Bitcoin traders, watch out! BTC won’t see a real breakout unless…

- Bitcoin’s Quick-Time period Holders (STHs) are at present holding at a mean unrealized lack of 6%.

- A transfer above their value foundation might shift sentiment. What are the chances?

Bitcoin [BTC] has surged previous 4 key resistance ranges within the final two weeks, pushing beforehand underwater holders again into revenue.

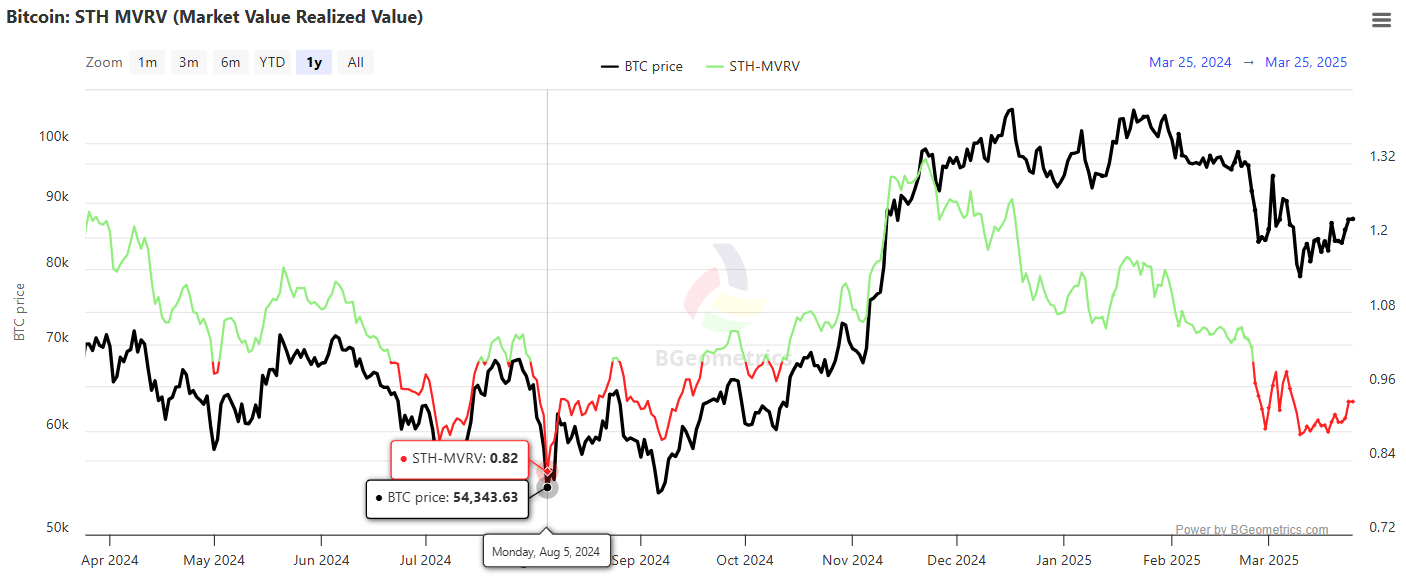

Nevertheless, the Quick-Time period Holder Market Worth to Realized Worth (STH MVRV) ratio remained in detrimental territory, signaling that short-term holders are nonetheless at an mixture unrealized loss.

A sustained transfer above their value foundation is required to drive FOMO and unlock additional upside potential. On-chain data from Glassnode pinpointed $93.5k because the vital breakeven threshold, marking a serious resistance cluster.

For Bitcoin to take care of its present market worth of $88,041 and lengthen the rally, bulls should forestall compelled liquidations amongst short-term holders, which might induce distribution-driven promote strain.

A failure to take action dangers a repeat of the early August 2024-style capitulation occasion, the place a detrimental STH MVRV studying preceded BTC’s sharp drawdown from $68,525 to $54,343 in below two weeks.

Supply: BGeometrics

The speedy goal for bulls, due to this fact, is to flip the $93.5k resistance into help, a transfer that might drive the STH MVRV ratio into optimistic territory.

Consequently, it will carry short-term holders (>155 days) into unrealized earnings, assuaging sell-side strain.

