Ethereum co-founder cashes out! Is now the time to sell your ETH?

- Ethereum’s worth surged almost 30%, coinciding with vital SEC regulatory updates.

- Co-founder Jeffrey Wilcke capitalized on the rally by depositing over $75 million value of ETH into Kraken.

The cryptocurrency market has been buzzing with Ethereum’s [ETH] latest worth surge.

The asset witnessed an almost 30% improve in worth over the previous week, escalating from beneath $3,000 as of this time final week to as excessive as $3,810 yesterday.

This uptick coincided with vital regulatory actions.

Notably, the U.S. Securities and Trade Fee (SEC) has to date revised its stance on Ethereum spot ETFs, prompting exchanges to replace their 19b-4 filings.

This week, a number of Ethereum ETF issuers submitted their up to date filings, with a call on the VanEck Ethereum ETF software anticipated shortly.

Establishments like Normal Chartered already predicted that an Ethereum ETF approval is imminent.

Amid these regulatory developments, Ethereum’s co-founder Jeffrey Wilcke has made headlines for reportedly cashing out throughout this worth rally.

Detailing the Ethereum co-founder’s transactions

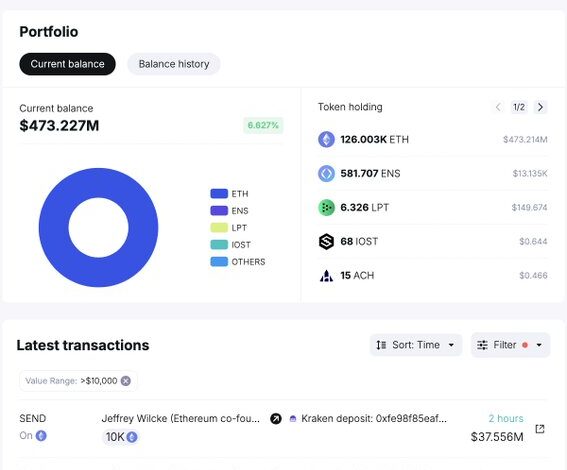

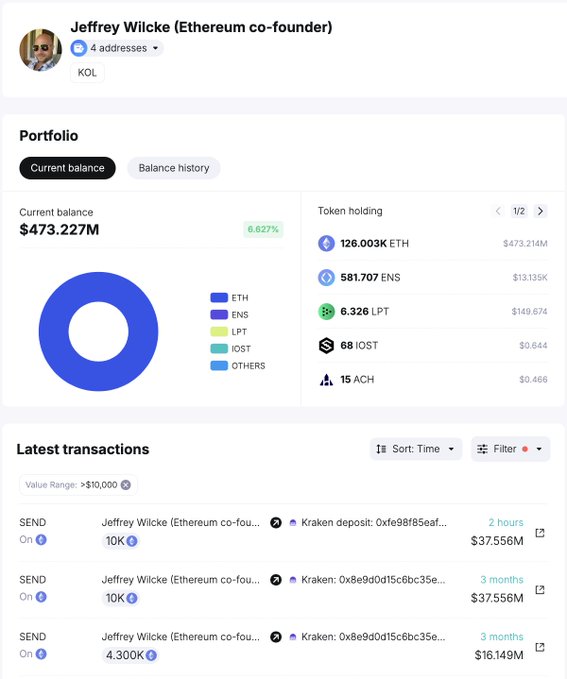

SpotonChain reported that Wilcke transferred roughly 10,000 ETH (value round $37.38 million) to the Kraken change at a price of $3,738 per ETH.

Because the starting of 2024, Wilcke has moved a complete of 24,300 ETH to Kraken, totaling about $75.52 million.

Supply: Spotonchain

These transactions indicated Wilcke’s technique to capitalize on the rising costs, regardless of nonetheless holding a considerable 126,000 ETH, valued at roughly $473 million.

To this point, Ethereum co-founder Jeffrey Wilcke’s latest actions have raised questions on his market technique.

By depositing giant quantities of ETH into the Kraken change, Wilcke seems to be profiting from the value improve.

