Bitcoin spot ETFs are exciting, but don’t forget the halving

- Traditionally, halvings have resulted in bull markets for Bitcoin.

- As BTC was getting scarcer, traders confirmed extra willingness to HODL.

Whereas the optimism across the first-ever spot exchange-traded funds (ETFs) within the U.S. is reaching a fever pitch, Bitcoin [BTC] has one other robust bullish narrative to stay up for in 2024.

No prizes for guessing — it’s the upcoming halving event due in April. The quadrennial prevalence cuts miners’ block rewards by half, eliminating the variety of tokens in circulation, and doubtlessly driving up demand for the decreased provide.

Halvings have confirmed to be bullish occurrences

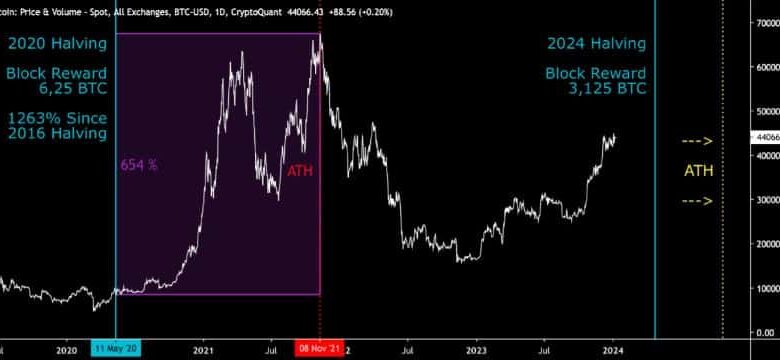

If historical past is something to go by, these occurrences did precede durations of excessive returns. A CryptoQuant analyst drew consideration to the varied durations in historical past throughout which Bitcoin’s value was closely impacted by the cyclical occasion.

Not going too far again, the king coin surged 1263% between the halvings of 2016 and 2020. Earlier than that, Bitcoin witnessed a rise of 5187% in the course of the 2012-2016 section.

Supply: CryptoQuant

One other essential takeaway from these historic numbers was how a lot Bitcoin elevated from its halving to its succeeding peaks.

From the interval between the final halving in 2020 to its all-time excessive (ATH) in November 2021, Bitcoin grew by 654%. Equally, between 2016 and 2017’s peak, Bitcoin rose 2922%.

After observing these tendencies, the analyst mentioned,

“It may be mentioned that halving occasions act as a catalyst for value will increase each earlier than and after the occasion.”

In the meantime, there have been different indicators that represented traders’ bullish sentiment surrounding the halving occasion.

Traders accumulate within the run-up to halving

A preferred crypto analyst Kashif Raza revealed that traders have been holding on to extra Bitcoin than what was getting freshly mined in a month. He famous that such a improvement was uncommon and hadn’t occurred a lot previously.

Traders obtained extra Bitcoin than mined in a month, the primary time since December.

This tells us so much about how individuals are utilizing and holding onto their Bitcoin.🧵.. pic.twitter.com/nzK6TWUFde

— Kashif Raza (@simplykashif) January 8, 2024

The saved provide exceeding the brand new issuance in a pre-halving atmosphere mirrored a shift of their technique — a technique that had in all probability a lot to do with Bitcoin turning into scarce and difficult to buy again as soon as bought.

However because it stands, the pivotal factor remains to be greater than three months away. The fast level of focus for Bitcoin and the broader crypto market remained the yet-to-be-approved ETFs.

Market observers and ETF issuers within the U.S. pinned their hopes on Wednesday because the day of the watershed occasion.

How a lot are 1,10,100 BTCs value immediately?

Are most people within the U.S. excited?

However whereas institutional curiosity within the U.S. in Bitcoin ETFs was peaking, particular person traders weren’t too excited.

In keeping with a research by crypto market tracker CoinGecko, the U.S. stood twelfth amongst international locations most serious about Bitcoin ETFs. The truth is, U.S. curiosity was lower than half of first-ranked Luxembourg’s curiosity.

Supply: CoinGecko

That is an intriguing improvement, because the U.S. ETFs have the flexibility to alter how crypto is seen globally. Such much less curiosity may very well be a trigger for alarm, however as of now, it’s too early to say something simply but.