Bitcoin spot ETF: BlackRock expects approval on this date

- BlackRock is anticipating approval for its proposed Bitcoin spot ETF on the tenth of January.

- The possibilities of rejection of the ETFs dropped from 10% to five%, per an analyst.

The approaching week may grow to be historic for cryptocurrencies, because the U.S. Securities and Trade Fee (SEC) was set to pronounce a call on the spot Bitcoin [BTC] exchange-traded funds (ETFs) functions.

BlackRock expects approval on today

Amidst the hype and anticipation, BlackRock, the world’s largest asset supervisor, remained optimistic about its possibilities. In accordance with a report by Fox Enterprise, the TradFi large was anticipating an approval on the tenth of January.

BlackRock submitted a request to the SEC for an ETF tied to the spot value of Bitcoin in June final yr, encouraging different TradFi corporations to drop their hat within the ring as nicely.

The submitting by an organization, with greater than $9 trillion in belongings beneath administration (AUM), has been extensively seen as one of the best indication of rising institutional curiosity in Bitcoin and cryptos basically.

Certainly, the market erupted in jubilation with Bitcoin rising 25% in every week following BlackRock’s submission at the moment, AMBCrypto observed utilizing CoinMarketCap’s knowledge.

Countdown begins

As of this writing, most formalities linked to the ETF functions have been accomplished. After this, the SEC is anticipated to formally begin clearing the ETFs.

In the meantime, the possibilities of rejection for the ETFs dropped from 10% to five%, in line with Bloomberg ETF analyst Eric Balchunas.

The possible causes for rejection, together with President Biden’s intervention and SEC developing with new causes, had been deemed unlikely.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Bitcoin spikes above $44,000

These developments continued to offer a bullish impetus to BTC. The king coin surged over 44,000 within the final 24 hours.

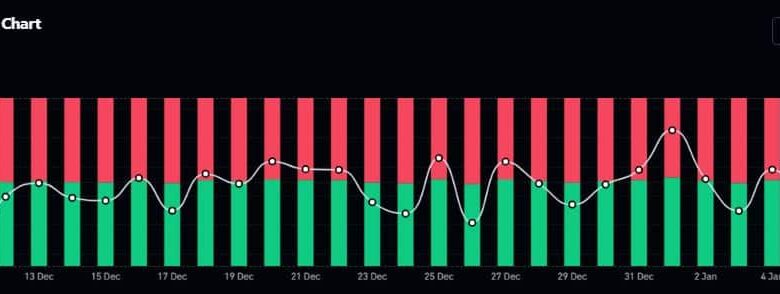

Furthermore, the variety of lengthy positions taken for the world’s largest digital coin elevated, as per AMBCrypto’s evaluation of Coinglass’ knowledge. The upper variety of bullish leveraged bets vis-à-vis bearish ones, mirrored confidence in Bitcoin.

Supply: Coinglass