ETH, Nasdaq correlation grows closer as the altcoin…

- Although the correlation between the standard entity and ETH remained unfavourable, they closed in on one another.

- The altcoin may preserve its latest restoration.

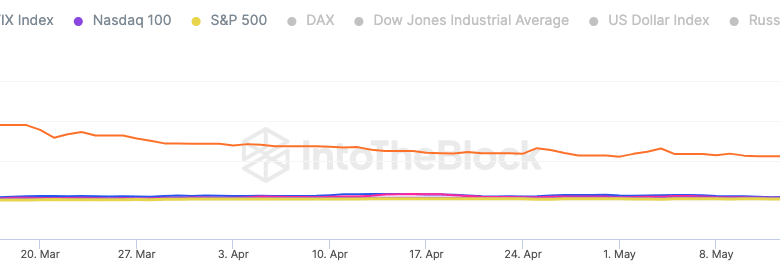

The correlation between Ethereum [ETH] and the Nasdaq composite index continues to exit the distant place they’ve had in latest instances.

With a most worth of 1, the correlation between entities within the crypto sector, and the standard counterpart is decided by assessing the value motion and efficiency over a time period.

How a lot are 1,10,100 ETHs price in the present day?

Two on the identical path

When the correlation coefficient is optimistic, it implies that each property are shifting in a really related course. However a detailed correlation to the unfavourable area signifies that the 2 property are shifting in reverse instructions.

In response to the IntoTheBlock Capital Markets knowledge, ETH’s 90-day correlation coefficient with Nasdaq was -0.25.

Supply: IntoTheBlock

Though unfavourable, the information confirmed that the correlation had improved. Recently, ETH, like Bitcoin [BTC] considerably outperformed the Nasdaq fairness index earlier within the yr.

Whereas the crypto market panorama has modified, the closeness in correspondence might be related to ETH’s latest efficiency which has left his 30-day efficiency in a 0.31% uptick.

Bullseye but?

In the meantime, ETH’s Market Worth to Realized Worth (MVRV) ratio has been capable of get better from its earlier journey into the crimson zone. At press time, the metric was 4.308%.

The MVRV ratio serves as a measure of the undervalued or overvalued state of an asset. It additionally signifies the speed of income gained by holders.

Subsequently, the rise suggested that ETH holders have had some restoration recently, particularly with the three.18% uptick within the final 24 hours.

Supply: Santiment

On the technical facet, the Transferring Common Convergence Divergence (MACD) confirmed that the altcoin might quickly overthrow the dominance of sellers.

On the time of writing, the trend-following momentum indicator revealed that the blue dynamic line had risen above the orange line. A scenario like this infers that patrons had gained command of the jurisdiction.

So, there’s a probability that ETH maintains the bullish streak for a while. When it comes to the Chaikin Cash Move (CMF), the every day chart confirmed that the indicator had elevated to 0.16.

Reasonable or not, right here’s ETH’s market cap in BTC phrases

The indicator makes use of a 21-day interval to measure the volume-weighted common accumulation and distribution.

Because the CMF was optimistic and nearing the closing worth, it instructed that extra accumulation had taken place. Subsequently, there might be extra power backing the ETH uptick.

![Ethereum [ETH] price action](https://statics.ambcrypto.com/wp-content/uploads/2023/05/ETHUSD_2023-05-29_12-54-53.png)

Supply: TradingView