Bitcoin’s long % rises, despite price correction — What else to watch for a bounce?

- Bitcoin’s lengthy proportion began to rise as the value fell, trapping longs

- Bitcoin’s demand surged because the Funding Charges remained constructive, regardless of the dip

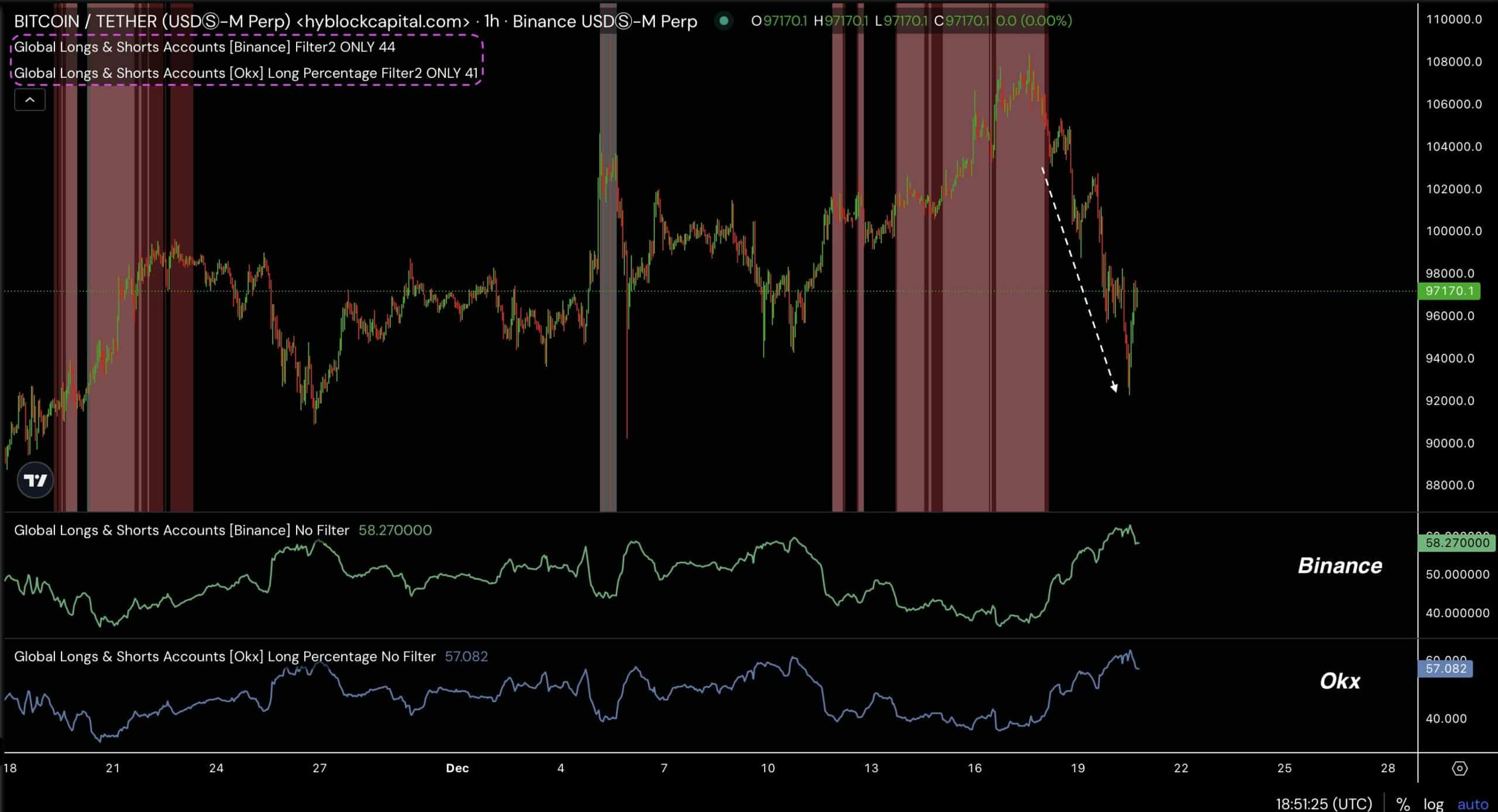

Bitcoin (BTC) noticed a hike in lengthy positions whilst its value fell sharply, suggesting that its merchants had been caught in an extended lure. The truth is, the share of longs on Binance and OKX escalated considerably when BTC’s value fell to lows close to $92k.

