Bitcoin ETFs Records Largest Net Outflows in One Day Since Launch As $671,900,000 Yanked Out Amid BTC Plunge

New knowledge from a crypto insights platform reveals that Bitcoin (BTC) exchange-traded funds (ETFs) noticed the biggest internet outflows in sooner or later since they launched in January.

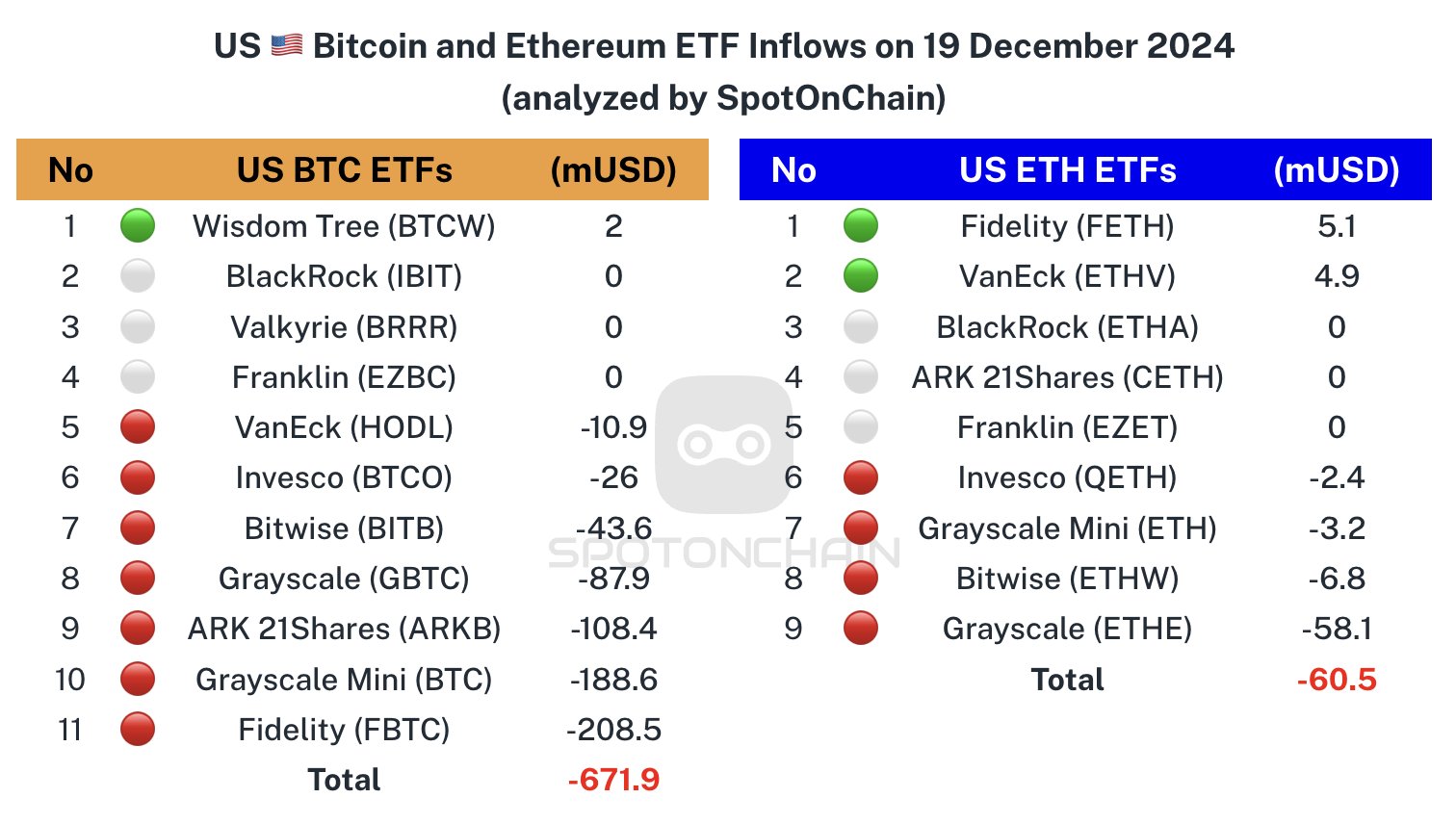

In a brand new thread on the social media platform X, market intelligence agency Spot On Chain says that Bitcoin ETFs witnessed lots of of hundreds of thousands of {dollars} price of outflows on December nineteenth as the value of the crypto king dipped under the $100,000 mark.

In line with Spot On Chain, the ETF that led the way in which when it comes to general outflows was Constancy’s FBTC whereas BlackRock’s IBIT ETF remained sideways. December nineteenth additionally marked the top of a 15-day influx streak for Bitcoin ETFs.

“The US BTC ETFs simply skilled their LARGEST internet outflow since launch: $671.9 million. Constancy’s FBTC led the outflows with a report $208.5 million, whereas BlackRock’s IBIT stayed regular with a $0 internet circulate.

This additionally marked the top of a 15-day influx streak for BTC ETFs and an 18-day streak for ETH ETFs. Within the final 24 hours, BTC dropped 4.22%, and ETH fell 7.97%.”

In line with blockchain tracker SoSoValue, different BTC ETFs that witnessed notable outflows include Grayscale’s GBTC, which noticed $87.86 million; ARK Make investments’s ARK 21Shares ARKB, which noticed $108.35 million; VanEck’s HODL, which noticed $10.91 million and Invesco’s BTCO, which noticed $25.97 million.

The highest crypto asset by market cap is buying and selling for $97,417 at time of writing. On December seventeenth, it peaked at round $108,000.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Athitat Shinagowin/Andy Chipus