Ethereum holders, watch out for THIS as over 45,000 ETH flood exchanges

- Over 45,000 ETH had been deposited to exchanges on eighth April

- ETH has fallen by over 1%.

Ethereum [ETH] skilled a value rise on the finish of buying and selling on eighth April. This surge in value coincided with a rise in trade influx as Alameda seized the chance to capitalize on its holdings.

Alameda dumps extra Ethereum

Latest knowledge tracked by Spot on Chain revealed that Alameda Analysis of FTX deposited Ethereum to the Coinbase trade. The info indicated that Alameda deposited 4,000 ETH, valued at round $14.7 million when ETH was buying and selling at roughly $3,688.

This accretion marked the primary important transfer by Alameda since February, coinciding with a rally in ETH costs.

FTX and Alameda have deposited over 21,000 ETH, amounting to greater than $72 million. Alameda’s latest transfer mirrors the sample noticed out there on eighth February, characterised by a major inflow of ETH into exchanges.

Merchants reap the benefits of the Ethereum rally

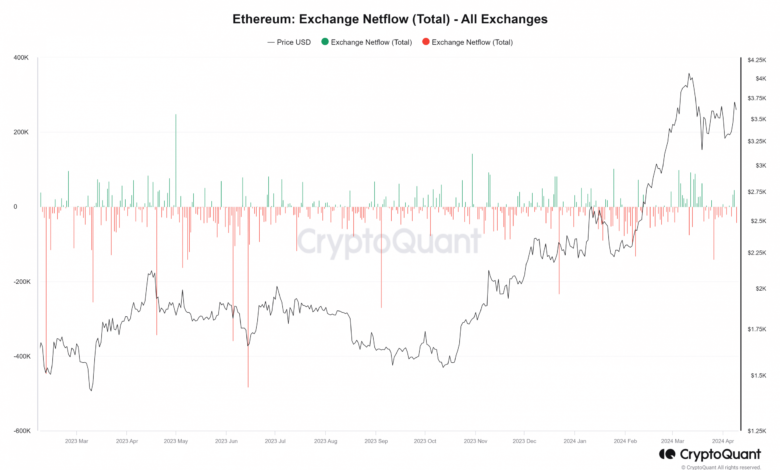

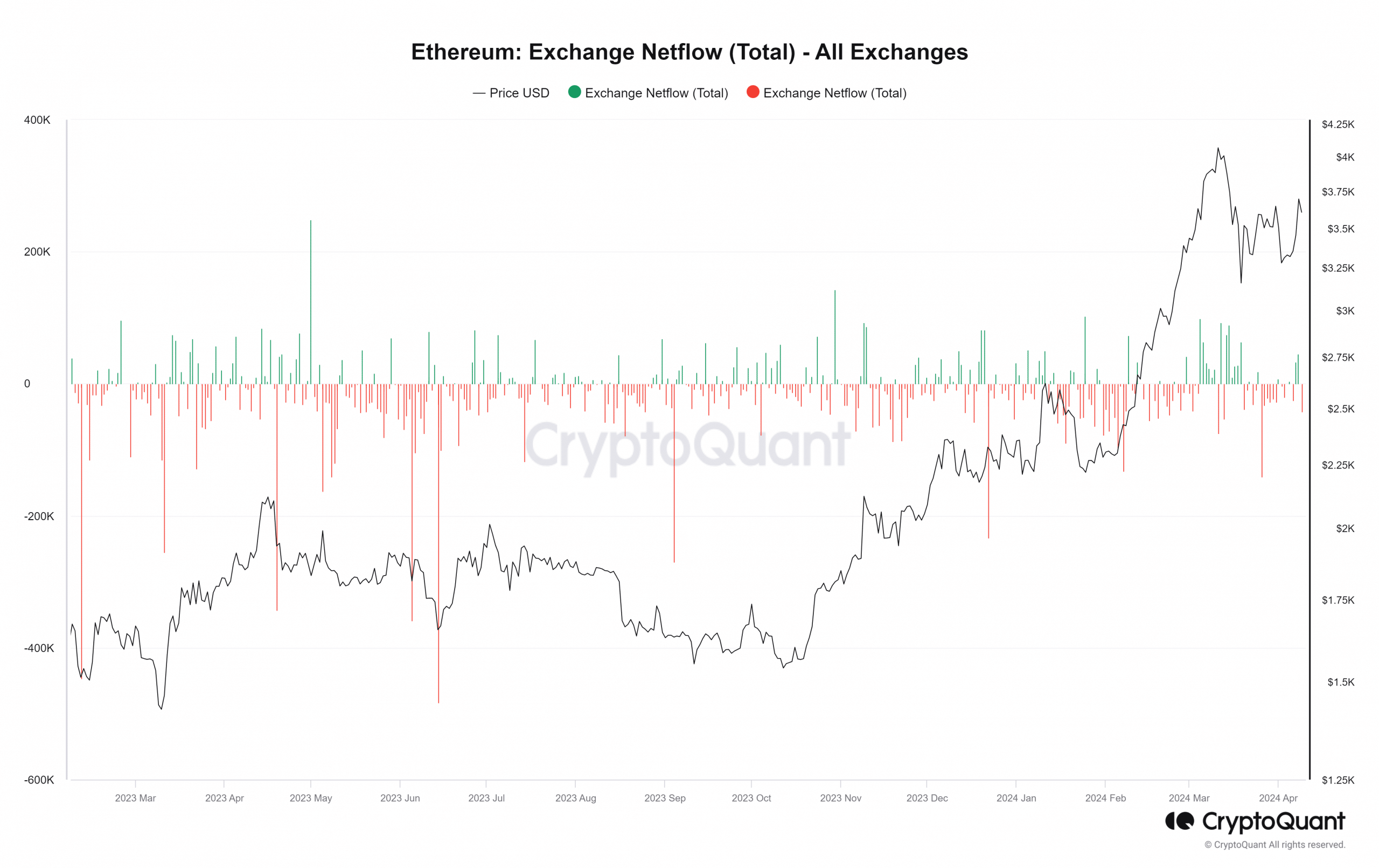

The Alternate Netflow knowledge evaluation revealed that Ethereum skilled its highest trade circulation for the month on eighth April. Furthermore, the evaluation indicated that ETH influx predominated the circulation, indicating that extra merchants had been depositing their holdings onto exchanges.

