in transactions over $100,000 in almost two years.

Prior to now 24 hours, #Bitcoin skilled its largest spike in transactions over $100,000 in almost two years.

The 16,900 giant transactions function a proxy for $BTC whale exercise, providing insights into how these main gamers could be positioned within the #crypto market. pic.twitter.com/CCnaoBOK0F

— Ali (@ali_charts) January 5, 2024

He talked about,

“The 16,900 giant transactions function a proxy for BTC whale exercise, providing insights into how these main gamers could be positioned within the crypto market.”

To verify how whales have been reacting to this, AMBCrypto took a take a look at Bitcoin’s metrics. We discovered that whale exercise across the coin truly elevated in the previous few days.

Moreover, a take a look at BTC’s provide distribution revealed that whales have been shopping for BTC, as evident from the slight rise within the variety of addresses holding greater than 100 BTC (yellow line).

Supply: Santiment

Is a contemporary bull rally across the nook?

Whereas the whales appeared to have gathered BTC, AMBCrypto checked otter metrics to learn how retail traders have been doing. As per our evaluation of CryptoQuant’s data, BTC’s web deposit on exchanges was low in comparison with the final seven-day common.

This meant that the shopping for strain on the coin was excessive. Furthermore, its coinbase premium remained inexperienced, which means that purchasing sentiment was dominant amongst US traders.

Supply: CryptoQuant

Since shopping for strain was excessive, AMBCrypto took a take a look at BTC’s day by day chart to raised perceive the place a bull rally was across the nook. Our evaluation of BTC’s MACD revealed that the bulls and the bears have been in a battle to flip one another.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Curiously, Bitcoin’s Chaikin Cash Stream (CMF) registered a pointy uptick, which was certainly a bullish sign.

Nonetheless, nothing may be stated with certainty as each BTC’s Relative Energy Index (RSI) and Cash Stream Index (MFI) have been resting across the impartial mark, which spells bother. At press time, BTC was buying and selling at $43,601.01 with a market cap of over $854 billion.