This pattern hinted at an impending pivot, one the place the extreme bullish sentiment might reverse itself, prompting a possible value restoration as shorts enter and longs exit.

Supply: Hyblock Capital

These cycles usually precede vital market reversals. The downturn would place BTC for a sure rebound if the lengthy percentages attain their peak and start to say no.

This might sign a shift in sentiment, presumably trapping shorts within the course of. Right here, it’s value noting that other than the lengthy proportion hike, BTC additionally confirmed different indicators of rebound on the charts.

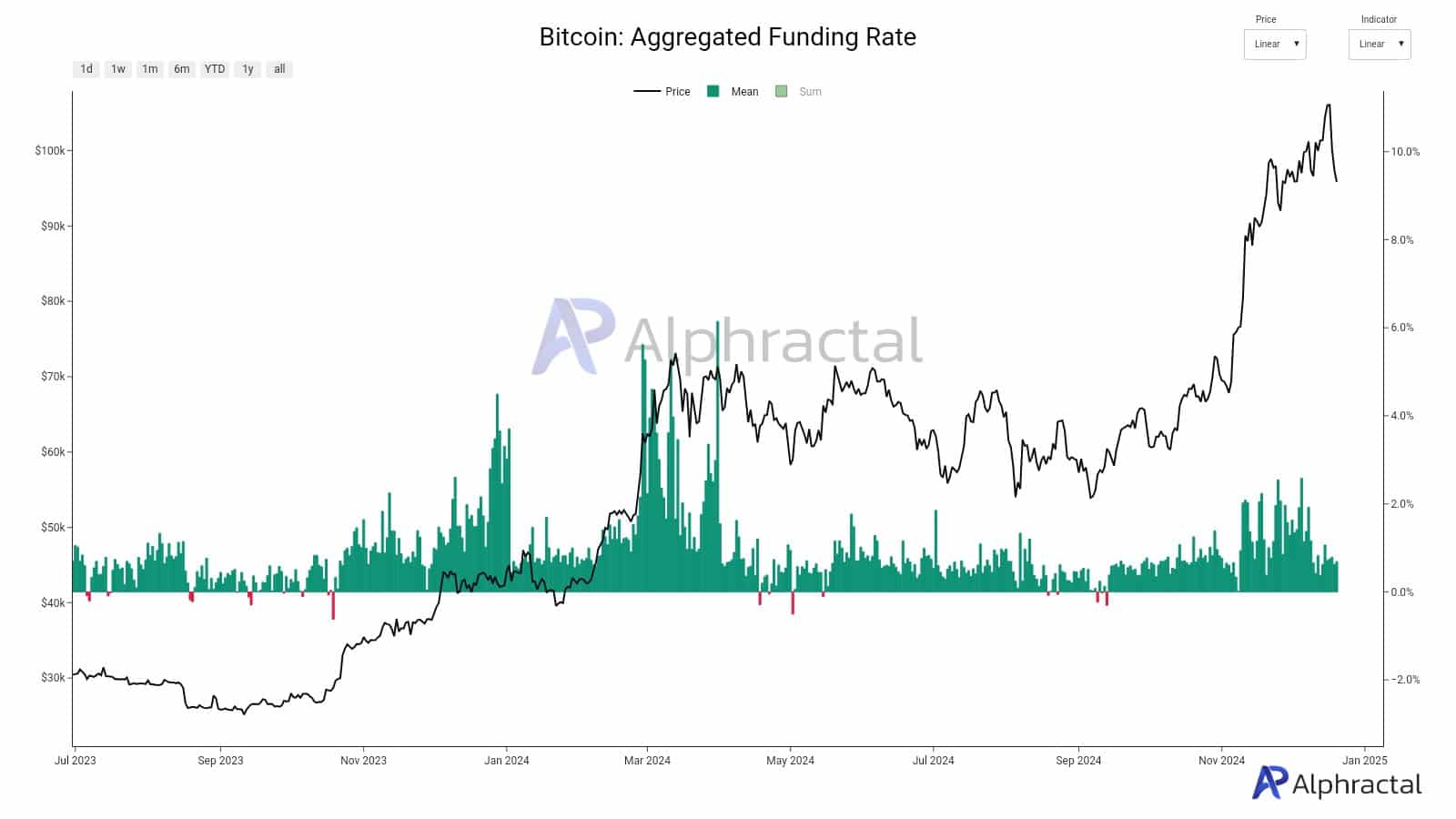

Bitcoin’s Funding Fee

The aggregated funding price noticed a pointy hike as the value escalated – An indication of robust bullish sentiment. Subsequently, the funding price remained elevated whereas Bitcoin’s value started a descent – Pointing to an overextended market.

Merchants doubtless entered lengthy positions through the hike, and the market’s lack of ability to maintain increased shopping for strain resulted in a correction.

Supply: Alphractal

The pullback might need spurred profit-taking or incited shorts to capitalize on the excessive funding price, introducing promoting strain.

Regardless of this, nonetheless, the sustained constructive funding price hinted at underlying market confidence, albeit warning is perhaps warranted. If the funding price sustains or reverses itself, it might sign potential market strikes. Stabilization or a reversal within the funding price might outline Bitcoin’s near-term trajectory.

