Bitcoin – Widespread capitulation signals likely bottom, BUT risks remain

- Bitcoin’s huge +$800M per day realized losses might mark a possible backside

- Total demand has remained destructive, with BTC ETFs bleeding over $5 billion

Bitcoin [BTC] has stayed under $85k on the charts after a quick dip to $76k – A transfer Bitfinex alternate analysts imagine might seemingly sign stabilization.

Of their weekly market report, the analysts famous that merchants noticed a realized lack of $818 million per day, a market flush that all the time precedes a possible backside.

“Such widespread capitulation typically precedes market stabilisation, although geopolitical and macroeconomic considerations stay a big overhang.”

Will BTC rebound?

Nevertheless, short-term holders (STH) have been promoting BTC at a loss for the primary time since October 2024. It is a development that, if prolonged, might complicate reversal efforts, the analysts added.

Supply: Bitfinex

They cited the Bitcoin Spent Output Revenue Ratio (SOPR), which tracks merchants’ profitability, because it dipped under 1. It indicated that holders have been promoting at a loss.

“Quick-term holder SOPR recorded its second-largest destructive print of this cycle at 0.95, signalling that new market entrants are capitulating.”

For the restoration shift, Bitfinex analysts claimed that SOPR should surge above 1 once more, which might recommend ‘re-accumulation’ and ‘bullish continuation.’

