Bitcoin Spot ETFs Approved After 14 Years- The Journey So Far

The 12 months 2024 marks the daybreak of a brand new period, not only for expertise however for finance, as a serious victory was achieved for Bitcoin Spot ETFs (Exchang-Traded Funds). It’s now the period the place the previous shall be appreciated for its foresight and doggedness.

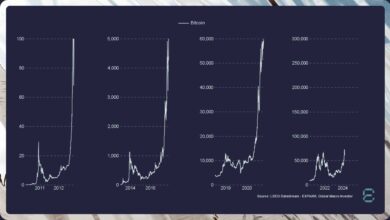

When the pioneer cryptocurrency and digital foreign money, Bitcoin launched in January 2009, it was nothing like a real-world asset or of an ‘agreed’ digital worth, however an virtually uncared for bag of gold because it confronted sufficient rejection from all phases. Even with Satoshi’s Whitepaper, Bitcoin wasn’t given a cordial welcome on the earth of finance.

Nonetheless, for all its promise, BTC remained shrouded in an aura and skepticism. It took a number of years for Bitcoin to cement its worth on the earth of expertise, finance, and the digital economic system, assuming a large position amidst many different cryptocurrencies.

Nonetheless, On January 10, 2024, the SEC, in its official submitting, approves all 11 Bitcoin Spot ETFs. This long-awaited inexperienced mild from the US SEC marked a watershed second, not only for Bitcoin, however for the complete cryptocurrency trade.

The 14-year journey up to now was arduous and paved with skepticism; regulatory hurdles loomed massive, with the SEC citing considerations about market manipulation and investor safety as justification for repeated rejections. Makes an attempt like Bitcoin futures ETFs provided restricted publicity, failing to seize the true essence of a spot ETF’s direct value monitoring.

Bitcoin Spot ETF Defined

The current approval of Bitcoin spot ETFs has stirred pleasure throughout the monetary panorama. However what precisely are these devices, and what influence will they’ve on the way forward for BTC and, extra broadly, on the funding panorama?

Bitcoin “Spot” ETFs (exchange-traded funds), not like their futures-based counterparts, don’t observe the worth of Bitcoin futures contracts. As a substitute, they take a extra direct method, holding the underlying asset – Bitcoin itself – in safe digital custodians.

This eliminates the potential for “foundation danger,” a phenomenon the place futures costs deviate from the precise money value of Bitcoin. Merely put, Spot ETFs provide a extra simple and clear strategy to acquire publicity to BTC’s value actions, akin to conventional gold-backed ETFs.

Bitcoin Spot ETFs perform equally to their conventional counterparts, corresponding to these monitoring inventory market indices. They pool investor capital, buying Bitcoin and holding it securely. Every share of the ETF represents a fractional possession of the pooled Bitcoin, permitting buyers to take part out there with out straight holding or managing the cryptocurrency themselves. This eliminates technical complexities and potential safety dangers, significantly for these with restricted crypto expertise, doubtlessly broadening the bottom of Bitcoin buyers.

The Genesis Of Bitcoin ETFs (Early Days and Conceptualization – 2013-2017)

The earliest sparks of a Bitcoin ETF idea date again to 2013, when the Winklevoss twins first proposed their Gemini ETF. Winklevoss twins, Cameron and Tyler, each tech entrepreneurs with a imaginative and prescient in 2013, submitted the primary software for a Bitcoin ETF, the Gemini ETF, sparking the decade-long journey to regulatory approval.

This audacious proposal was outrightly rejected by the SEC through the tenure of its former chairman, Jay Clayton, who later resigned in 2020 and have become a supporter of cryptocurrency. Curiously, Clayton is now actively concerned in crypto rules when he joined the advisory board of Fireblocks, a crypto custody platform.

The next years have been a crucible of innovation and uncertainty. Whereas Bitcoin’s market capitalization surged, attracting each fervent supporters and cautious observers, the SEC remained hesitant. The regulator’s considerations about market manipulation, value volatility, and the nascent state of blockchain expertise have been cited as justifications for repeated rejections of subsequent ETF proposals, together with Grayscale’s try and convert its Bitcoin Funding Belief right into a spot ETF.

But, amidst the rejections, there have been sparkles of progress. Technological developments improved blockchain safety and custody options, addressing preliminary considerations about vulnerability and potential wash buying and selling. The worldwide adoption of Bitcoin, significantly in Canada with its approval of Spot ETFs in 2021, served as a compelling case examine for elevated accessibility and market stability.

This era additionally noticed the SEC’s stance slowly evolve. The appointment of Gary Gensler as SEC Chair in 2021 introduced a newfound openness to dialogue and exploration of potential regulatory frameworks for cryptocurrencies. The approval of the primary US-listed futures-based bitcoin ETF in October 2021, regardless of its limitations, provided a glimpse of what could possibly be.

The Turning Level: A Decade Of Persistence Pays Off (2018-2023)

Whereas the 2017-2018 crypto growth and subsequent crash despatched shockwaves by means of the trade, it additionally served as a crucible, forging resilience and fueling a renewed concentrate on compliance and innovation. Trade figures like Grayscale, undeterred by earlier rejections, continued to refine their proposals, incorporating essential safeguards and addressing regulatory considerations.

This relentless pursuit of approval lastly yielded ends in 2023. In Could, Cathie Wooden’s ARK Investments filed for a spot bitcoin ETF, setting a definitive deadline for the SEC’s choice.

Then, in June, BlackRock’s entry into the world with its personal Spot Bitcoin ETF software despatched ripples of pleasure by means of the monetary world. This transfer by a standard monetary big signalled an important shift in sentiment, demonstrating rising institutional confidence in BTC’s potential.

