Bitcoin: What rising outflows mean for BTC prices

- Outflows for Bitcoin began to rise, giving HODLers hope.

- Miner revenues grew, easing the promoting stress on BTC.

Bitcoin’s [BTC] rally has had main impacts on the general state of the crypto market. However many have began questioning whether or not this rally will maintain itself going ahead.

State of the king coin

Some components, nonetheless, can nonetheless assist with BTC’s bullish dream. Notably, there’s a surge in BTC outflows.

This surge results in an increase in transaction charges, which straight quantifies the demand on the community. Elevated charges in peak occasions signify customers’ urgency to validate transactions, essential knowledge for each miners and traders.

The on-chain habits of #Bitcoin displays a cyclical sample, typically stimulated by exogenous occasions.

The heatmap visualizes varied measures of behaviour additional time, highlighting how cash are mobilized in response to environmental stimuli, or anticipation of future stimuli

— NeuroInvest Analysis (@Neuro__Invest) December 1, 2023

The pronounced spikes in BTC outflows can have a number of vital impacts on the Bitcoin ecosystem.

Firstly, the elevated transaction charges ensuing from this surge mirror heightened demand on the community. This demand is indicative of excessive consumer exercise as properly.

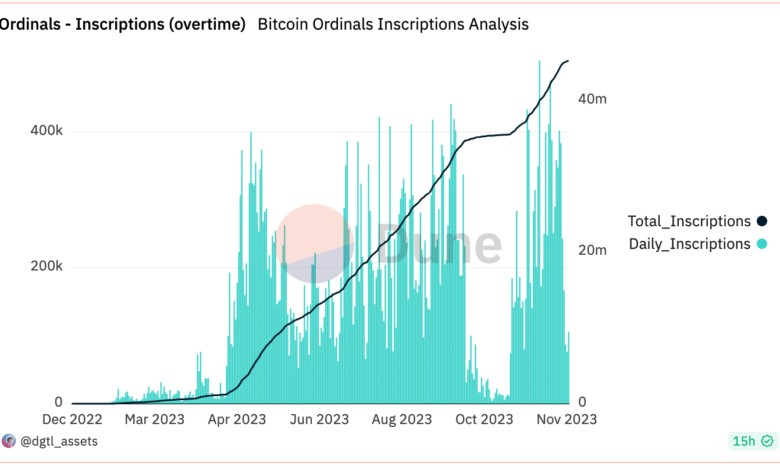

One of many causes for the rise in addresses could possibly be the growing curiosity in BTC ordinals. In accordance with Dune Analytics’ knowledge, the variety of inscriptions for the Ordinals had additionally grown.

The rising curiosity in Ordinals will enable NFT traders to get into the Bitcoin community as properly. This rising utilization of BTC coupled with elevated outflows might play an amazing position in supporting BTC’s present worth.

How are miners doing?

For miners, the cycles of elevated transaction charges throughout high-traffic intervals turn out to be financially advantageous.

The mixture of newly created cash and transaction charges serves as an incentive for miners to proceed contributing computational energy to the community.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

Over the previous few weeks, the income collected by miners has grown. This may occasionally assist ease promoting stress on these miners. It’s because if miner income declines, miners are pressured to promote their holdings, which finally ends up driving down Bitcoin’s worth.

At press time BTC was buying and selling at $38,777.65 and within the final 24 hours elevated by 1.56%. The amount at which BTC was buying and selling additionally grew. In the previous few weeks, the quantity at which BTC was buying and selling rose from 8.39 billion to 19.27 billion.