Bitcoin [BTC] accumulation rises as ETF outflows cool – Is a breakout coming?

- There was a major fall in BTC outflows after hitting a brand new withdrawal level

- Liquidity inflows into Coinbase correlated with buyers’ shopping for motion within the spot market

Bitcoin, the world’s largest cryptocurrency, is constant to commerce at ranges effectively beneath its all-time highs. Actually, losses may be seen throughout the board, with the cyrpto valued at simply over $81,000, at press time, after a 24-hour decline of just about 2%.

Now, with Bitcoin buying and selling near its crucial help ranges on the chart, spot merchants have steadily begun to build up the asset. Therefore, it’s value analyzing different components to find out whether or not BTC will see a worth pump within the coming days or not.

Spot ETF outflows decelerate

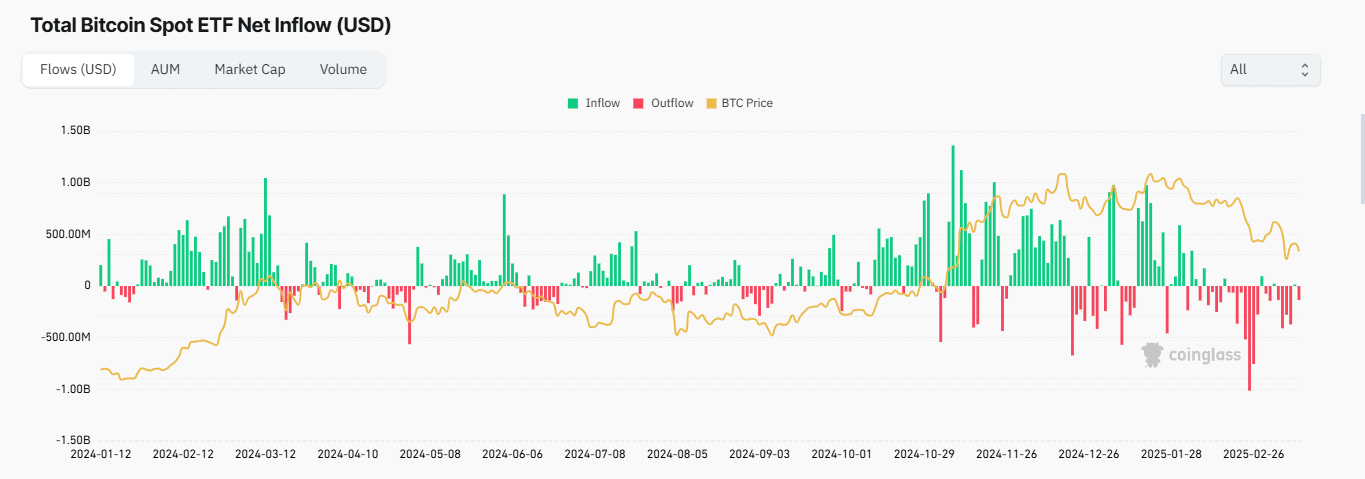

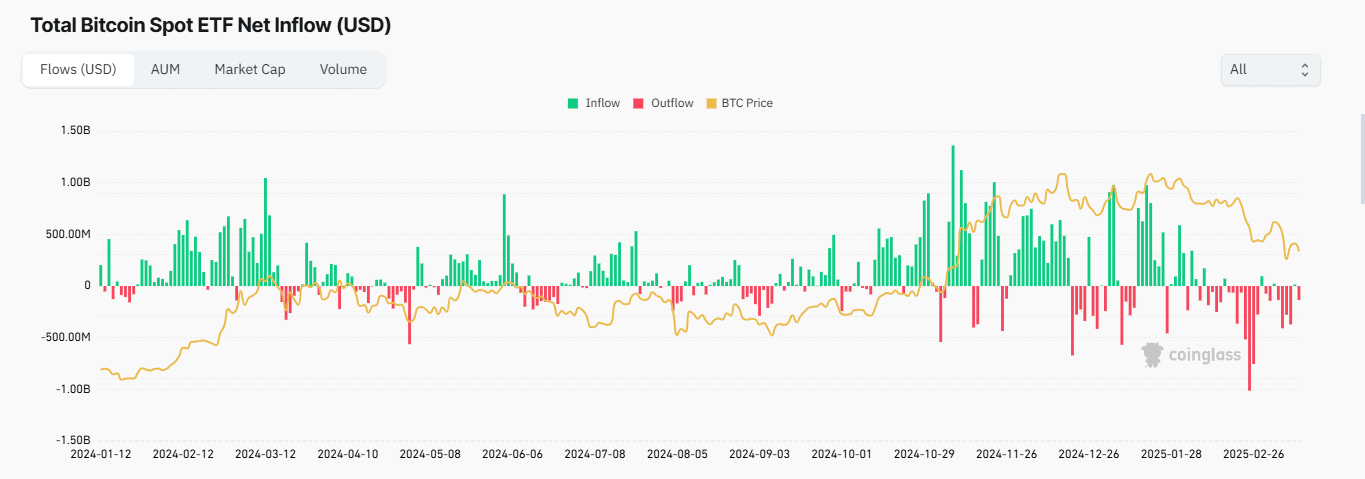

Latest knowledge revealed a major fall in BTC outflows from exchange-traded funds (ETFs) over the previous month.

On the time of writing, after Bitcoin peaked with outflows of $1.01 billion on 25 February – with complete Bitcoin gross sales of $2.039 billion between 25-27 February 25 – investor promoting stress cooled down.

Within the final 24 hours alone, $135.20 million was withdrawn from the market, with property underneath administration at $97.62 billion – A considerably excessive quantity.

Supply: Coinglass

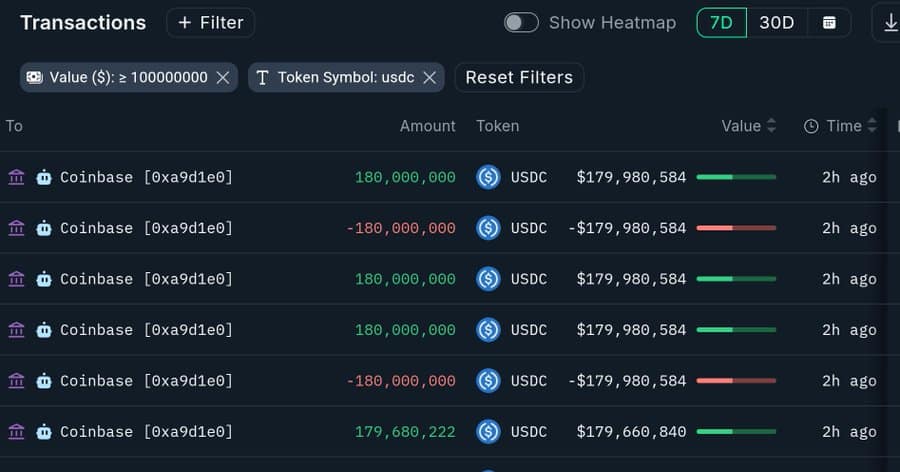

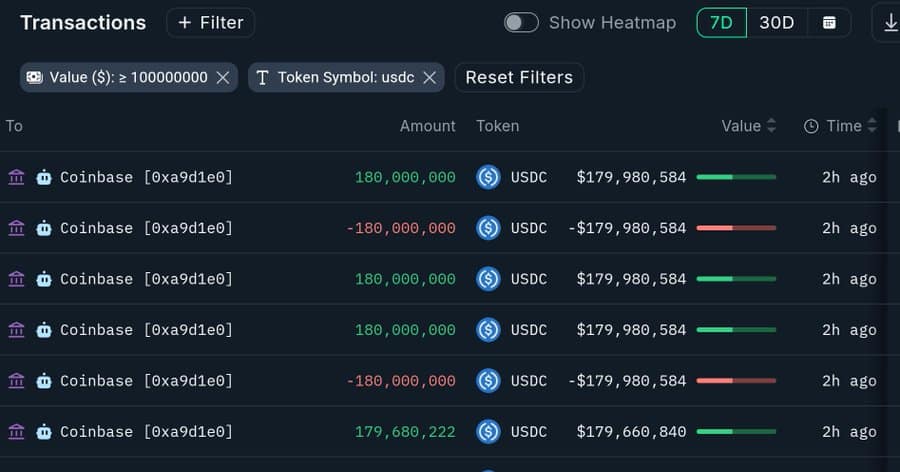

Whereas promoting in BTC Spot ETFs has slowed down, there have been large liquidity inflows into Coinbase.