This breakout is especially essential as Q2 approaches, with macroeconomic shifts poised to introduce liquidity fluctuations. So, to forestall compelled liquidations, Bitcoin should affirm this as a requirement zone.

A vital week forward

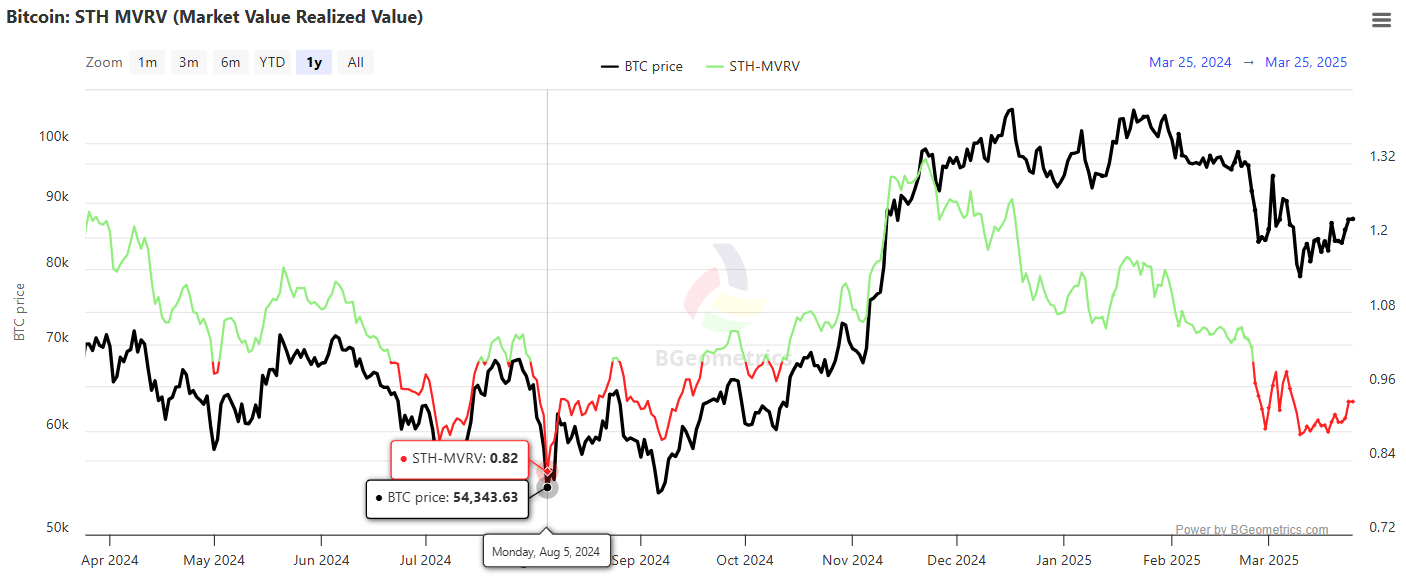

Bitcoin’s retracement to its pre-election low of $78k on the tenth of March triggered “excessive concern,” traditionally marking a powerful accumulation zone.

Since then, BTC has climbed 12.82%, restoring a big share of stakeholders to internet unrealized revenue.

This shift has pushed market sentiment into the “perception” section, as indicated by the Web Unrealized Revenue/Loss (NUPL) metric.

Supply: CryptoQuant

Put merely, this indicators a desire for HODLing over distribution at key resistance ranges.

Moreover, Open Curiosity (OI) has surged again to its November peak of $57 billion, with $12 billion in new leveraged positions prior to now two weeks, underscoring sturdy speculative demand.

Nevertheless, Bitcoin’s reclaim of $93.5k, a key Quick-Time period Holder (STH) breakeven stage, stays unsure. A sustained rejection right here might set off promoting strain, elevating the chance of liquidations.

A deeper downturn in STH MVRV would then affirm capitulation amongst weak fingers, doubtlessly accelerating a broader distribution section.

With macroeconomic uncertainty forward, Q2 might introduce recent volatility – An element to look at earlier than buying and selling purely on bullish metrics.