Bitcoin struggles at $51,000 level, weekly net outflows from exchanges are largest since June 2023

Macroeconomics and monetary markets

On the US New York inventory market on the twenty third of final week, the Dow Jones Industrial Common closed 39,131 factors (0.16%) increased than the day prior to this, whereas the Nasdaq index closed 44.8 factors (0.28%) decrease.

Within the Tokyo inventory market, the Nikkei Inventory Common, which hit a document excessive for the primary time in 34 years, continued to rise to 39,340 yen, a rise of 227 yen (0.58%) from the day prior to this.

Amongst US shares associated to crypto belongings (digital foreign money), Coinbase fell 2.99% from the day prior to this, and MicroStrategy fell 3.6%.

CoinPost app (warmth map operate)

connection:Why Sumitomo Mitsui Card Platinum Most well-liked is quickly gaining reputation as a brand new NISA financial savings funding

Digital foreign money market situations

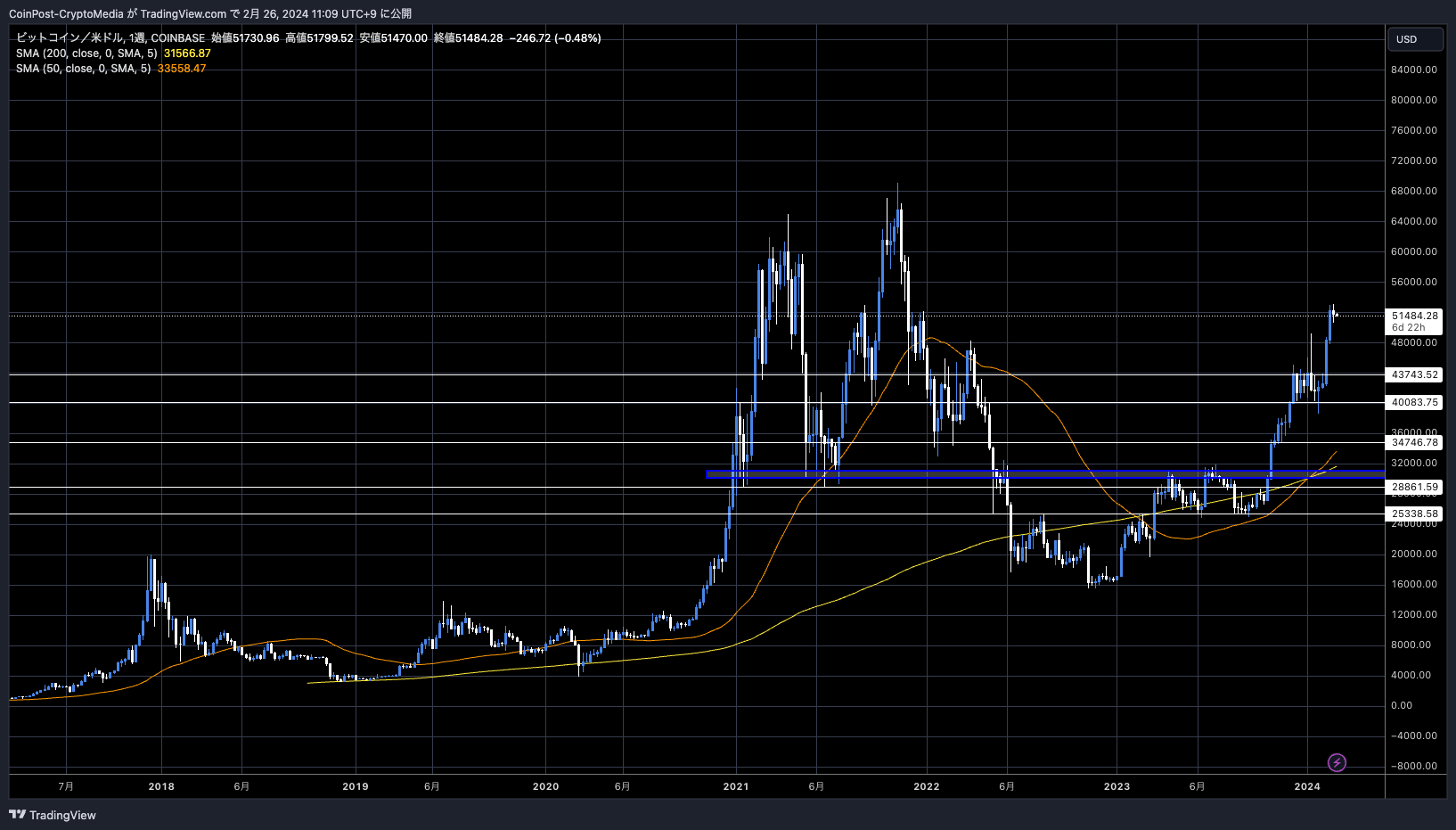

Within the crypto asset (digital foreign money) market, Bitcoin (BTC) fell 0.37% from the day prior to this to 1 BTC = $51,484.

BTC/USD weekly

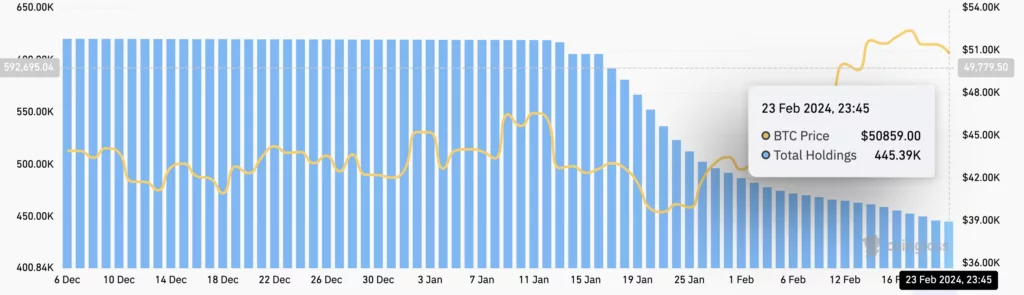

Grayscale Bitcoin Belief (GBTC) outflows slowed to $44.2 million on February twenty third, the bottom since changing to a Bitcoin spot ETF on January eleventh. .

Bitcoin ETF Movement – 24 Feb 2024

All information now in, besides maybe for the Galaxy/Invesco product

Friday was a robust day, with +$232.3m of web influx. Additionally, the outflow for GBTC was simply $44m, lowest degree since eleventh Jan pic.twitter.com/1Q0OtjEJLt

