Ethereum sees $2.3B in inflows as ETF anticipation sparks optimism

- Ethereum noticed round $2.3 billion inflows.

- The ETH value rise triggered a notable quick liquidation quantity.

Ethereum [ETH] lately skilled a big value transfer, triggering a big quantity of quick liquidations and resulting in a document influx quantity.

Amid these developments, there’s hypothesis that establishments is perhaps making ready for the potential approval of an Ethereum-based monetary product.

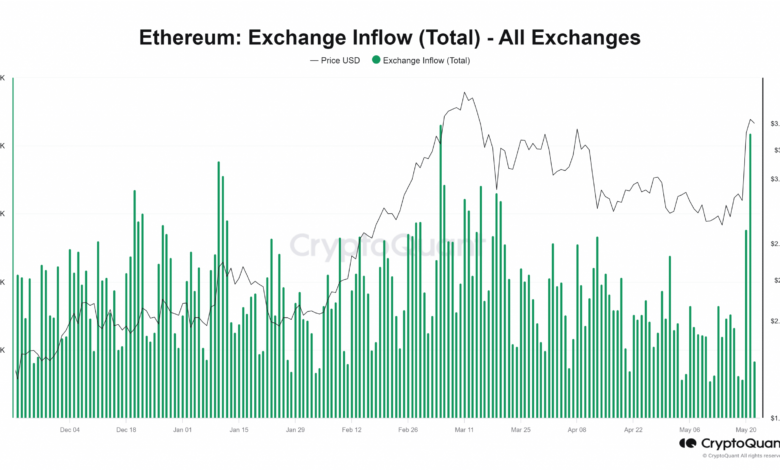

Ethereum sees vital circulation into exchanges

AMBCrypto’s evaluation of Ethereum’s influx chart on CryptoQuant confirmed that merchants have moved to make the most of the current value improve.

On the twenty first of Could, round 627,770 ETH, valued at over $2.3 billion at roughly $3,789 per ETH, flowed into exchanges. This marked the second-largest influx quantity in over a yr.

The biggest influx occurred in March when 648,000 ETH, additionally value about $2.3 billion, have been transferred. At press time, the influx had already exceeded 100,000 ETH.

