Bitcoin: THIS metric predicts BTC’s bottom at $96K – Time to buy?

- The TD Sequential which completely timed Bitcoin prime on the twenty first of January is now flashing a purchase sign on the every day chart.

- After BTC swept liquidity under $95K, it’s headed for liquidity in ranges above $98K as Whale buys at $97K.

Evaluation of Bitcoin [BTC] utilizing the TD Sequential indicator signaled a market prime on the twenty first of January 2025, at $103,000. Following this peak, the worth of Bitcoin noticed a notable decline, reinforcing the TD Sequential’s predictive reliability.

Not too long ago, TD Sequential issued a purchase sign on the every day timeframe, with Bitcoin’s worth round $96,214.

This recommended the potential for a market backside, indicating an opportune second for traders to think about coming into the market.

The presence of a purchase sign after a decline signifies that the promoting strain could also be exhausting, and a reversal could possibly be imminent.

Supply: Ali/X

If the purchase sign doesn’t result in sustained shopping for strain, BTC may check decrease help ranges, probably across the current lows of $94,400.

Such a drop would align with TD Sequential’s sample of figuring out pivotal factors, however as an alternative of a rally, it may precipitate additional declines.

Thus, whereas the present purchase sign presents a probably bullish situation for Bitcoin, traders ought to stay cautious.

They need to take into account each the potential for a rebound in the direction of greater ranges, reminiscent of $100,000, or a continued downtrend if the sign fails to manifest into tangible shopping for momentum.

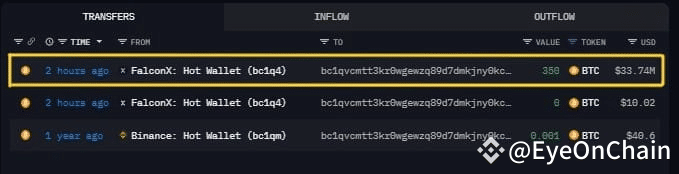

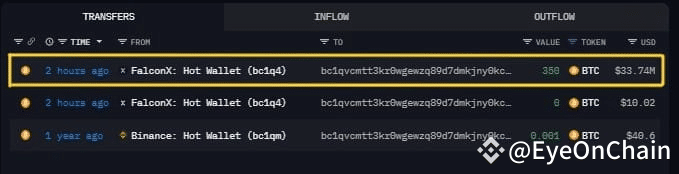

Dormant whale buys as BTC targets liquidity above

A dormant whale pockets “bc1qv…” withdrew 350 BTC, valued at$33.97 million, from FalconX at $97,053 per BTC. The substantial buy by a serious participant may point out potential upward momentum.

Nevertheless, if the market sentiment doesn’t align with the whale’s shopping for technique, this might probably push costs down if others determine to money out, fearing a prime.

Supply: EyeOnChain/X

Following a sweep of liquidity under $95K, BTC seems poised to check greater ranges, notably round $98K. This transfer helps a possible continuation if BTC can preserve help above these essential liquidity thresholds.

Usually, overcoming such zones can catalyze additional shopping for curiosity, probably pushing costs upwards. Conversely, if BTC fails to breach the $98K liquidity zone, it may point out inadequate shopping for strain, probably main to a different retracement.

Supply: Coinglass

Lastly, in keeping with analyst Benjamin Cowen on X, the Whole On-Chain Threat indicator recommended that Bitcoin’s peak might not have been reached.

The metric at the moment reveals ranges that aren’t typical of a market prime. This means a possible for an extra rally.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

Conversely, if the danger indicator begins to indicate values related to earlier market tops, it may sign that the present rally is perhaps nearing its finish.

This situation would require shut monitoring of any shifts in on-chain exercise that would precede a worth correction.