Bitcoin’s 47K outflows – A supply shock or just another move?

- Bitcoin noticed 47K BTC outflows, however the worth remained considerably steady on the charts

- Change reserves have continued to say no throughout the market

Bitcoin not too long ago noticed a big outflow of 47,000 BTC, a motion that has sparked debate on whether or not it represents a real provide shock or a routine inside transaction. Traditionally, giant outflows have been related to long-term accumulation, decreasing BTC’s liquid provide and probably setting the stage for bullish momentum.

Nonetheless, this newest transfer requires a better take a look at on-chain knowledge and worth motion.

Analyzing Bitcoin alternate reserves – Is accumulation in play?

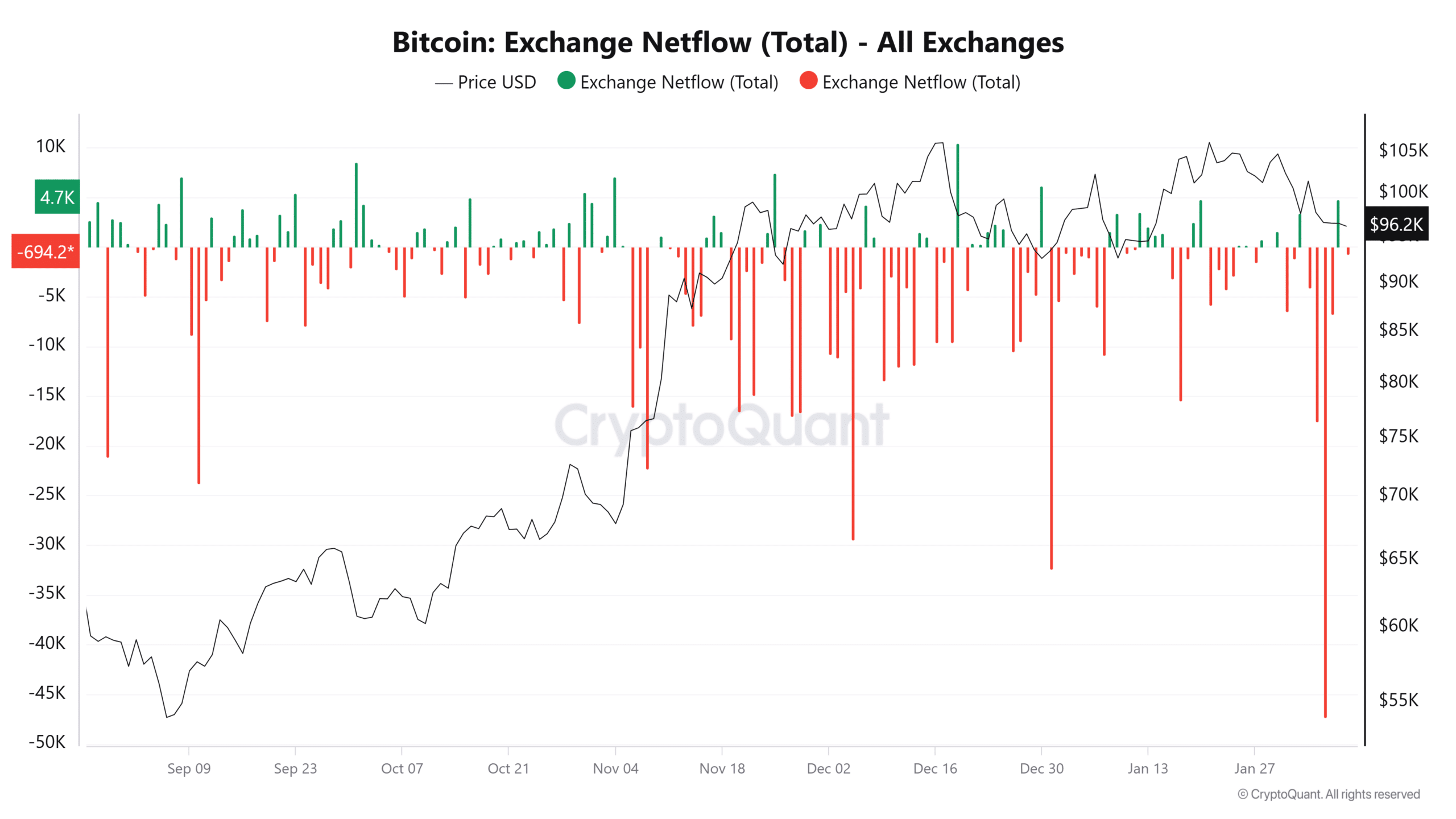

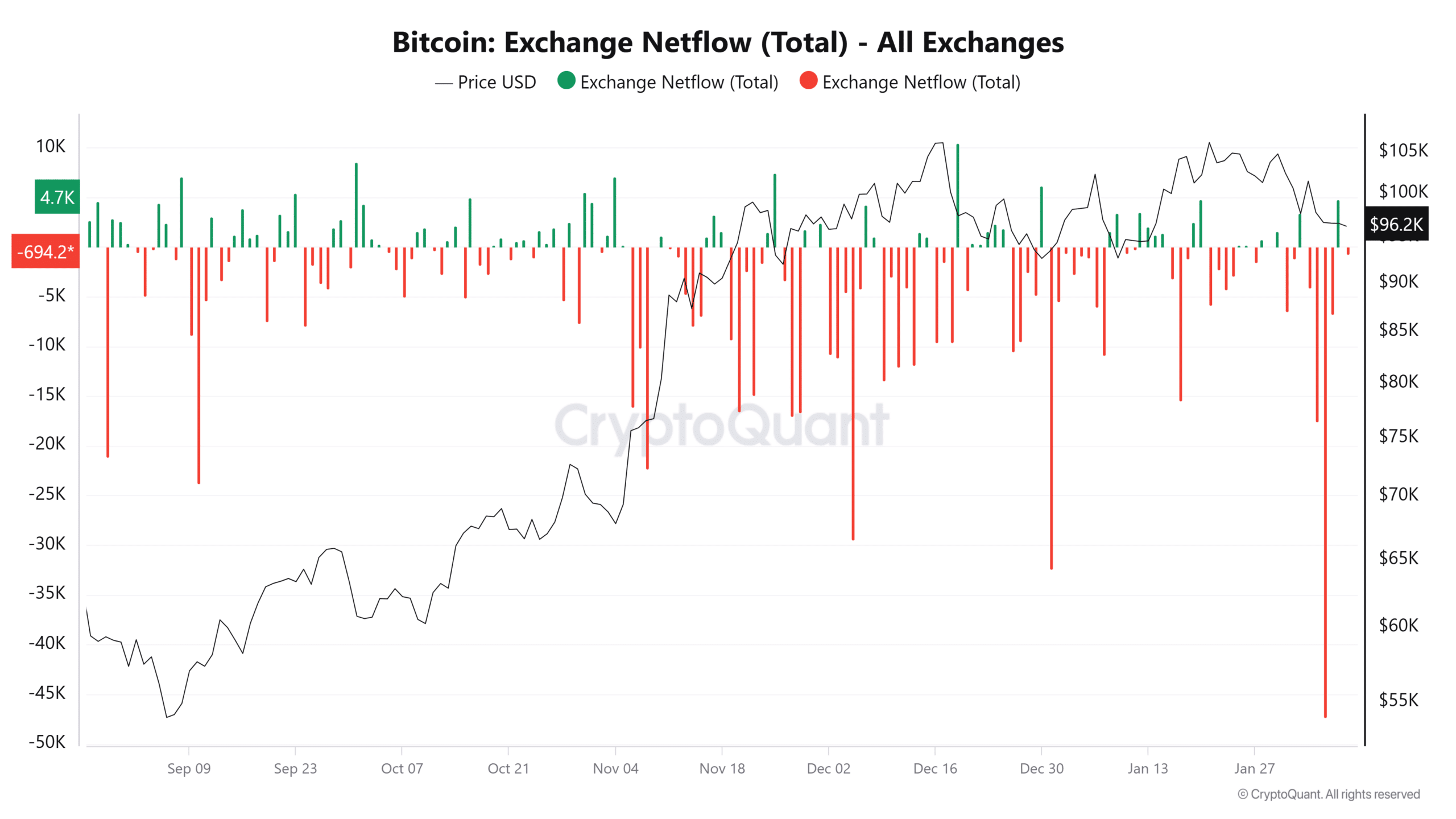

An evaluation of Bitcoin‘s netflows confirmed that it has been seeing vital outflows, earlier than the spike it witnessed a couple of days in the past. BTC outflows spiked to over 47,000 BTC, making it the most important such transfer since 2022.