Over the past seven days alone, inflows have totaled 719 million USDC. Such a big influx right into a cryptocurrency change, whereas worth stays stagnant, is an indication of ongoing accumulation. This is able to additionally recommend that contributors are shopping for in anticipation of a rally.

Supply: Nansen

A have a look at Bitcoin’s change netflows on Coinglass confirmed this shopping for exercise. Particularly as spot merchants bought roughly $57 million value of BTC within the final two days, turning change netflows detrimental.

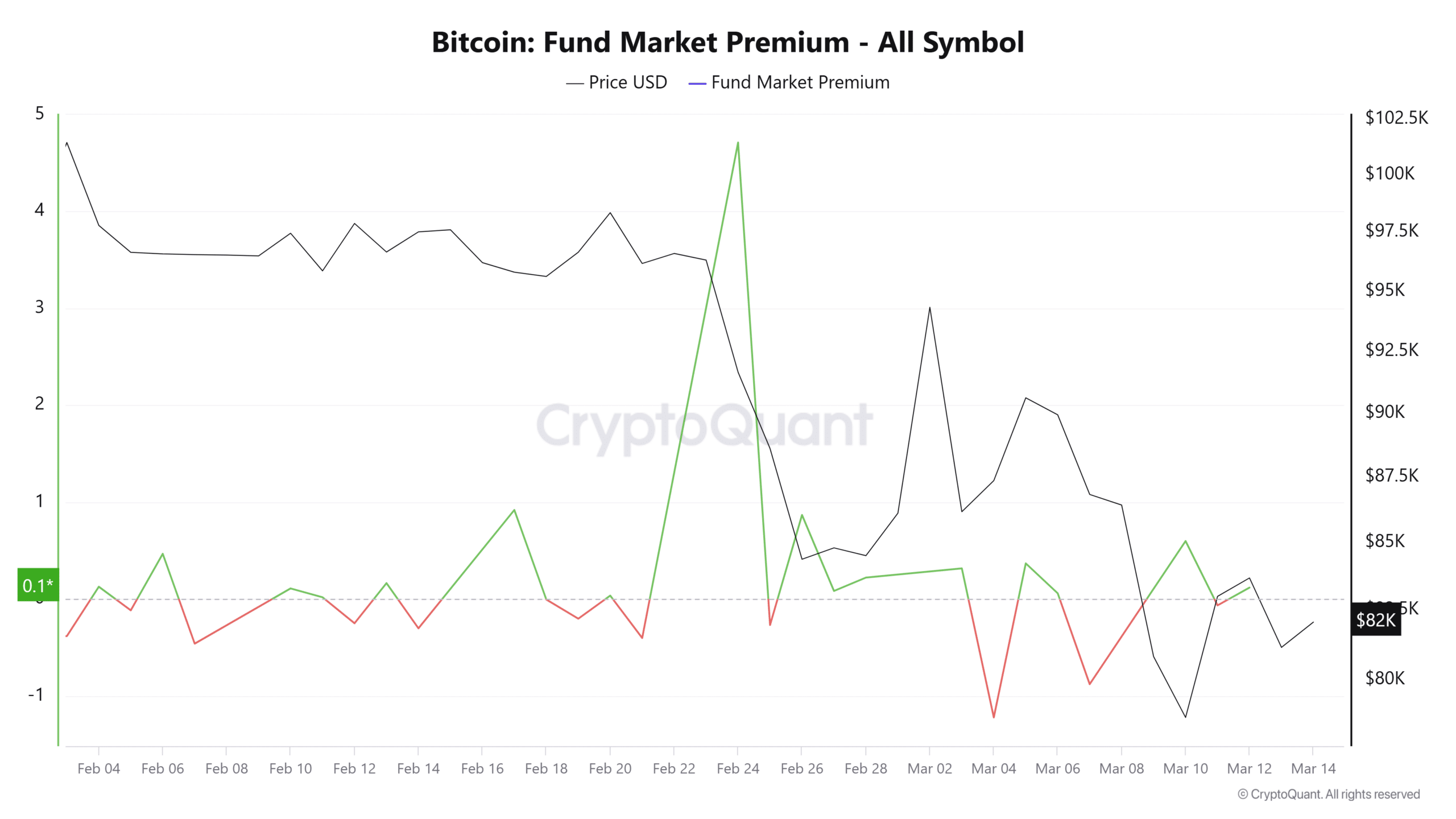

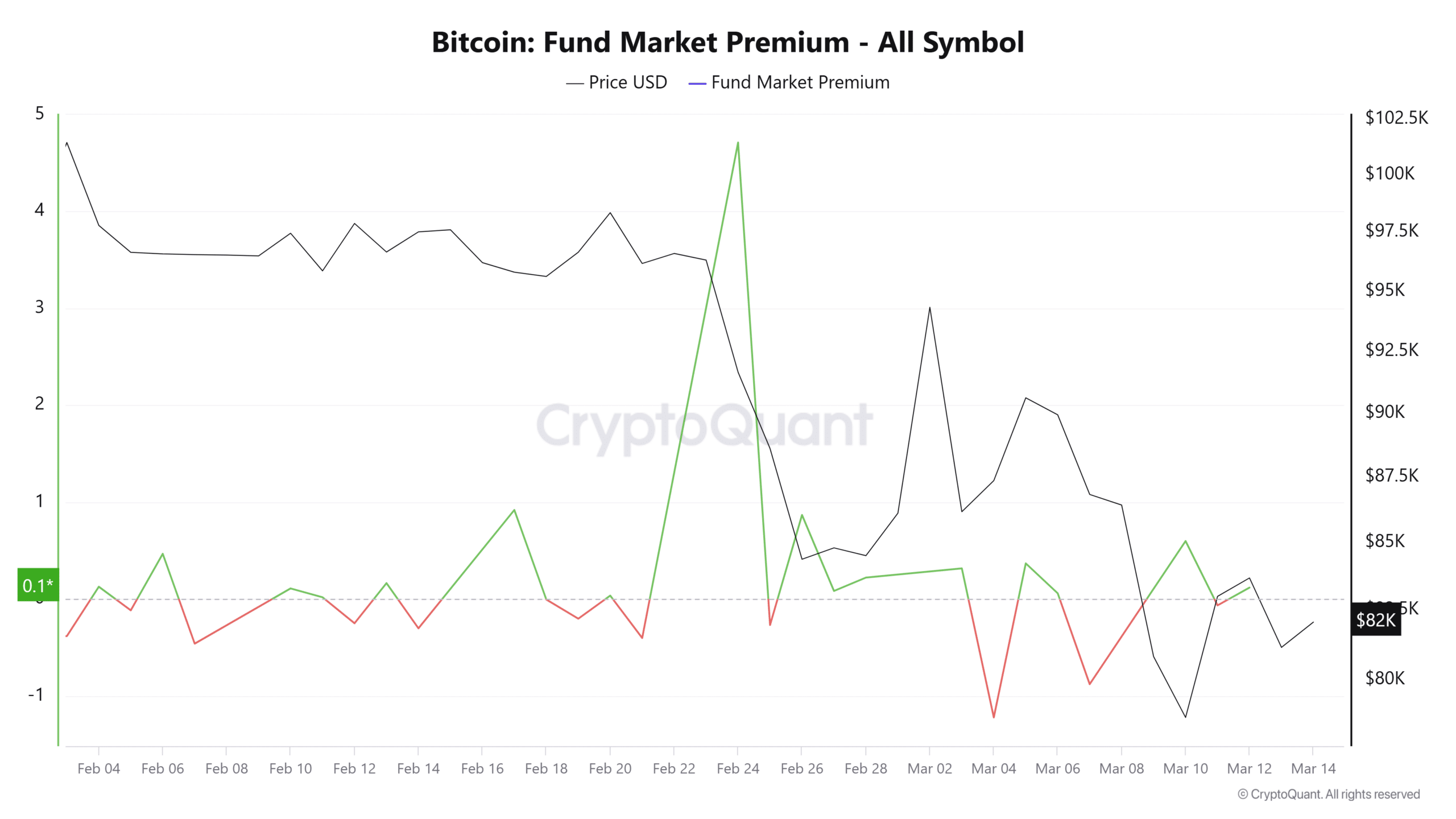

Detrimental netflows imply that merchants are shopping for an asset. Institutional buyers appeared to share an identical sentiment, because the funds market premium turned optimistic. It had a studying of 1.03, at press time.

Supply: CryptoQuant

Right here, it’s value mentioning that the funds market premium measures institutional demand and provide for BTC.

