Bitcoin records two outflows from Coinbase in a week: What’s going on?

- Bitcoin has seen two giant outflows from Coinbase within the final week.

- There was a corresponding spike within the trade’s premium index.

On the first of April, Bitcoin [BTC] recorded its second-largest outflow from main cryptocurrency trade Coinbase, CryptoQuant’s knowledge confirmed.

In line with the info supplier, on that day, 17,000 BTC price round $1 billion was faraway from the trade. Earlier, on the twenty eighth of March, outflow from Coinbase totaled 16,800 BTC.

Excessive outflows from Coinbase typically point out giant institutional buyers transferring vital quantities of their BTC holdings.

This may be for a number of causes, similar to funding diversification or allocation to different funding automobiles.

Sharing the identical viewpoint, CryptoQuant’s analyst, Burak Kesmeci, noted that the latest spike in BTC outflows from Coinbase could possibly be “associated to institutional buy or Spot ETF.”

Coinbase premium retraces

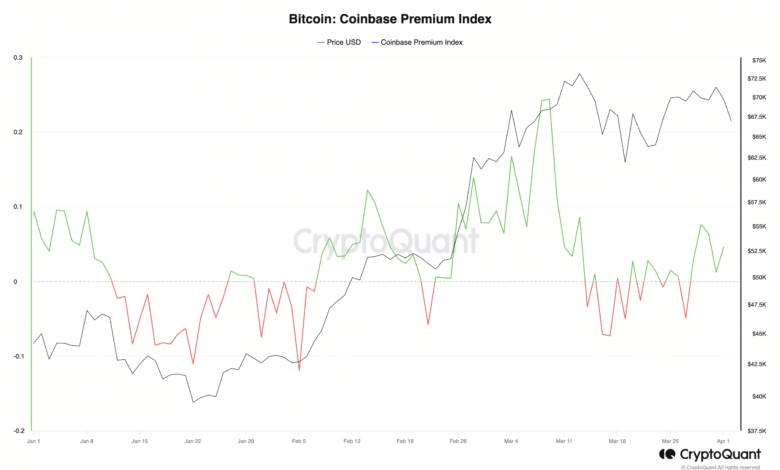

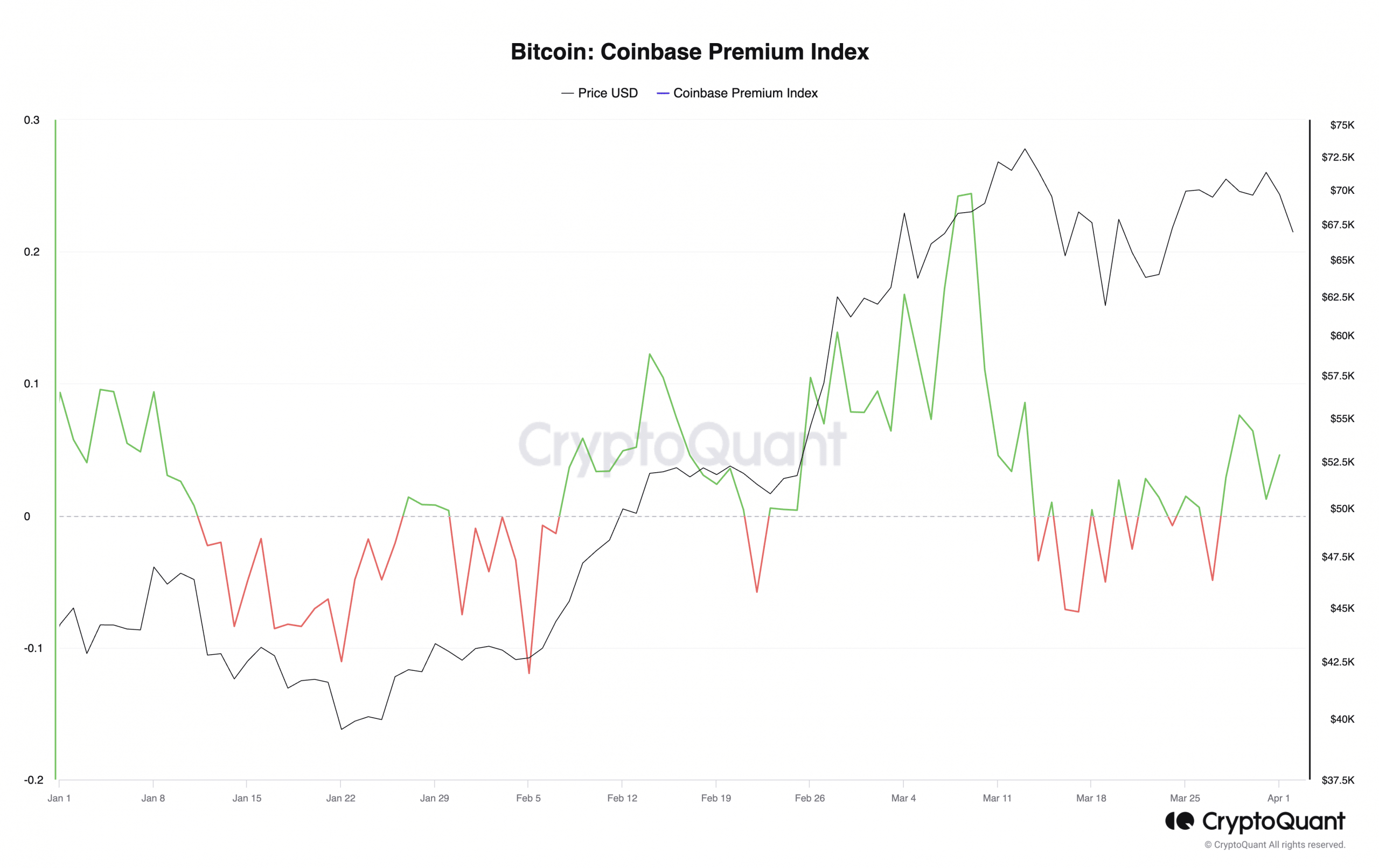

The big variety of BTCs faraway from Coinbase on the first of April coincided with a reversal within the coin’s Coinbase Premium Index (CPI).

