Ethereum retail sentiment hits rock bottom – Is a breakout rally brewing?

- The U.S. authorities joins institutional traders in promoting ETH in massive portions, including downward strain to the value.

- Retailers additionally be a part of the wave, however this ETH faces the potential of a steeper market loss.

Ethereum [ETH]traders are starting to face the bearish wave of the market as large sell-offs are recorded throughout the board.

Within the final 24 hours alone, the asset has dropped 5.75%, with the potential of falling even decrease.

AMBCrypto’s evaluation reveals {that a} historic development supporting an ETH bounce again after a sell-off now not exists. If market members throughout the board proceed to promote, losses will intensify.

U.S. authorities sells massively, ETH defies previous catalysts

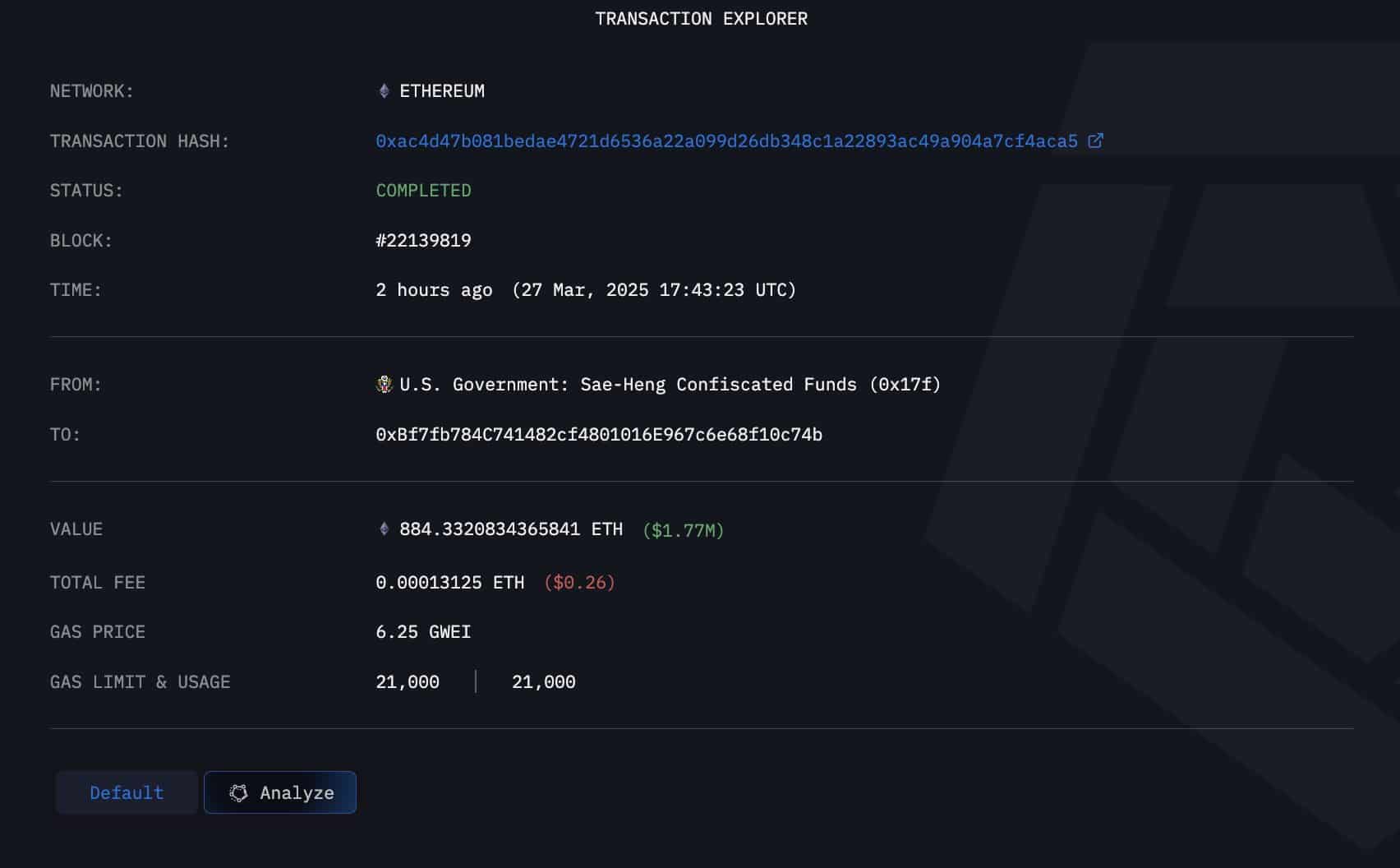

Previously 24 hours, the U.S. authorities has offered an enormous quantity of ETH out there—884.33 ETH value $1.77 million on the time of the commerce.

