Bitcoin [BTC]: Are global markets entering a liquidity cycle? If so, this is how BTC will react

- A worldwide liquidity cycle might result in improved BTC costs in accordance with current knowledge.

- Regardless of Bitcoin exhibiting bullish indicators, merchants proceed to stay bearish in opposition to BTC.

Bitcoin’s [BTC] rising costs have led to huge quantities of hypothesis amongst the crypto group. Though some merchants are skeptical concerning the growing BTC costs, some knowledge suggests there’s extra positivity on the way in which.

Learn Bitcoin’s Worth Prediction 2023-2024

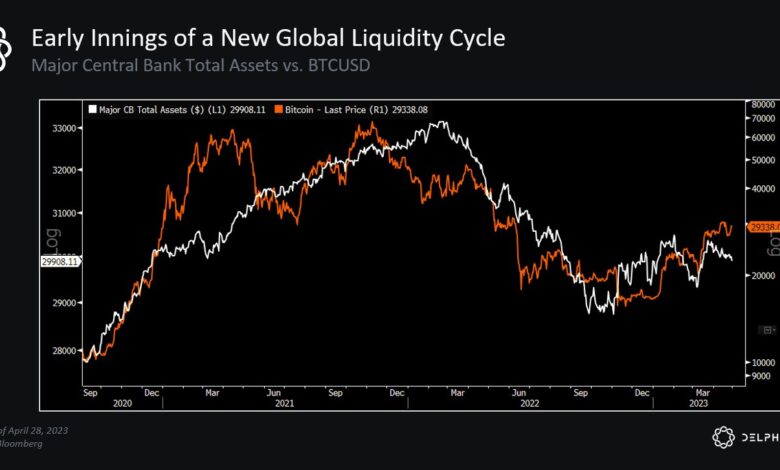

In accordance with Delphi Digital, the 75% spike Bitcoin witnessed over the previous few months might point out that the worldwide markets are getting into into a brand new liquidity cycle.

A brand new international liquidity cycle refers to a interval the place there’s a important improve within the availability of cash and credit score within the international monetary system.

This may be on account of components corresponding to central financial institution insurance policies, authorities stimulus applications, and elevated investor confidence.

If the market enters a brand new international liquidity cycle, it might probably have a optimistic impression on the worth of BTC. It is because elevated liquidity and credit score availability can result in greater funding exercise and asset costs, which might drive demand for BTC.

Supply: Delphi Digital

Taking issues positively

One other optimistic indicator for BTC can be its MVRV ratio. In accordance with knowledge offered by CryptoQuant, there’s a probability that BTC might enter one other bull run.

In January 2023, the MVRV ratio for Bitcoin broke the 1.5 stage, indicating the beginning of a bull market. The MVRV ratio was fluctuating between 1.55 and 1.45 at press time, with giant buyers monitoring it intently to purchase discounted Bitcoins throughout dips.

The evaluation additionally confirmed that the 365DSMA needs to be considered as properly, with the MVRV ratio breaking it to sign a pattern change.

If Bitcoin’s MVRV ratio breaks the 1.5 stage once more, it’s prone to shift to a variety of values between 1.8 and a couple of, that’s if BTC value reaches 30K.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Supply: CryptoQuant

Bears claw their means in

Regardless of all these bullish indicators, merchants continued to stay cynical about BTC’s development. Based mostly on knowledge from TheBlock, the Put to Name ratio for Bitcoin has skilled a big improve over current months.

This prompt that numerous merchants have taken positions betting on a possible future lower in BTC’s market value.

Supply: The Block