Ethereum price analysis: Strong outflows, MACD hint at a move to…

- Ethereum’s value resilience and key resistance ranges recommend potential for an imminent breakout.

- Robust outflows, constructive MACD, and dominant lengthy positions point out a supportive bullish setup.

Ethereum [ETH] has as soon as once more captured consideration because it data a considerable each day internet outflow exceeding 25 million, main all different blockchains in capital motion. Such a large-scale shift might sign profit-taking or strategic repositioning by main traders.

With ETH buying and selling at $2,618.54, up by 3.32% at press time, this development raises the query: might these outflows consolidate liquidity and gasoline a brand new bullish surge? Let’s break down the technicals and market indicators behind Ethereum’s present value dynamics.

ETH value evaluation: Constructing as much as a breakout?

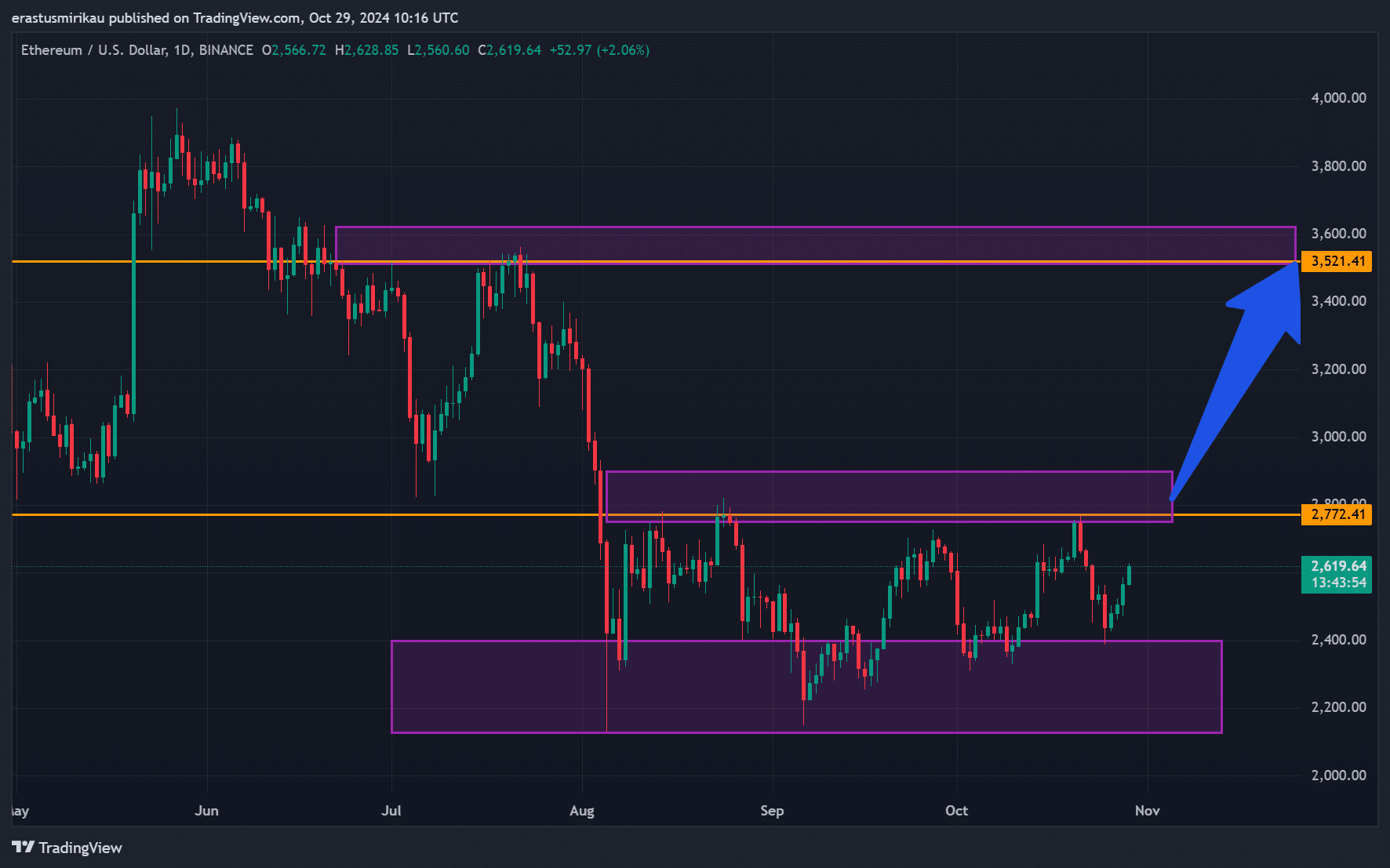

Ethereum’s latest value actions recommend {that a} breakout is perhaps within the works. ETH has maintained power above $2,500, a key psychological assist, regardless of market fluctuations.