A notable sell-off from massive traders just like the U.S. authorities, which holds 59,965 ETH in its steadiness, usually signifies a insecurity within the asset and tends to negatively affect the broader market.

Supply: Arkham Intelligence

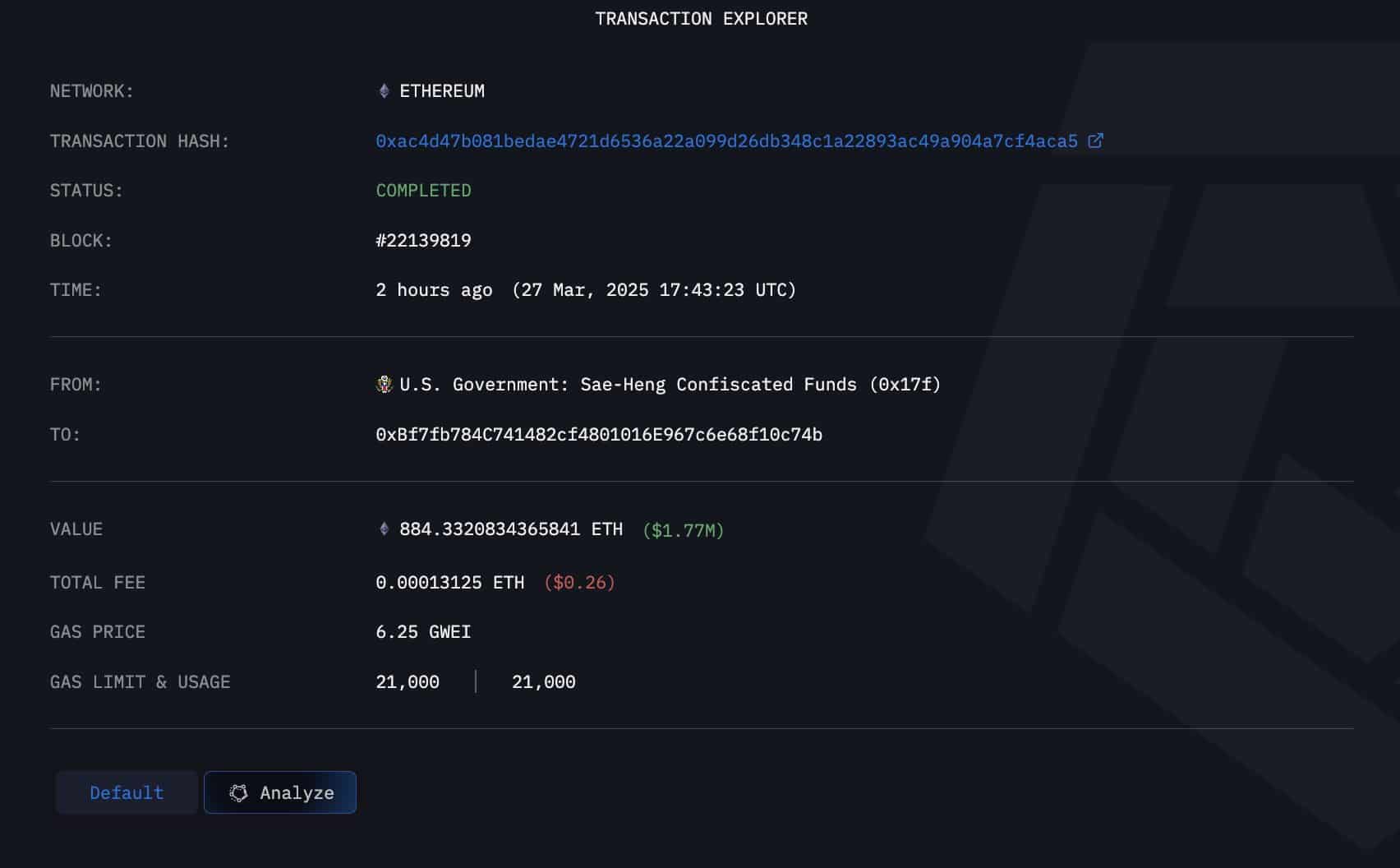

To know the affect of this, AMBCrypto studied the U.S. authorities’s previous ETH gross sales and their results in the marketplace.