— BitMEX Analysis (@BitMEXResearch) February 24, 2024

With BlackRock’s Bitcoin ETF IBIT elevating $6.6 billion and Constancy’s FBTC elevating $4.7 billion, it may be stated that extra demand is pushing up the value of Bitcoin.

Grayscale’s holdings have already been halved.

Moreover, $540 million price of Bitcoin was withdrawn from main cryptocurrency exchanges, the biggest weekly web outflow since June 2023. This means a significant change in investor sentiment because it suggests remittance to chilly wallets and long-term holding reasonably than sale.

$540M price of Bitcoin was withdrawn from CEXs, the biggest weekly web outflows since June 2023 pic.twitter.com/L8uG9k43RZ

— IntoTheBlock (@intotheblock) February 23, 2024

connection:What’s Bitcoin halving?Outlook for 2024 primarily based on previous market worth fluctuations

connection:The way to generate profits with digital foreign money IEO funding. Home and worldwide success tales and how you can take part.

altcoin market

UNI has seen a surge following new governance proposal upgrades at Uniswap, the main decentralized finance (DeFi) protocol.

As of the twenty sixth, UNI worth was 43.5% increased than the earlier week.

The governance proposals purpose to strengthen the protocol’s decision-making course of, implement a fee-sharing mechanism, and pro-rata reward incentives to UNI token holders who delegate staking.

🧵 Greatest week in Uniswap Protocol Governance… ever?

