Ethereum [ETH] in the spotlight: From Finality halt to recovery attempt, and more

- Ethereum’s Finality pause brought about a decline in lively addresses, however they bounced again quickly after.

- Whereas the outflow pattern has reversed, Ethereum has but to get better totally from its bearish pattern.

The Ethereum [ETH] blockchain encountered a technical hiccup not too way back, resulting in a halt within the finalization of blocks inside the community. Nonetheless, the difficulty was resolved after a while, and the community’s Finality was restored. So, how did numerous key metrics reply to this eventful scenario?

Learn Ethereum’s [ETH] Worth Prediction 2023-24

Ethereum: Finality pause and Inactive Leak set off

Throughout 11 – 12 Could, a major incident occurred on the Ethereum community, involving over 60% of validators ceasing their duties and inflicting a disruption in Finality.

Finality, a vital state, happens when a supermajority of validators (representing two-thirds of the whole stake) attest to the definitive state of the blockchain. This ensures {that a} block and its processed transactions stay unalterable and can’t be faraway from the blockchain.

The second disruption in Finality led to an unprecedented Inactivity Leak, per a current submit from Glassnode. This emergency state was activated to revive Finality on the Beacon Chain.

Each incidents didn’t have an effect on the end-users on the #Ethereum mainnet with transactions being processed as normal. Nonetheless, the second stall in Finality resulted within the first ever Inactivity Leak.

An Inactivity Leak is an emergency state utilized to get better Finality on the Beacon… pic.twitter.com/7xvlH8yVyP

— glassnode (@glassnode) May 14, 2023

In an Inactivity Leak, inactive validators face more and more extreme penalties till they exit the chain or resume their participation. These penalties are subtracted from the affected validators’ beacon chain accounts, successfully burning a portion of their holdings. This results in a lowered issuance of ETH through the inactivity leak.

Ethereum lively addresses bounce again

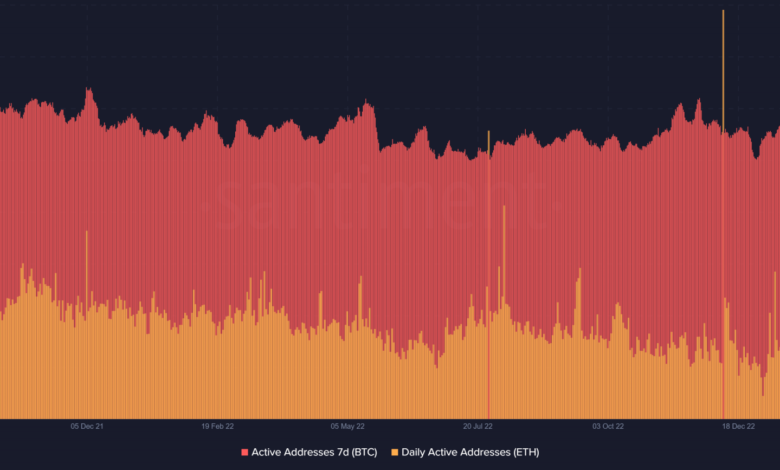

Based on information from Santiment, an evaluation of the seven-day lively tackle metric revealed a noticeable impression from the dearth of Finality on 11 – 12 Could. Throughout these days, the chart displayed a visual decline, with lively addresses dropping to roughly 3.8 million.

Nonetheless, the metric has since recovered; on the time of writing, it stood at slightly over 4 million.

Supply: Santiment

Equally, a better examination of the each day lively tackle metric highlighted a pointy decline on 11 Could, however a subsequent rebound has occurred. As of this writing, there have been 186,000 ETH each day lively addresses, indicating a restoration from the sooner setback.

Unfavourable Netflow as ETH makes an attempt restoration

Based mostly on Netflow information from CryptoQuant, ETH exhibited a pattern of extra outflows earlier than the technical difficulty on the Beacon chain. Apparently, there was an uncommon shift within the sample on 11 – 12 Could, the place inflows dominated the market.

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Nonetheless, the circulation pattern has reversed, and outflows have change into the predominant motion. On the time of writing, the information indicated over 19,000 outflows.

Supply: CryptoQuant

When observing the each day timeframe of ETH, it could possibly be famous that the coin was making strides towards restoration. Buying and selling at round $1,800 at press time, ETH skilled a achieve of over 1.5%. Nonetheless, it had not totally recovered from its bearish pattern, because the Relative Energy Index (RSI) indicated.

Supply: TradingView