Cetus exploit: Sui Foundation’s plans for a ‘100% recovery’ entails…

- Sui Basis backs Cetus with a mortgage to allow full consumer reimbursement submit $223M hack.

- Nasdaq recordsdata for Sui ETF, signaling institutional confidence and potential retail revival.

The Cetus protocol is on the heart of ongoing headlines following a devastating exploit that led to a $223 million loss.

Sui Basis and its restoration plan

In a swift transfer to stabilize the scenario and restore consumer belief, the Sui Basis has stepped in with a secured mortgage to help full consumer reimbursement.

This monetary backing, mixed with Cetus’ treasury, is a part of a broader restoration framework designed to handle the breach’s fallout.

The inspiration’s support particularly targets losses stemming from property bridged off the Sui community.

The submit noted,

“Utilizing our money and token treasuries, we at the moment are ready to totally cowl the stolen property at present off-chain if the locked funds are recovered by means of the upcoming neighborhood vote. This features a important mortgage from the Sui Basis, making a 100% restoration for all affected customers potential.”

Neighborhood reactions

Reacting to the steps taken, an X user mentioned,

“lastly some excellent news for memecoins on sui!.”

Echoing the same sentiment, Samuel Xeus, Founding father of The Nirvana Academy, added,

Supply: Samuel Xeus/X

Can a neighborhood vote actually unlock thousands and thousands?

Thus, as Cetus positions for a full restoration, the ultimate step now hinges on a neighborhood vote to unlock extra funds and guarantee affected customers are made entire.

A pivotal neighborhood vote, launched on the twenty seventh of Could, will decide whether or not a protocol improve can proceed with out requiring the hacker’s signature to reclaim frozen property.

If the proposal is permitted, the retrieved funds can be transferred to a 4-of-6 multisig pockets overseen by Cetus, OtterSec, and the Sui Basis.

On this governance course of, SUI holders play a key function by delegating their stake to validators casting votes of “sure,” “no,” or “abstain,” with the Basis’s personal stake intentionally excluded to keep up impartiality.

For the improve to cross, over 50% of the whole stake should take part, and a majority should help the change.

In the meantime, Sui has additionally introduced a $10 million safety initiative targeted on audits, bug bounty applications, and tooling enhancements, marking a powerful dedication to safeguarding its ecosystem and fostering larger collective accountability.

Affect on Cetus and Sui value motion

Following the announcement of the Sui Basis’s restoration mortgage, CETUS witnessed a notable value bounce of 23.94%, climbing to $0.1602, whereas SUI additionally gained 6.55%, buying and selling at $3.72 at press time.