His deposits began when ETH was priced decrease, and his most up-to-date deposit preceded one other vital worth surge. This timing suggests a calculated method to maximise returns.

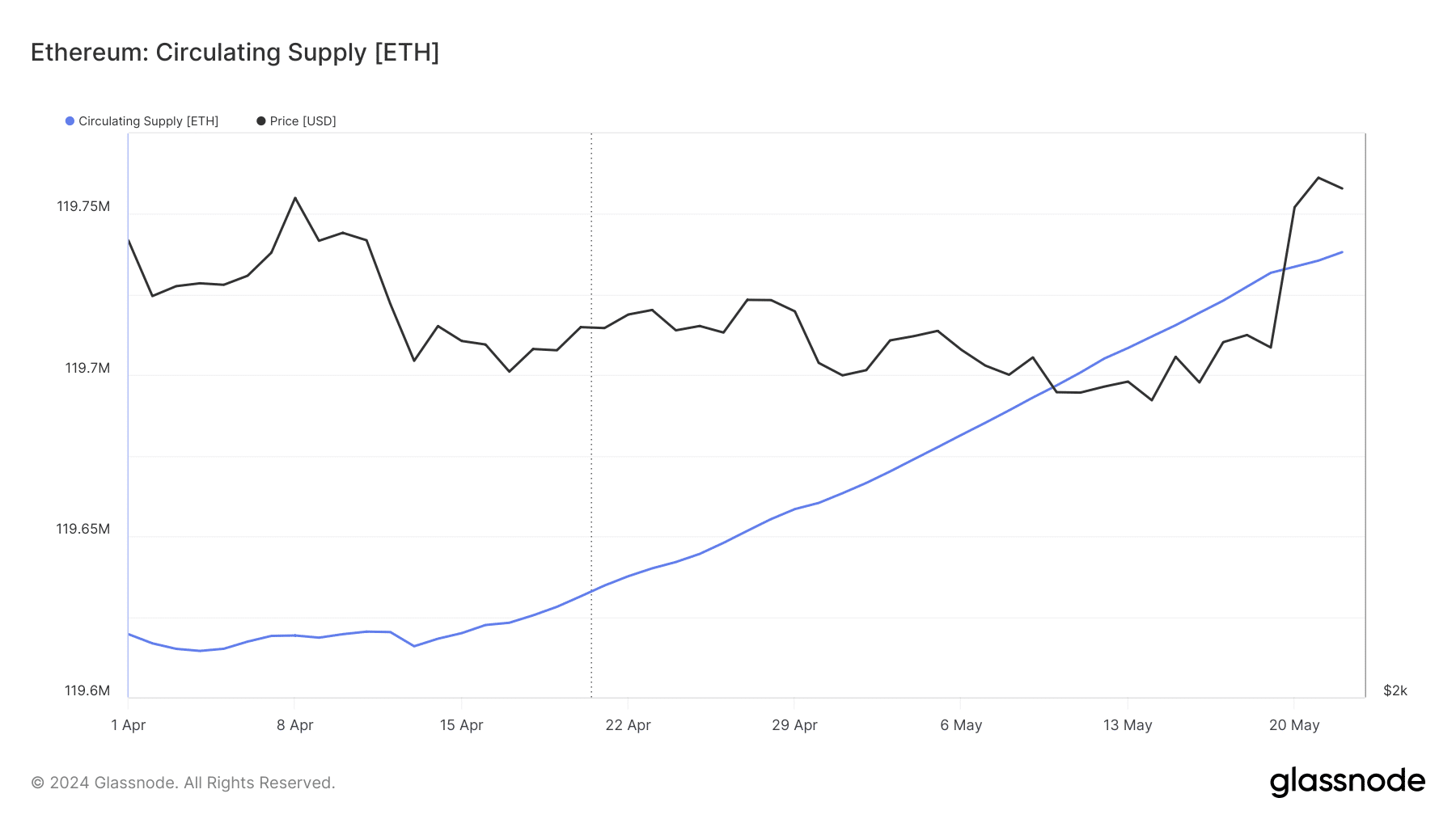

In the meantime, AMBCrypto’s have a look at Glassnode data indicated that the circulating provide of Ethereum has spiked over the previous month. Usually, a rise in provide might strain the value downward.

