Bitcoin ETFs see outflows once again – ‘Becoming comical now’

- Bitcoin ETFs noticed vital inflows of $192.4 million after a short outflow section.

- Ethereum ETFs proceed to battle with inconsistent inflows, highlighting market volatility.

Institutional buyers have momentarily halted their aggressive accumulation of Bitcoin [BTC], as the worth of BTC enters a consolidation section.

As per latest information from numerous sources, together with UK-based funding agency Farside Investors, inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) have turned internet detrimental for the primary time in two weeks.

This pause in shopping for exercise highlighted rising warning amongst buyers as they assess the following transfer in BTC’s risky market.

Bitcoin ETF analyzed

In response to the newest replace, Bitcoin ETFs skilled a big outflow of $79.1 million on the twenty second of October.

Notably, Ark’s 21Shares BTC ETF led the downturn with the most important outflow, amounting to $134.7 million.

Nevertheless, not all ETFs noticed detrimental motion—different Bitcoin ETFs registered internet inflows, with BlackRock’s iShares Bitcoin Belief (IBIT) standing out by recording the best influx of $43 million.

This divergence in fund actions displays various investor sentiment throughout completely different Bitcoin ETF merchandise.

Moreover, as of the twenty third of October, BTC ETFs reversed course with a considerable influx of $192.4 million.

Regardless of Ark’s 21Shares persevering with to steer outflows with $99 million, adopted by Bitwise’s BITB dropping $25.2 million and VanEck’s HODL down by $5.6 million, the general development shifted.

Notably, BlackRock’s iShares Bitcoin Belief ETF (IBIT) recorded a outstanding influx of $317.5 million, underscoring its ongoing enchantment amongst buyers.

This constant inflow highlights rising investor confidence in BlackRock’s Bitcoin ETF as a most popular alternative for market publicity.

Execs weigh in

Remarking on the identical, Nate Geraci, cofounder of the ETF Institute, took to X (previously Twitter) and famous,

Supply: Nate Geraci/X

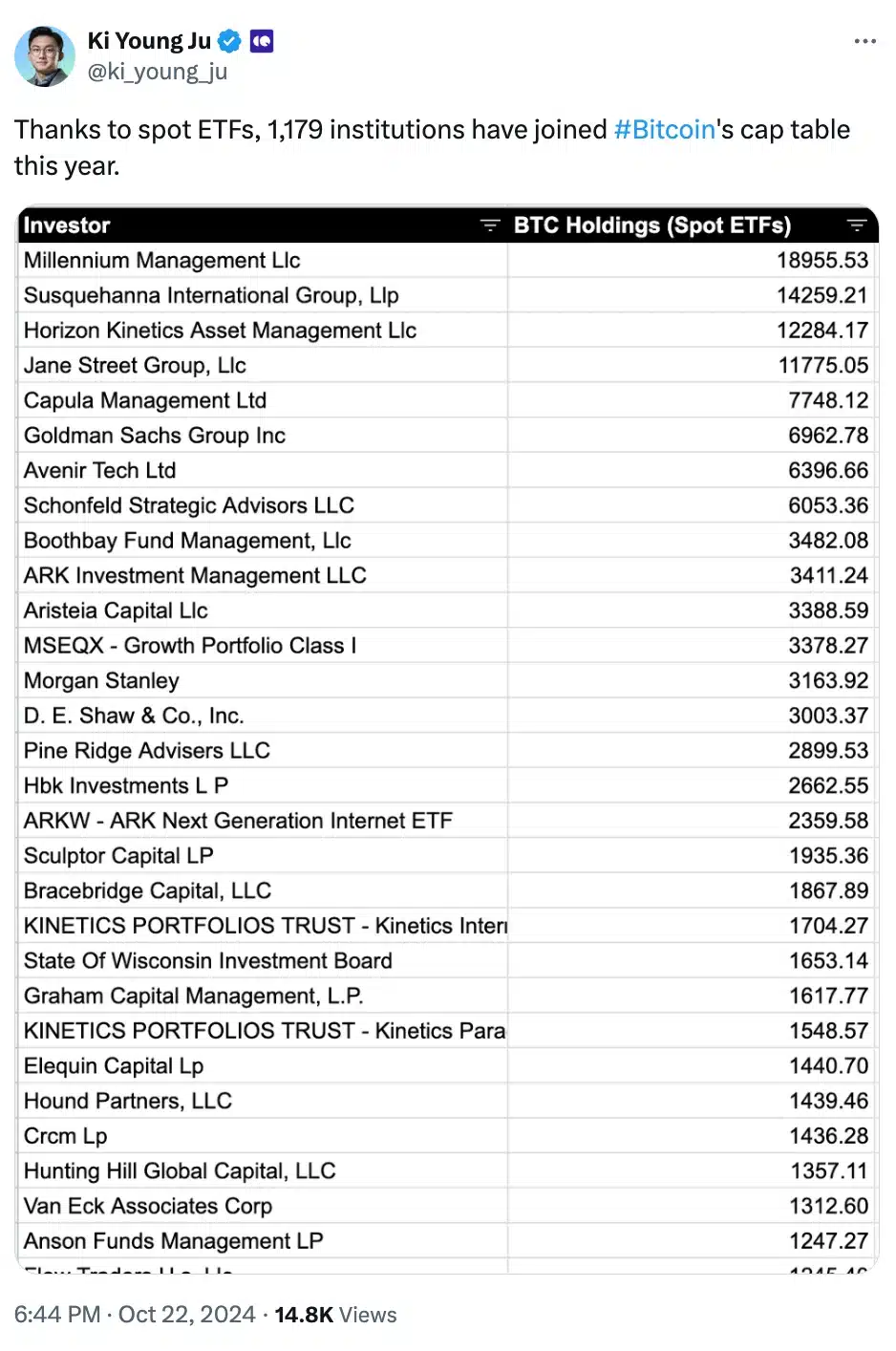

Including to the fray was Ki Younger Ju, co-founder of onchain analytics platform CryptoQuant who stated,

Supply: Ki Younger Ju/X

Ethereum ETF replace

Then again, Ethereum [ETH] ETFs skilled blended outcomes on each the twenty second and the twenty third October, though they haven’t garnered the identical stage of curiosity as Bitcoin ETFs.

On the twenty second of October, ETH ETFs noticed a complete outflow of $11.9 million, with solely BlackRock’s ETHA reporting any inflows, whereas all others remained stagnant.

The next day, Ethereum ETFs noticed modest inflows of $1.2 million.

Nevertheless, Grayscale’s ETHE confronted outflows of $7.6 million, whereas solely Constancy, 21Shares, and Invesco’s Ethereum ETFs managed to file inflows, indicating the risky nature of ETH ETF investments.

ETH’s and BTC’s worth motion defined

In the meantime, as of the newest market updates, Bitcoin is trading at $66,811.00, reflecting a 0.51% improve over the previous 24 hours, displaying regular momentum.

In distinction, Ethereum skilled a downturn, with its worth dropping by 2.29% to $2,519.34 in line with CoinMarketCap information.

These fluctuations spotlight the continued volatility within the crypto market, with BTC sustaining its upward development whereas ETH faces short-term declines.