Ethereum Funding Rate drops to lowest level in 2024: Impact on ETH?

- ETH noticed its lowest Funding Fee of the 12 months.

- ETH is buying and selling across the $2,300 value degree.

Ethereum [ETH] has seen a notable decline in its by-product market, signaling a possible shift in market sentiment.

Nonetheless, decoding this decline can result in completely different conclusions relying on how different components, such because the spot quantity, carry out.

Ethereum’s Funding Fee declines

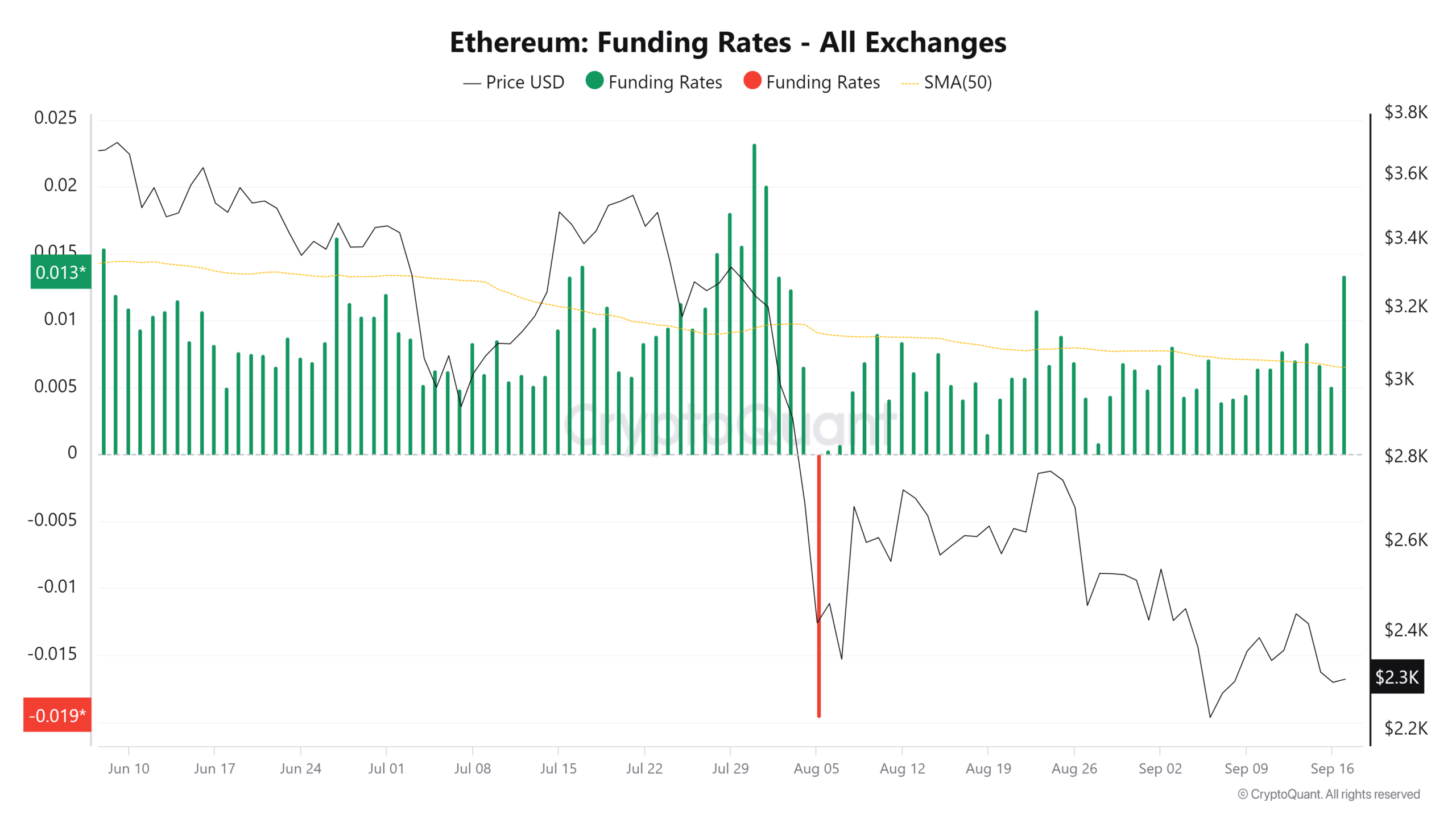

The latest knowledge from CryptoQuant revealed that Ethereum’s Funding Fee hit its lowest level of the 12 months, signaling a pointy decline in shopping for curiosity from by-product merchants.

Funding Fee is a key indicator utilized in Futures markets to measure the price of holding lengthy (purchase) or quick (promote) positions.