Supply: Glassnode

Nevertheless, Ethereum’s worth has risen alongside the availability, suggesting that demand has stored tempo with the elevated availability.

This stability is essential for sustaining worth stability and indicated a wholesome market the place new provide is absorbed by rising demand.

Market tendencies and technical evaluation

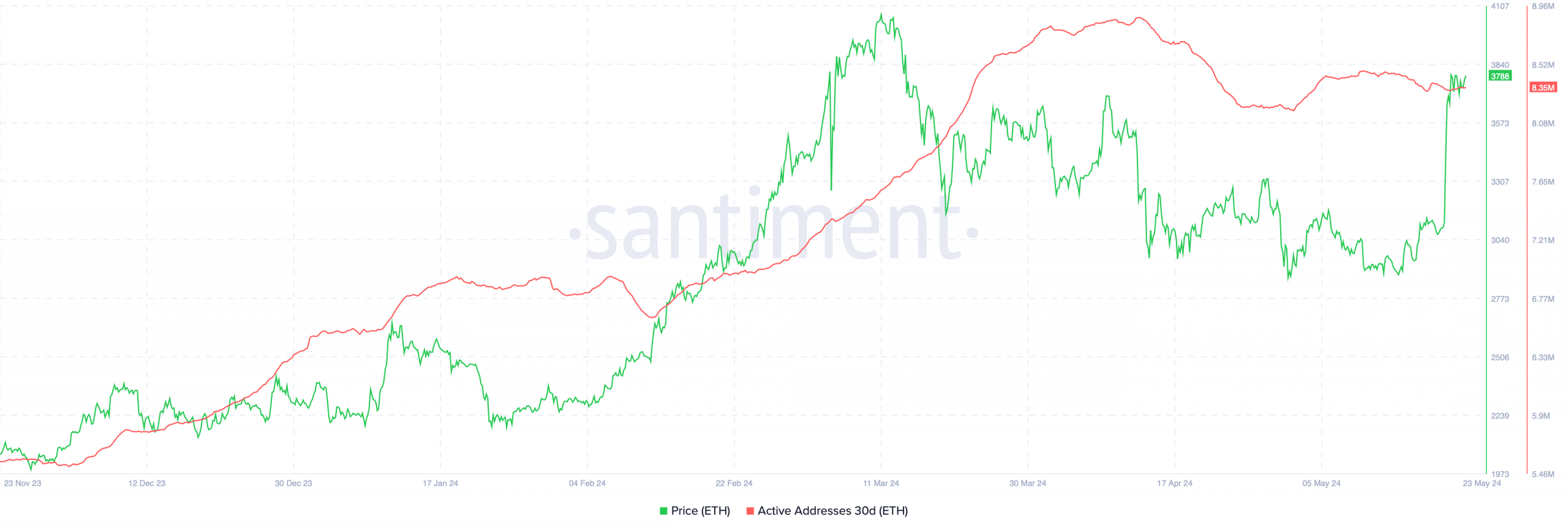

The market dynamics round Ethereum are fairly intriguing, particularly with the elevated circulating provide and energetic addresses.

Santiment data exhibits an increase in Ethereum’s energetic addresses from underneath 8 million in March to just about 9 million in April, though there was a slight retraction to eight.35 million, as of press time.

