Cryptocurrencies set to reach $100 in 2024

Whereas the general cryptocurrency market is at the moment experiencing a short-term decline, there may be optimism that the majority belongings will seemingly get better within the coming months. Notably, bullish fundamentals, together with occasions just like the upcoming Bitcoin (BTC) halving and potential rate of interest cuts by the Federal Reserve, contribute to this optimistic outlook.

In anticipation of a possible rally, a number of tasks present promise in reaching key help ranges, notably round $100. On this context, Finbold has recognized three cryptocurrencies more likely to expertise a surge in direction of the $100 mark.

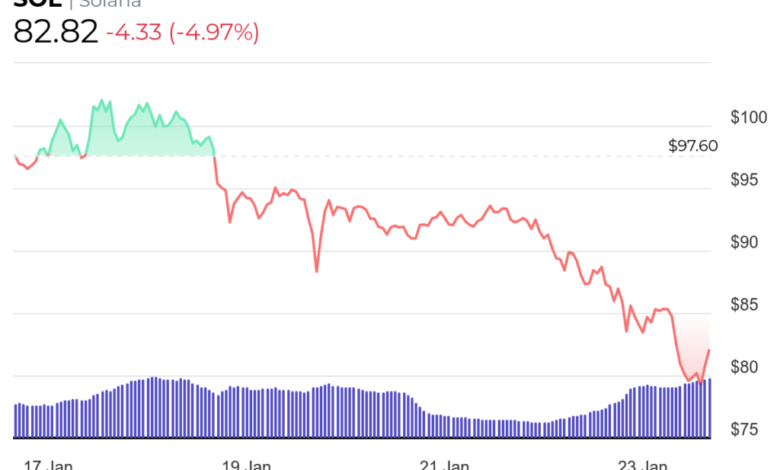

Solana (SOL)

Solana (SOL), acknowledged for its high-performance blockchain expertise, has gained important traction in current months regardless of dealing with the specter of a big drop attributable to its affiliation with the collapsed FTX alternate. Certainly, the cryptocurrency considerably recovered from late October 2023, surging to a excessive of $121 in late December.

In December alone, the token recorded a formidable development of 105%. This surge was attributed primarily to the concern of lacking out (FOMO) surrounding Solana’s SPL token airdrops.

Though the cryptocurrency at the moment trades in keeping with bearish market sentiments, it nonetheless has an actual likelihood of reclaiming the $100 mark. This potential is guided by Solana’s mixture of technological developments, elevated demand for decentralized finance (DeFi) tasks, and a rising neighborhood of builders contributing to its ecosystem.

The renewed demand and ongoing upgrades to deal with previous community outages might additional propel SOL towards larger floor.

By press time, Solana was buying and selling at $82.82 with each day losses of 4%, whereas on the weekly chart, the token is down 14%.

Avalanche (AVAX)

Avalanche (AVAX), famend for its scalability and interoperability, continues to draw DeFi tasks in search of aid from Ethereum’s (ETH) congestion.

Latest developments surrounding AVAX, together with strategic partnerships and collaborations, have considerably enhanced its fame. For example, the platform partnered with Alibaba Cloud to create a blockchain-based metaverse deployment platform known as Cloudbase.

Moreover, it solid one other high-profile collaboration with Amazon Internet Providers (AWS).

The enlargement of its ecosystem and the mixing of latest tasks gasoline optimism amongst buyers, seemingly propelling AVAX towards the $100 milestone.

On the identical time, the Avalanche Basis is broadening the scope of its “Tradition Catalyst” initiative to incorporate financing for the acquisition of meme cash. Initially centered on non-fungible tokens (NFTs), the $100-million funding fund revealed a shift in allocation, with a portion designated for memecoins.

Certainly, contemplating the tendency of meme cash to rally considerably, AVAX has the potential to construct on the inspiration’s push and rally towards $100, en path to reclaiming its file excessive of $134 attained in 2021.

By press time, AVAX was valued at $28.59 with over 5% losses within the final 24 hours, whereas on the weekly chart, the token is down 20%.

Ethereum Traditional (ETC)

Ethereum Traditional (ETC), the onerous fork of Ethereum that retained the unique Proof-of-Work (PoW) consensus mechanism, occupies a singular place within the crypto panorama. As Ethereum shifted to Proof-of-Stake (PoS), ETC has grow to be a refuge for miners and PoW fans. The current scaling challenges confronted by Ethereum might doubtlessly drive customers in direction of ETC, offering a possible enhance to its worth.

Moreover, the flexibility of ETC to rally is carefully tied to its compatibility with current Ethereum tasks. This compatibility positions Ethereum Traditional in its place funding for these in search of publicity to Ethereum’s ecosystem however with a special threat profile.

Then again, ETC might obtain a lift from regulatory developments. Particularly, with the current approval of the spot Bitcoin exchange-traded fund (ETF), consideration has now turned to an analogous product for Ethereum.

Consequently, the approval of a spot ETH ETF would seemingly have an effect on ETC. On this state of affairs, optimistic information of this nature might propel ETC in direction of doubtlessly reclaiming its all-time excessive of $127, which was recorded in 2021.

As of the newest replace, ETC was down 4% on the each day chart, buying and selling at $22.37.

In conclusion, the prospects of Solana, Avalanche, and Ethereum Traditional reaching $100 in 2024 seem promising, pushed by a mixture of technological developments, market developments, and rising investor curiosity. Whereas these projections current thrilling alternatives, it’s value noting that their success will largely rely on total market sentiments.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.