A studying above 1 signifies shopping for, whereas a detrimental studying confirms promoting.

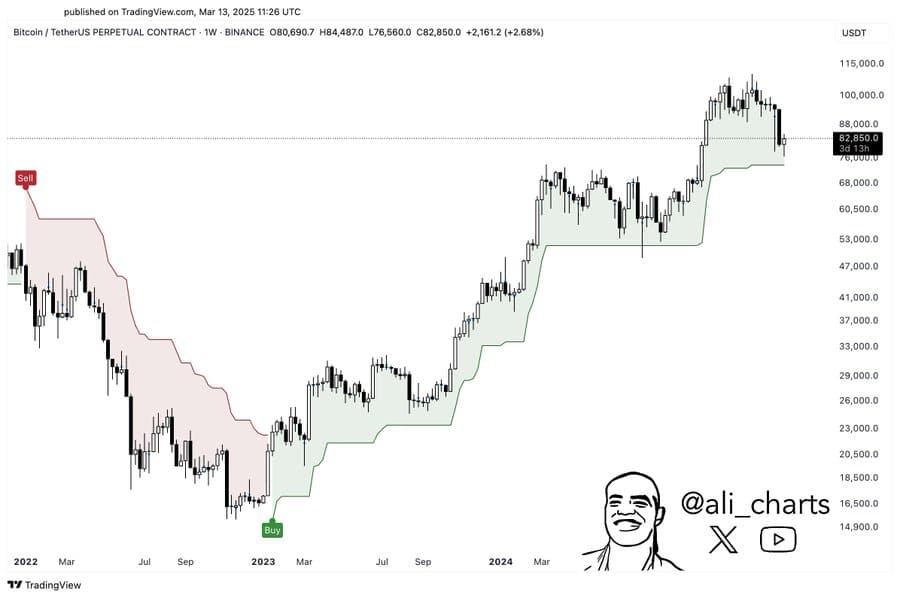

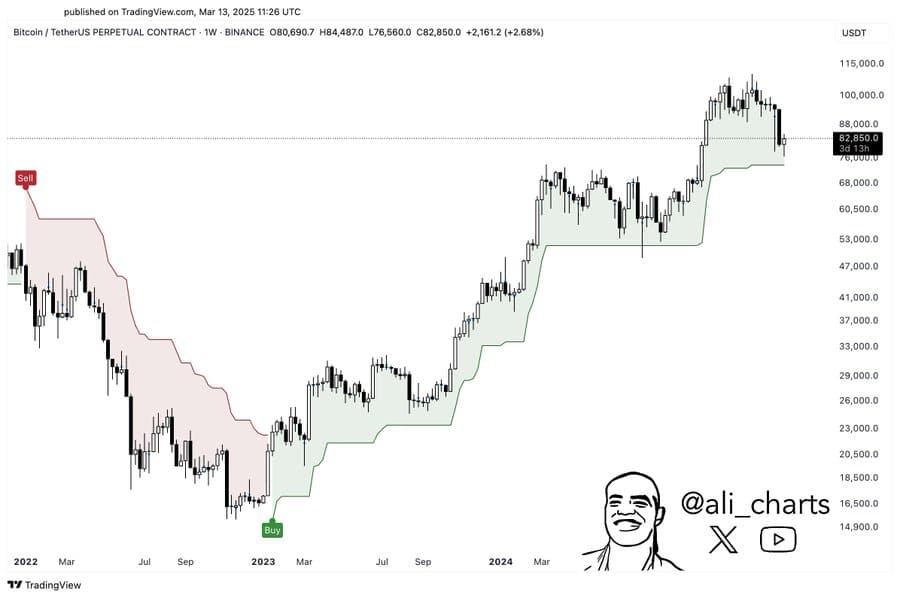

Weekly help stays a key issue

Whereas Bitcoin has been regaining energy available in the market, hinting at a attainable rally, market sentiment may shift. If this occurs, the following notable help degree can be at $74,000.

Supply: TradingView

This help degree has held agency since January 2023 and has been a basis for market rallies. If the worth reacts positively and tendencies larger from this degree, it may sign a serious Bitcoin rally. Nonetheless, a breach of this help may point out excessive bearish sentiment, resulting in additional worth declines.

For now, the market stays well-positioned for an upswing, supplied bullish sentiment continues to dominate.