Supply: CryptoQuant

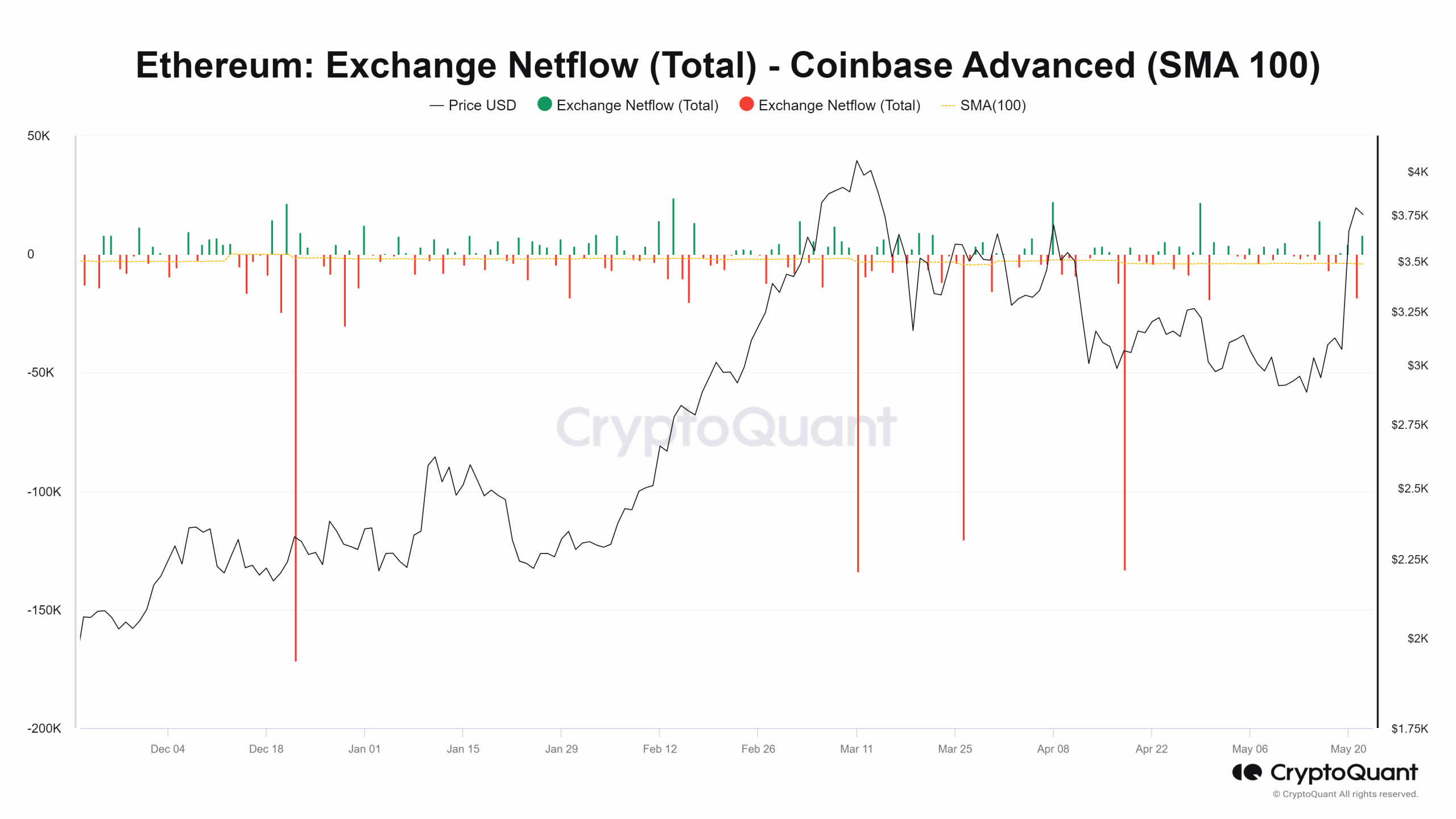

Resulting from these substantial inflows, Ethereum’s Netflow has been constructive over the previous few days. The Netflow indicated that extra ETH was coming into exchanges than leaving.

On the twenty first of Could, the Netflow was round 49,000 ETH — this development continued with an extra Netflow of over 5,600 ETH on the time of writing.

