Bitcoin: Signs of bull run emerge, but all’s not well with BTC

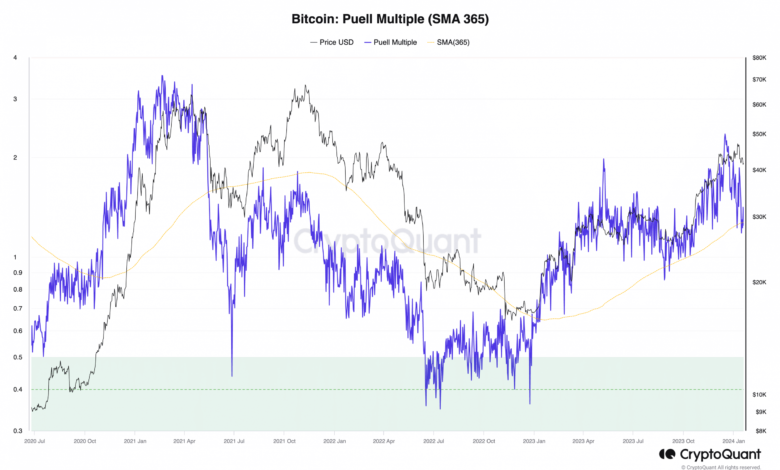

- BTC’s day by day Puell A number of tried to cross above its 365-day shifting common.

- Traditionally, this has preceded a leap in BTC’s worth.

Bitcoin’s [BTC] day by day Puell A number of is poised to cross above its 365-day shifting common, suggesting a possible for an upward rally, information from CryptoQuant has proven.

Supply: CryptoQuant

BTC’s Puell A number of measures the ratio of measures the ratio of BTC mined day by day to the 365-day common worth.

When it returns a excessive worth (above 4), miners are raking in earnings above their typical prices, probably main them to dump a few of their holdings, placing downward strain on the worth.

Conversely, a low Puell A number of (under 0.5) alerts miners are fighting low revenue and are extra inclined to carry onto their cash to keep away from taking a loss.

In a brand new report, the chart offered by pseudonymous CryptoQuant analyst DataScope confirmed that, traditionally, a crossover of the day by day Puell A number of above the 365-day shifting common has typically been adopted by intervals of BTC worth appreciation.

In accordance with the analyst:

“The connection between the day by day Puell A number of values and the 365-day Puell A number of shifting common can point out market traits, with a day by day Puell A number of crossing above the 365-day shifting common typically indicating an upward worth pattern.”

No rally in view within the quick time period

Whereas many predicted a rally above $50,000 post-ETF approval, BTC peaked at $48,625 on the eleventh of January and has since trended downward.

Exchanging fingers at $40,918 at press time, the main coin’s worth has plummeted by 16% within the final ten days, based on information from CoinMarketCap.

Additionally, the approaching crossover of BTC’s day by day Puell A number of above the 365-day shifting common prompt the opportunity of a rally.

Nevertheless, the low commerce quantity skilled within the final week indicated that this might not be attainable within the quick time period.

An evaluation of the coin’s day by day buying and selling quantity on a seven-day shifting common confirmed that it has declined by 35% for the reason that 14th of January.

Knowledge from Santiment revealed that the low buying and selling exercise is perhaps because of the detrimental weighted sentiment that has trailed the coin since ETF went dwell.

Returning a detrimental worth at press time, BTC’s Weighted Sentiment was -0.494.

Additional, readings from the coin’s day by day worth chart confirmed that it had remained in a bear cycle for the reason that twelfth of January, when its MACD line crossed under the pattern line to return detrimental values.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

When an asset’s MACD line intersects its pattern line and falls under the zero line, it signifies that the short-term shifting common has crossed under the long-term shifting common, suggesting that downward momentum is stronger than any uptrend.

Merchants typically interpret this as a promote sign, placing downward strain on an asset’s worth. Subsequently, any potential worth uptrend could also be delayed till sentiment improves and the bulls try and regain market management.