Ethereum Price Recovery In Trouble? Here Are Key Hurdles To Fresh Increase

Ethereum value declined sharply alongside Bitcoin. ETH traded under $2,000, however it’s nonetheless holding the important thing help at $1,920 and would possibly try a contemporary improve.

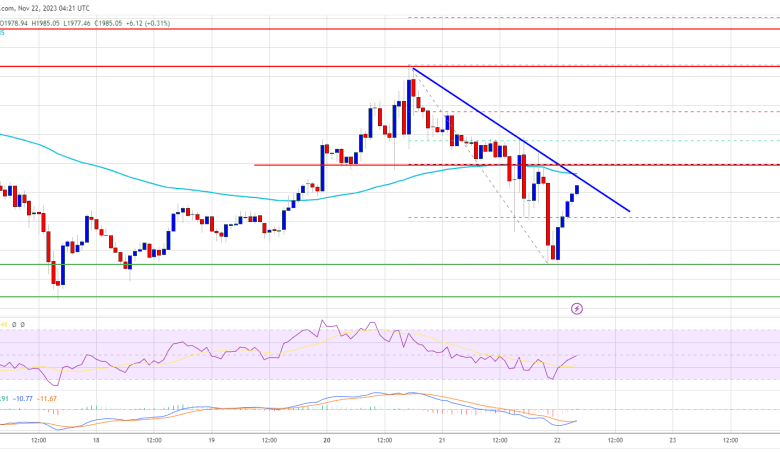

- Ethereum struggled to clear the $2,070 resistance and corrected decrease.

- The value is buying and selling under $2,000 and the 100-hourly Easy Transferring Common.

- There’s a key bearish pattern line forming with resistance close to $1,990 on the hourly chart of ETH/USD (knowledge feed by way of Kraken).

- The pair might begin a contemporary improve if it clears the $2,000 hurdle.

Ethereum Value Eyes Recent Improve

Ethereum value didn’t clear the $2,070 resistance and reacted to the draw back. ETH declined under the $2,000 help zone after experiences of Binance’s settlement, like Bitcoin.

The bears even pushed the worth under the $1,950 help zone and the 100-hourly Easy Transferring Common. Nevertheless, Ether stayed above the $1,920 help zone. A low was shaped close to $1,930 and the worth is now making an attempt a contemporary improve.

Ethereum broke the 23.6% Fib retracement stage of the latest decline from the $2,068 swing excessive to the $1,930 stage. Nevertheless, it’s nonetheless under $2,000 and the 100-hourly Easy Transferring Common.

On the upside, the worth is dealing with resistance close to the $1,990 zone. There may be additionally a key bearish pattern line forming with resistance close to $1,990 on the hourly chart of ETH/USD. The primary key resistance is close to the $2,000 stage or the 50% Fib retracement stage of the latest decline from the $2,068 swing excessive to the $1,930 stage.

Supply: ETHUSD on TradingView.com

A transparent transfer above the $2,000 stage might spark bullish strikes. The subsequent resistance is close to $2,070, above which the worth might intention for a transfer towards the $2,120 stage. Any extra features might begin a wave towards the $2,200 stage.

Extra Losses in ETH?

If Ethereum fails to clear the $2,000 resistance, it might begin a contemporary decline. Preliminary help on the draw back is close to the $1,950 stage.

The subsequent key help is $1,930 or $1,920. The principle help continues to be close to $1,905. A draw back break under the $1,905 help would possibly set off extra losses. Within the acknowledged case, Ether might drop towards the $1,820 help zone within the close to time period.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is dropping momentum within the bearish zone.

Hourly RSI – The RSI for ETH/USD is now close to the 50 stage.

Main Help Degree – $1,930

Main Resistance Degree – $2,000