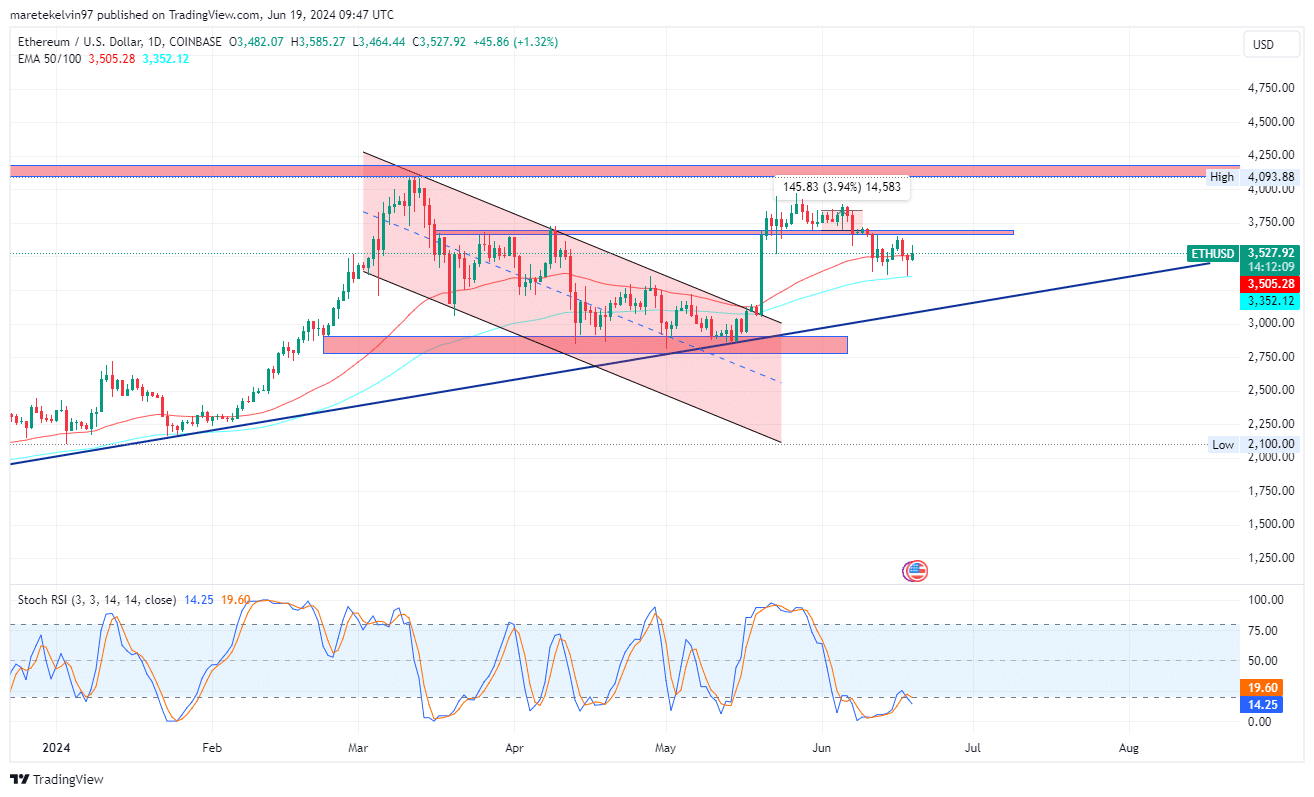

Ethereum price analysis: ETH targets $3,700 resistance after recovery

- Ethereum’s worth surged by 6% from its weekly low of $3,381.

- Metrics point out a possible worth reversal.

In an distinctive turnaround, the king of altcoins has witnessed a big worth restoration from its weekly low of $3,381.

In accordance with the information from the highest platforms, Ethereum’s [ETH] upswing might be attributed to whale actions.

Ethereum worth was up by 14% within the final 30 days. Ethereum was buying and selling at a mean worth of $3,527, at press time. Its 24 hour buying and selling quantity stood at round $19.5 billion, with a market cap of $433 billion.

Ethereum has surged by 6% since retesting a 50-day exponential shifting common resistance degree. The following worth goal stays at across the $3700 resistance degree if the bulls accumulate extra momentum.

Supply: TradingView

The stochastic RSI signifies an oversold zone that would sign a possible worth reversal to the bullish aspect.

