Curve 3pool Sees Increased Outflows Since hack

- The stablecoins that make-up Curve’s 3pool have seen elevated outflows for the reason that hack.

- The demand for CRV continues to fall, placing downward stress on worth.

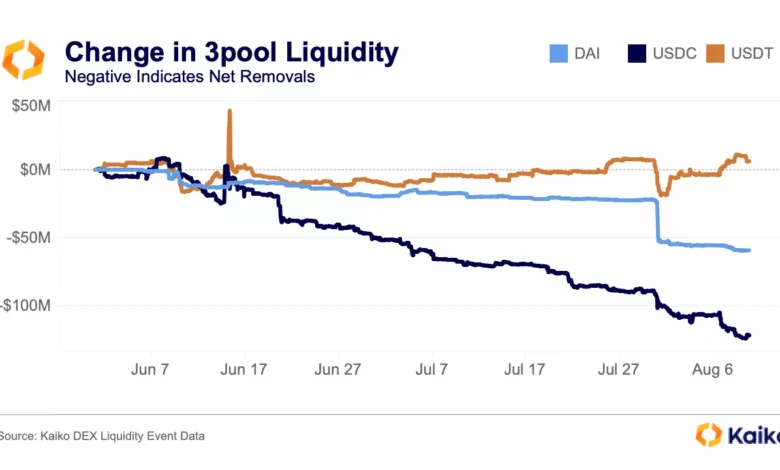

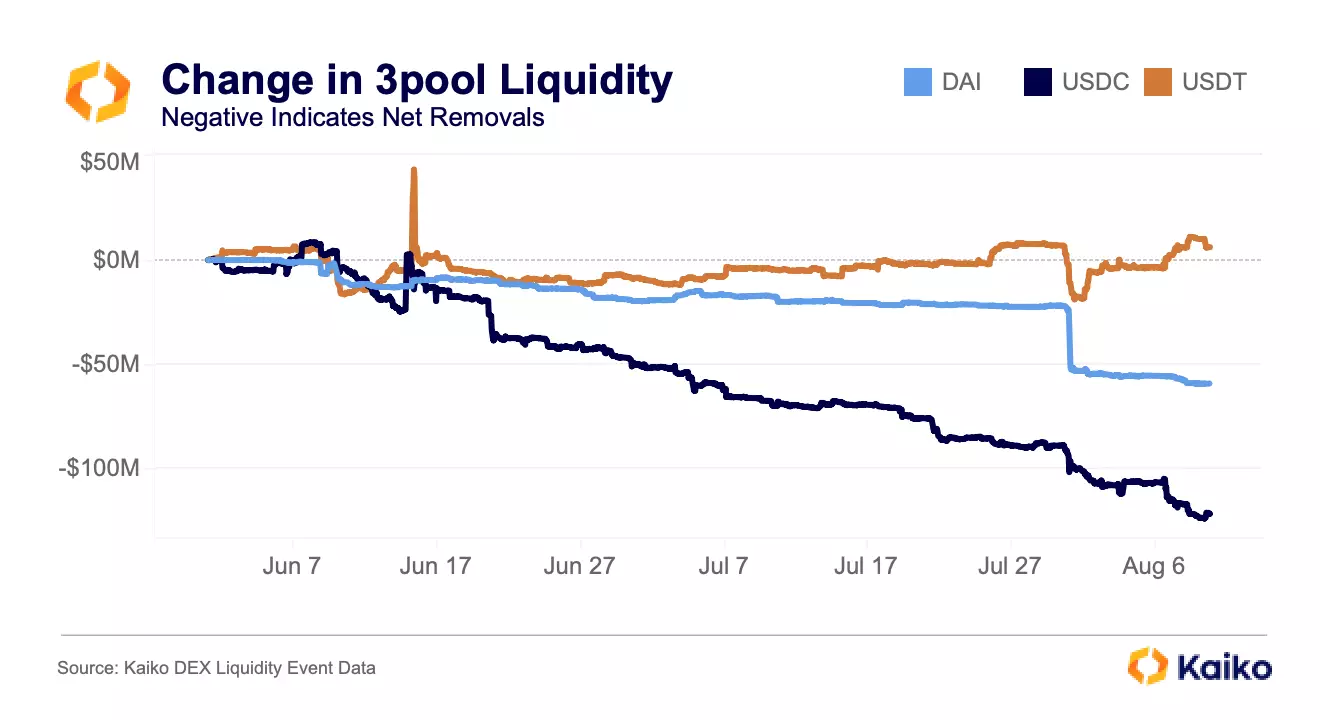

Within the aftermath of Curve’s reentrancy exploit of July 30, 3pool, one of many decentralized trade’s (DEX) outstanding liquidity swimming pools, proceed to expertise capital flight, analysis agency Kaiko famous in a latest report.

In keeping with Kaiko, Curve’s 3pool represents considered one of its “most necessary sources of liquidity for DAI, USDC, and USDT” and has seen $175 million for the reason that hack.

USDC has seen probably the most outflows of all of the three stablecoins that make up the forex reserves within the pool. For the reason that exploit, liquidity suppliers have eliminated USDC cash value $125 million from 3pool. DAI is available in second place with outflows that totaled $60 million, “$25mn of which got here in simply three transactions on July 31,” the report said.

Relating to Tether’s USDT, Kaiko discovered that it has remained roughly even within the Curve 3pool, regardless of the elevated removing of the opposite stablecoins.

In keeping with Kaiko, this means that buyers have gotten extra skittish about USDT. It is because USDT makes up a disproportionate quantity of the pool, so a run on USDT may trigger the pool to depeg.

The truth that customers are incentivized to take away USDT from the Curve 3pool is an indication that they’re fearful concerning the stability of USDT. This might result in additional outflows from the pool, which may put downward stress on the value of USDT.

