Crypto.com, Bybit and Other Centralized Exchanges See Trading Volume Skyrocket in December: Report

New information reveals that outstanding centralized change (CEX) platforms, together with Crypto.com and Bybit, noticed their buying and selling volumes surge in December.

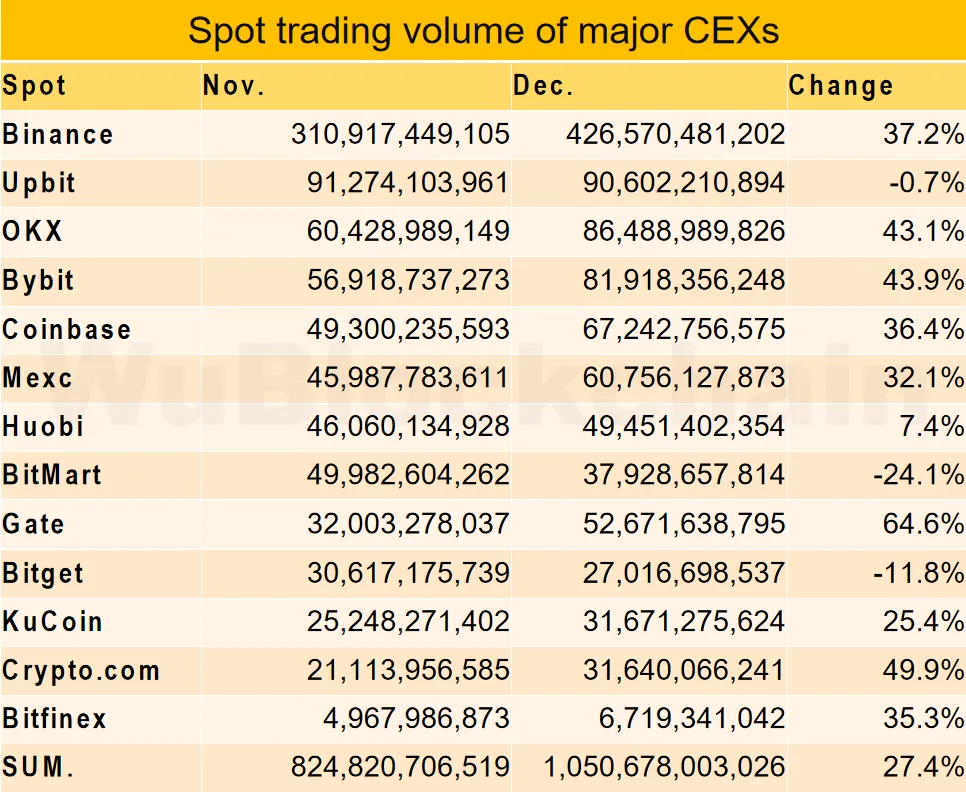

In line with blockchain reporter Colin Wu, in December, the general spot buying and selling quantity of centralized crypto exchanges rose 27.4% month-on-month regardless of a few of them seeing notable dips.

“In December, the spot buying and selling quantity of main exchanges rose by 27.4% month-on-month. The highest three by way of proportion change have been Gate at 65%, Crypto.com at 50%, and Bybit at 44%. The underside three have been BitMart at -24%, Bitget at -12%, and Upbit at -1%.”

In line with Wu’s information, derivatives buying and selling on main crypto exchanges rose 22.3% month-on-month whereas general visitors to their web sites noticed a 21% month-on-month enhance.

“For by-product buying and selling quantity in December, there was a 22.3% month-on-month enhance amongst main exchanges. The highest three in proportion change have been Crypto.com at 46%, Bitget at 42%, and Binance at 26%. The underside three have been Mexc at -13%, Huobi at -5%, and Kucoin at 14%.

Relating to web site visitors for main exchanges in December, there was a 21% month-on-month enhance. The highest three in proportion change have been Mexc at 45%, Bybit at 38%, and Gate at 34%. The underside three have been Huobi at -80%, BitMart at -17%, and Bitget at 8%.”

In December, market intelligence platform Glassnode recommended that a rise in flows into crypto exchanges meant that institutional buyers have been readying themselves for the potential approval of a spot market Bitcoin (BTC) exchange-traded fund.

On the time, an evaluation by the agency discovered that the 30-day easy shifting common (SMA) of Bitcoin flows out and in of exchanges grew 220% from the beginning of the 12 months, taking pictures as much as $3 billion from $930 million.

The U.S. Securities and Trade Fee (SEC) is slated to approve or reject spot market BTC ETFs someday immediately.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Generated Picture: Midjourney