The months that adopted have been a whirlwind of exercise. A flurry of purposes from corporations like Constancy and Invesco poured in, fueled by the momentum of BlackRock’s transfer and the prospect of imminent approval. In August, a pivotal authorized victory for Grayscale within the D.C. Circuit Courtroom additional strengthened the case for spot ETFs, forcing the SEC to re-examine its earlier rejections.

Lastly, the SEC, in a historic choice, greenlighted 11 spot bitcoin ETF proposals, together with these from BlackRock, Constancy, and VanEck. This second marked the fruits of a decade-long wrestle, signifying the mainstream acceptance of investor participation within the cryptocurrency area.

Ripples Throughout The Crypto Panorama: Implications Of Bitcoin Spot ETFs (2024)

The arrival of spot ETFs has forged a large internet, sending ripples throughout varied spheres of the monetary world. There are lots of potentials and challenges offered by spot ETFs, important influence on market stability, institutional adoption, and regulatory oversight. There are constructive predictions that the Bitcoin market cap might rise above $1 Trillion after the launch of Bitcoin Spot ETFs.

Let’s ponder the broader significance of this pivotal second, what it means for the way forward for finance, and its relationship between expertise and conventional monetary methods right here.

Investor Crossroads

For retail buyers, Spot ETFs provide a handy and acquainted strategy to take part within the Bitcoin market with out straight holding the cryptocurrency. This opens the door to broader adoption and elevated liquidity, doubtlessly resulting in smoother value discovery and decreased volatility. The influential American journal, Forbes predicted the BTC value will commerce as excessive as $80,000 because of Bitcoin Spot ETFs’ approval.

The 12 months 2024 can be shaping as much as be a very good one, if not probably the greatest seasons for cryptocurrency, particularly Bitcoin, because it’s the season for Bitcoin halving, which can have one other mega influence on the crypto trade.

Nonetheless, the inherent dangers of Bitcoin, together with value fluctuations and potential publicity to fraud, should not be underplayed. Buyers ought to method spot ETFs with cautious optimism, making certain a correct understanding of the expertise, market dynamics, and related dangers earlier than venturing in.

Institutional Embrace Bitcoin

The arrival of spot ETFs marks a major step in direction of institutional acceptance of Bitcoin. The involvement of established monetary establishments like BlackRock and Constancy lends credibility to the cryptocurrency and paves the way in which for additional integration with conventional monetary services and products.

Issues stay in regards to the influence of institutional involvement on market manipulation and potential conflicts of curiosity. Nonetheless, regulatory oversight and strong compliance frameworks shall be essential in making certain a good and clear marketplace for all members.

Market Redefined

Spot ETFs might doubtlessly result in higher market stability by introducing institutional buyers and their danger administration experience. This might mitigate among the inherent volatility of the cryptocurrency market, attracting a wider vary of buyers and fostering sustainable progress.

The SEC’s approval represents a cautious acceptance, not a clean test. Additional regulatory readability and potential adaptation of present frameworks is likely to be required to successfully deal with the distinctive challenges posed by the combination of cryptocurrencies into mainstream monetary methods.

Past Bitcoin

Spot ETFs might act as a gateway for buyers to discover the broader crypto panorama. Their familiarity and ease of entry would possibly encourage exploration of different promising blockchain-based initiatives, accelerating the general progress and growth of the cryptocurrency ecosystem.

The success of spot ETFs will hinge on the continued evolution of blockchain expertise and related infrastructure. Scalability, safety, and person expertise will stay key areas of focus for making certain the sleek functioning and widespread adoption of crypto-based monetary merchandise.

The 11 Spot Bitcoin ETFs merchandise (with their ticker symbols) authorized on January 10, 2024, are:

- Blackrock’s iShares Bitcoin Belief (IBIT)

- ARK 21Shares Bitcoin ETF (ARKB)

- WisdomTree Bitcoin Fund (BTCW)

- Invesco Galaxy Bitcoin ETF (BTCO)

- Bitwise Bitcoin ETF (BITB)

- VanEck Bitcoin Belief (HODL)

- Franklin Bitcoin ETF (EZBC)

- Constancy Clever Origin Bitcoin Belief (FBTC)

- Valkyrie Bitcoin Fund (BRRR)

- Grayscale Bitcoin Belief (GBTC)

- Hashdex Bitcoin ETF (DEFI)

Conclusion

The approval of Bitcoin spot ETFs is a watershed second, not only for the cryptocurrency itself, however for the complete monetary panorama. It marks a brand new chapter within the saga of Bitcoin, one the place its disruptive potential could be harnessed inside the framework of established monetary methods.

Additionally, this path ahead is paved with each alternatives and challenges. Navigating rules and addressing investor danger considerations are essential to make sure seamless integration with conventional monetary methods and regulatory our bodies, which shall be essential in figuring out the last word success of this technological leap.

Closing Ideas

The approval of Bitcoin spot ETFs will not be merely a regulatory inexperienced mild; it’s a convincing declaration of Bitcoin’s arrival on the principle stage of finance.

Associated Studying: Celestia Community: How To Stake TIA And Place For five-Determine Airdrops

Nonetheless, the journey is much from over. This approval is a milestone, not a vacation spot. As we stand at this turning level, it’s essential to recollect the spirit of defiance that birthed BTC. It was born from a want for autonomy, for freedom from centralised management, and for a extra equitable monetary system.

Whereas ETFs provide a bridge between this decentralized world and the established monetary order, it’s essential to not lose sight of those core ideas.

BTC value struggles post-Bitcoin Spot ETF approval | Supply: BTCUSD on Tradingview.com

Featured picture from Cryptopolitan, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal danger.