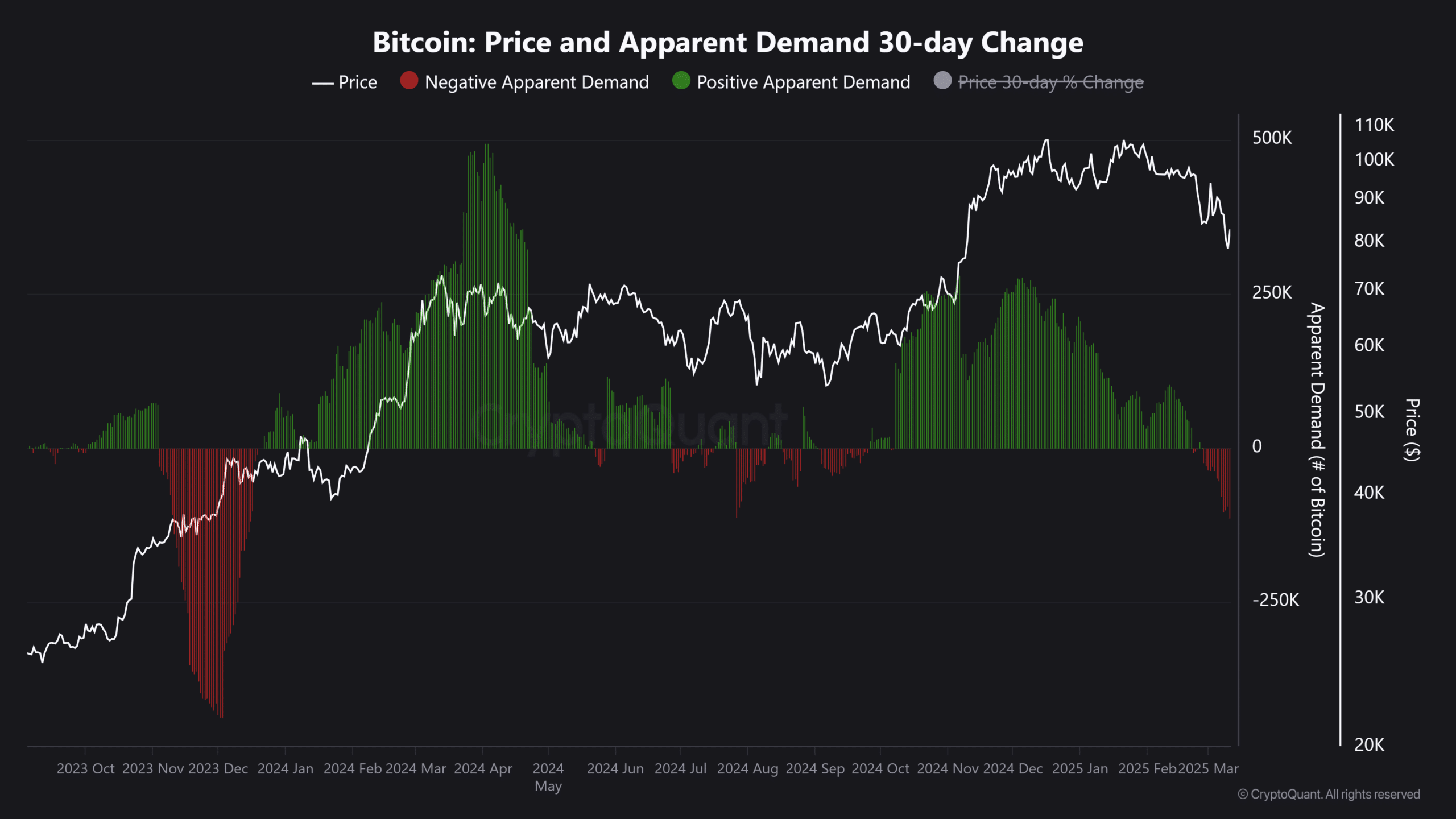

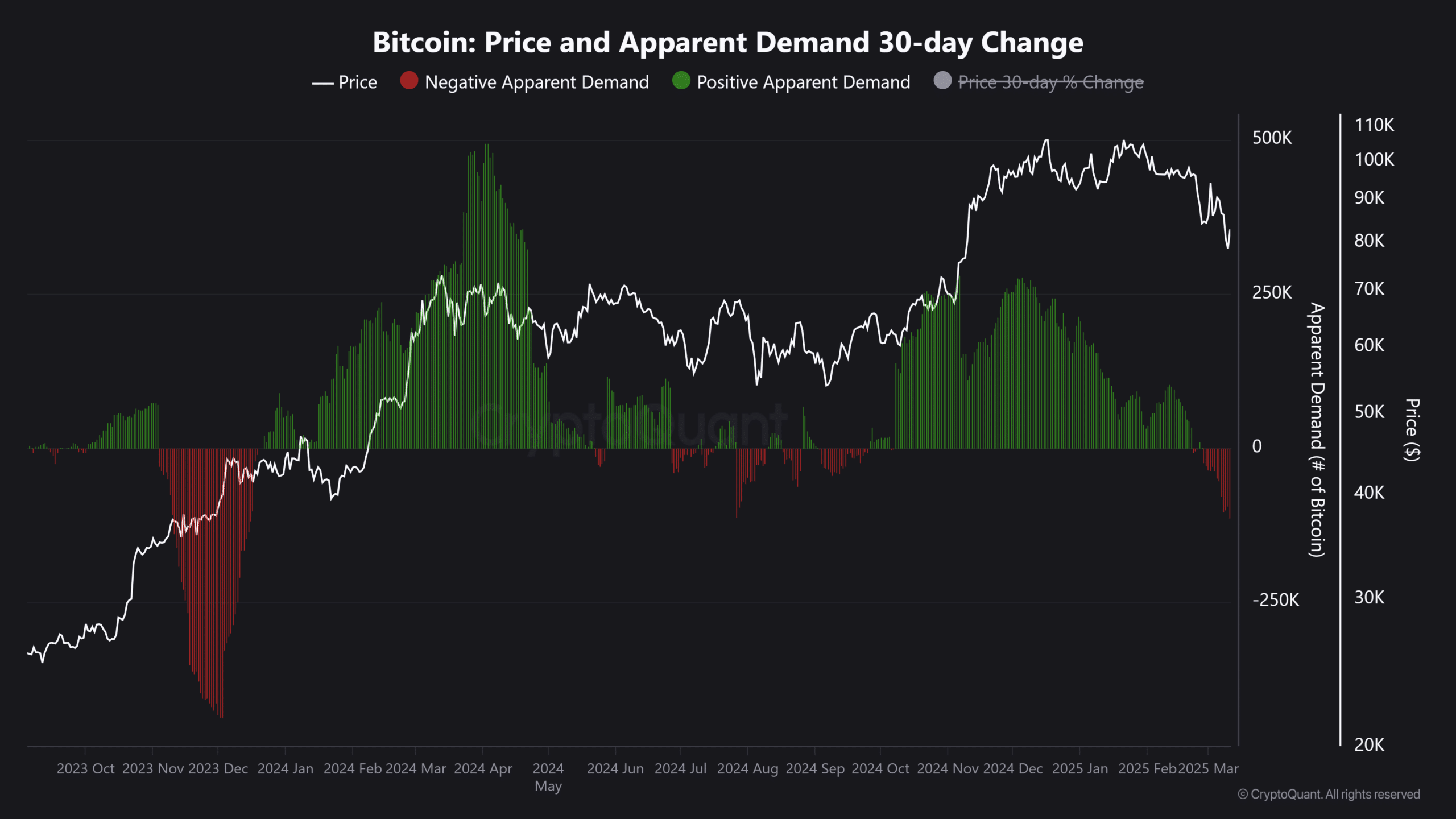

The weak BTC demand corroborated Bitfinex’s warning. In actual fact, in accordance with CryptoQuant’s knowledge, demand for the cryptocurrency has remained destructive since late February.

Supply: CryptoQuant

U.S. spot BTC ETFs have bled $1.5 billion within the first half of March. In February alone, the product noticed $3.56 billion outflows per Soso Worth. They’ve seen over $5 billion bleed-out within the final 6 weeks.

Bitfinex analysts additional warned that the blended studying on U.S macroeconomic components might nonetheless