This stage has confirmed resilient and will act as a launchpad for a stronger upward thrust.

Wanting forward, $2,772 stands because the instant resistance stage, whereas $3,521.41 represents a extra important barrier that would both verify or halt bullish momentum.

If Ethereum efficiently clears these ranges, we might witness a pointy rally. Nonetheless, if resistance holds agency, ETH would possibly enter a consolidation section, awaiting a decisive catalyst.

Supply: TradingView

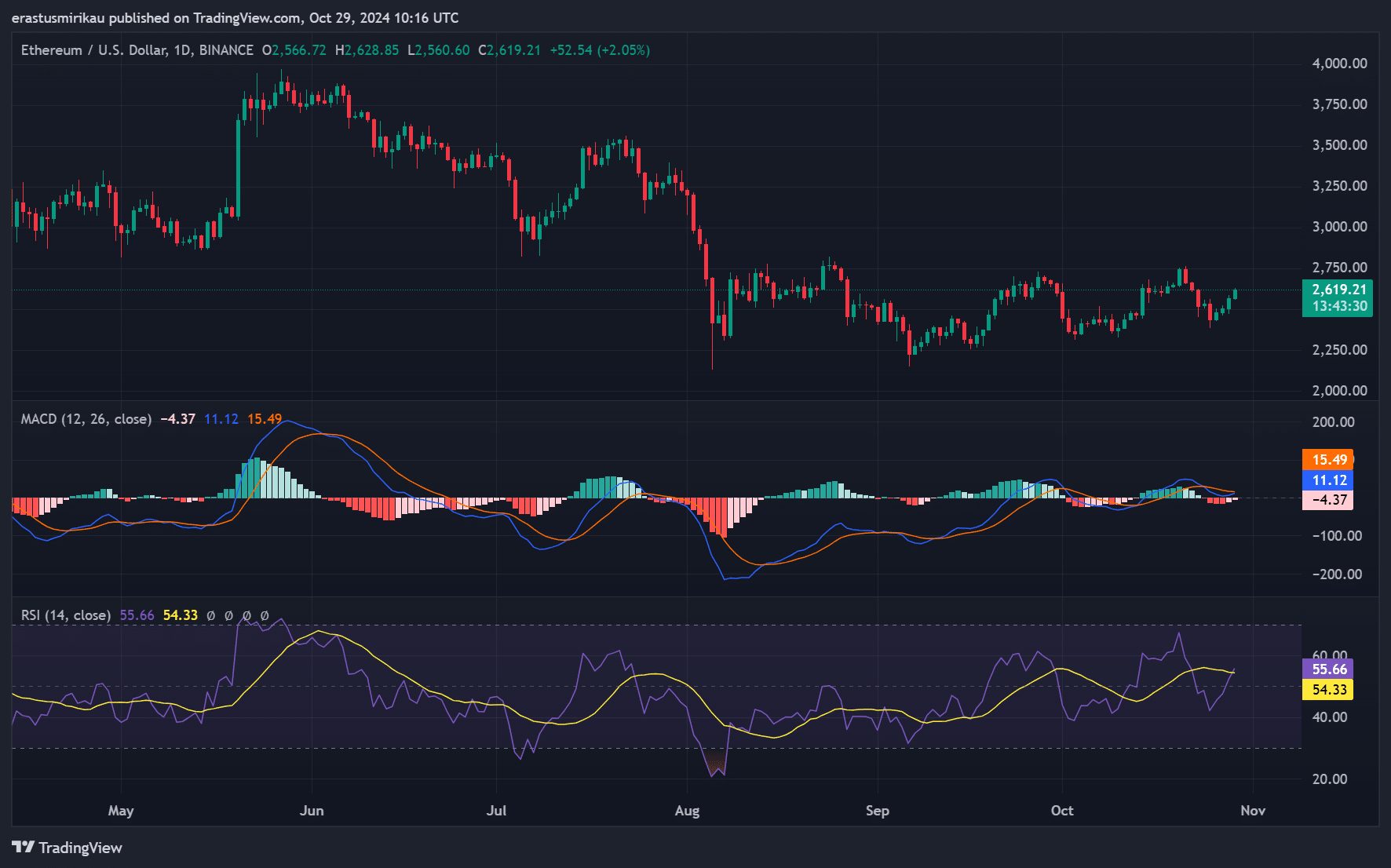

MACD and RSI point out strengthening momentum

Ethereum’s technical indicators additional emphasize its potential for an upward transfer. The Transferring Common Convergence Divergence (MACD) indicator is displaying bullish indicators, because the MACD line has crossed above the sign line, usually seen as a precursor to constructive value motion.

Moreover, the Relative Power Index (RSI) is at the moment round 54.33, a reasonably bullish stage.

Due to this fact, Ethereum has appreciable room for upward momentum earlier than it approaches overbought circumstances, signaling that patrons might nonetheless drive costs increased within the close to time period.

