Bitcoin’s long-term investors should watch out for THIS key signal!

- Brief-term sentiment behind Bitcoin was bullish and a transfer to $87k is likely to be attainable

- Onset of an accumulation part may buoy long-term buyers’ sentiment

Bitcoin [BTC] noticed a 13.2% value hike over the previous six days, with the crypto as soon as once more above the important thing short-term degree at $81k. This degree had been a robust assist in mid-March, however was flipped to resistance within the first week of April.

Though these beneficial properties appeared bullish, famend market analyst Peter Brandt referred to as the transfer extra corrective than impulsive. He claimed that going by the Elliot Wave concept, the present bounce would probably be adopted by a deeper value drop. In reality, a goal of $72k-$74k was highlighted as a “max ache accumulation goal.”

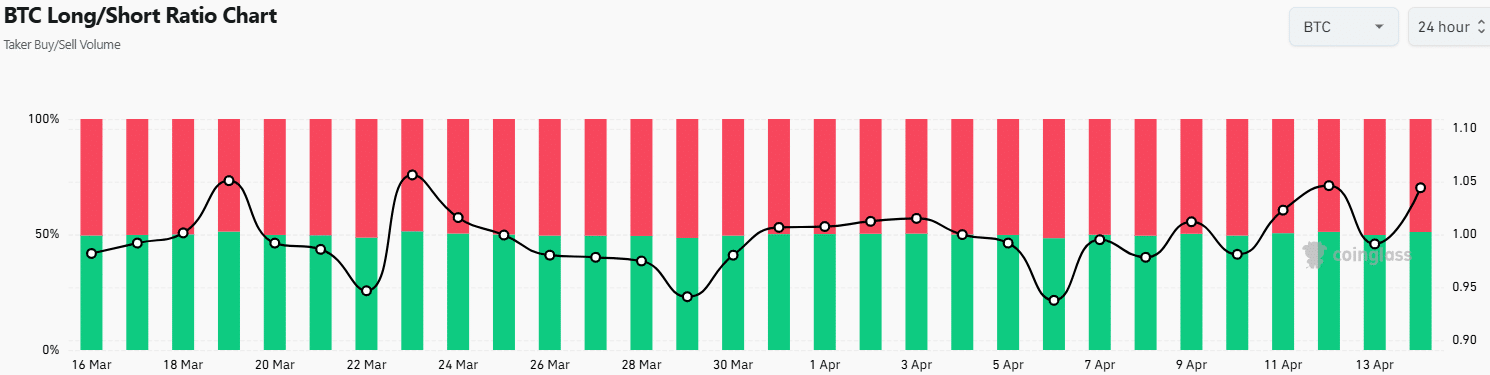

The taker purchase/promote quantity revealed that the lengthy/quick ratio was 1.04. In different phrases, 51% of the taker quantity was lengthy, which pointed in direction of some short-term bullish sentiment. Can BTC bulls preserve this going, or will the corrective part prediction come true?