The importance of those outflows led to talks a couple of provide shock. Nonetheless, this alone didn’t fairly verify a provide shock.

Supply: CryptoQuant

Additionally, the Bitcoin Exchange Reserve chart revealed a sustained decline in BTC held throughout exchanges, dropping from over 3 million BTC in mid-2024 to round 2.45 million BTC in February 2025.

A shrinking alternate stability usually means buyers are shifting BTC to personal wallets for long-term holding, decreasing the provision obtainable for fast sale.

How did Bitcoin’s worth react?

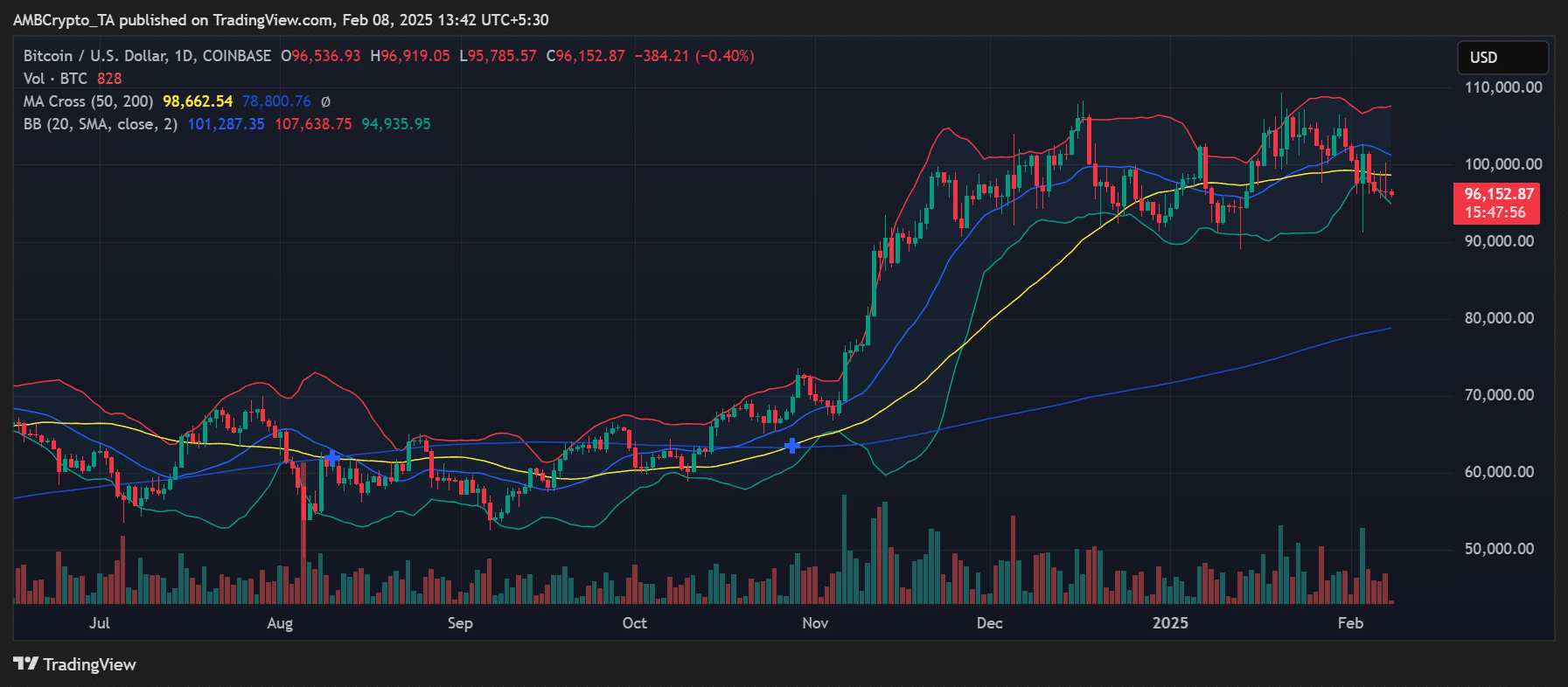

