Ethereum ETF speculations rise: A June debut on the horizon?

- BlackRock leads Ethereum ETF approval by updating Kind S-1, marking vital progress.

- Hashdex and Vanguard have both withdrawn their functions or determined towards launching spot Ether ETFs.

June may see the ultimate approval of Ethereum [ETH] exchange-traded funds (ETFs) as BlackRock turns into the primary to replace a key submitting crucial for launch.

The USA Securities and Change Fee (SEC) issued a directive for numerous establishments considering launching their Ethereum ETFs, to replace their 19b-4 and S-1 filings.

Beforehand, the SEC permitted the rule 19b-4 types for eight Ether ETF functions, together with these from BlackRock (BLK), Constancy (FNF), Grayscale, ARK Make investments, VanEck, Invesco Galaxy, and Franklin Templeton.

BlackRock’s daring transfer

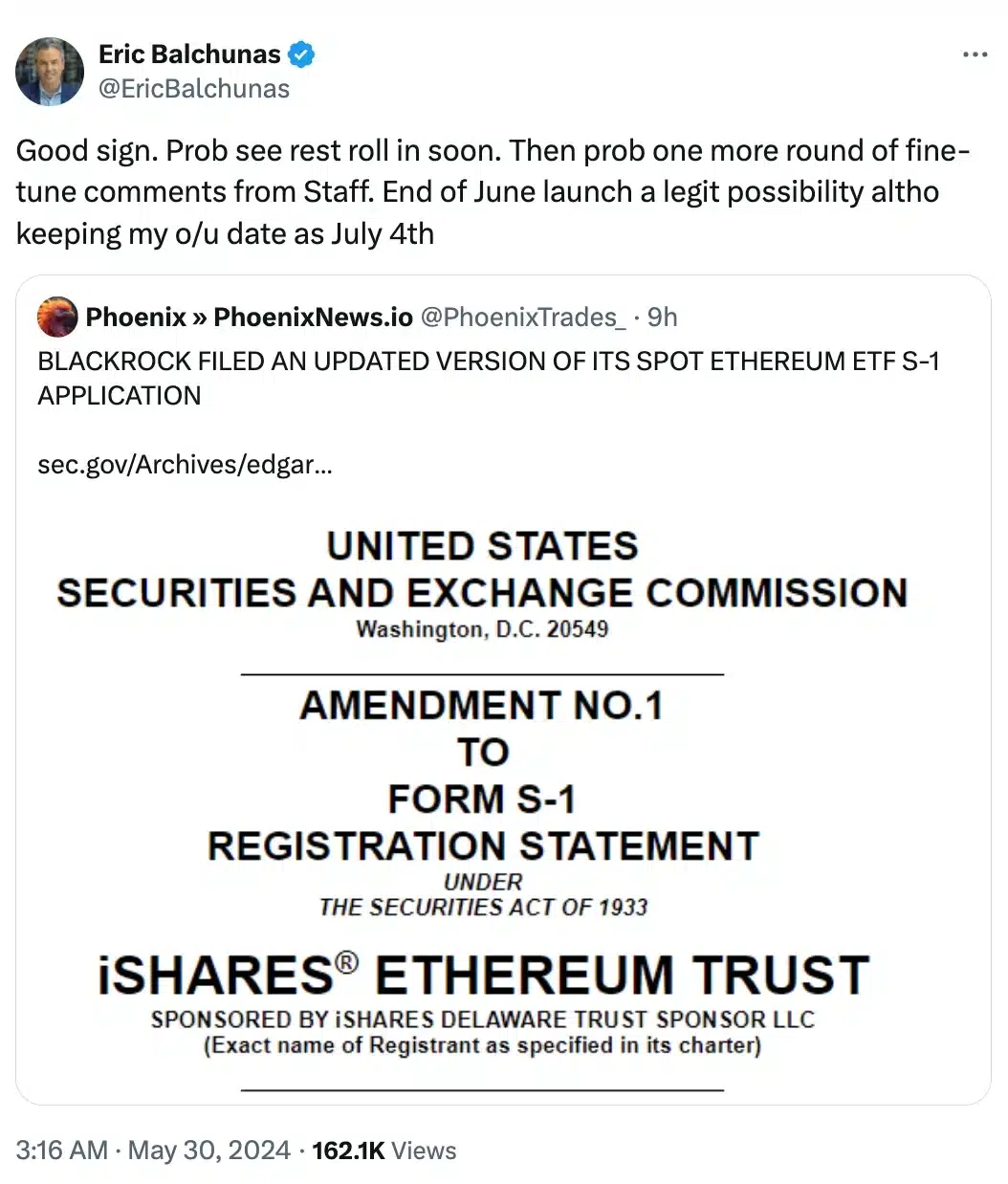

On the twenty ninth of Could, BlackRock finally updated its Form S-1 for its iShares Ethereum Belief (ETHA) with the SEC, practically every week after the regulator permitted its 19b-4 submitting.