Supply: TradingView

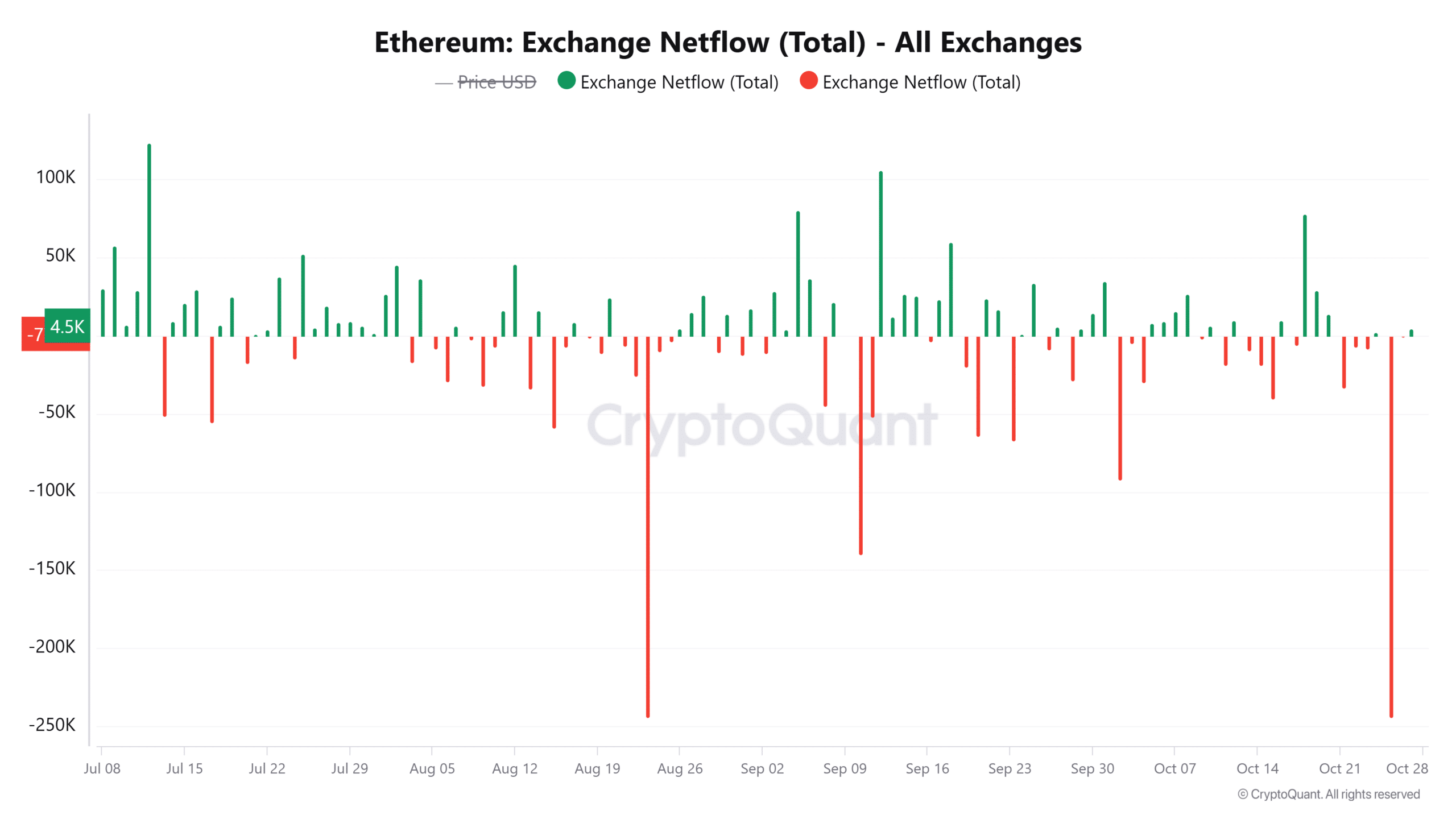

Main outflows from exchanges: An indication of bullish sentiment?

Ethereum’s alternate netflow knowledge reveals a big outflow of 4.5K ETH over the previous 24 hours, marking a 3.03% decline in obtainable alternate liquidity.

Consequently, when giant quantities of ETH transfer off exchanges, it usually means that traders are selecting to carry their belongings long-term or stake them elsewhere, decreasing instant promote stress.

Supply: CryptoQuant

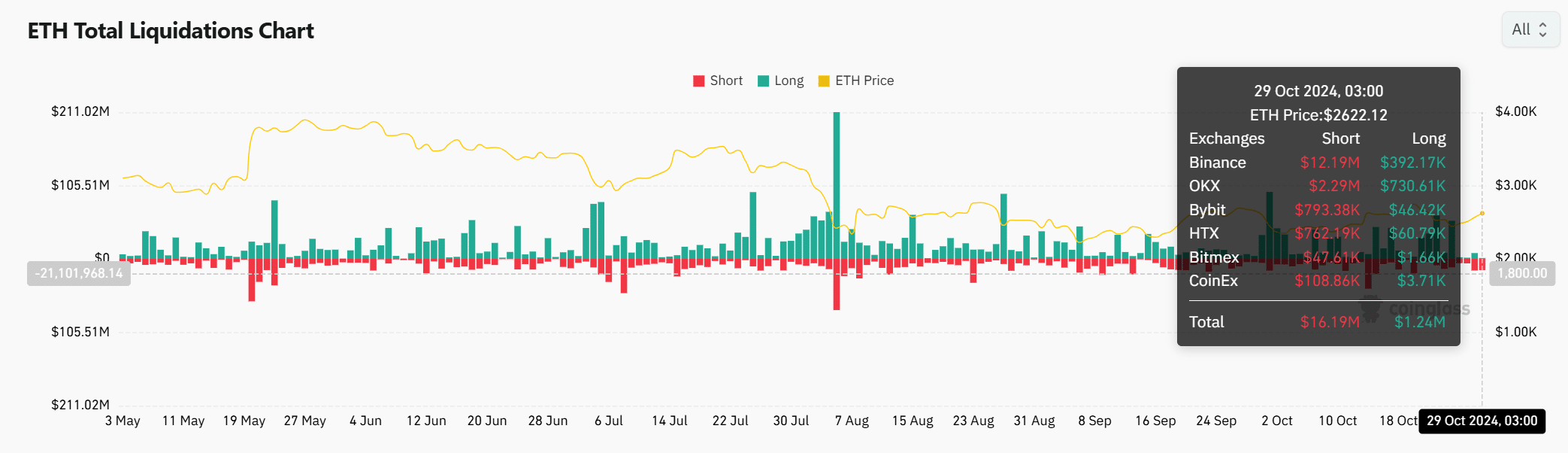

ETH liquidation knowledge highlights dominance of longs

Ethereum’s liquidation knowledge helps a bullish narrative. Nearly all of liquidations are on brief positions, whereas lengthy positions dominate the scene. This development signifies confidence amongst merchants in Ethereum’s upward potential, as lengthy holders anticipate continued positive factors.

Consequently, this confidence amongst lengthy positions might add additional upward stress, offering the assist wanted for a sustained rally.

Supply: Coinglass

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Ethereum’s appreciable outflows from exchanges, at the side of its supportive technical indicators, trace at a possible bullish continuation.

Breaking key resistance ranges could possibly be the ultimate set off for a robust rally. Ethereum seems well-positioned for a surge as liquidity consolidates, making the approaching days essential for ETH’s value motion.