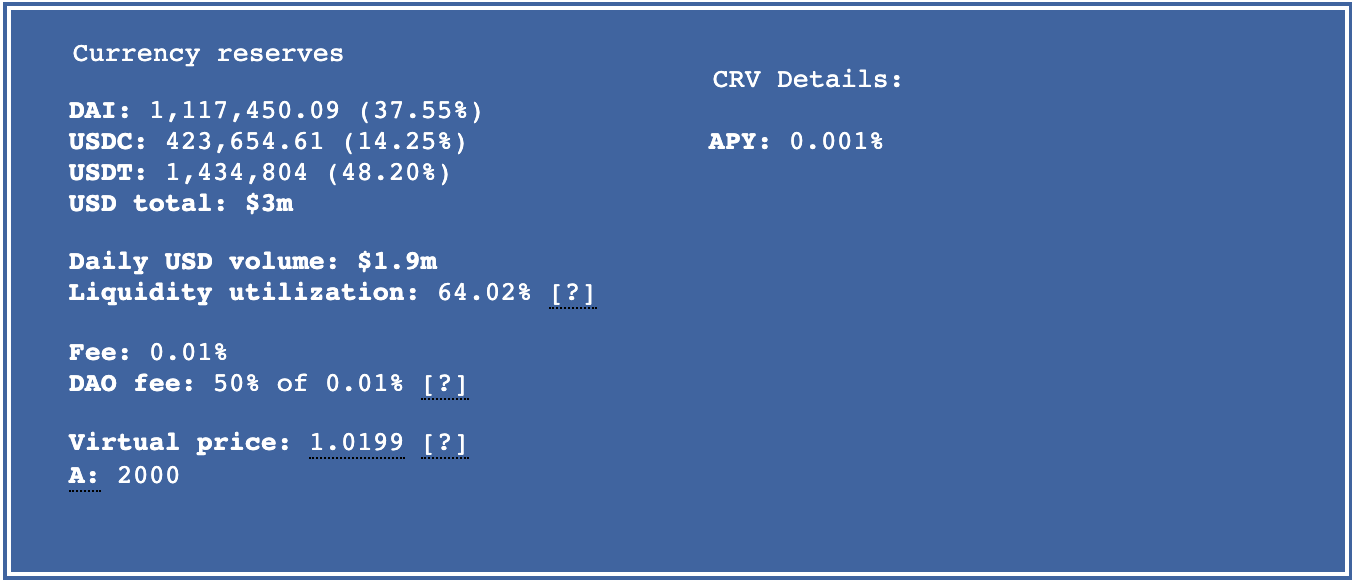

The full forex reserves in Curve’s 3pool at press time was $3 million. USDT accounted for the most important share of the reserves, with $1.43 million, or 48.20%. USDC was the second-largest reserve, with $423,654, or 14.25%. DAI was the third-largest reserve, with $1.11 million, or 38%.

CRV continues to dwindle amid elevated sell-offs

At press time, CRV exchanged arms at $0.5597. In keeping with CoinMarketCap, the altcoin’s worth has plummeted by 32% within the final month.

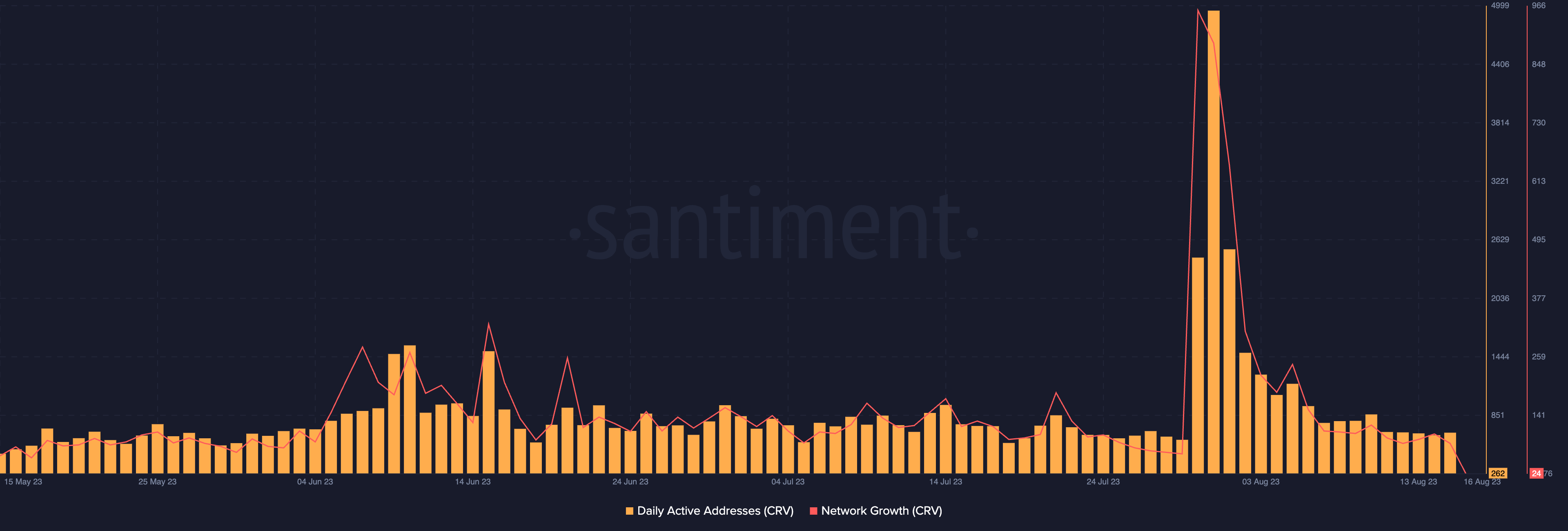

Amid the concern of a whole liquidation of Michael Egorov’s collateral on Aave following the hack, the depend of transactions involving CRV has dropped since 30 July. In keeping with Santiment, the depend of each day energetic addresses that commerce CRV has declined by 94% for the reason that hack.

Likewise, CRV has failed to attract in new demand as individuals proceed to shut their buying and selling positions. Knowledge from Santiment revealed a 90% lower within the variety of new addresses which were created to commerce CRV for the reason that hack.