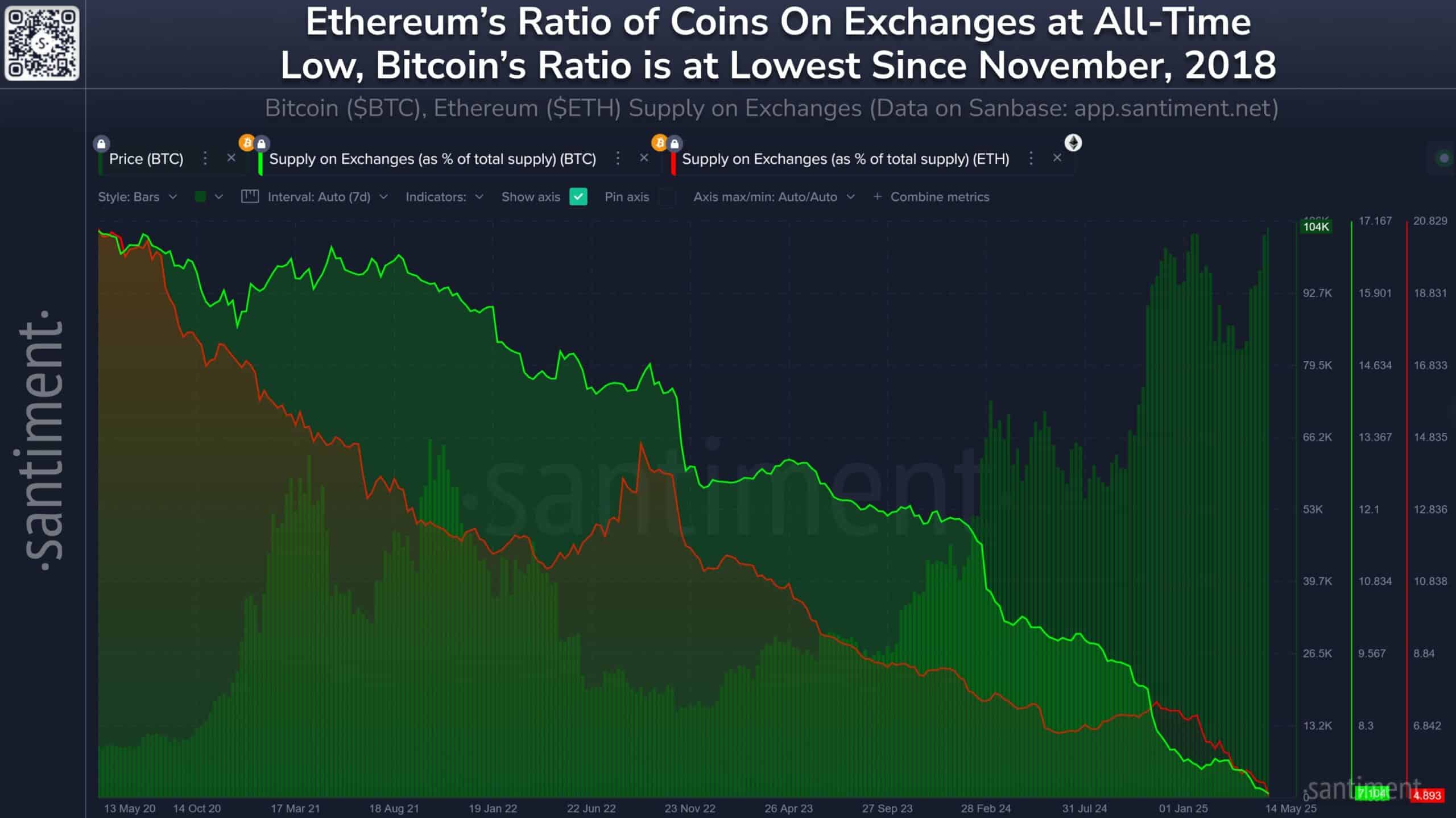

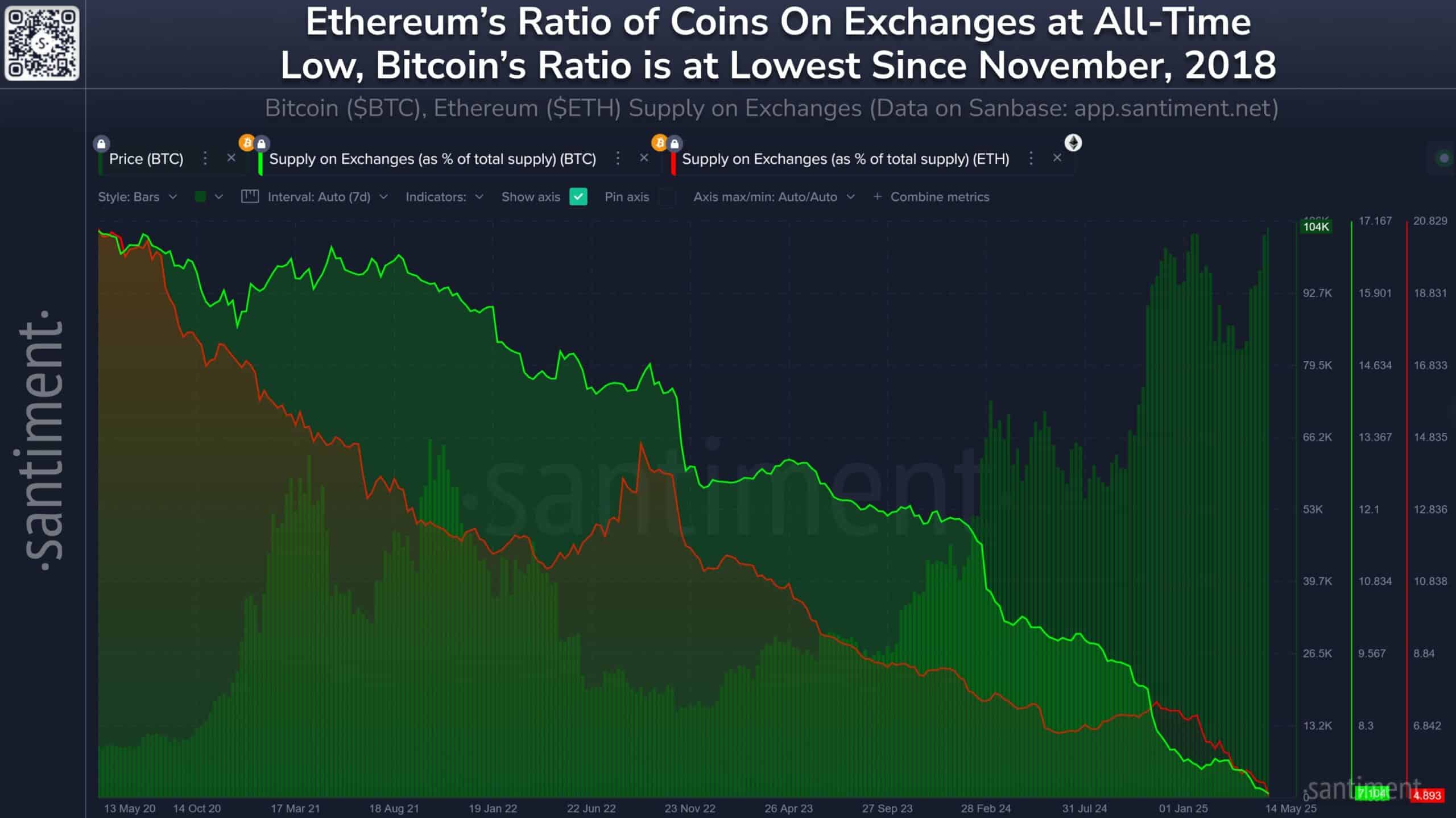

Crypto supply shock? Bitcoin and Ethereum leave exchanges at record pace

Bitcoin’s supply on exchanges has fallen to simply 7.1% — its lowest stage since November 2018 — whereas Ethereum has dropped beneath 4.9% for the primary time in its 10+ 12 months historical past.

The tempo of outflows over the previous 5 years is putting: greater than 1.7 million BTC and 15.3 million ETH have been withdrawn from CEXes.

These figures point out a rising pattern towards self-custody and long-term holding, doubtlessly setting the stage for a provide squeeze if demand begins to speed up.

Supply: Santiment

The provision shock debate

A provide shock sometimes happens when accessible tokens on exchanges dwindle simply as demand surges, creating upward strain on costs. With BTC and ETH balances at multi-year lows, the stage appears set.

Traditionally, comparable tendencies have preceded main rallies, as shrinking float limits sell-side liquidity. However not everybody’s satisfied.

Some argue whales might merely be transferring funds to chilly storage for safety, not accumulation. Others level to a still-cautious retail crowd and a doable cooling buzz post-ETFs.

If sentiment shifts, sidelined capital might re-enter exchanges, rapidly reversing the pattern.

Bitcoin: From fringe to mainstream

Roughly 50 million People now personal Bitcoin — surpassing gold possession by a large margin, per River and The Nakamoto Venture. As BTC vanishes from exchanges, this shift is large so far as priorities go.

Supply: X

Bitcoin is now not a fringe asset however a rising reserve various. The sharp drop in alternate provide could also be tied much less to hypothesis and extra to a long-term redefinition of worth within the digital age.