Commenting on the identical, Eric Balchunas, Senior ETF analyst at Bloomberg, famous in his latest publish on X,

Supply: Eric Balchunas/X

Including to the fray was James Seyffart, analysis analyst at Bloomberg, who mentioned,

“That is virtually definitely the engagement we had been searching for on the S-1’s following the 19b-4 approvals. Issuers and SEC are working in the direction of spot Ethereum ETF launches.”

Nevertheless, not everybody took a step ahead within the ETH ETF approval course of. Hashdex, one other issuer looking for approval for a spot Ether ETF, withdrew its utility shortly after the SEC’s approval.

An identical sample was noticed with Vanguard, as highlighted by Nate Geraci, President of The ETF Retailer in his newest tweet. He mentioned,

“No shock, however Vanguard will NOT offer spot eth ETFs on its brokerage platform…”

What’s the value state of affairs?

Amid hopes of Ether spot ETF approval, ETH was buying and selling at $3,769, reflecting a 2.45% decline on the time of writing.

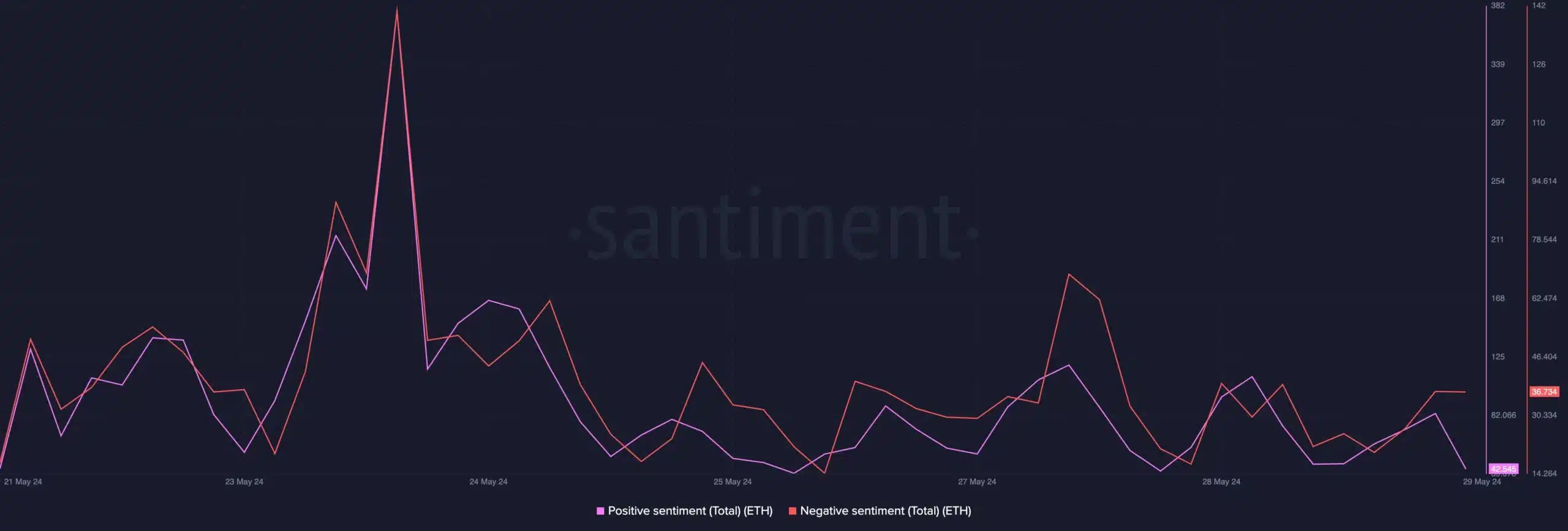

This was additional confirmed by AMBCrypto’s evaluation of Santiment information on investor sentiment. The outcomes indicated that unfavorable sentiment was rising whereas constructive sentiment was reducing.

Supply: Santiment

Optimistic outlook persists

Regardless of prevailing unfavorable sentiments round Ethereum, Jaret Seiberg from TD Cowen’s Washington Analysis Group not too long ago famous,

“This (ETH ETF approval) comes about six months quicker than we anticipated…but this choice was additionally inevitable as soon as the SEC permitted crypto futures ETFs.”

He added,

“The following step could possibly be an ETF with a ‘basket of crypto tokens’.”

Due to this fact, as we await the complete and last approval of the ETH ETF, it will likely be attention-grabbing to look at the shifts in sentiment throughout the SEC, particularly relating to SEC Chair Gary Gensler, who’s recognized for his anti-crypto stance.