Crypto market liquidation $1B in 24 hrs

- Crypto market is crushing at excessive charges than envisioned.

- Right here’s a take a look at three causes inflicting the cryptocurrency market dip.

The final 24 hours have seen the biggest crypto market crash in latest months. Bitcoin’s [BTC] decline from $50k to $60k has pushed the crypto market to an enormous decline.

With BTC’s excessive volatility amidst elevated world monetary market uncertainty, altcoins have been hit probably the most. Spectator Index reported that cryptocurrency markets have witnessed about $ 1 billion liquidation over the previous 24 hrs.

The decline has left merchants and analysts questioning what’s inflicting such an enormous drop. AMBCrypto has discovered three main causes for crypto markets crashing over the previous 24 hrs.

Altcoins decline to excessive lows

With the elevated crypto decline, most altcoins have skilled the biggest hit, making excessive lows. Over the previous seven days, most altcoins have confronted bearish sentiment, thus getting into a bear market.

Supply: X

Amidst this decline, all main altcoins have been hit arduous. For starters, ETH was buying and selling at $2326 at press time after a 19.85% decline on each day charts and a 30% decline on weekly charts.

This drop has impacted ETH’s market cap extensively. The Ethereum market was $410 billion 2 weeks in the past, and now it’s at $280 billion. That’s a $127 billion haircut, which is greater than the whole market cap of Solana and BNB.

Equally, BNB has declined by 15% on each day charts and 24% on weekly charts to commerce at $446. Additionally, Solana has skilled an enormous decline to $121 after a 36% drop on weekly charts and 14.77% on each day charts.

What’s inflicting the crypto dip?

Supply: X

Three main causes are pushing crypto markets down.

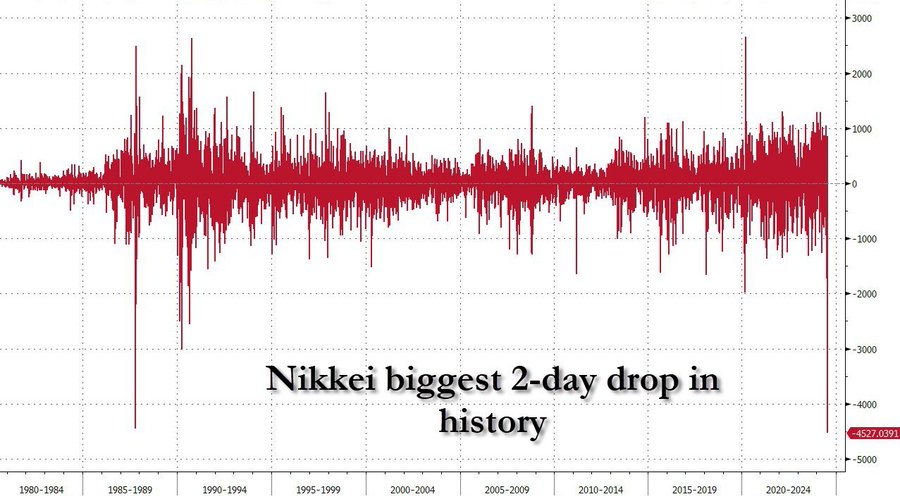

Firstly, the Japanese inventory market crash has impacted the broader crypto trade. Japan’s inventory market is reporting the worst 2 day decline in its latest historical past.

Zerohedge states the decline is bigger than the Black Monday crash of 1987.

Thus, negatively impacts merchants who’ve bought low cost yen to leverage their positions within the inventory market. Adam Khoo addressed the event, noting that,

“Japanese shares (Nikkei 225) plunging over 25% from their highs to 30,900 help. If this help can maintain, a pleasant bounce may come.”

Accordingly, the Japanese inventory market has declined for numerous causes. Firstly, BoJ is climbing rates of interest to manage inflation and is predicted to proceed climbing. Secondly, as famous by Adam Khoo,

“The spike in Jap Yen (JPY) will doubtlessly make Japanese large-cap multi-national firms exports much less aggressive and cut back income from abroad income.”

The Japanese market has prompted panic promoting, thus affecting different markets, together with Taiwan and South Korea. Equally, the U.S. FED is rumored to announce charge cuts to cushion markets towards any ripple impact from Japanese markets.

Supply: X

Elevated geopolitical tensions

The present geopolitical tensions affected the broader crypto markets as effectively, sending merchants into panic promoting.

