Ethereum clears THIS key hurdle: What’s next for ETH’s price?

- Ethereum’s worth solely moved marginally within the final 24 hours.

- Market indicators hinted that Ethereum’s bull rally would possibly resume quickly.

Ethereum [ETH] efficiently broke above a bullish falling wedge sample a couple of days in the past. Since then, the king of altcoins has been on observe and has earned traders revenue.

If the development lasts, then ETH has an extended option to go.

Ethereum bulls are slowing down

World Of Charts, a preferred crypto analyst, not too long ago posted a tweet highlighting how ETH managed to interrupt out of a falling wedge sample.

The token’s worth has consolidated contained in the sample since March and at last broke out a couple of days in the past. Since then, ETH gave the impression to be heading in the right direction, as its worth elevated by nearly 5%.

Nevertheless, this achieve might simply be the start, because the breakout has the potential to push ETH’s worth by 45%. Nevertheless, the previous couple of hours showcased much less volatility, which considerably paused ETH’s gaining spree.

Based on CoinMarketCap, ETH’s worth solely moved up marginally within the final 24 hours. On the time of writing, ETH was buying and selling at $3,131.77 with a market capitalization of over $376 billion.

To see whether or not this sluggish 24-hour worth motion might result in a worth correction, AMBCrypto checked Ethereum’s on-chain metrics.

Our evaluation of CryptoQuant’s data revealed that ETH’s internet deposit on exchanges was low in comparison with the final seven days’ common.

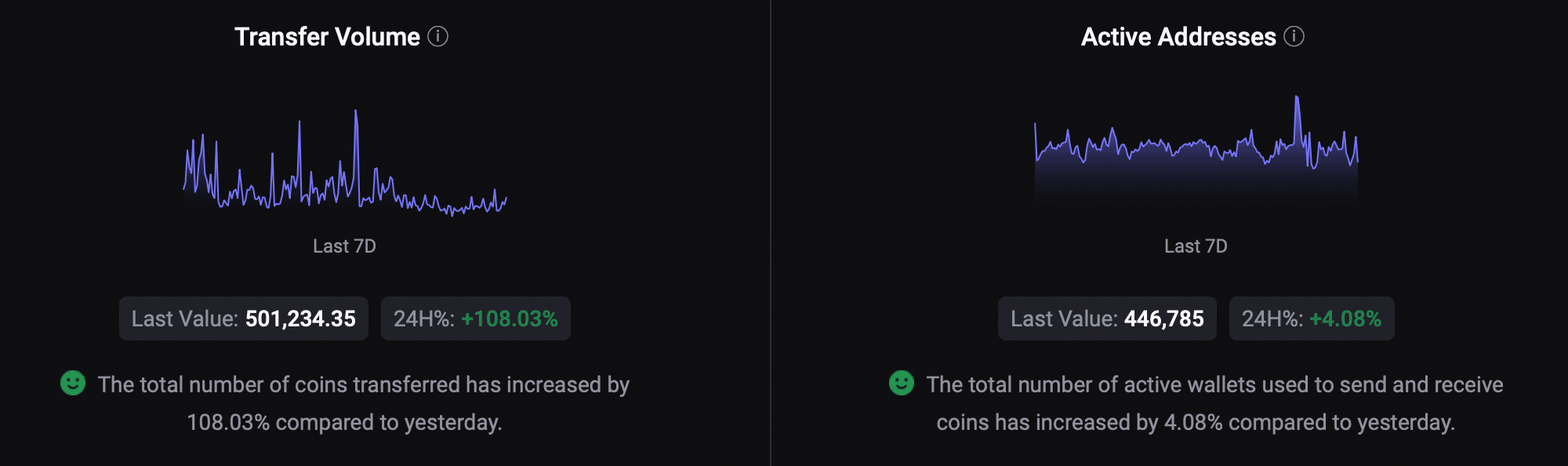

This meant that promoting strain on ETH was low. Moreover, each its Switch Quantity and Lively Addresses remained excessive, which was an optimistic signal.

