Digital asset funds extend winning streak, record more inflows

- 12 months-to-date inflows went previous the $5.7 billion mark.

- The full belongings beneath administration hit a 26-week excessive.

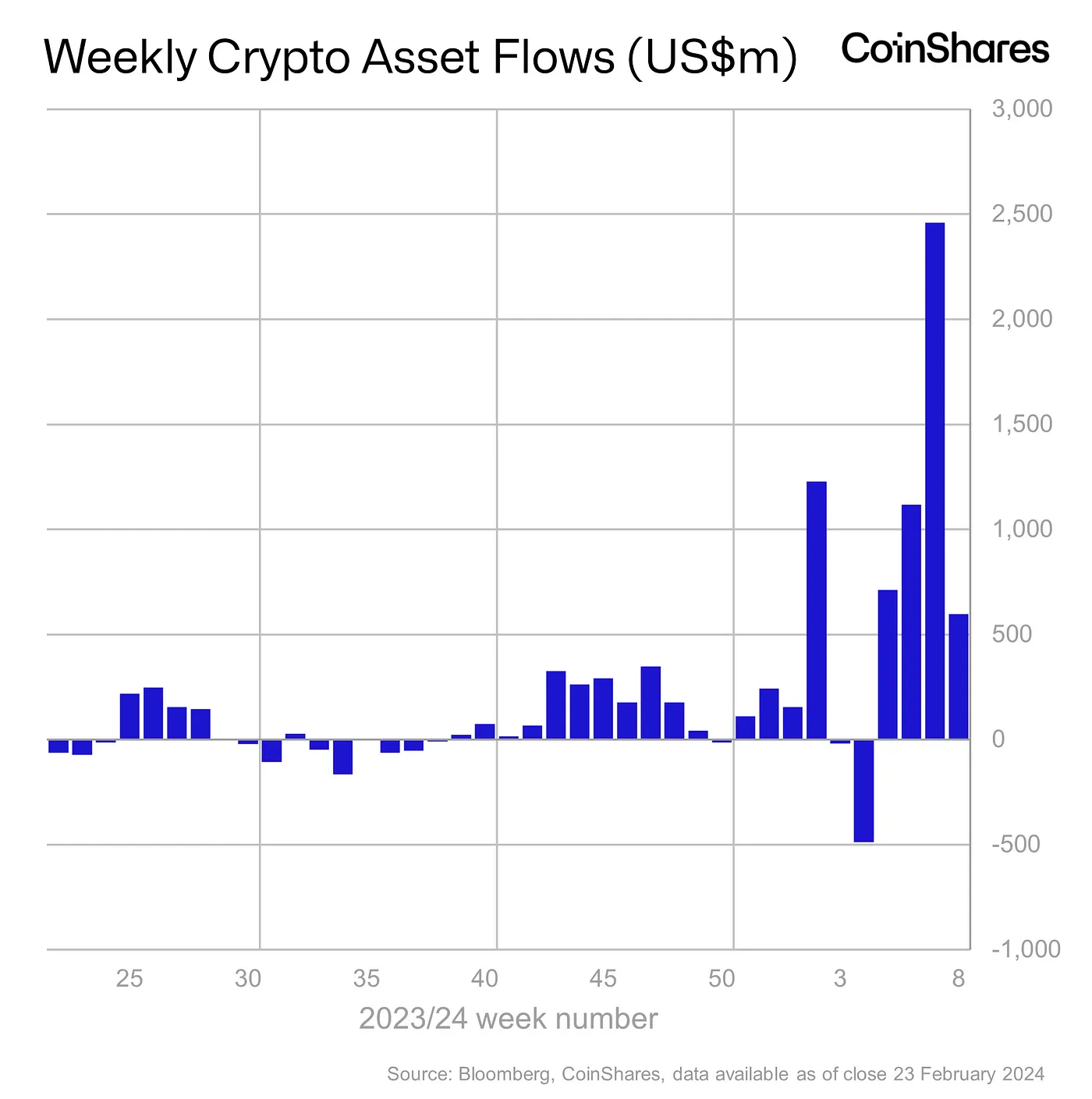

Digital asset funding merchandise recorded the fourth straight week of internet inflows as institutional curiosity in spot Bitcoin [BTC] continued to mount.

In response to the most recent report by crypto asset administration agency CoinShares, buyers poured $598 million into cryptocurrency-linked funds final week, taking the year-to-date (YTD) inflows previous the $5.7 billion mark.

This determine already represented 55% of the document inflows seen throughout 2021 — the 12 months when the crypto market achieved its high.

The full belongings beneath administration (AuM) hit a 26-week excessive of $68.3 billion, inching nearer to the height of $87 billion recorded in November 2021.

AUM is a vital efficiency gradient of a fund. The upper the worth of AuM, the extra investments it tends to draw.

U.S. corners the vast majority of inflows

The U.S. remained the main focus, with the recently-launched spot Bitcoin ETFs accounting for the majority of the investments at $610 million.

To the market’s reduction, outflows from Grayscale Bitcoin Belief (GBTC) ebbed significantly final week, totaling $436 million.

So as to add context to the decline, about $640 million was plugged out of the incumbent issuer on a single day final week.

Hits and misses

The most important institutional crypto product Bitcoin loved investments of $570 million final week, bringing YTD inflows to $5.6 billion.

The main crypto asset’s sideways trajectory impacted market sentiment, inflicting a marked drop from $2.3 billion inflows recorded within the week prior.

Funds linked to the second-largest cryptocurrency Ethereum [ETH] additionally noticed spectacular inflows, totaling $17 million final week.

Then again, the outage-induced FUD triggered a second consecutive week of outflows from Solana [SOL]-tied crypto merchandise.

The worldwide crypto market lifted 6.32% within the final 24 hours on vital features made by main belongings, information from CoinMarketCap confirmed.

If the rally sustains, the upcoming week will possible see significantly increased inflows into the digital belongings market.