A damaging Funding Fee signifies that quick sellers are paying lengthy holders to maintain their positions open, suggesting a bearish sentiment.

ETH’s Funding Fee dropping to its lowest degree this 12 months displays a decline in demand for getting Ethereum on leverage by means of derivatives. This may very well be a bearish signal for the worth within the quick time period.

Supply: CryptoQuant

The decline within the Funding Fee signifies a scarcity of enthusiasm from merchants within the derivatives market, which may additional stress Ethereum’s value.

A possible for Ethereum quick squeeze

With fewer merchants prepared to take lengthy positions, the Ethereum downward development may proceed until spot consumers step in to soak up the promote stress.

Nonetheless, whereas the low Funding Fee suggests a bearish sentiment, it additionally units the stage for a possible quick liquidation cascade. The damaging Funding Fee may shortly reverse if spot consumers enter the market sufficiently.

This forces quick sellers to shut their positions, leading to compelled shopping for (quick squeeze), which might improve the worth.

How ETH’s quantity has trended

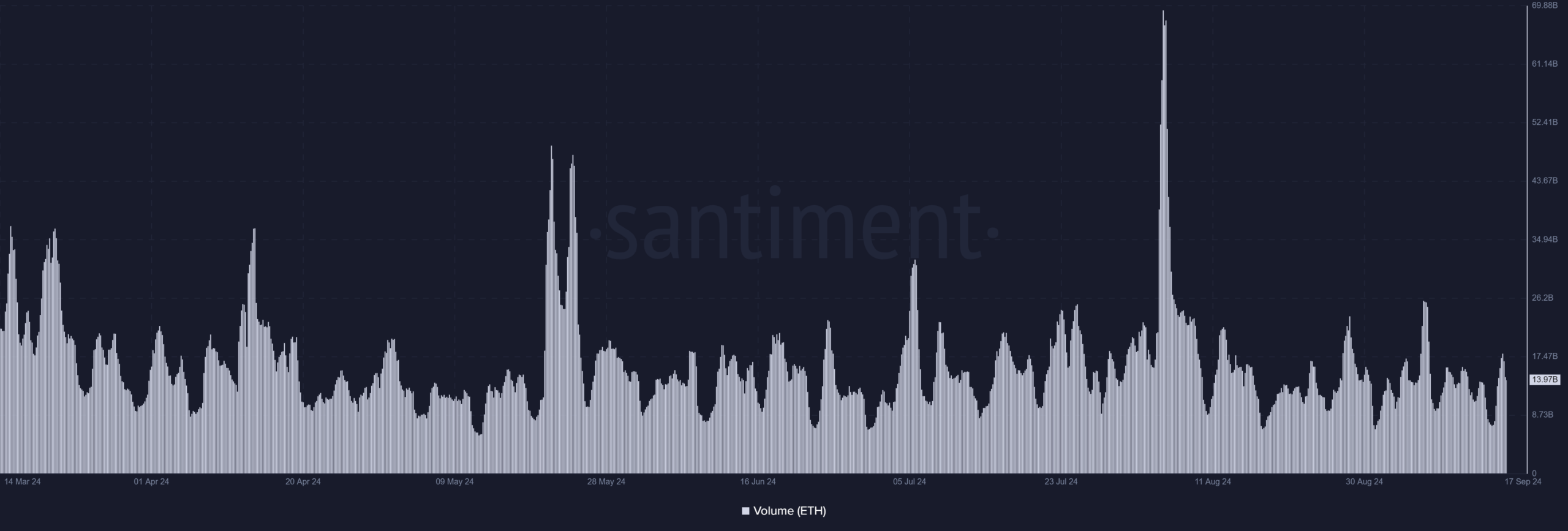

The evaluation of Ethereum’s spot quantity on Santiment confirmed that the present common quantity has held regular at round $14 billion in latest weeks.

This constant quantity is essential for sustaining value stability, particularly as Ethereum’s funding fee has dipped to its lowest degree of the 12 months.

Supply: Santiment

The spot quantity for Ethereum has remained comparatively secure, averaging $14 billion. This constant quantity has doubtless helped ETH keep away from a extra extreme value decline.

That is regardless of the bearish sentiment from derivatives merchants, mirrored within the damaging funding fee.

Moreover, if the spot quantity drops under this $14 billion vary, Ethereum may face elevated downward stress.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

With the Funding Fee already at report lows, a drop in spot quantity would cut back the shopping for curiosity. The shopping for curiosity is required to counterbalance the damaging sentiment within the derivatives market.

The present low Funding Fee indicators that quick positions dominate the derivatives market. If spot quantity declines, there will not be sufficient demand to soak up the promote stress, main to cost declines.