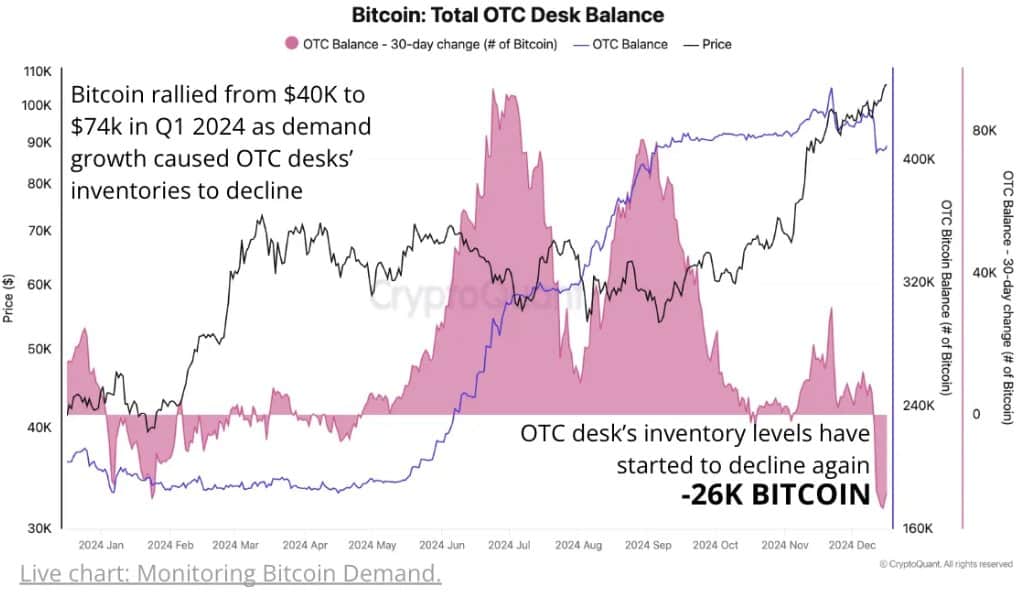

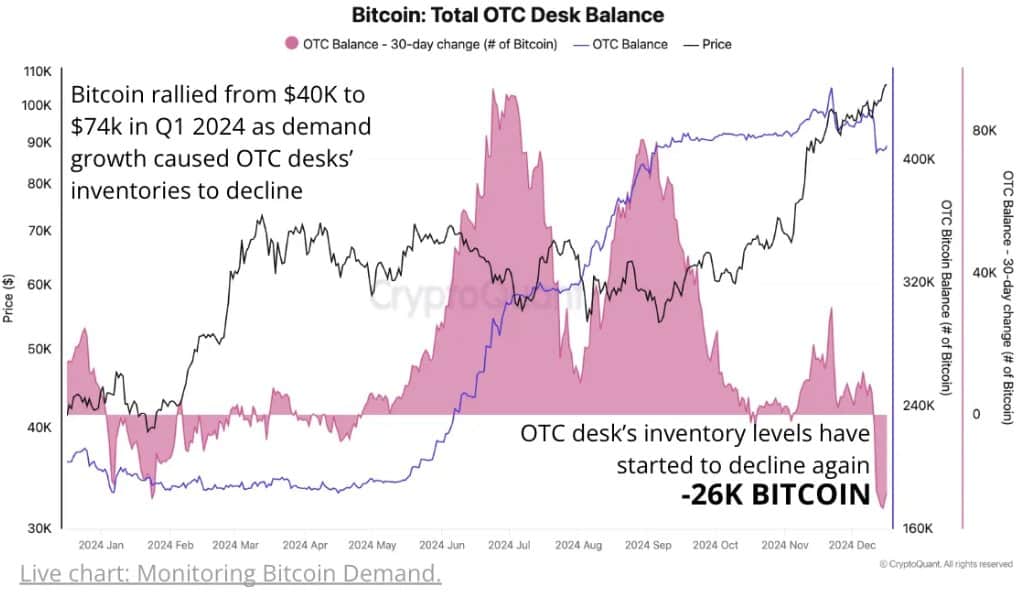

Demand meets brick wall

Bitcoin famous a major rally, rising from $40k to $74k by the tip of the primary quarter of 2024.

This surge was pushed by growing demand, because the substantial fall in stock at over-the-counter (OTC) buying and selling desks indicated. Throughout this era, OTC desks reported their largest month-to-month stock drop of the yr, with a decline of 26,000 BTC – An indication of tightening of provide.

Supply: CryptoQuant

Whole balances at OTC desks fell by 40,000 BTC from November 2020 too, additional suggesting a dwindling provide amid rising demand.

The decline in OTC balances alongside the value rise may be seen as a powerful signal of robust momentum. The connection additionally indicated that if OTC stock ranges proceed to fall, Bitcoin’s value might additional escalate. Particularly if the demand persists.