Usually, the U.S. authorities sells when the market is already declining, which is the present case. Not like earlier than, ETH won’t see a bounce again.

On three previous events—August 5, October 1, and October 24—the U.S. authorities offered 299.95, 74.5, and 177.89 ETH, respectively. Every time, the asset declined to a key help degree at $2,348.43, which acted as a catalyst for a bounce again.

Supply: TradingView

Nonetheless, this time is completely different. ETH is presently buying and selling under this help degree, forming a collection of decrease lows. If promoting strain intensifies, ETH dangers dropping under $1,754. If it fails to bounce again from this degree, additional decline is probably going.

AMBCrypto’s additional evaluation discovered {that a} continued decline could possibly be the present market development, as retail sentiment towards the asset has hit a brand new low—a degree final seen a 12 months in the past.

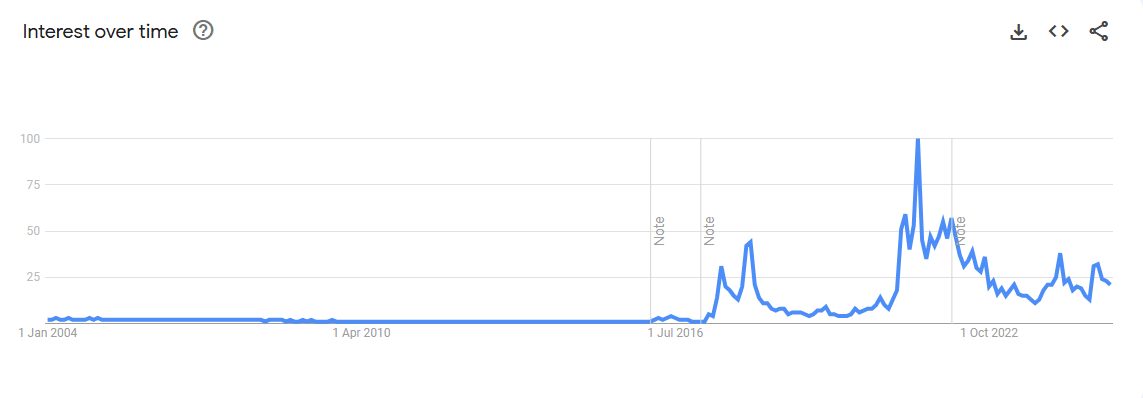

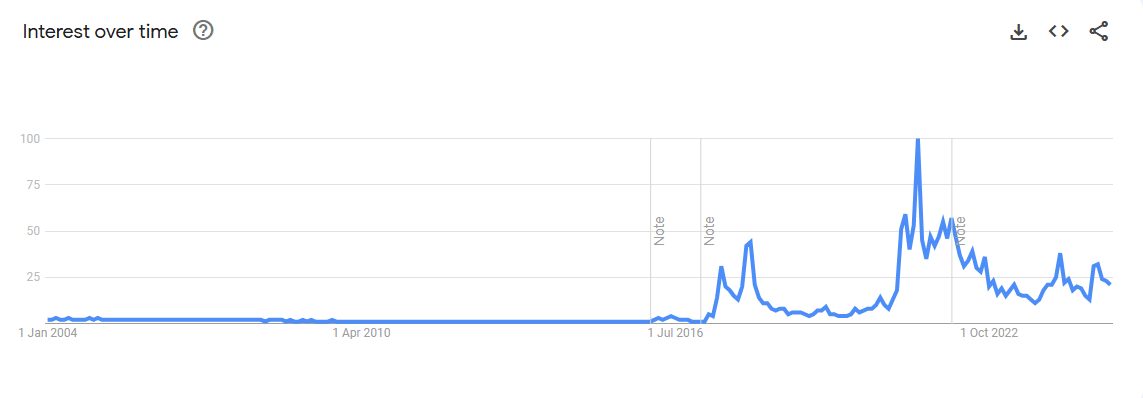

Supply: Google Development

This was confirmed by Google search curiosity over time, which reveals that retail search curiosity in ETH has dropped considerably, an indication usually attributed to promoting.

