Bitcoin capital outflows – Reset for $60k or a launchpad to higher levels?

- Bitcoin capital outflows immediate market reassessment, signaling potential value shifts

- Bitcoin’s key assist zones may decide future bullish or bearish momentum

Bitcoin’s [BTC] latest capital outflows have raised considerations about future value actions. Traditionally, such actions have served as precursors to market shifts, prompting buyers to reassess their methods. With market makers probably on the lookout for new entry factors, the query stays – The place is Bitcoin heading?

Bitcoin capital outflows

Capital outflows in Bitcoin signify a redistribution of funds, usually reflecting adjustments in market sentiment. When buyers pull their belongings from BTC, it may point out profit-taking, fear-driven promoting, or shifts to different asset courses. Market makers – who act as liquidity suppliers – reply by exploring decrease or larger value ranges to find out optimum re-entry zones.

Such outflows usually are not inherently bearish; they often function a recalibration part. For market individuals, monitoring these actions is important.

Bullish pattern continuation?

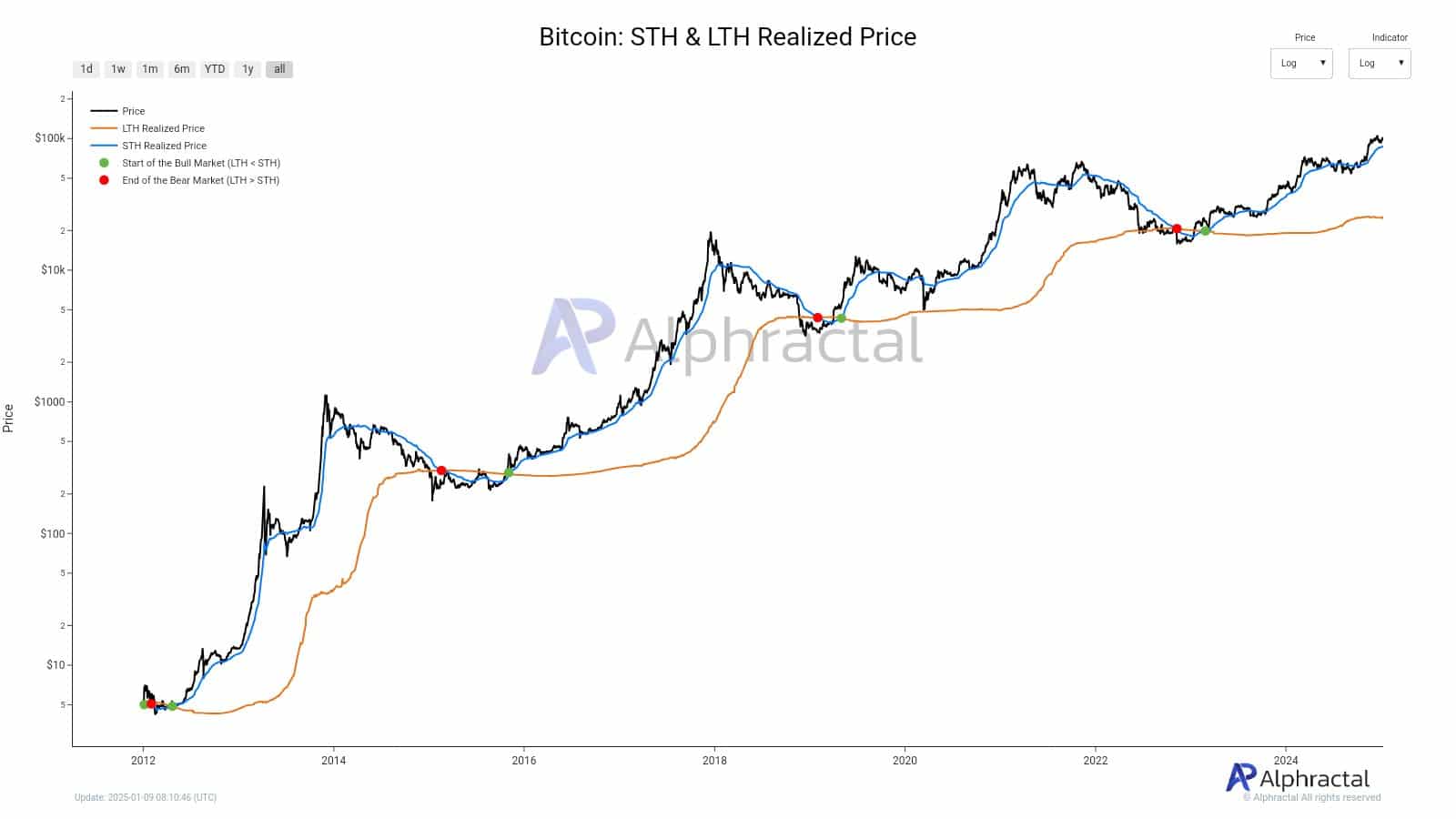

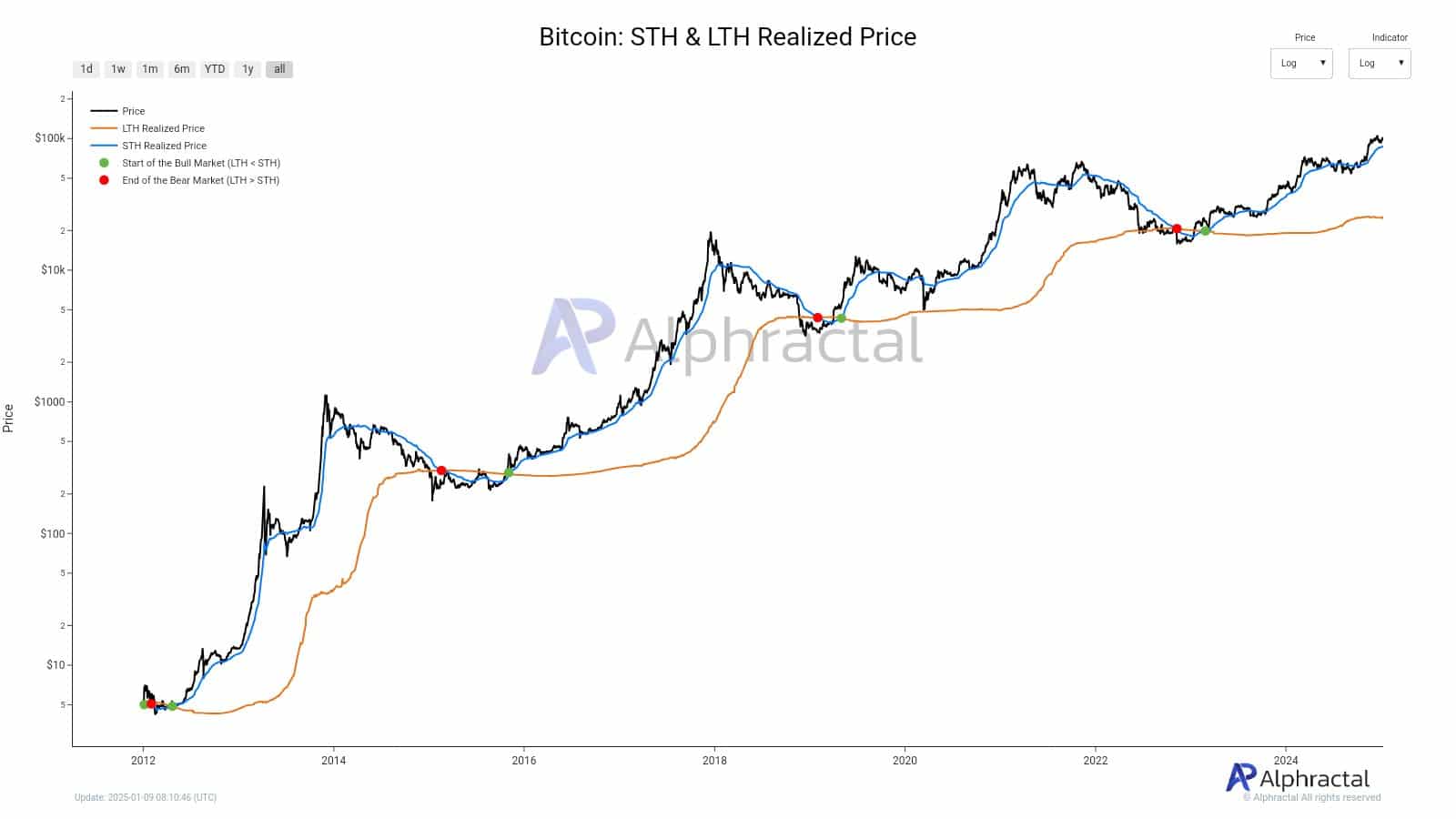

One bullish state of affairs hinges on Bitcoin reclaiming its STH Realized Value, presently pegged at $86.2k. This metric, representing the typical value of cash held by short-term holders, usually serves as a psychological and technical assist throughout bull markets. Its restoration has traditionally coincided with renewed investor confidence and bullish momentum.

Supply: Alphractal

The info highlighted how earlier bull runs revered the STH Realized Value as a springboard for additional beneficial properties. If Bitcoin surpasses this degree, it may point out a resurgence in shopping for stress, signaling that market makers and retail buyers alike are able to propel the worth larger.

