Bitcoin’s hashrate crosses ATH: What it means ahead of the halving

- Bitcoin’s hashrate spiked at a time when miner income declined.

- Miners had been promoting BTC, however shopping for sentiment was dominant within the broader market.

With only some months remaining till the fourth Bitcoin [BTC] halving, the mining ecosystem has been appearing in an attention-grabbing method.

On one hand, the blockchain’s hashrate spiked considerably, indicating an inflow of miners. Alternatively, miners had been persevering with to promote their BTC holdings.

A take a look at Bitcoin’s mining sector

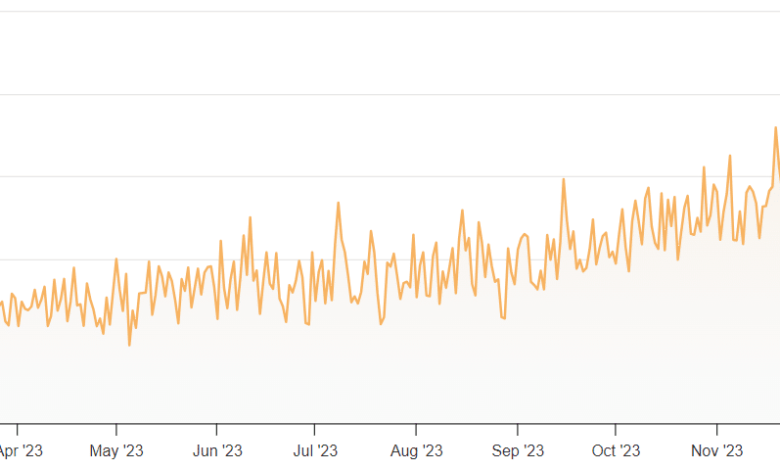

The newest information revealed that Bitcoin’s hashrate has gained upward momentum over the previous few months. It additionally managed to succeed in an all-time excessive of over 655 exahashes within the current previous.

As per Coinwarz, on the time of writing, BTC’s hashrate stood at 529.99 EH/s.

Supply: Coinwarz

Because of the rise in hashrate, the blockchain’s mining problem additionally elevated throughout the identical interval. At press time, BTC had a mining problem of 70.34 T.

A potential motive behind the surge in these metrics could possibly be the upcoming halving, which is scheduled to occur in April 2024.

For the reason that halving will cut back miners’ rewards to half, the miners might need been getting into the market to earn extra rewards earlier than the occasion happened.

Another excuse could possibly be an increase in miners’ income, which may have lured extra miners into the community. Nonetheless, that didn’t appear to be the case.

AMBCrypto’s take a look at Glassnode’s information revealed that miners’ income was really on a declining pattern over the previous few weeks.

Supply: Glassnode

Are miners promoting Bitcoin?

Although there was an inflow of latest miners, it was shocking to see that they had been promoting their Bitcoin holdings.

Our evaluation revealed that BTC’s miners’ internet place change remained all through the final month, indicating excessive sell-offs. A rise in promoting strain from miners may damage the value of the king coin.

Supply: Glassnode

Although miners continued to promote, it was not the dominant sentiment available in the market. AMBCrypto’s take a look at Santiment’s chart identified that BTC’s Provide on Exchanges has fallen sharply.

This occurred concurrently with an increase in Bitcoin’s Provide outdoors of Exchanges, clearly indicating an increase in shopping for strain.

An uptick in shopping for strain normally signifies that traders had been assured in BTC and count on its worth to rally over the weeks to comply with.

Supply: Santiment

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, the derivatives market statistics paint a distinct image. For instance, BTC’s taker purchase/promote ratio remained pink. This advised that promoting sentiment was dominant within the futures market.

On the time of writing, BTC was trading at $41,076.50, with a market capitalization of over $805 billion.

Supply: CryptoQuant