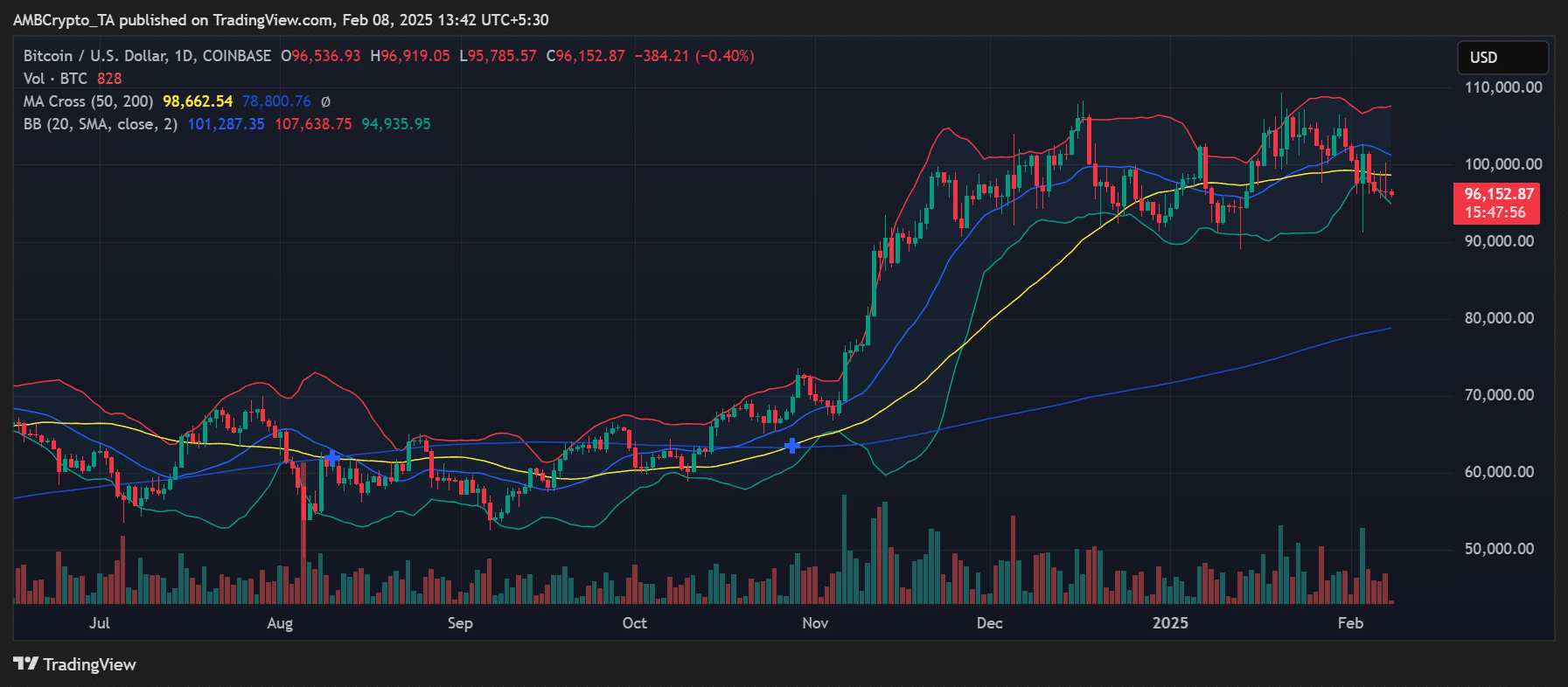

Following the outflows, Bitcoin’s worth remained steady round $96,152 – An indication that the fast market influence was minimal.

The Bollinger Bands indicated reasonable volatility, with the worth consolidating between $94,935 and $107,638. The 50-day shifting common sat at $98,662, performing as a near-term resistance degree.

Supply: TradingView

Whereas main outflows can point out accumulation, a scarcity of robust worth response signifies that this motion was not perceived as a market-altering occasion. At the least within the brief time period.