Potential for a Bitcoin accumulation part

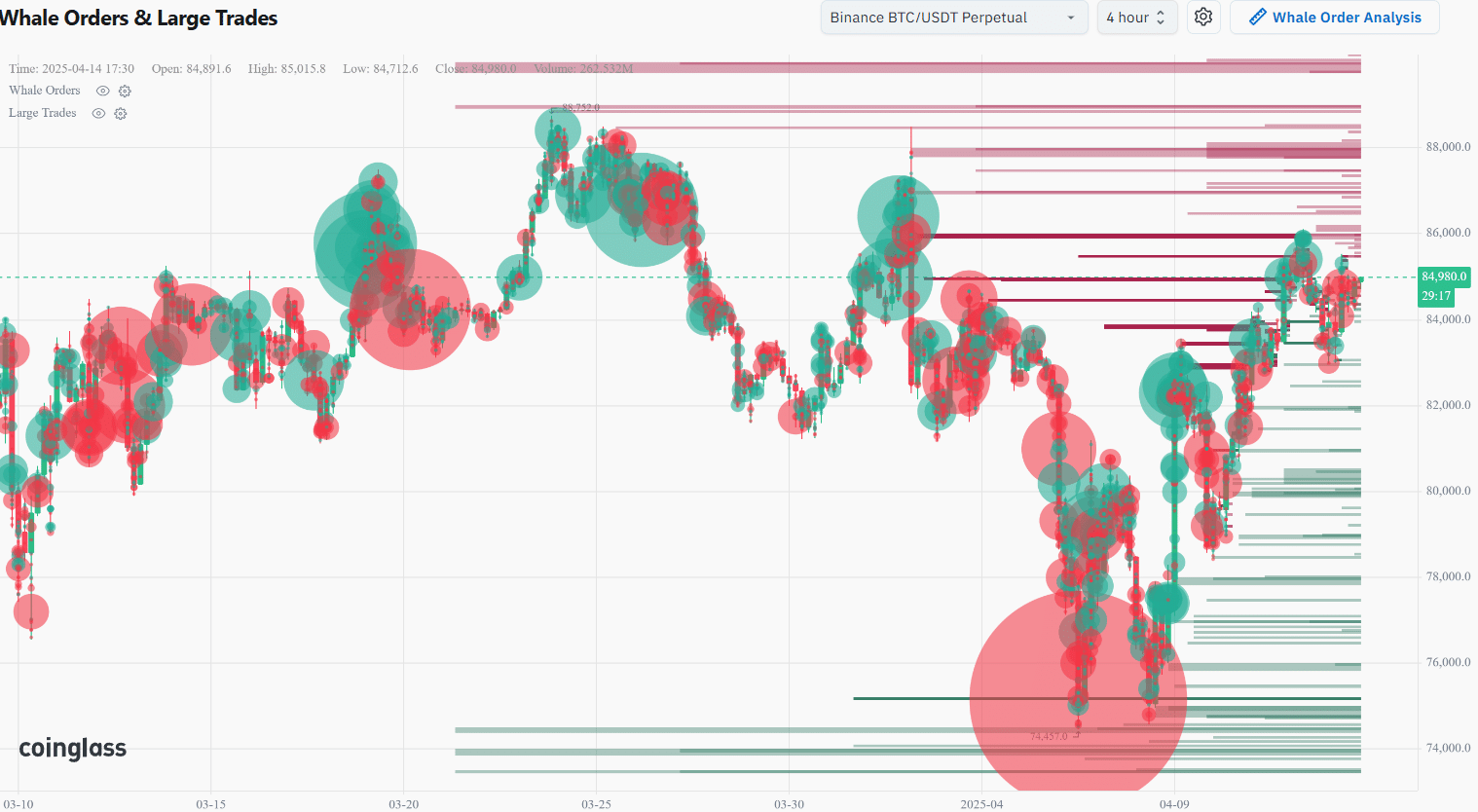

The whale orders chart from Coinglass confirmed a sizeable promote wall at $86k, $88k, and at $91k. Therefore, over the following few days, merchants already in a protracted place can use these ranges to take income at.

The whale promote quantity earlier on Monday indicated some giant promote orders, however this was not sufficient to halt the sluggish climb in direction of $85k.