Over the past week, tensions within the Center East have prompted issues over a wider regional warfare. Because the Israel killing of the Hamas chief in Iran and army actions in Lebanon, there have been elevated worries of all-out warfare, with the U.S. army sending reinforcements to the area.

Via his X web page, Patrick Bet David famous that regional stress is an element that impacts markets. He famous that,

“Rumors of an underground bunker in Jerusalem the place senior leaders can stay for an prolonged interval throughout a warfare has been ready by the Shin Wager safety service and is absolutely operational, the Walla information web site reported on Sunday, amid concern of assaults on Israel from Hezbollah and Iran.”

Undoubtedly, the potential of a regional warfare would crash the crypto markets and the broader monetary markets.

Market uncertainty

Because the Fed didn’t announce any charge cuts, the market has skilled a second of uncertainty. With the U. S debt hitting previous $35 trillion, the markets have reacted with panic as fears develop over inflation and FED’s stand on charge cuts.

Due to this fact, the rising inventory market panic has created rumors that FED will announce cuts in response to present conditions.

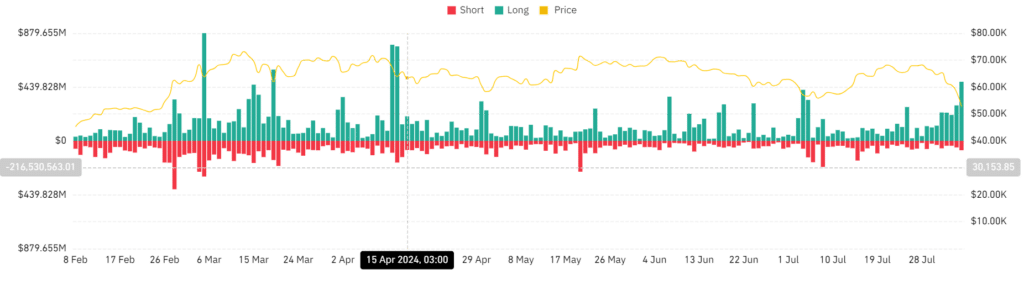

Supply: Coinglass

Equally, elevated market uncertainty has resulted in elevated crypto liquidations over the previous 24 hours.

In accordance with Coinglass, complete liquidations for Crypto markets have elevated from $269.4 million to $482.5 million on each day charts. Different studies from Spectator Index report over a $1 billion liquidation in crypto markets.

The rise in liquidations reveals buyers are unsure over crypto’s future and thus refuse to pay premium to carry their positions, forcing them out of those positions.

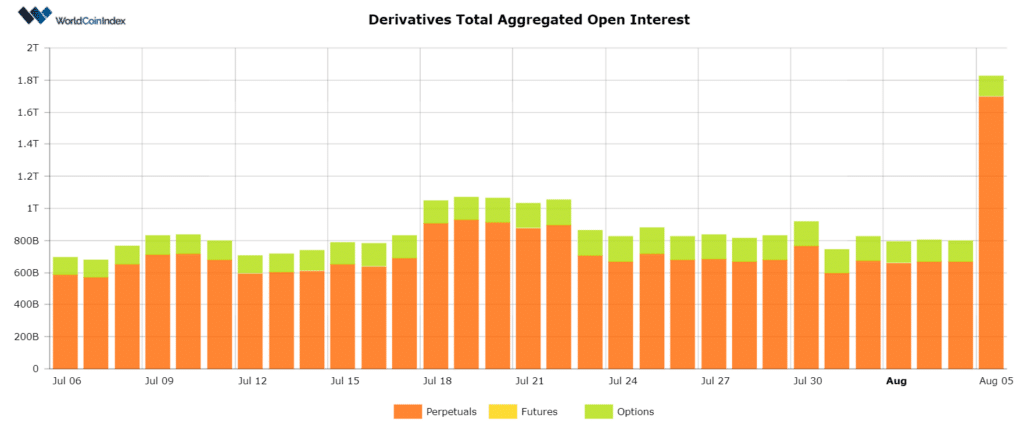

Supply: Worldcoinindex

Lastly, in keeping with the Worldcoin index, the amassed open curiosity of crypto derivatives has elevated from $667.2 billion to $1.7 trillion.

When derivatives aggregated open curiosity rises with declining costs, it implies these getting into the markets are betting towards worth will increase as they anticipate markets to drop additional.