Futures market underlines hypothesis

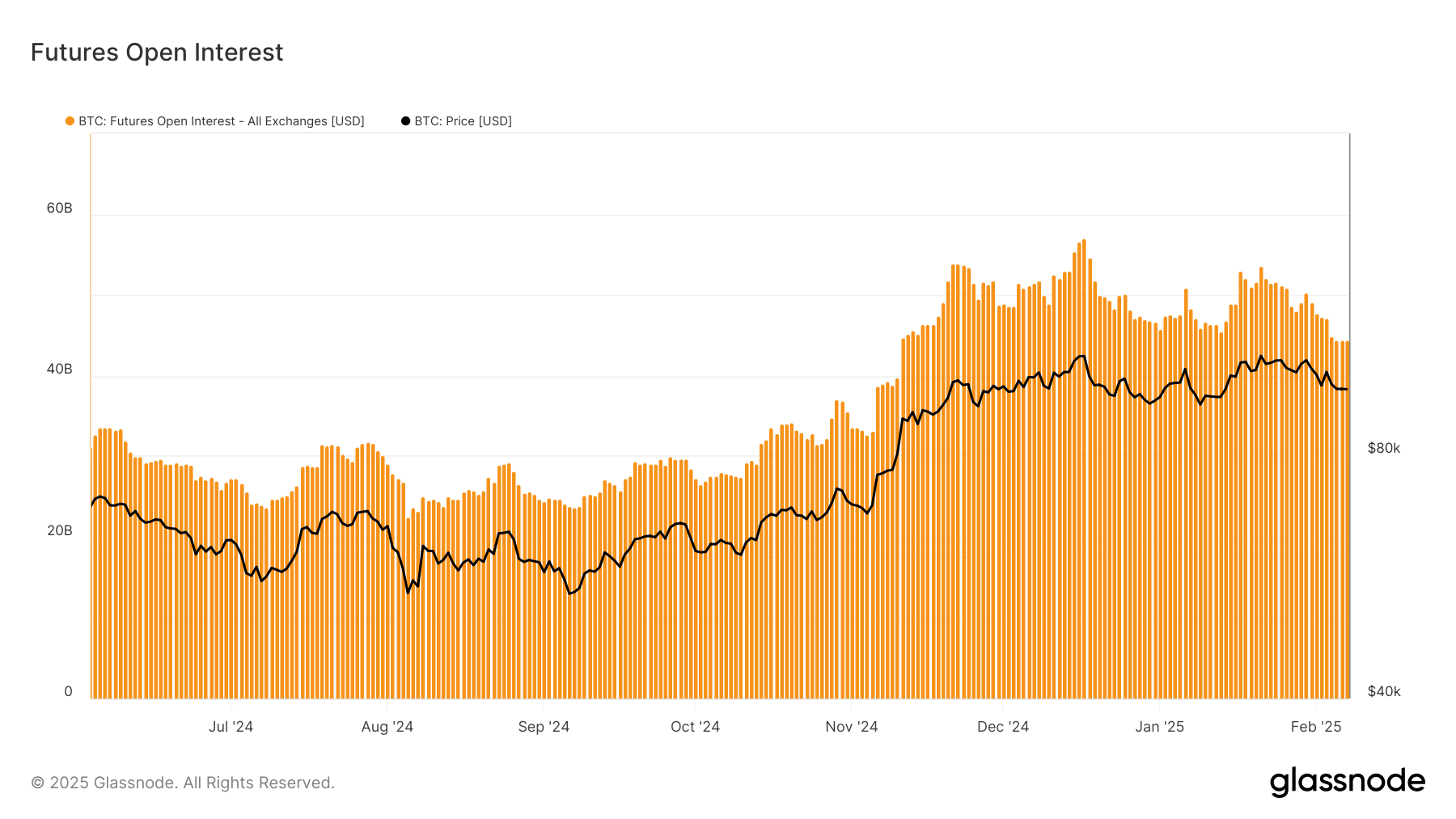

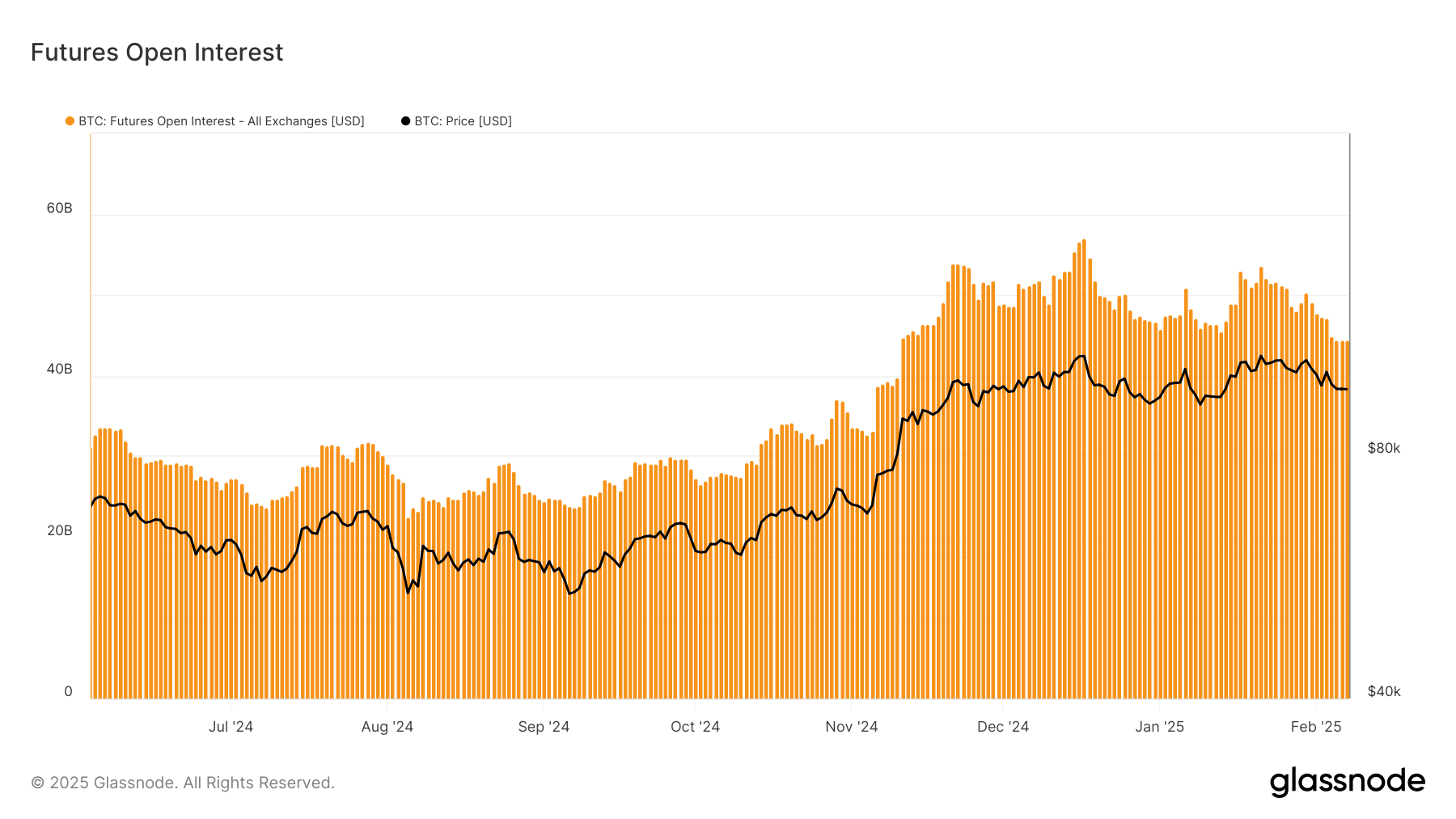

Glassnode’s Futures Open Curiosity chart revealed a gradual enhance in speculative positioning in January, with Open Curiosity nearing $60 billion.

Rising Open Curiosity and vital alternate outflows typically imply that merchants are betting on an upcoming provide squeeze. On the time of writing, the OI had a studying of round $44 billion.

Supply: Glassnode

Nonetheless, if funding charges flip excessively constructive, it may point out that the market is over-leveraged. This might make Bitcoin prone to liquidation-driven pullbacks.

Provide shock or routine transfer?

Whereas the 47K BTC outflows appeared to align with a broader development of declining alternate reserves, its fast market influence has been muted.

A number of elements, together with a scarcity of a pointy worth motion and the potential for inside pockets reshuffling, counsel that this was not an instantaneous provide shock. As a substitute, part of a long-term accumulation development.

– Learn bitcoin (BTC) Value Prediction 2025-26

That being stated, if Bitcoin withdrawals and whale exercise proceed like this, a provide squeeze may emerge within the coming months. The development will regularly exert upward strain on Bitcoin’s worth.