This state of affairs suggests a possible upward continuation, with $86.2k performing as the primary checkpoint in Bitcoin’s rally.

Sentiment-based value motion

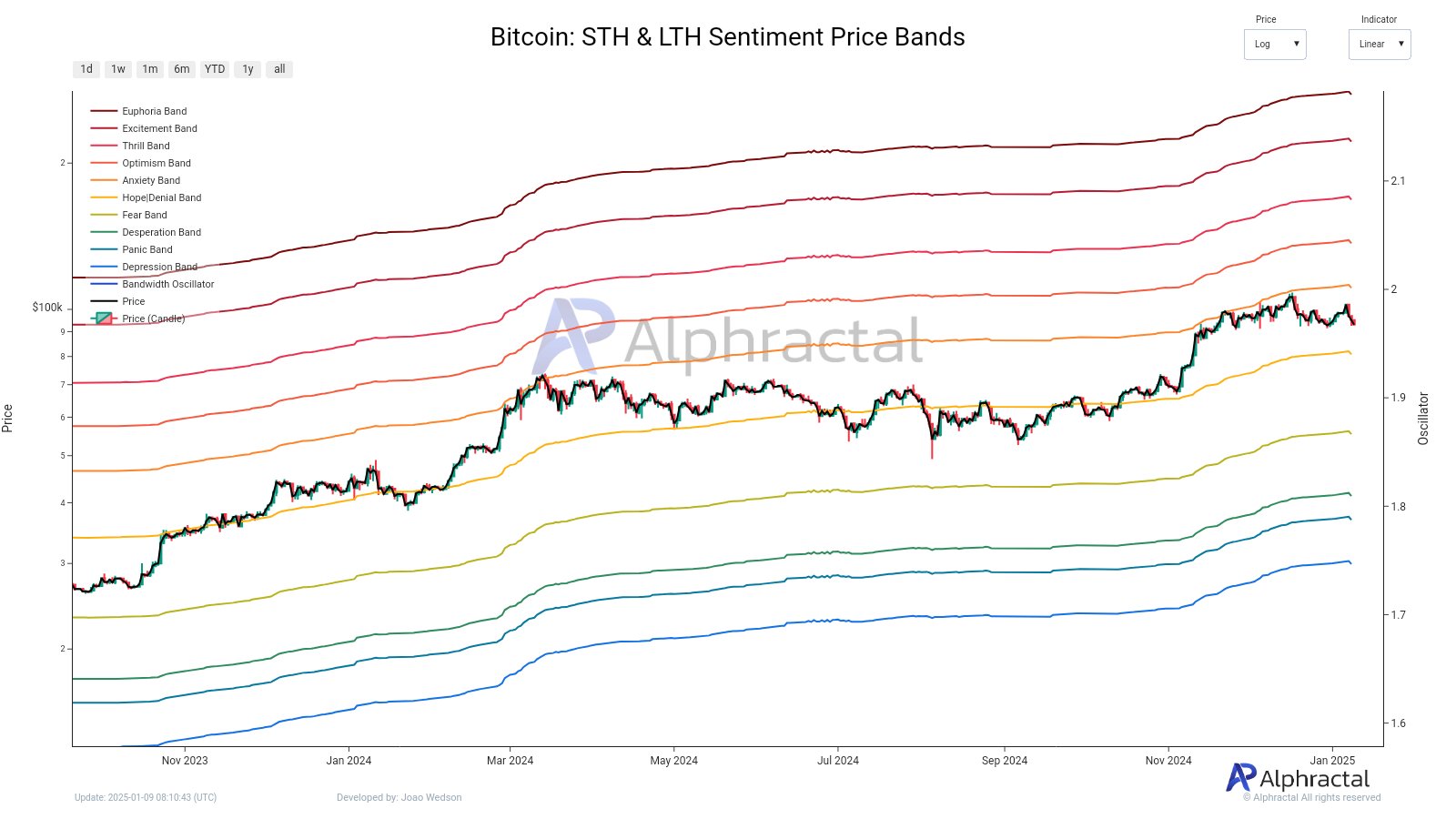

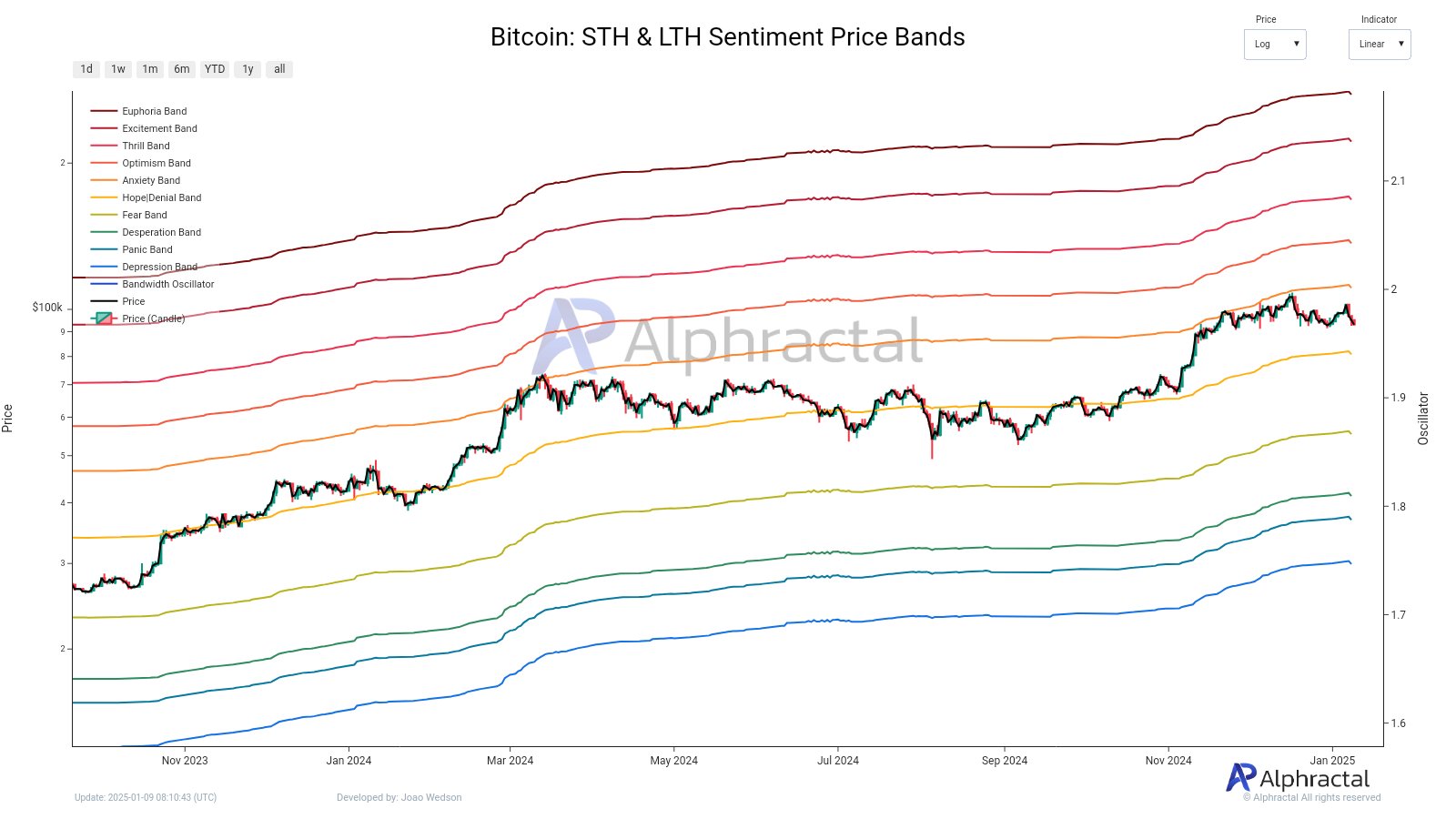

The Hope/Denial Band, presently positioned at $80.7k, serves as a significant metric reflecting the sentiment stability between short-term holders and long-term holders. This band captures emotional shifts available in the market, oscillating between optimism and warning, and infrequently acts as a stabilizing drive throughout bullish phases.

Supply: Alphractal

Traditionally, Bitcoin’s value has revered this vary, with sustained tendencies often rising from these ranges. For STHs, this zone symbolizes confidence, whereas LTHs view it as a possible validation of long-term funding methods.

As proven within the chart, prior interactions with the Hope/Denial Band coincided with upward value actions, reinforcing its function as a key reference level. A robust protection of $80.7k may sign resilience and bolster bullish momentum.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

A possible downturn

The chance of the most recent Bitcoin value drop appeared to reflect occasions from Might 2021, when the market confronted a pointy correction following overheated sentiment and profit-taking. In that occasion, important capital outflows drove Bitcoin to decrease assist ranges, resetting market expectations.

At present, related dynamics are in play. If bearish pressures prevail, Bitcoin may decline to the $66k–$60k vary. These ranges align with key metrics such because the Energetic Realized Value and True Market Imply Value, which account for the community’s truthful worth excluding newly mined cash.

Such a downturn would check investor confidence and problem each short- and long-term holders. Whereas this state of affairs alerts warning, it additionally offers a chance for market makers to discover sustainable re-entry factors.