Supply: CryptoQuant

Troubles nonetheless persist for Ethereum

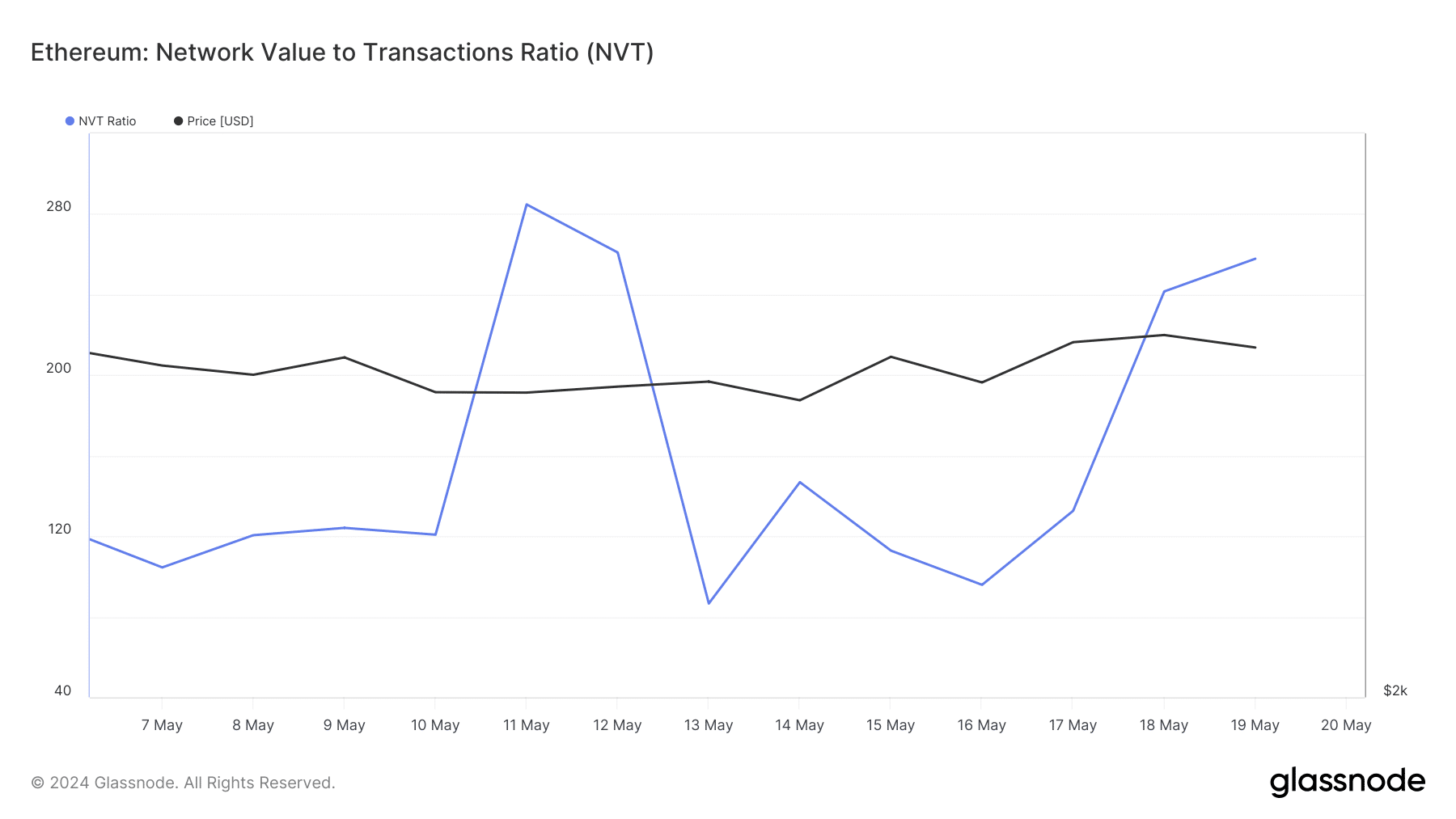

Although the aforementioned metrics appeared promising, a couple of of the others raised considerations. AMBCrypto’s take a look at Glassnode’s knowledge revealed that ETH’s NVT ratio had elevated sharply over the previous couple of days.

For the uninitiated, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity, measured in USD.

An increase within the metric meant that ETH was overvalued, which indicated a doable worth correction quickly.

Supply: Glassnode

Other than this, one other key indicator appeared bearish. Ethereum’s fear and greed index had a worth of 83% at press time, which means that the market was in an “excessive worry” part.

Every time the metric hits such ranges, it means that an asset’s worth has excessive probabilities of dropping.

