Coinbase CEO divulges new information on the SEC lawsuit

- A current assertion made by Coinase CEO highlighted the SEC’s stance.

- The lawsuit may have unfavourable impacts on the rising memecoin hype on BASE.

On 6 June, the SEC charged Coinbase with violating federal securities regulation, accusing the corporate of performing as a dealer, trade, and clearinghouse for unregistered securities, together with 13 cryptocurrencies. In response, Coinbase refuted the SEC’s motion, asserting that the regulator breached due course of and represented an abuse of discretion.

The saga continues

In keeping with Coinbase CEO, earlier than suing the trade, the SEC requested it to stop buying and selling in all cryptocurrencies apart from Bitcoin.

This signaled its intention to exert regulatory authority over a broader phase of the crypto market. The SEC’s case recognized 13 cryptocurrencies on Coinbase’s platform as securities, putting the trade underneath its regulatory oversight.

In an interview with the Monetary Occasions, Brian Armstrong mentioned the SEC insisted that each one belongings, besides Bitcoin, had been deemed securities with out offering additional clarification. The SEC’s push for Coinbase to delist over 200 tokens displays the company’s purpose to increase its jurisdiction throughout the cryptocurrency business.

Had Coinbase complied with the SEC’s request, it may have established a precedent requiring most American crypto companies to function throughout the fee’s laws.

The Coinbase CEO emphasised that they felt compelled to contest the SEC’s request. Armstrong instructed the FT that,

“We actually didn’t have a selection at that time. Delisting each asset apart from bitcoin, which by the best way isn’t what the regulation says, would have primarily meant the top of the crypto business within the U.S.”

Given the magnitude of the choice and its potential penalties, Coinbase opted to pursue authorized motion to hunt readability from the courtroom on the matter in response to Brian.

Crypto neighborhood goes for BALD and BASED

SEC’s actions may additionally impression the huge curiosity showcased by the crypto neighborhood for memecoins on the BASE community.

Coinbase’s just lately launched BASE community for builders has skilled a surge in exercise associated to meme cash. Merchants flocked to buy tokens like BALD, COIN, and BASED utilizing the DEX LeetSwap.

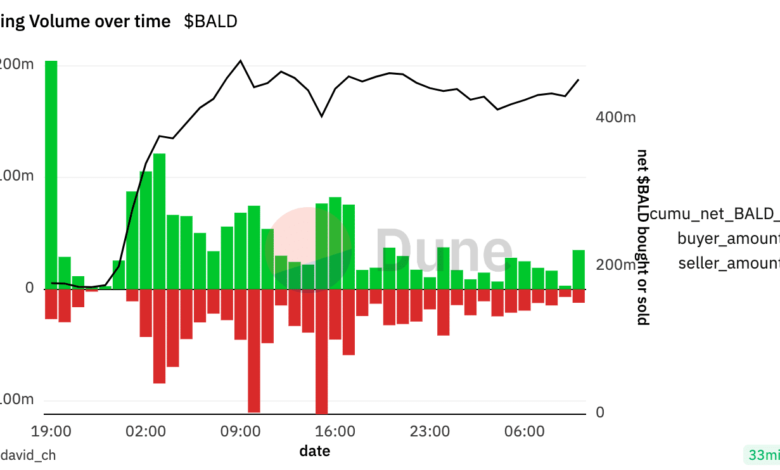

Previously 24 hours, LeetSwap recorded practically $200 million in buying and selling quantity by means of 377,000 transactions. Half of the quantity was on account of BALD transactions which surged by 3100%. The token may probably be a reference to Coinbase CEO Brian Armstrong’s shaved head.

In the meantime, BASED bounced, held a market capitalization of $291 million, and grew considerably, regardless of being round for lower than 24 hours. BASE’s public launch is scheduled for August. And until then withdrawing tokens from BASE earlier than the official launch entails extra issues.

Coinbase collaborated with Optimism, an Ethereum scaling answer using Optimistic Rollups, to develop BASE.

This was one of many many the reason why customers had been flocking to the Optimism protocol over the previous few weeks. Nonetheless, Optimism may quickly be one of many protocols that would get caught within the crossfire between Coinbase and SEC.

Quite the opposite, this may very well be seen as a bullish sign for BTC. The SEC explicitly said that it doesn’t view Bitcoin as a safety.

Supply: Dune Analytics