I simply proposed a large-scale improve to the system. Particularly, I imagine we should always improve the protocol in order that its charge mechanism rewards UNI token holders which have staked and delegated their tokens. 🦄

— Erin Koen (@eek637) February 23, 2024

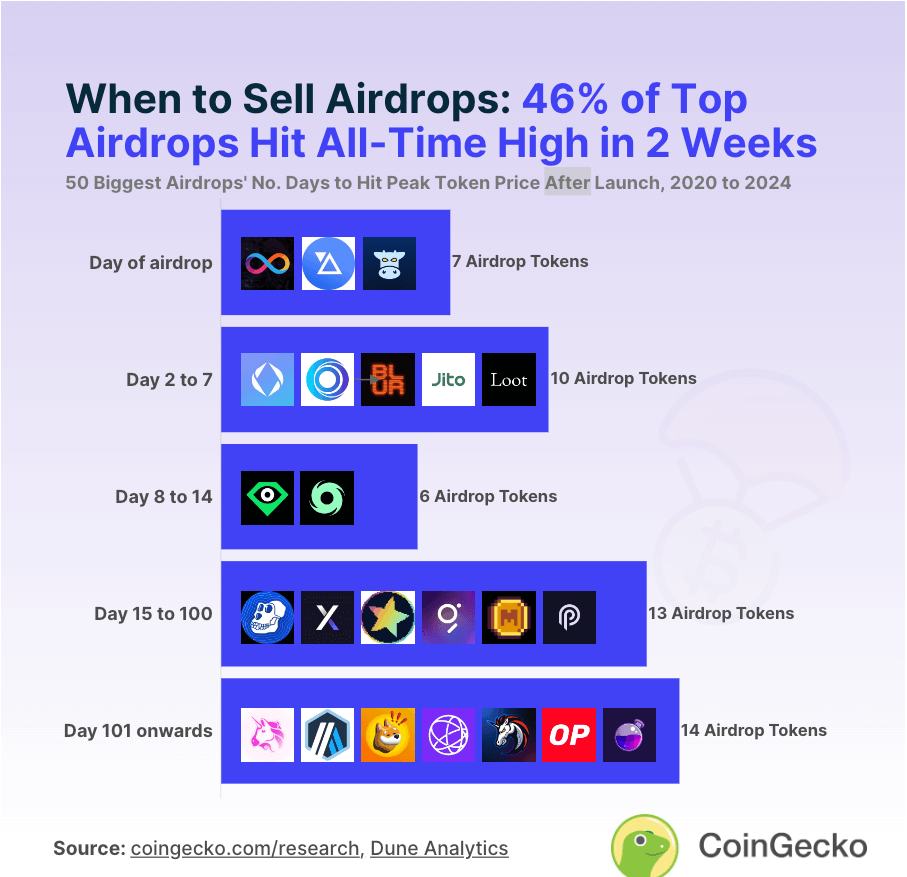

Analysis by information aggregator CoinGecko has proven that airdropped tokens have a tendency to succeed in all-time highs inside just a few weeks.

This examine investigated large-scale airdrops from January 1, 2020 to February 20, 2024.

Consequently, 23 tokens, or 46% of the 50 tokens, reached an all-time excessive inside two weeks after Airdro.

coingecko

The speed of improve and reduce included a number of gadgets that soared between 37% and 425%. Seven of those tokens reached their highest worth on the primary day of itemizing and continued to fall. Relating to this level, CoinGecko stated, “Whereas token airdrops are confirmed to be an efficient advertising and progress technique, they have a tendency to peak out within the first spherical.”

For instance, Solana aggregator Jupiter’s airdropped token JUP began buying and selling at $0.66 on its first day of itemizing, however has since fallen by as much as 28% and stays beneath its preliminary worth.

Though it’s largely influenced by market sentiment, examples of revaluations reaching document highs greater than 100 days after the airdrop embody Uniswap (1,145%), 1inch (216%), and Gitcoin (242%). ).

connection:Examine the advantages of really helpful digital foreign money exchanges with illustrated explanations

connection:Explaining some great benefits of staking and accumulation companies and some great benefits of digital foreign money trade “SBI VC Commerce”

We’ve launched the “Warmth Map” operate to the CoinPost app for traders!

Along with vital information about digital currencies, you may also see at a look trade info such because the greenback yen and worth actions of crypto asset-related shares within the inventory market corresponding to Coinbase.■Click on right here to obtain the iOS and Android variations

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (digital foreign money media) (@coin_post) December 21, 2023

Click on right here for an inventory of previous market stories