Bitcoin whales are buying while weak hands panic – Is a market bottom near?

- Bitcoin whales are shopping for whereas smaller traders panic and promote, just like the 2020 bull cycle

- Knowledge hinted on the rising likelihood of a possible backside.

A Bitcoin [BTC] backside usually types when a number of key situations align. First, it establishes a essential accumulation zone the place sell-side liquidity is absorbed by robust arms. This section typically indicators a provide squeeze, setting the stage for a strong rally as demand begins to outpace accessible provide.

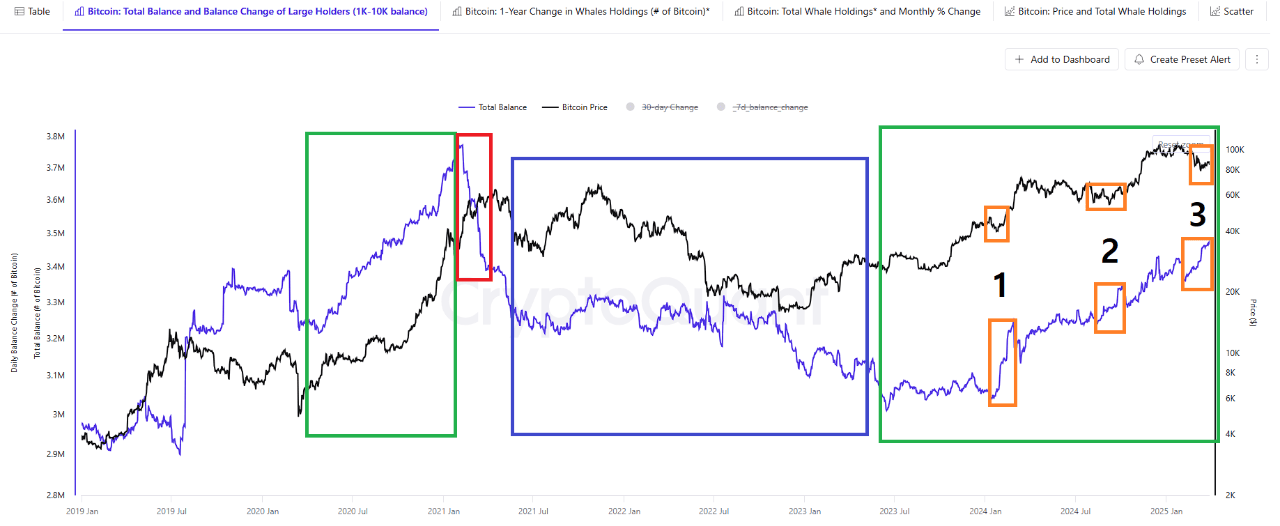

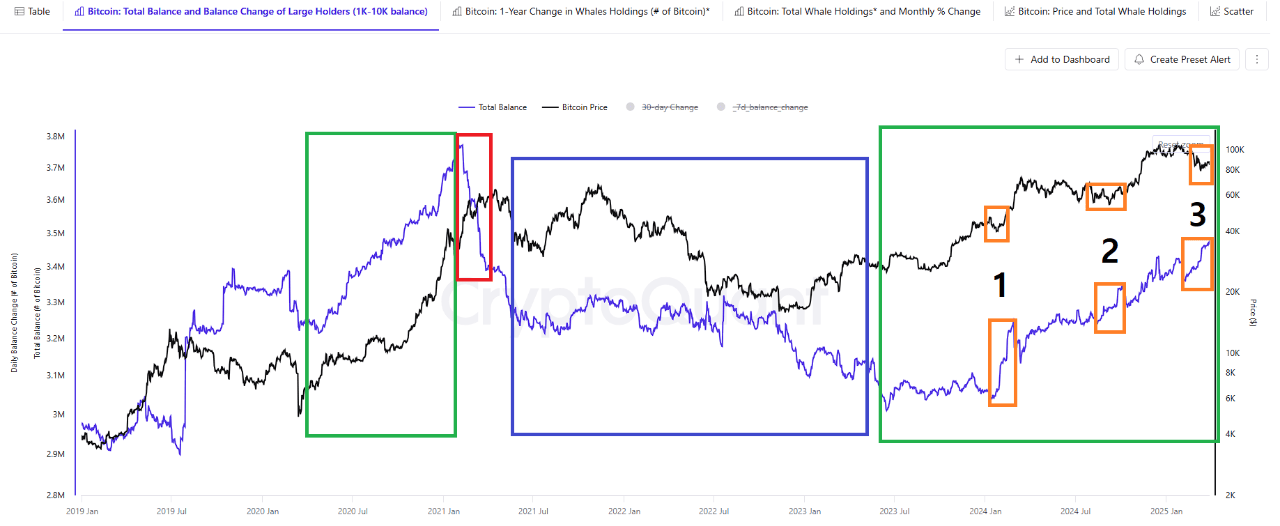

On the time of writing, on-chain data from CryptoQuant appeared to disclose a well-known sample – Bitcoin whales are aggressively accumulating whereas smaller traders capitulate.

Does this imply the underside is in?

$407 billion in sell-off threat – The STH dilemma

Three weeks in the past, Bitcoin despatched the market right into a tailspin because it retraced to its pre-election low of $77k. Regardless of the broader sentiment swinging between extremes of fear, BTC’s capability to carry above $80k speaks volumes about its underlying power.

Nevertheless, this wasn’t only a coincidence. Particularly since there was a pointy spike within the complete steadiness of Bitcoin whales holding 1k–10k BTC (marked in orange).

Supply: CryptoQuant

This accumulation has been a key think about stopping a deeper market correction, suggesting that whale exercise is absorbing sell-side stress and offering the help wanted to stabilize costs.

As famous by AMBCrypto’s latest evaluation, the SOPR (Spent Output Revenue Ratio) stays under 1. It is a signal that short-term holders (STHs) with positions older than 155 days have been realizing losses.

Put merely, with Bitcoin down 23% from its all-time excessive of $109k, a big pool of patrons’ acquisition worth stays nicely above the press time market worth of $83k.

AMBCrypto additionally discovered that $95,138 is the average acquisition price for these STHs, the place roughly 4.28 million BTC have been traded. This equates to roughly $407 billion in potential sell-off threat from these holders.

Ought to STHs capitulate, we may see a surge in promote stress. Even so, the query stays – Will whales proceed to soak up this stress and ensure $80k as a powerful backside?

$80k at stake – Will Bitcoin whales verify the underside?

Notably, the sample of Bitcoin whales accumulating whereas smaller traders panic-sell mirrors earlier cycle bottoms, notably the 2020 cycle.

Throughout that section, BTC broke above $10k for the primary time by mid-Q3, kicking off what got here to be generally known as the “breakout cycle.”

In a putting parallel, CryptoQuant knowledge additionally confirmed no signs of Bitcoin whales exiting in the course of the 2020 bull run. This implied that these whales should still be absorbing sell-side stress. This might lay the groundwork for a significant shift within the present cycle.

Proper now, there is no such thing as a important distribution from these whales. In reality, as an alternative of going dormant, they’re actively accumulating. Therefore, the possibilities of a collapse under $77k–$80k on account of macroeconomic uncertainty or weak arms exiting are low.

Supply: TradingView (BTC/USDT)

Furthermore, U.S. buy orders stay strong whereas Bitcoin change reserves proceed to plunge.

If these dynamics align within the coming days, Bitcoin could possibly be on the cusp of confirming a market backside.