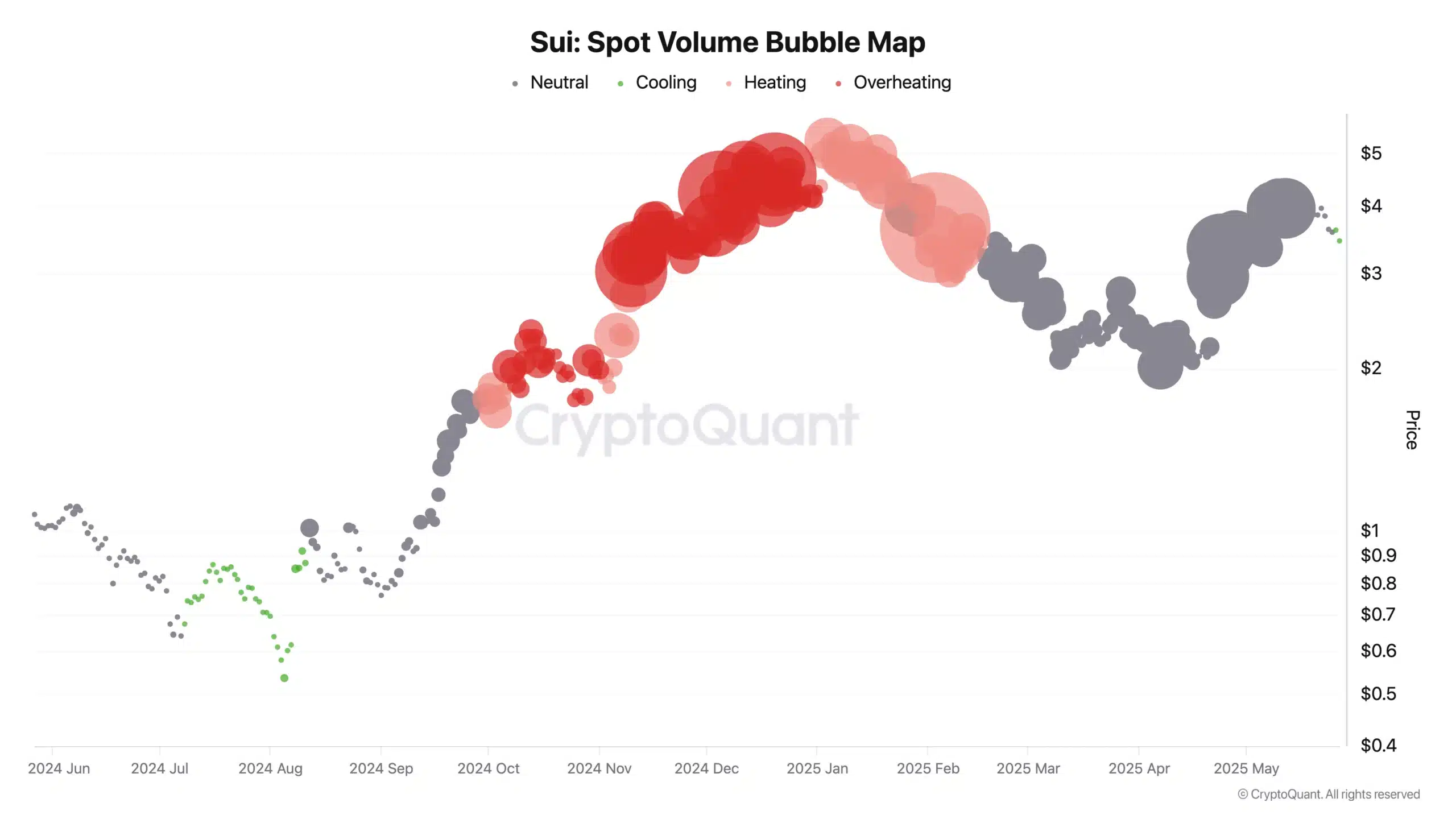

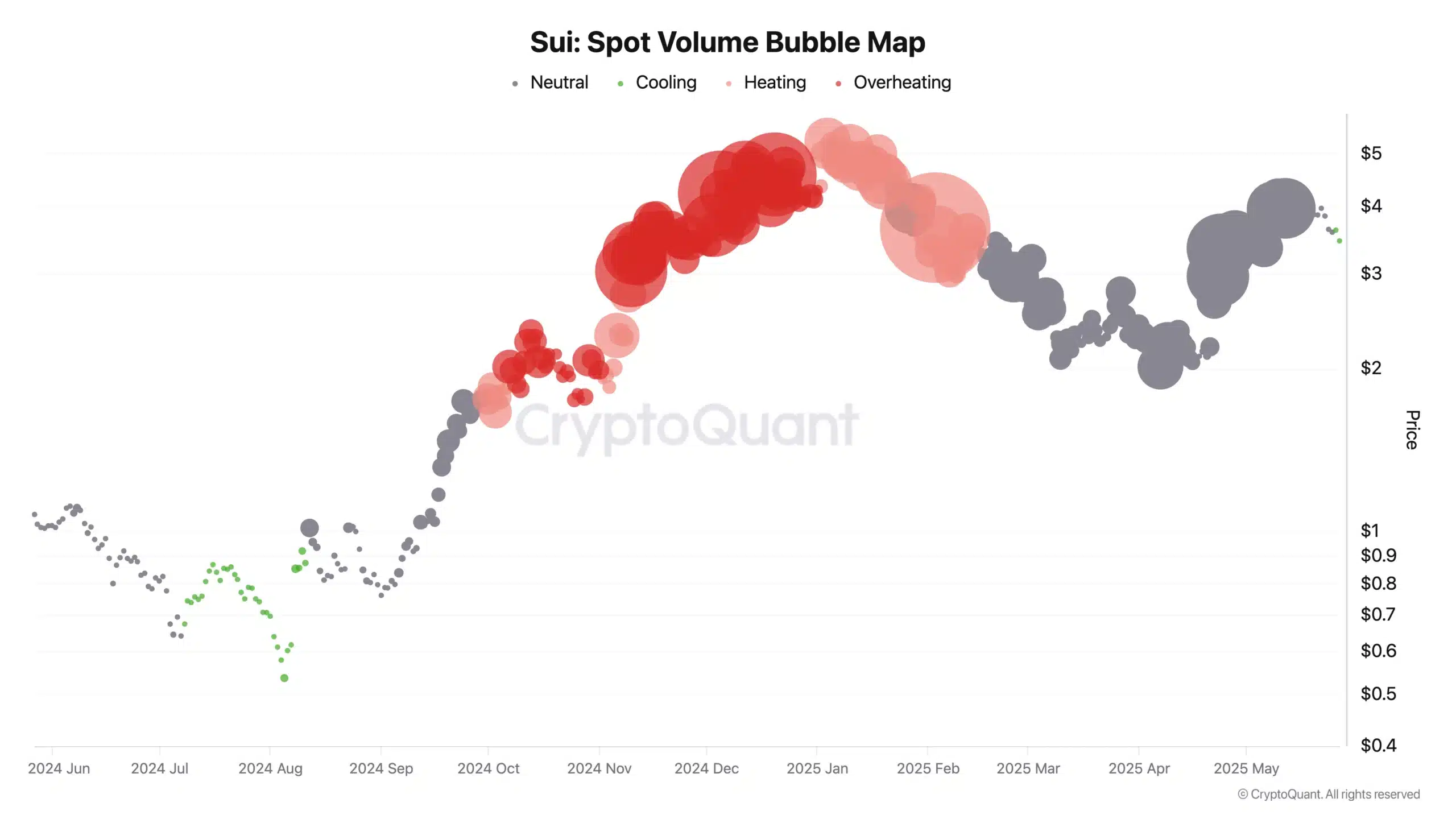

Regardless of this bullish value motion, deeper evaluation revealed a scarcity of great retail participation, indicating that SUI’s rally may nonetheless be in its early phases.

Insights from CryptoQuant’s spot quantity bubble map confirmed a lower in buying and selling quantity throughout exchanges.

However with elevated overheated indicators available in the market sometimes related to imminent corrections, there could also be room for additional upside earlier than going through a pullback.

Supply: CryptoQuant

Optimism persists

Including to the momentum, Nasdaq’s latest filing for 21Shares to launch a spot Sui ETF within the U.S. indicators rising institutional curiosity within the community.

Because the SEC begins its evaluate, this growth may catalyze broader retail engagement and strengthen market confidence.

Coupled with ongoing restoration efforts and safety enhancements, such initiatives might not solely offset the injury attributable to the Cetus exploit but in addition place Sui for long-term development and resilience.