Bearish developments amongst retail and institutional traders

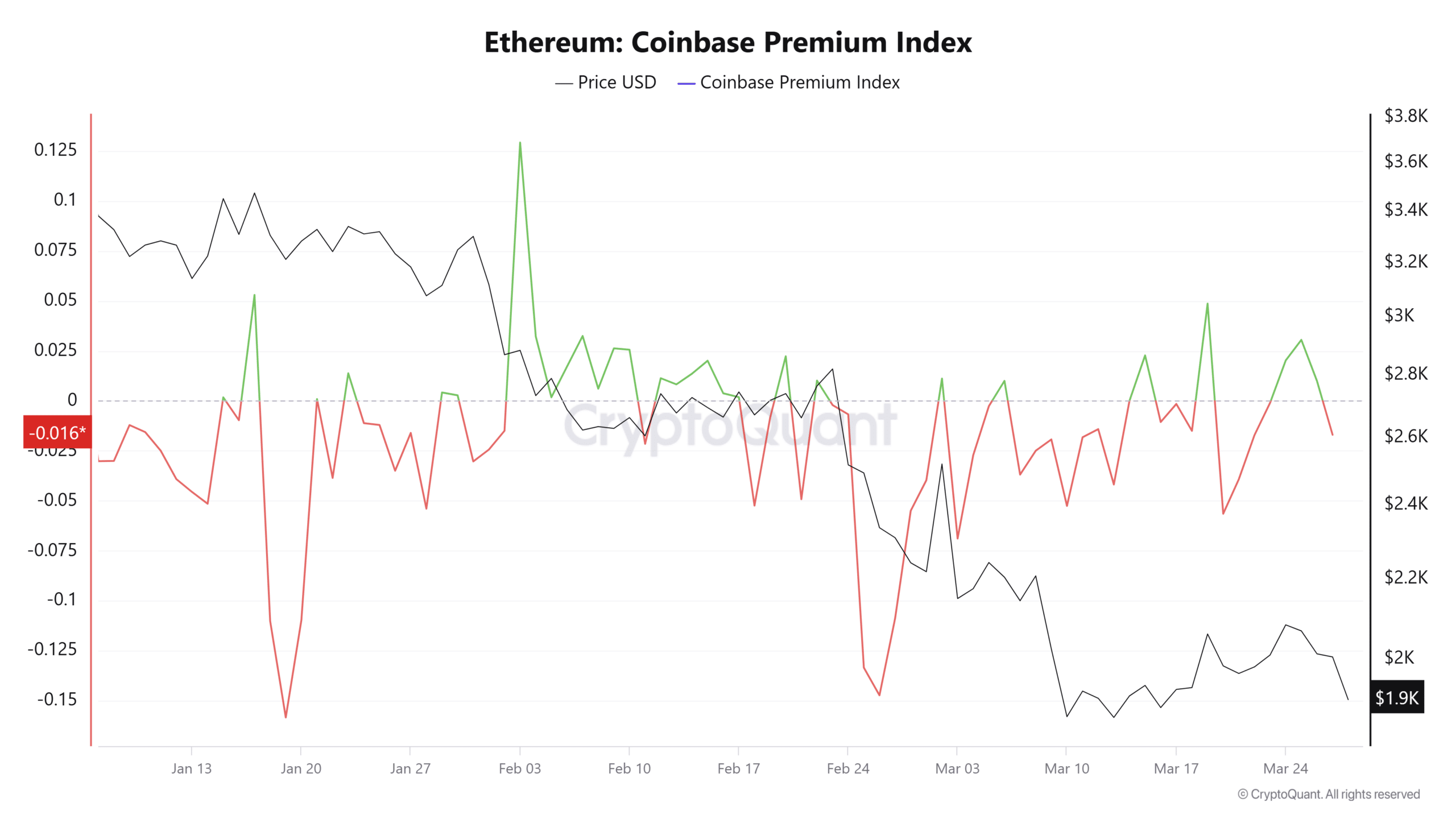

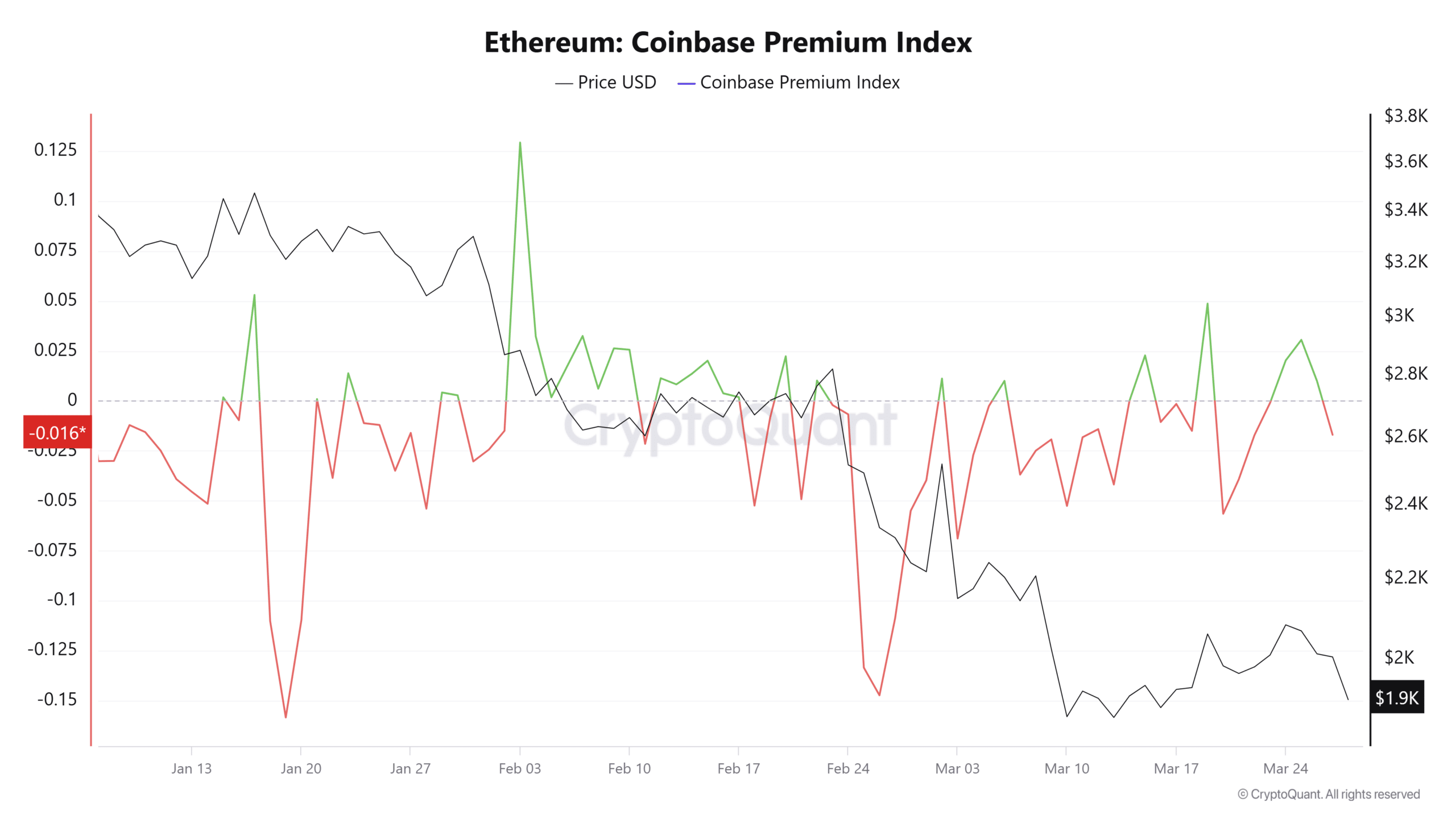

The U.S. authorities’s sell-off has pressured retailers within the nation to start out promoting aggressively. In accordance with the Coinbase Premium Index, which tracks this conduct, that is the primary time for the reason that twenty third of March that this cohort of merchants is promoting.

That is evident every time the index is in destructive territory. At press time, it had a studying of -0.0016, indicating that promoting strain is regularly mounting.

Supply: CryptoQuant

Institutional traders holding roughly $8.83 billion value of Ethereum as belongings below administration have additionally continued promoting for the reason that begin of March, including downward strain to the asset.

Between the third of March and now, a complete of $402.6 million value of Ethereum has been offered.

If institutional traders proceed to promote, ETH may attain the goal degree of $1,754, as indicated on the chart.