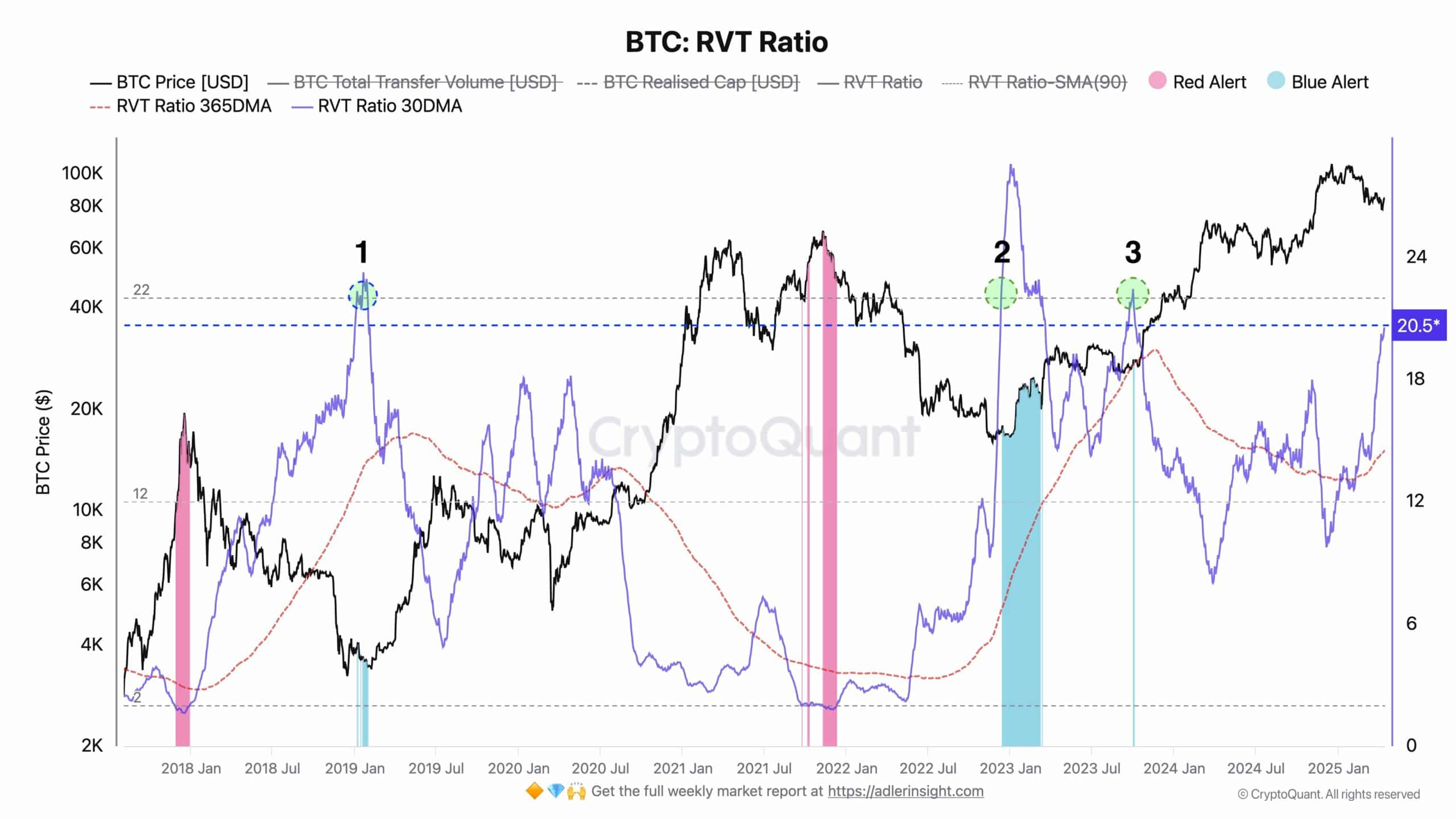

For buyers with a better time horizon, the findings of crypto analyst Axel Adler Jr could be extra related. The analyst noticed in a post on X that the Bitcoin Realized Worth to Transaction Quantity ratio (RVT) could also be on the verge of triggering a bullish sign.

The RVT is a counterpart to the Community Worth to Transaction Quantity (NVT) ratio, however with a better conviction. Each ratios are akin to the P/E ratio used for valuing firms and their shares. The RVT makes use of the realized cap as a substitute of the market cap in its calculation, making it much less risky as effectively.

The RVT metric’s 30-day transferring common was at 20.5, and its ascent past 22 usually marks an accumulation part. This is able to point out that a considerable amount of capital on the community just isn’t collaborating in every day transactions, signaling accumulation.

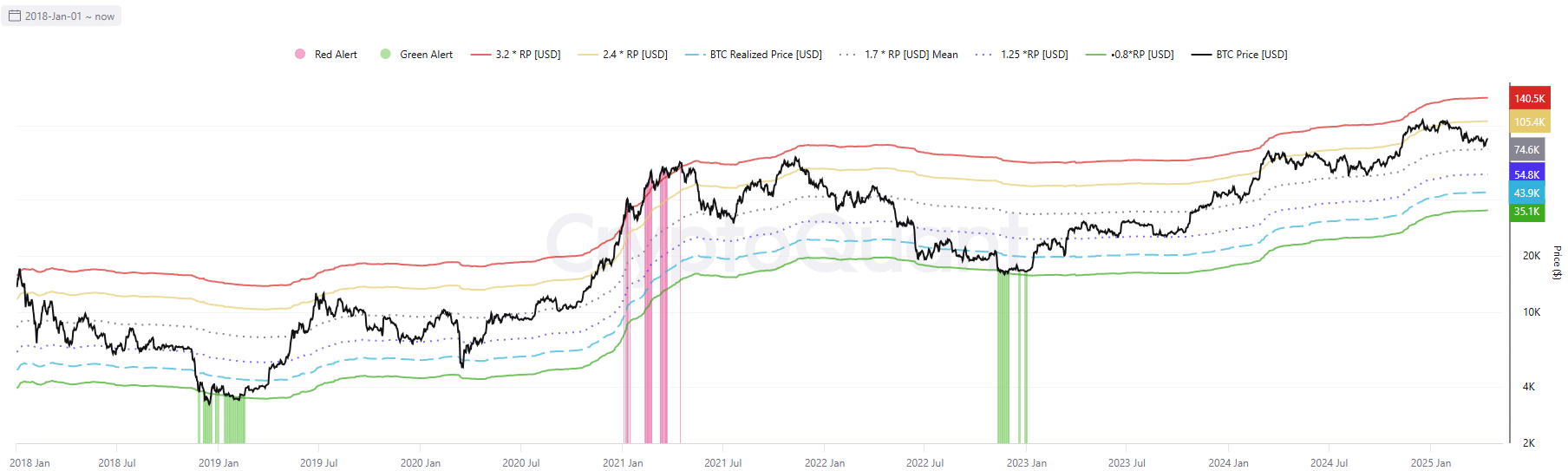

Bitcoin’s realized pricing bands additionally signaled a possible value bounce in direction of $105k or greater. Over the previous two weeks, they bounced greater from the 1.7RP at $74.6k (the realized value was at $43.9k at press time).

The earlier time the 1.7RP was examined was in September. Within the following months, a bounce past the two.4RP materialized. Whether or not BTC would proceed the present corrective part and retest $74k earlier than such a bounce is unclear proper now. Nevertheless, a BTC accumulation part can be one thing which may have an effect on the value traits positively.