Bitcoin, Ethereum fall – Reasons and could this be good news for you?

- Dialogue across the cryptocurrencies tumbled as costs fell

- Whales are shopping for the BTC dip however others preserve promoting ETH

Till the twenty second of January, Bitcoin’s [BTC] value stayed above $40,000. Ethereum [ETH], up to now, additionally modified arms above $2,400.

However the final 24 hours have been catastrophic for the highest two cryptocurrencies. BTC slid by 3.00% whereas ETH’s worth dropped by 3.59% inside the similar interval. On account of the lower, conversations across the undertaking fell.

What are the explanations behind the market decline?

The catalyst for the massacre continues to be fund flows from Grayscale Bitcoin Belief, previously Grayscale Bitcoin Belief (GBTC). In accordance with AMBCrypto’s evaluation of CryptoQuant’s information, 14,291 Bitcoins flew out of the fund on 22 January, equal to $570 million as per prevailing market costs.

For the reason that launch of the ETF, Grayscale’s on-chain stability has fallen by 66,000 BTCs, most of that are getting liquidated within the secondary market.

There’s quite a lot of negativity too. Utilizing the Social Quantity display on Santiment, AMBCrypto discovered that discussions about ETH fell by 21% in comparison with when the SEC authorised the Bitcoin spot ETFs. For BTC, it was a 35% decline.

📉 #Bitcoin briefly fell under $40K for the primary time since December 4th. Monday has been a massacre for many of the #crypto sector. Notably, there’s 35% much less dialogue towards $BTC and 21% much less towards $ETH in comparison with the prior #ETF approval week. #FUD is

(Cont) 👇 pic.twitter.com/iievb8mbHJ

— Santiment (@santimentfeed) January 22, 2024

Other than the decline in messages related to those cryptos, the drop additionally meant that merchants had avoided leaping in on the value actions.

Beforehand, AMBCrypto had assessed Bitcoin’s possibilities of dropping under $40,000 earlier than January ends. Within the article, we talked about the way it was attainable. However the fee at which it occurred was one thing surprising.

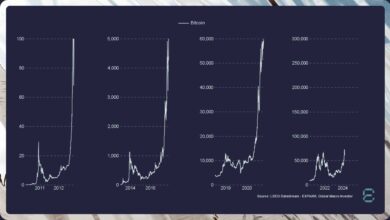

Down earlier than the following “up solely”

Nevertheless, the drawdown could possibly be a mandatory correction Bitcoin and Ethereum want for a better bounce. Regardless, there’s a excessive probability that the restoration won’t happen quickly, as extra decline could possibly be on the best way.

One of many causes for the potential rebound could possibly be linked to the Weighted Sentiment. At press time, Bitcoin’s Weighted Sentiment had slipped to 0.359.

Then again, the metric on ETH’s finish additionally dropped to -0.803.

Weighted Sentiment measures the constructive/damaging feedback about an asset. So, the decline into the damaging area suggests the typical notion round ETH and BTC was not optimistic.

Supply: Santiment

However by way of the value motion, this decline may foreshadow a better worth for the cryptocurrencies. For instance, on the 3oth of November 2023, Bitcoin’s value closed at $38,688.

At the moment, the Weighted Sentiment was across the similar worth it was at press time.

On the identical day, ETH’s value was $2,052., and the metric too was damaging. Quick-forward to the fifth of December, Bitcoin’s value was $44,080 whereas ETH was $2,293.

Massive traders need a low cost

Apart from this era, there are additionally a number of cases of the identical motion. Subsequently, there’s a probability that when revival arrives, BTC and ETH would possibly bounce increased than $49,000 and $2,700 respectively.

Within the meantime, some market individuals appear to be taking motion towards the potential rebound.

In accordance with AMBCrypto’s evaluation of Spot On Chain information, a whale bought $1.03 million price of the BTC dip simply earlier than it fell under $40,000.

One other whale purchased $600,000 worth of the coin as the value fell additional. Nevertheless, ETH has not loved that goodwill but, because it appears to be present process large-scale sell-offs.

Real looking or not, right here’s ETH’s market cap in BTC’s phrases

As an illustration, the Ethereum Basis offered not too long ago. As well as, Alameda Analysis and Celsius Community moved some ETH to Centralized Exchanges (CEXs).

With this in place, BTC may get well a lot quicker than ETH, until the whales determine so as to add ETH to the shopping for spree.