The chart displayed over 45,000 ETH deposited into these exchanges on eighth April, suggesting that, like Alameda, different merchants took benefit of the ETH value rally.

Supply: CryptoQuant

Nevertheless, there was a reversal within the circulation on the time of writing, with extra outflow recorded. Over 35,000 ETH have been withdrawn from exchanges so far. This motion could possibly be attributed to the slight pullback in ETH’s value on the time of writing.

ETH sees 1% decline

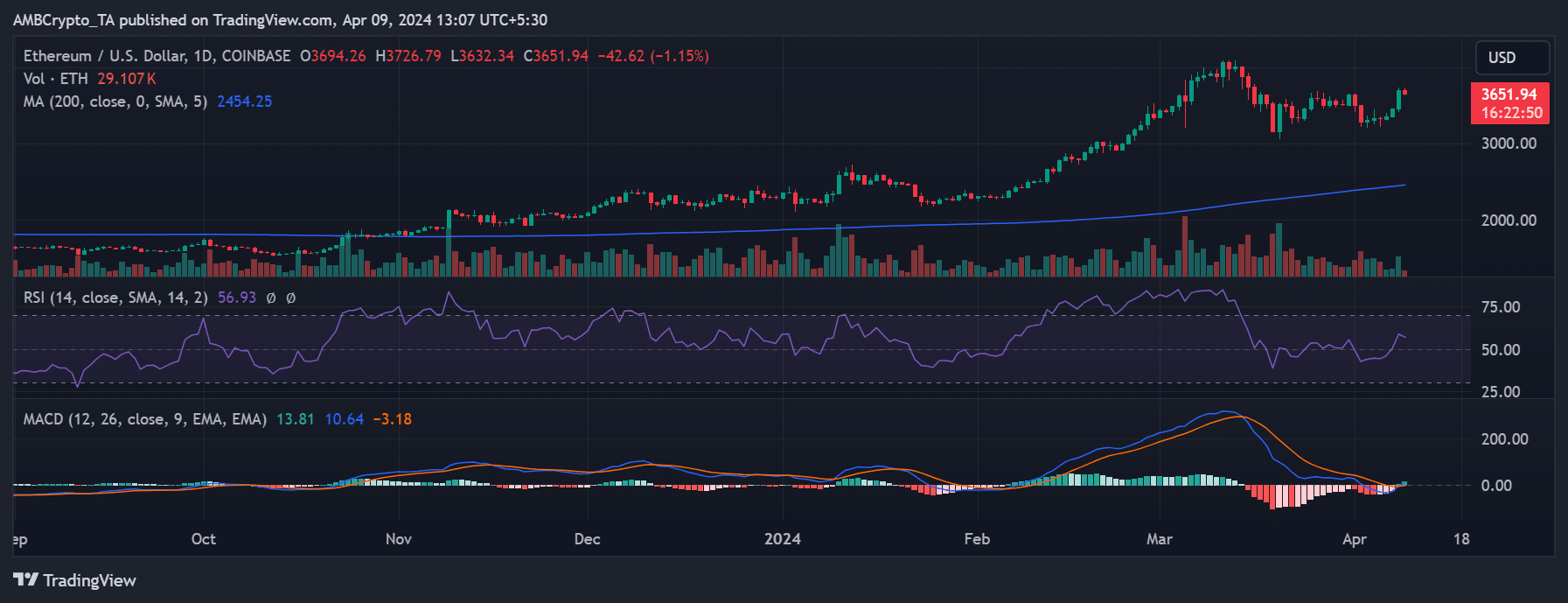

On eighth April, Ethereum witnessed a major surge, marking its largest improve in a while. Evaluation of the each day timeframe chart revealed an almost 7% rise, with ETH closing at roughly $3,694.

Concurrently, the quantity chart depicted a considerable improve in ETH quantity, exceeding $19 billion as its value surged.

Supply: Buying and selling View

On the time of writing, ETH’s value had skilled a slight decline of over 1%, but it remained throughout the $3,600 area.

Learn Ethereum (ETH) Value Prediction 2024-25

Regardless of this decline, Ethereum maintained its present bull development, as indicated by its Relative Energy Index.

Moreover, evaluation of its quantity indicated an uptick. On the time of this writing, the quantity was over $20 billion, reflecting ongoing market exercise and investor curiosity in Ethereum.