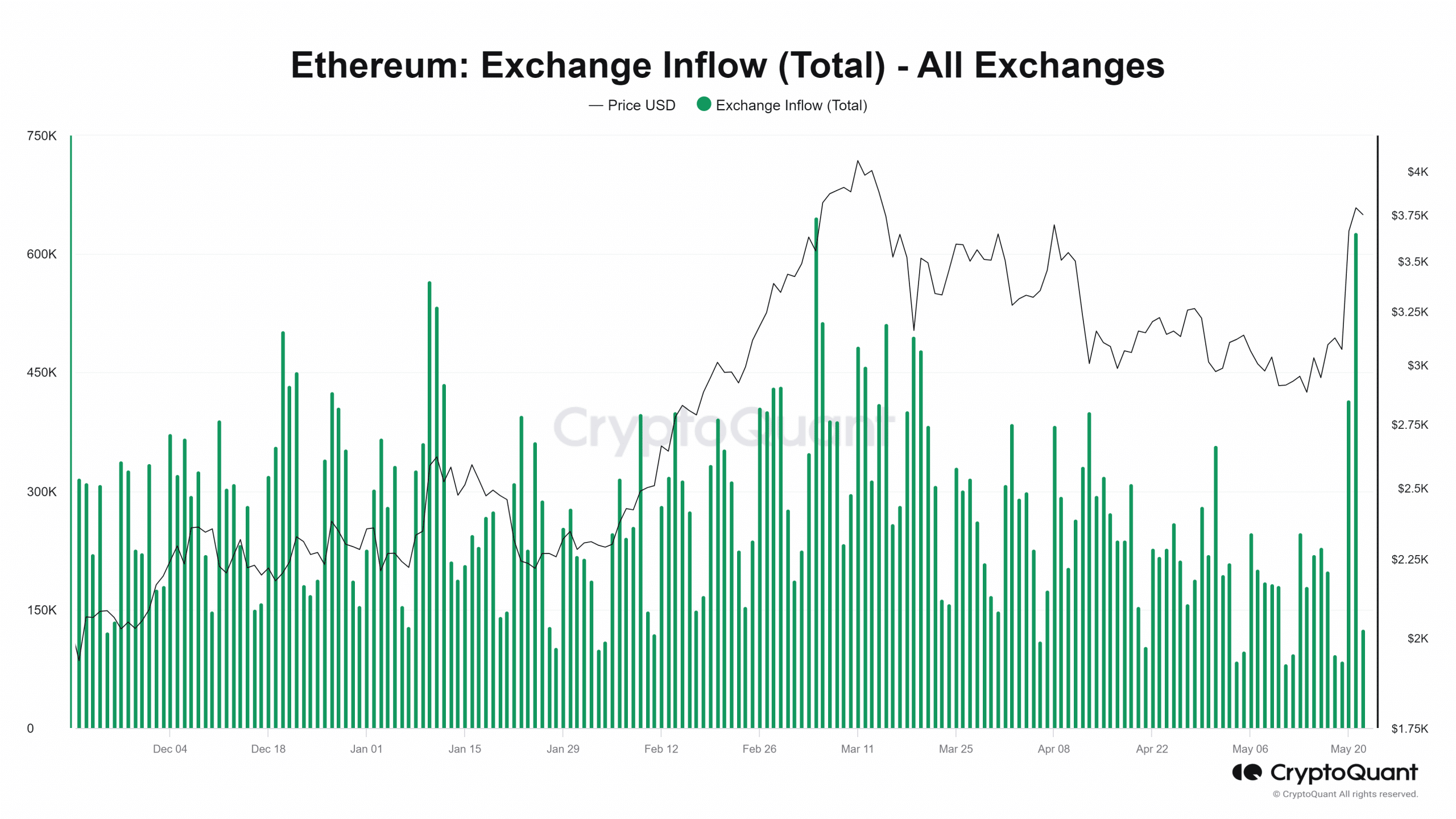

Ethereum shorts see extra liquidation

One other impact of the current Ethereum value improve has been a surge in liquidation quantity.

In response to AMBCrypto’s evaluation of the liquidation chart, quick merchants have skilled vital liquidations up to now few days.

Supply: CryptoQuant

On the twentieth of Could, roughly 20,558 ETH, valued at over $75.2 million, have been liquidated, marking the second-highest quick liquidation quantity in over a yr.

The development continued on the twenty first of Could, with over 11,600 ETH value round $44 million being liquidated.

