Ethereum ETFs get SEC’s thumbs up, but watch out for ETH whales!

- Ethereum ETFs have seen the sunshine of day, but when historical past repeats itself, whales may put bulls in a chokehold.

- Market indicators revealed the present state of ETH’s demand, together with alternate flows.

The twenty third of July is a historic day for the Ethereum [ETH] group. The U.S. Securities and Trade Fee (SEC) has given S1 Ethereum ETFs the greenlight, and they’re set to begin buying and selling.

The market has been captivated with Ethereum ETFs, with specialists anticipating billions of {dollars} to circulate into the ETF within the subsequent 12 months.

Bitcoin [BTC] ETFs have confirmed that there’s heavy demand for the cryptocurrency, and the identical ought to hold true for ETH. Nonetheless, historical past warrants warning earlier than you ape into ETH.

Are Ethereum ETFs a promote the information occasion?

Excessive market pleasure has traditionally supplied a playground for whales to control the market. Such a situation performed out when Bitcoin proper after Bitcoin’s ETFs approvals have been introduced.

Might the identical factor end up true for ETH following the spot ETFs approvals?

In response to Lookonchain, one whale reportedly moved 8,762 ETH to Binance after it was introduced that nine Ethereum ETFs have been accepted at an quantity valued over $30 million.

This prompt that the whales could be making ready to safe some exit liquidity and exit within the short-term.

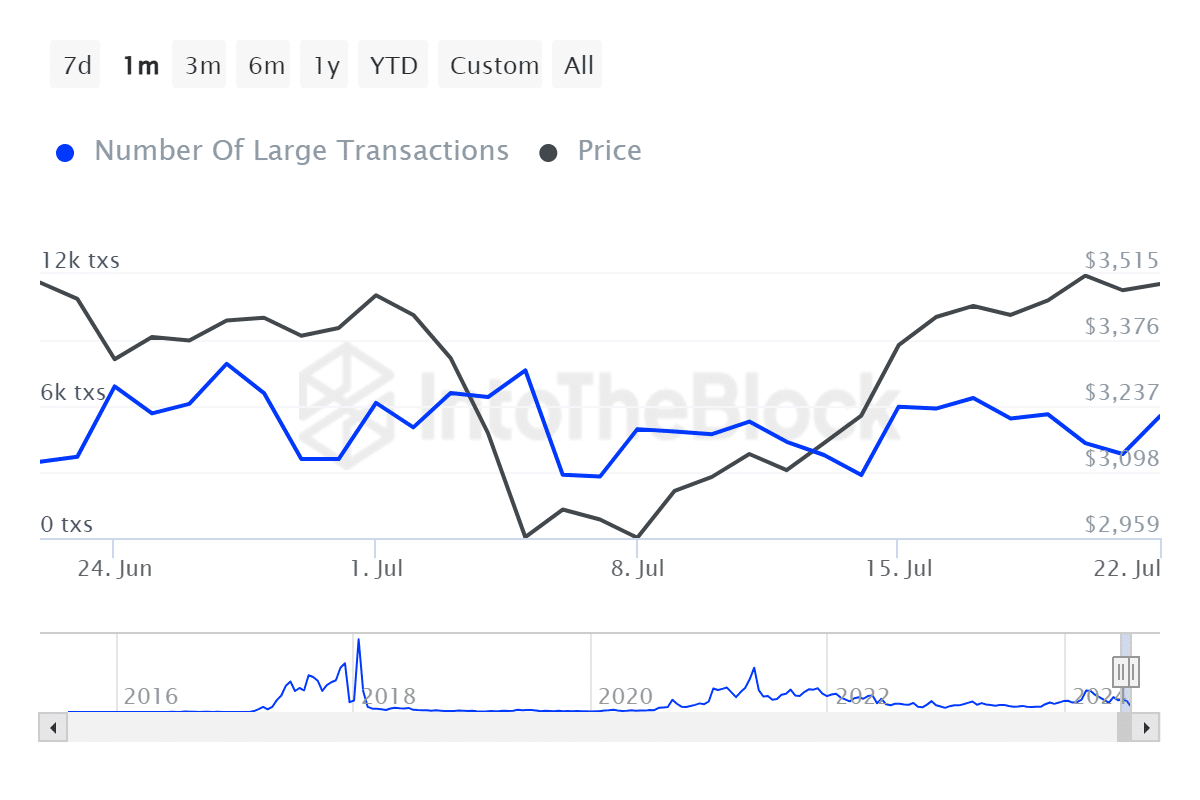

We explored on-chain information to find out the extent of whale participation at the moment available in the market. IntoTheBlock’s variety of massive transaction (addresses holding over $100,000 in worth) revealed a spike.

They bounced from 3,820 transactions to over 5400 transactions from the twenty first of July after beforehand indicating a slight slowdown since mid-July.

Supply: IntoTheBlock

The spike above occurred across the similar time that the Ethereum ETFs information have been making headlines. So, AMBCrypto determined to verify whether or not the whale exercise mirrored promote strain.

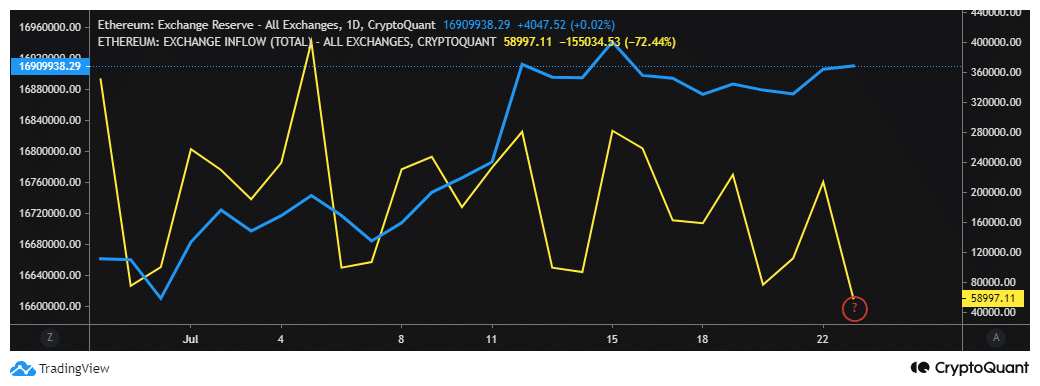

The alternate reserve on CryptoQuant revealed that there was a little bit of an uptick in alternate reserves within the final three days. Nonetheless, alternate inflows slowed down significantly throughout the identical interval.

Supply: CryptoQuant

Are ETH whales cashing out?

The metrics didn’t provide any concrete proof of whale-induced promote strain, not less than within the final three days. Nonetheless, ETH’s alternate reserves registered an uptick.

Doubtlessly signaling ETH promote strain from addresses holding the cryptocurrency on exchanges.

Alternatively, we noticed an alternate inflows slowdown. ETH whales holding the asset of their personal pockets is probably not promoting but.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

In conclusion, it’s nonetheless early on after the announcement. Whales and the market basically should still have time to react.

Historical past dictates {that a} wave of long-liquidations induced promote strain might set off some ETH draw back within the coming days. Nonetheless, issues could be totally different this time, particularly if the general crypto market circumstances align.