Supply: Santiment

This fluctuation in energetic addresses is a crucial indicator of demand. If the variety of energetic addresses continues to lower whereas provide rises, Ethereum might face a worth correction from present worth ranges.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

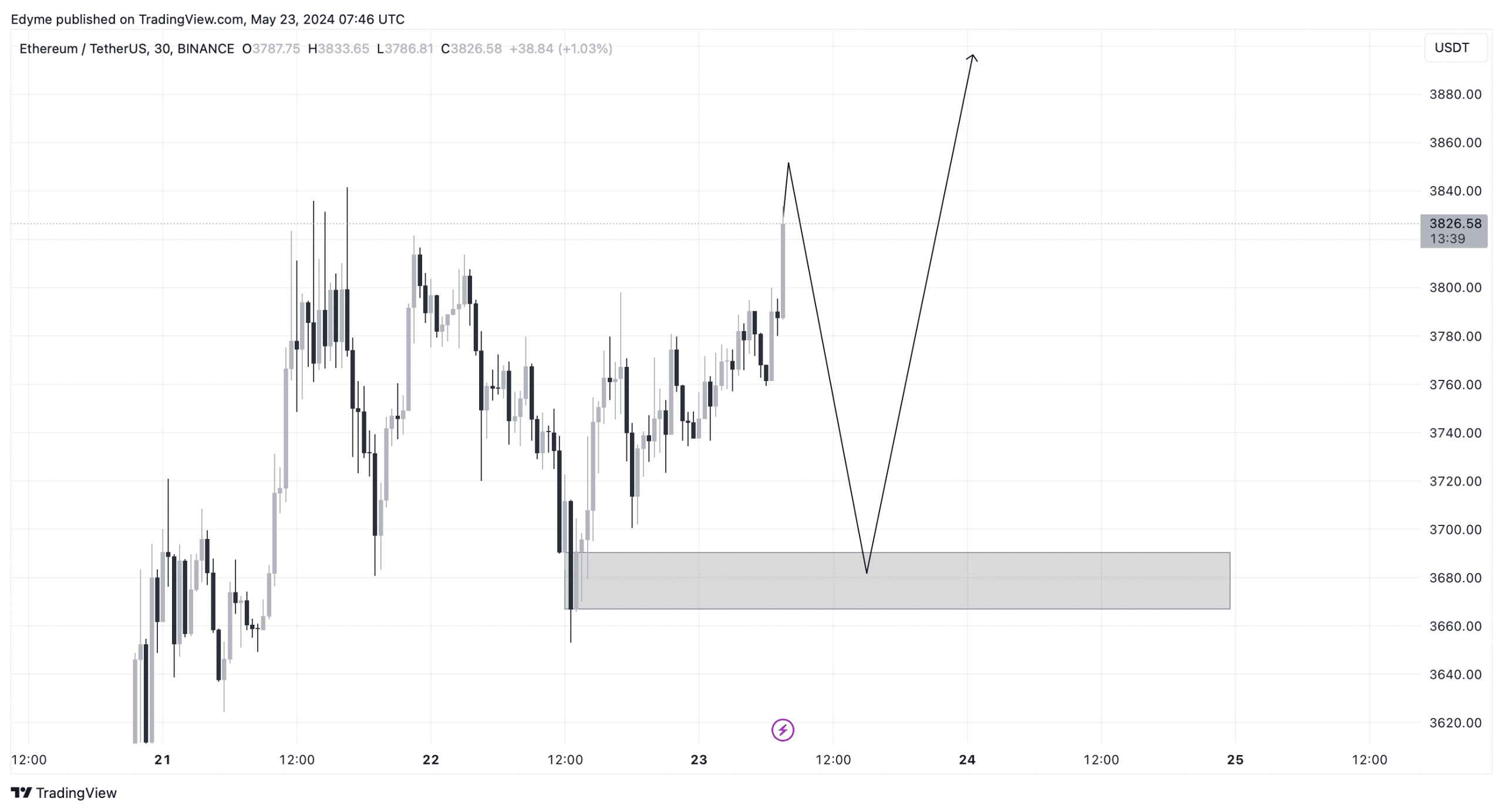

Moreover, technical evaluation of Ethereum’s 30-minute chart revealed a bullish pattern, with a number of breaks of construction to the upside.

Nevertheless, AMBCrypto predicted a possible retracement to round $3,600. This stage is seen as a liquidity zone that would present the gas for Ethereum’s continued upward trajectory.

Supply: TradingView