Dogecoin profits decline: Analyzing trends and trader sentiments

- Dogecoin has struggled to get better totally after a fall two weeks in the past.

- The full provide has additional declined as the worth struggles.

Just lately, Dogecoin [DOGE] has skilled a much less favorable worth pattern, resulting in a decline within the variety of tokens in a worthwhile state. Nonetheless, regardless of the downtrend, the spinoff metric signifies purchaser aggression.

Dogecoin revenue declines

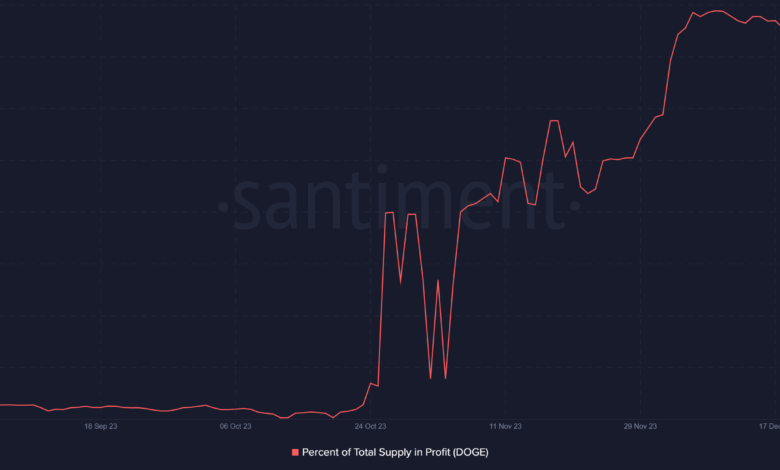

An evaluation of Dogecoin’s provide reveals a decline in revenue at first of the 12 months, following a comparatively secure pattern all through December.

The revenue remained principally fixed, with round 103 billion tokens in revenue. Nonetheless, it dipped to round 79 billion earlier within the 12 months, in accordance with Santiment.

Though there have been efforts to rebound, the quantity couldn’t surpass the 100 billion mark.

At the moment, there’s a slight lower, bringing the rely of DOGE in revenue to round 78 billion as of the most recent replace. Given the present vary, this interprets to a revenue share of round 59% of the whole provide.

DOGE stays rooted within the bear zone

Inspecting the day by day timeframe chart of Dogecoin confirmed a collection of fluctuations between good points and losses since its important decline on twelfth January.

Notably, the losses have outweighed the good points. By the shut of buying and selling on nineteenth January, DOGE was valued at round $0.078, marking a slight enhance of about 0.6%.

On the time of this replace, it sustained a slight revenue of round 0.2%, sustaining the $0.078 worth vary.

The pattern depicted by its brief transferring common (yellow line) signifies a bearish trajectory. The yellow line was positioned above the worth, signaling a much less favorable pattern.

Moreover, the Relative Energy Index (RSI) has remained under the impartial line, struggling to surpass it. As of the most recent information, the RSI line barely touched 40, displaying the prevailing robust bearish pattern.

Dogecoin consumers get extra aggressive

Whereas the general worth traits is probably not notably spectacular, an intriguing growth is clear on the spinoff facet amongst merchants.

Examination of the Coinglass funding fee chart confirmed a constant fee of about 0.01% since round 4th January.

Is your portfolio inexperienced? Take a look at the Dogecoin Revenue Calculator

Nonetheless, on the time of this replace, there was a notable surge within the funding fee, reaching round 0.05%. This uptick suggests an elevated degree of aggression amongst consumers.

Such an escalation typically signifies a wager by merchants anticipating a possible rise in costs.