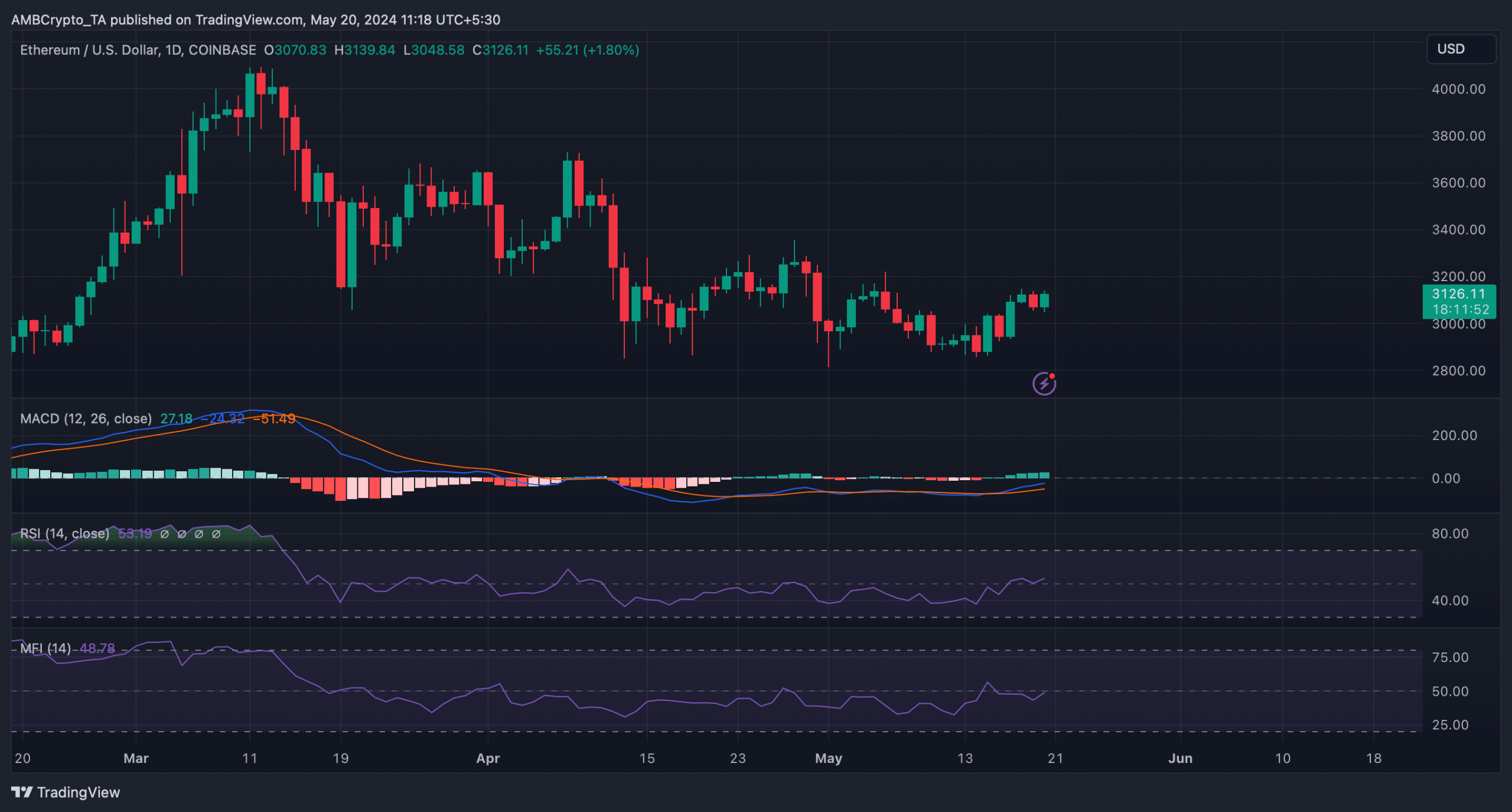

Due to this fact, AMBCrypto deliberate to test ETH’s day by day chart to raised perceive whether or not a worth correction was across the nook.

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

The MACD displayed a bullish crossover. Moreover, ETH’s Relative Power Index (RSI) registered an uptick from the impartial mark. Its Cash Movement Index (MFI) additionally adopted the same development.

These indicated that the probabilities of a serious worth correction had been slim.

Supply: TradingView