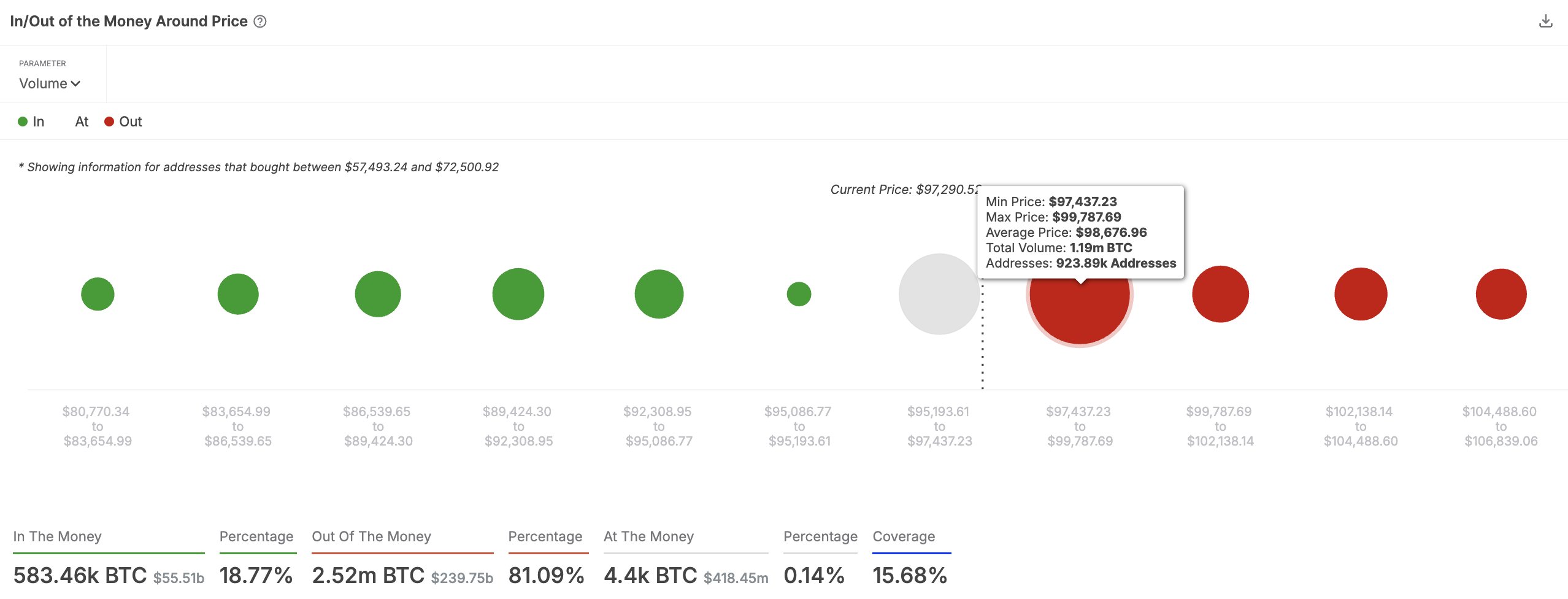

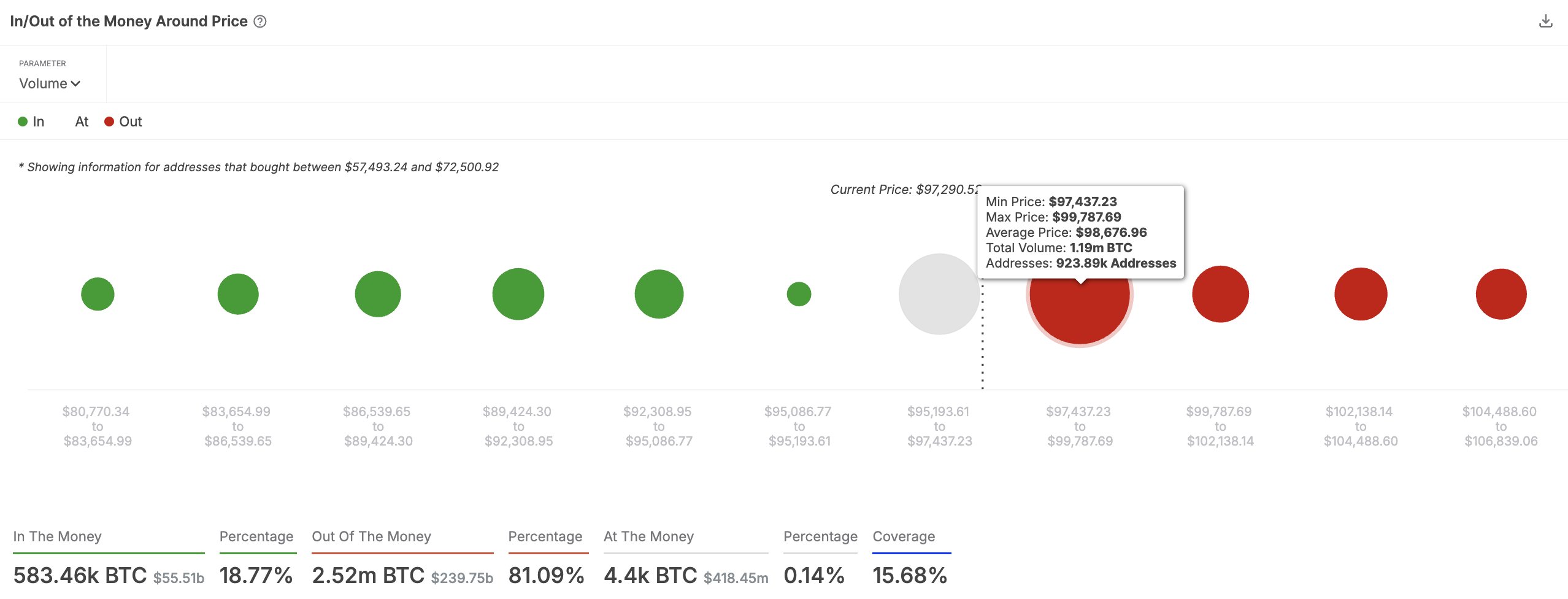

Nevertheless, the demand would face a key resistance between $97,500 and $99,800, the place 924,000 wallets maintain over 1.19 million BTC.

Supply: IntoTheBlock

If Bitcoin breaks above this resistance, there could also be potential for reaching new ATHs. Surpassing the barrier would imply robust shopping for momentum, presumably shifting the steadiness from bearish to bullish sentiment.