Ethereum Funding Rates Turn Deep Red, What Does It Mean?

Knowledge reveals the Ethereum funding charges have been fairly detrimental in current days. Right here’s what this might imply for the cryptocurrency’s value.

Ethereum Funding Charges Have Been Underneath The Zero Mark Not too long ago

As defined by an analyst in a CryptoQuant post, a brief squeeze could also be a risk for the asset at present. The “funding charge” is an indicator that retains monitor of the periodic charges that merchants on the futures market are exchanging with one another.

When the worth of this metric is constructive, it implies that the lengthy contract holders are paying a premium to the quick holders proper now. Such a pattern implies the longs outweigh the shorts at present, and therefore, a bullish mentality is the dominant drive within the sector.

Then again, detrimental values counsel the vast majority of the futures market customers share a bearish sentiment for the time being because the shorts are those paying a charge.

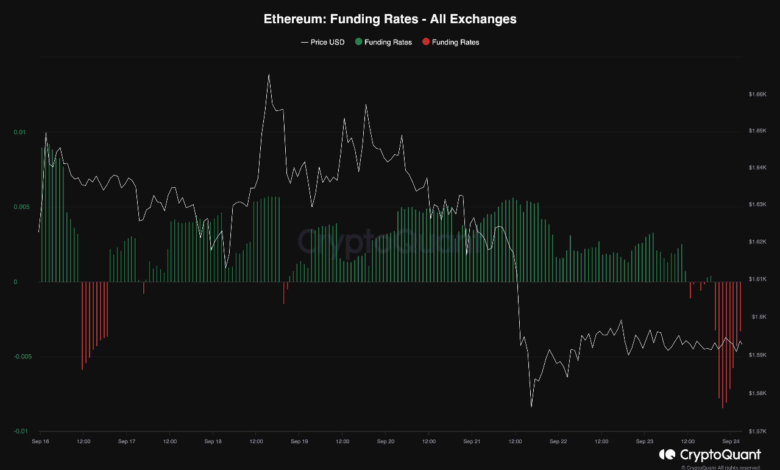

Now, here’s a chart that reveals the pattern within the Ethereum funding charges over the previous week:

Seems to be like the worth of the metric has been fairly detrimental in current days | Supply: CryptoQuant

As displayed within the above graph, the Ethereum funding charges had been constructive till simply a few days again, implying that almost all of the futures merchants had been betting on the asset’s value to go up.

The metric’s worth has plunged to the detrimental zone throughout the previous day or so, nonetheless, suggesting {that a} full flip in mentality has occurred among the many buyers.

This bearish sentiment, although, might not essentially be dangerous for the worth. It is because the extra the mentality has turn out to be skewed in a single route traditionally, the extra possible the worth of the cryptocurrency has turn out to be to point out a pointy transfer in the other way.

One main purpose why this occurs is that mass liquidation occasions, that are popularly referred to as “squeezes,” usually tend to contain the dominant facet of the futures market.

Throughout a squeeze, a sudden swing within the value finally ends up liquidating a considerable amount of contracts directly. Such liquidations solely present gasoline for the worth transfer that triggered them, thus amplifying it additional. This may result in a cascade of extra liquidations.

As shorts have piled up within the Ethereum futures market lately, the likelihood of a brief squeeze occurring could be elevated. Naturally, if such an occasion does happen, the asset’s worth might see a pointy rebound.

This doesn’t essentially must occur, in fact, and if it does, it is probably not quickly. From the chart, it’s seen that the funding charge had remained at notable constructive values for some time earlier than the ETH value lastly registered its plunge.

ETH Value

Ethereum has taken successful of greater than 3% throughout the previous week because the asset’s value is now buying and selling below the $1,600 stage.

ETH has gone down in the previous few days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com