On that day, the coin’s CPI, poised to fall once more into detrimental territory, modified its course and trended upward.

Supply: CryptoQuant

This metric measures the distinction between BTC’s costs on Coinbase and Binance. When its worth grows, it suggests vital shopping for exercise by US-based buyers on Coinbase.

Conversely, when it declines and dips into the detrimental territory, it alerts much less buying and selling exercise on the US-based trade. At press time, BTC’s CPI was 0.045.

Between the thirty first of March and the first of April, this climbed by over 250%.

Confirming a resurgence in exercise from U.S.-based coin holders, BTC’s Coinbase Premium Hole additionally elevated by over 200% throughout the 24-hour interval.

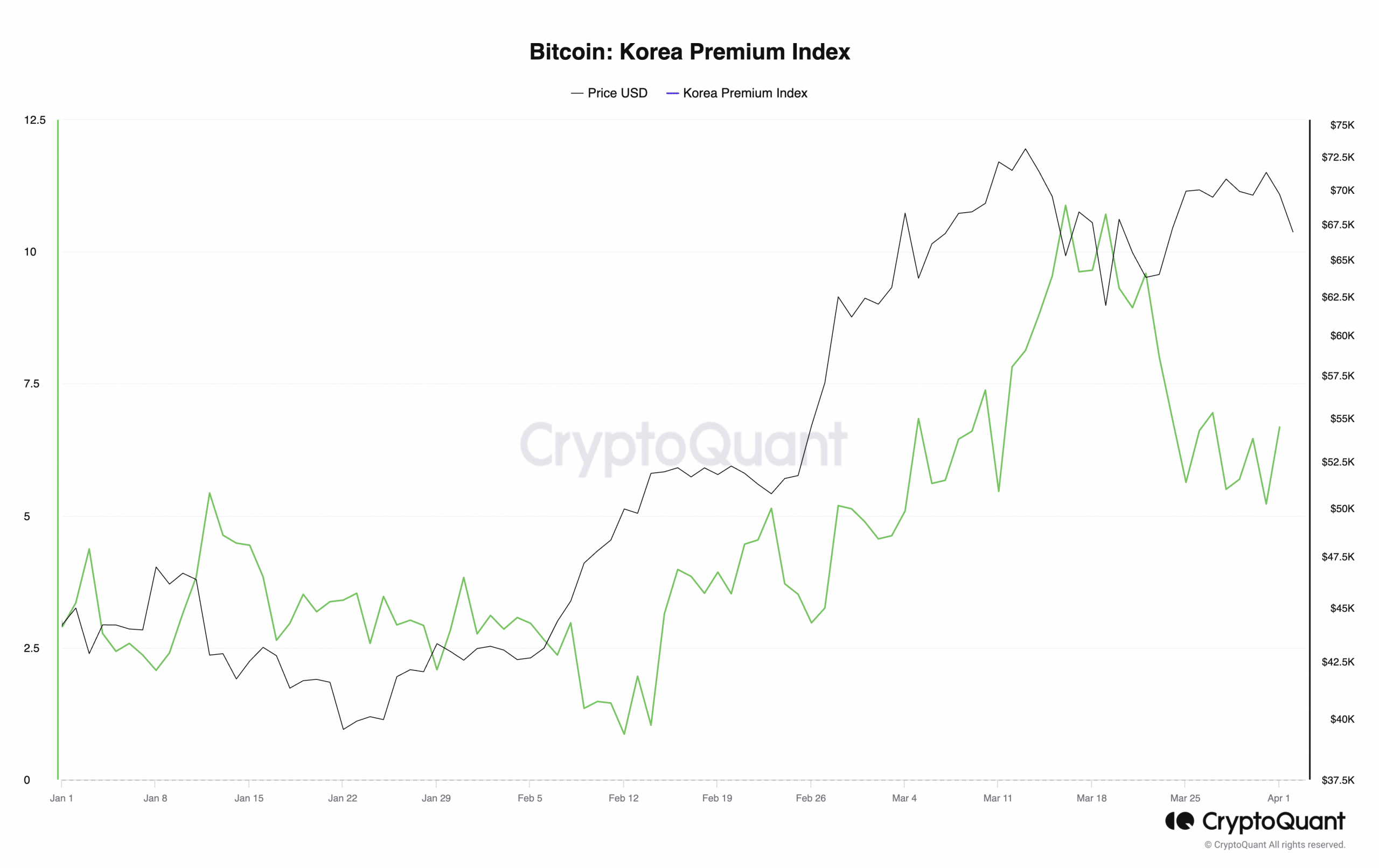

Though the Asian markets adopted an identical pattern throughout the window interval below overview, an evaluation of BTC’s Korean Premium Index (KPI) confirmed that it has remained constructive in 2024 regardless of a number of pullbacks.

At press time, BTC’s KPI was 6.68.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This metric measures BTC’s value hole between South Korean exchanges and different world exchanges.

When the index’s worth is constructive, it suggests elevated demand for Bitcoin throughout the South Korean market relative to completely different markets.