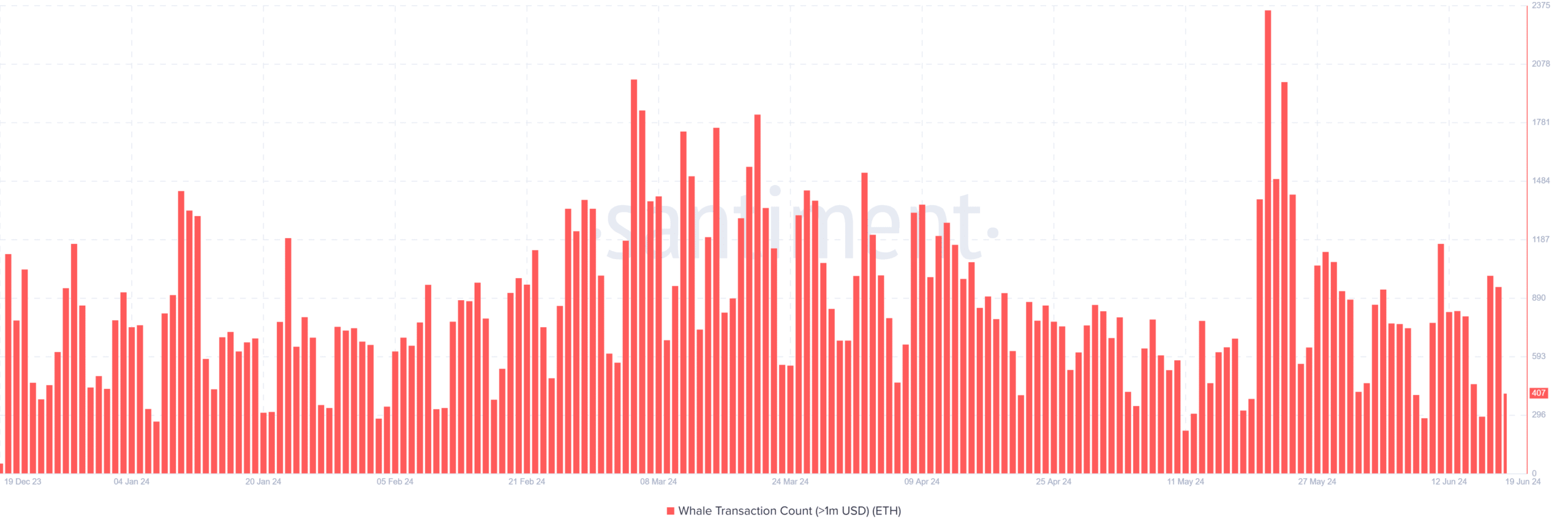

Whale transactions gasoline worth momentum

In accordance with santiment’s knowledge, the variety of whale actions involving ethereum has spiked in latest days. The variety of whale transactions soared to over 1400 on 18th June.

This heightened rise within the whale transaction coincides with Ethereum’s latest worth surges. This implies that buyers have been actively accumulating ETH through the latest dip.

The whales’ lengthy positions could trigger ETH to surge if the bullish stress continues.

Supply: Santiment

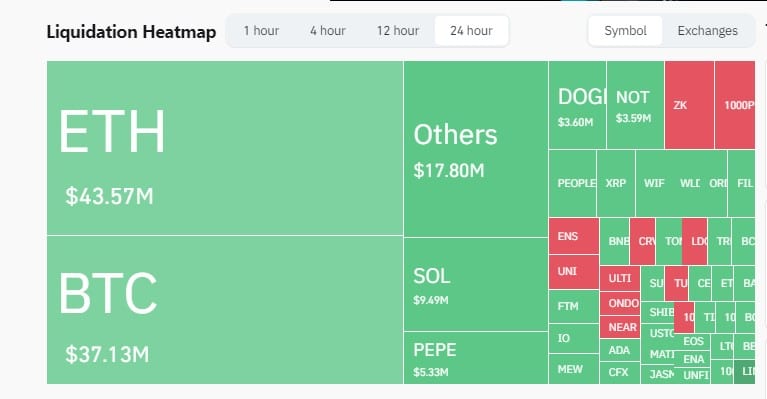

Liquidation heats up however Ethereum stays robust

Coinglass’s liquidation heatmap knowledge additional signifies Ethereum’s resilience.

Regardless of the liquidations throughout the cryptocurrency market, ETH whales managed to carry a big $43.57 million value of lengthy positions within the final 24 hours.

This whale’s commitments additional point out confidence amongst Ethereum’s long run prospects.

Supply: Coinglass

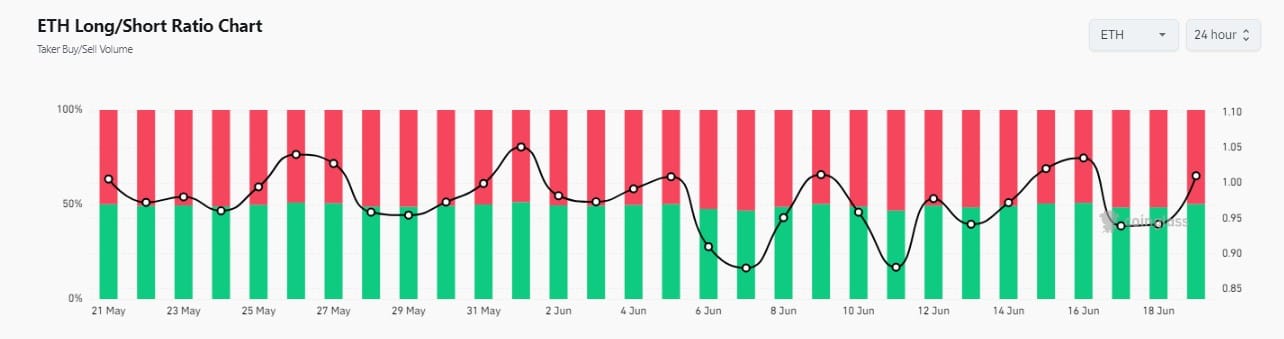

The long-short ratio knowledge reveal that there was a stagnation within the lengthy positions-indicated by a flattened curve. Nevertheless, there was a spike within the knowledge, indicating that the lengthy positions are presently answerable for the market.

Supply: Coinglass

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

What subsequent for ETH?

With elevated whale exercise and investor resilience, Ethereum’s latest bullish momentum is prone to be maintained.

The market sentiments point out that lengthy buyers outweigh brief place merchants, which may sign a worth surge within the close to future. Nevertheless, the bearish rally may proceed.