Bitcoin: Rising transactions cause speculation, more inside

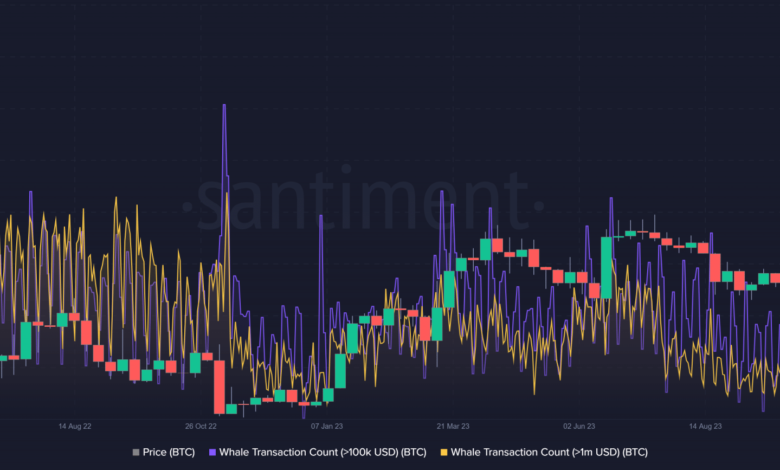

- Whale transactions have elevated to a degree not seen in over six months.

- Bitcoin’s change netflow instructed the absence of sell-offs.

Not too long ago, an increase in Bitcoin [BTC] whale transactions coincided with a value drop brought on by a market crash. Had been these transactions indicative of a sell-off, or a strategic accumulation by the whales?

Bitcoin whales step up transactions

Within the wake of current value volatility by the king coin, transactions by Bitcoin whales elevated noticeably. In line with AMBCrypto’s evaluation of Santiment’s chart, transactions over $100,000 rose notably across the 4th and fifth of January.

The chart confirmed that the variety of transactions on this bracket was over 34,000. Notably, this marked the primary occasion of whale transactions reaching such heights since June 2022.

Nonetheless, it’s price noting that the transaction rely had decreased to round 9,400 on the time of this writing.

Supply: Santiment

Promote-off or accumulation?

The current transaction surge by Bitcoin whales prompted curiosity concerning the commerce course. One strategy to gaining insights is to look at the change circulate of BTC throughout and after the rise in transaction counts.

AMBCrypto’s examine of CryptoQuant’s change netflow knowledge confirmed constant negativity over the previous few days. Aside from the 4th of January, which witnessed a slight constructive influx of round 1,500, different days noticed damaging flows.

Supply: CryptoQuant

Nonetheless, a better take a look at the chart confirmed that the damaging circulate was insignificant, signifying many inflows.

As of press time, the netflow stood at -1,174. AMBCrypto’s evaluation of the change circulate instructed an absence of indications pointing in direction of a sell-off from main addresses. Quite the opposite, there have been indications of minor accumulations.

This implied that some merchants sought to capitalize on the marginal value decline.

Bitcoin volatility sees slight contractions

AMBCrypto’s examination of Bitcoin’s each day timeframe confirmed a noteworthy remark—it constantly maintained a place above its short-moving common (yellow line). Regardless of the continued decline, this confirmed that the general development remained constructive.

Learn Bitcoin’s [BTC] Value prediction 2024-25

An examination additional revealed minimal fluctuations during the last three days. As of this writing, it was buying and selling at over $44,290, displaying a lower than 1% improve.

Supply: Buying and selling View

A take a look at Bitcoin’s Bollinger Band (BB) instructed a slight discount in BTC volatility at press time. The development displayed a bullish stance, evident within the Relative Power Index (RSI).