dent crypto markets. Regardless of Trump’s tariff wars, the U.S CPI inflation knowledge got here in cooler than anticipated for February.

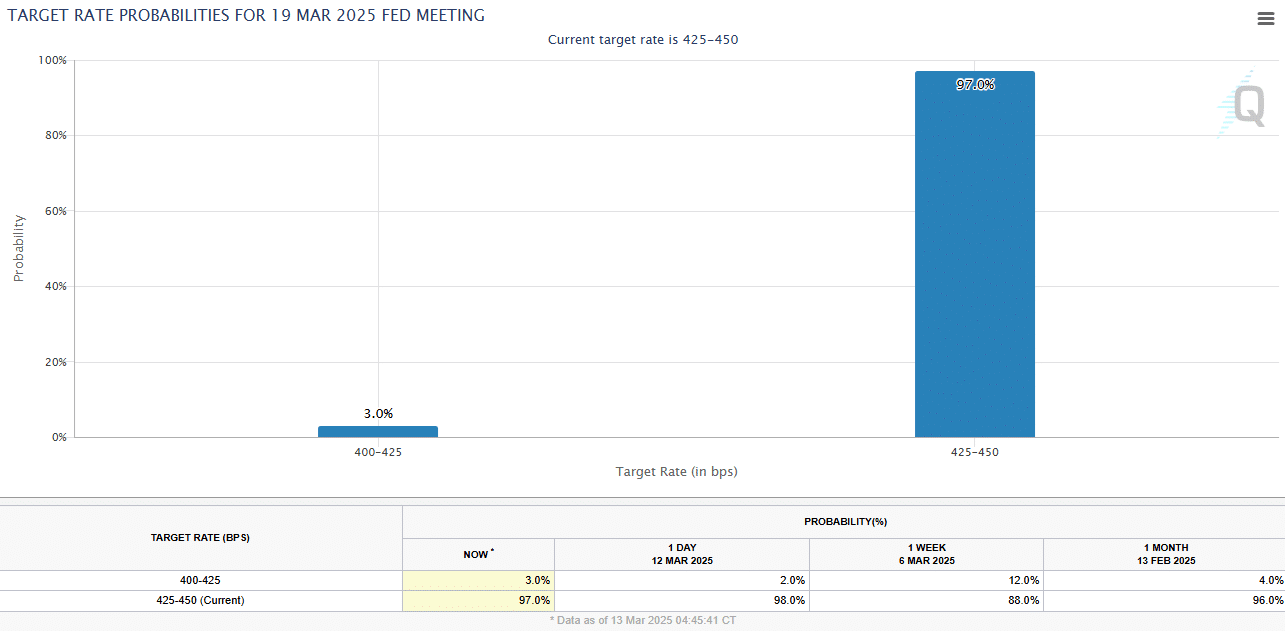

Sadly, the market isn’t anticipating any Fed fee minimize within the subsequent FOMC assembly scheduled for 19 March. Curiosity merchants have been pricing a 97% probability that the Fed would preserve the charges unchanged on the present goal of 4.25%-4.50%.

There’s solely a 3% probability of a 25bps fee minimize throughout subsequent week’s FOMC assembly. As such, BTC might nonetheless be caught in uneven waters within the brief time period.