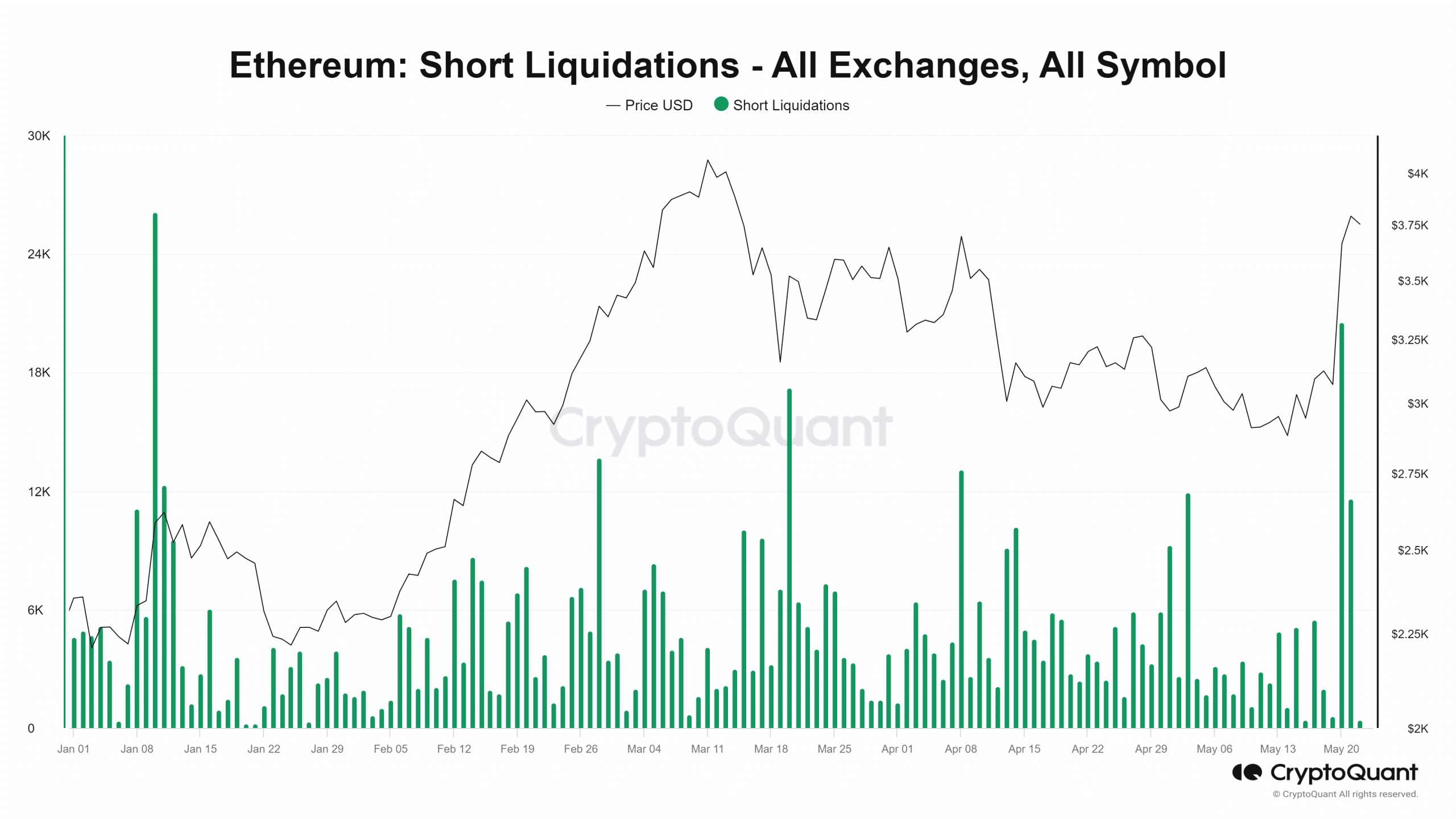

Establishments making ready for ETF approval?

Amid the current value improve in Ethereum, there’s rising hypothesis in regards to the imminent approval of an Ethereum ETF.

Commentators are optimistic about this approval, and a few analysts imagine that establishments are already making ready for it.

A CryptoQuant chart confirmed notable outflows of ETH on Coinbase on the eleventh and twenty seventh of March and 18th April, with volumes of roughly -134,000, -120,454, and -133,000 ETH, respectively.

Comparable outflow patterns have been noticed on Coinbase earlier than the announcement of the Bitcoin ETF approval in January, suggesting that establishments is perhaps positioning themselves for a possible approval now as properly.

Supply: CryptoQuant

ETH sees a slight drop

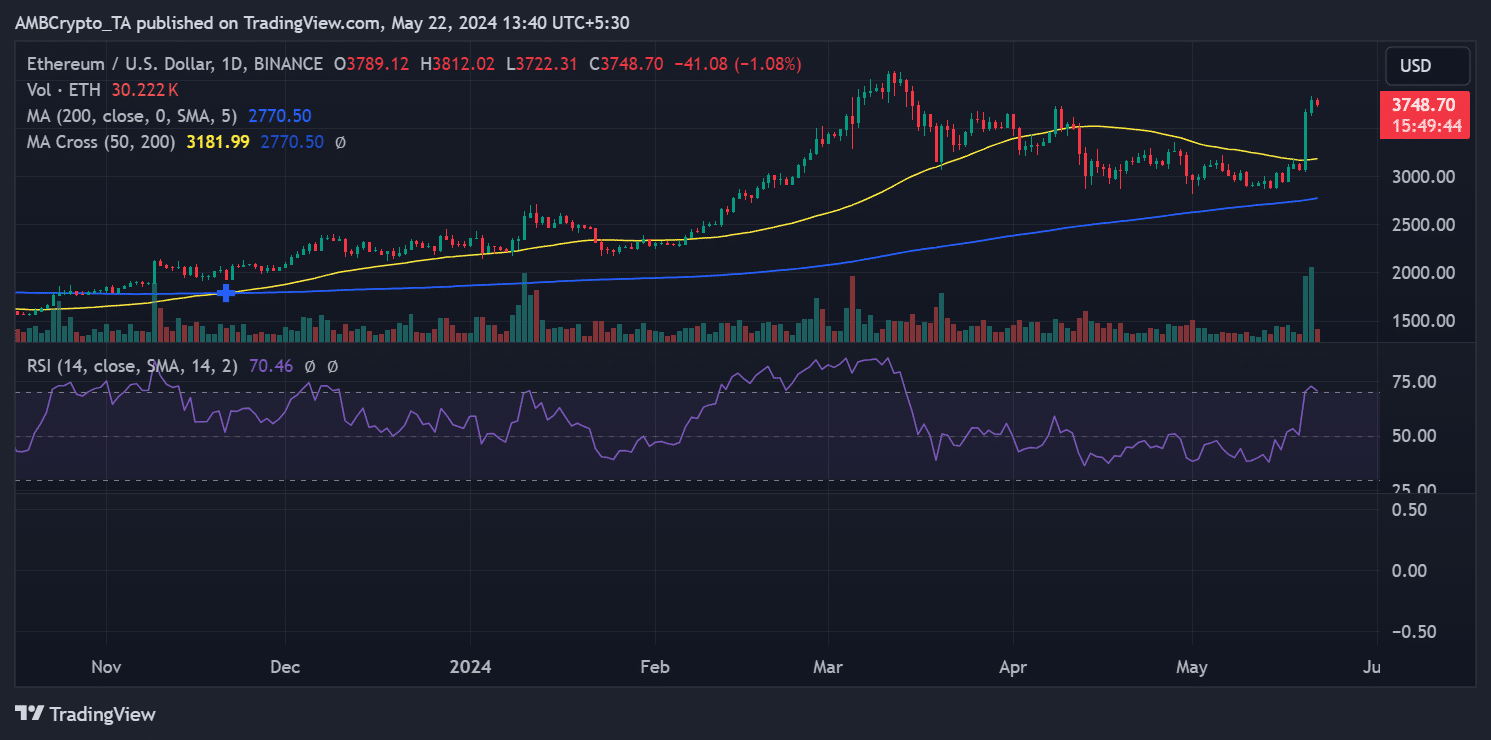

Ethereum surged to roughly $3,661 following a 19% improve on the twentieth of Could.

Learn Ethereum’s [ETH] Value Prediction 2024-25

In response to AMBCrypto’s evaluation of the day by day timeframe chart, this upward development continued on the twenty first of Could, with ETH reaching round $3,789 after a 3.50% improve, hitting a value zone final seen in March.

As of this writing, Ethereum was buying and selling at about $3,749, reflecting a decline of simply over 1%.

Supply: TradingView